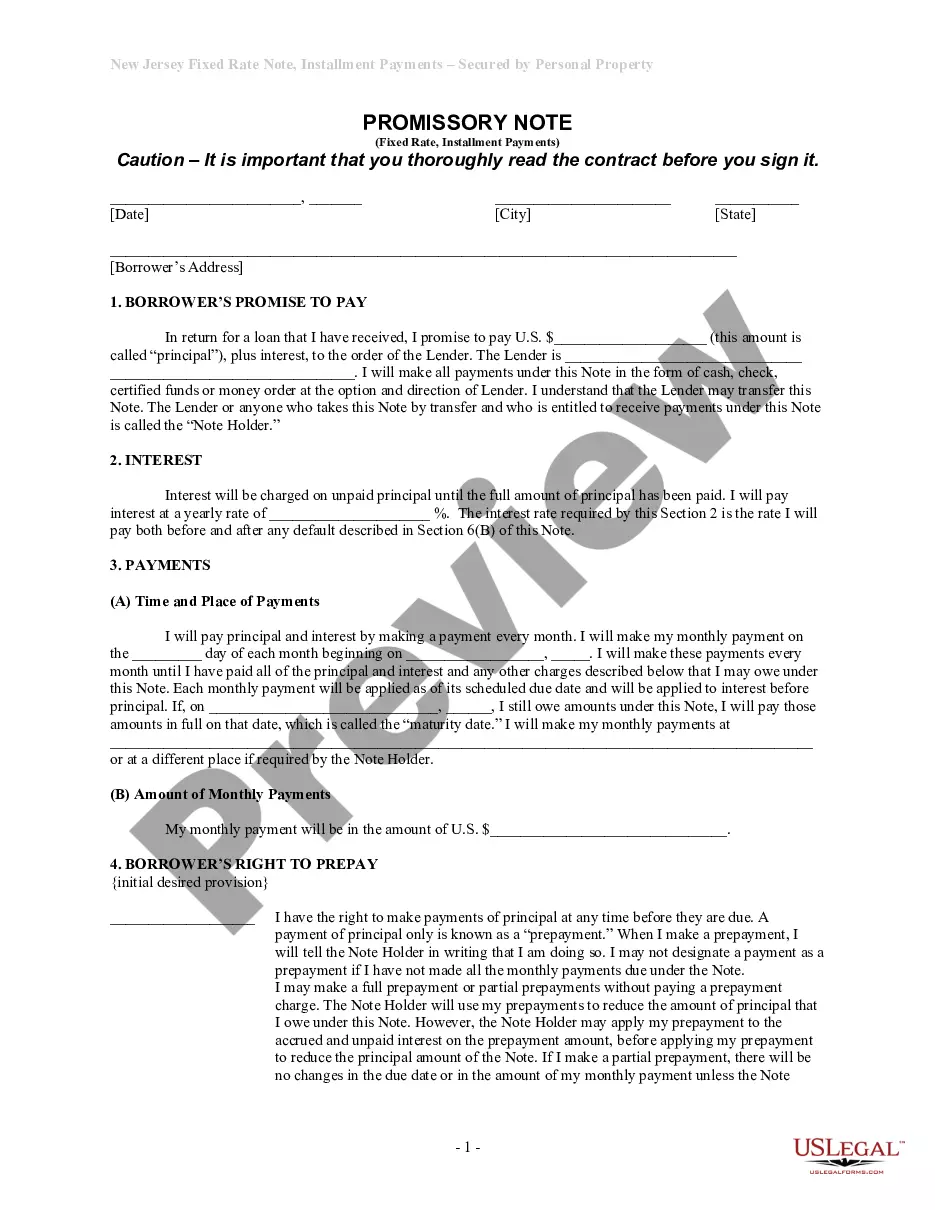

Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property

Description

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Personal Property?

Regardless of one’s social or career standing, completing law-related documents is an unfortunate requirement in today’s professional landscape.

Frequently, it’s practically unfeasible for someone lacking legal training to create these types of documents from scratch, primarily due to the intricate terminology and legal nuances associated with them.

This is where US Legal Forms proves to be beneficial.

Confirm that the template you have selected is applicable for your locality, as the regulations of one state or county may not apply to another.

Review the document and glance through a brief summary (if available) of the situations for which the document can be utilized.

- Our platform provides an extensive database with over 85,000 ready-to-use, state-specific forms suitable for nearly any legal scenario.

- US Legal Forms is also an excellent tool for associates or legal advisors who aim to save time using our DIY forms.

- Whether you need the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property or any other document valid in your state or county, with US Legal Forms, everything is readily available.

- Here’s how you can swiftly obtain the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property using our reliable platform.

- If you’re already a registered user, feel free to Log In to your account to download the desired form.

- If you are new to our collection, please ensure you follow these steps before obtaining the Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property.

Form popularity

FAQ

Receiving a promissory note means you are obtaining a legal document that assures repayment for a certain amount, usually under specified conditions. This note serves as a valuable asset, especially with a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, as it often includes collateral details. By possessing this note, you gain rights that can be enforced in case of non-payment, providing you with security in financial transactions.

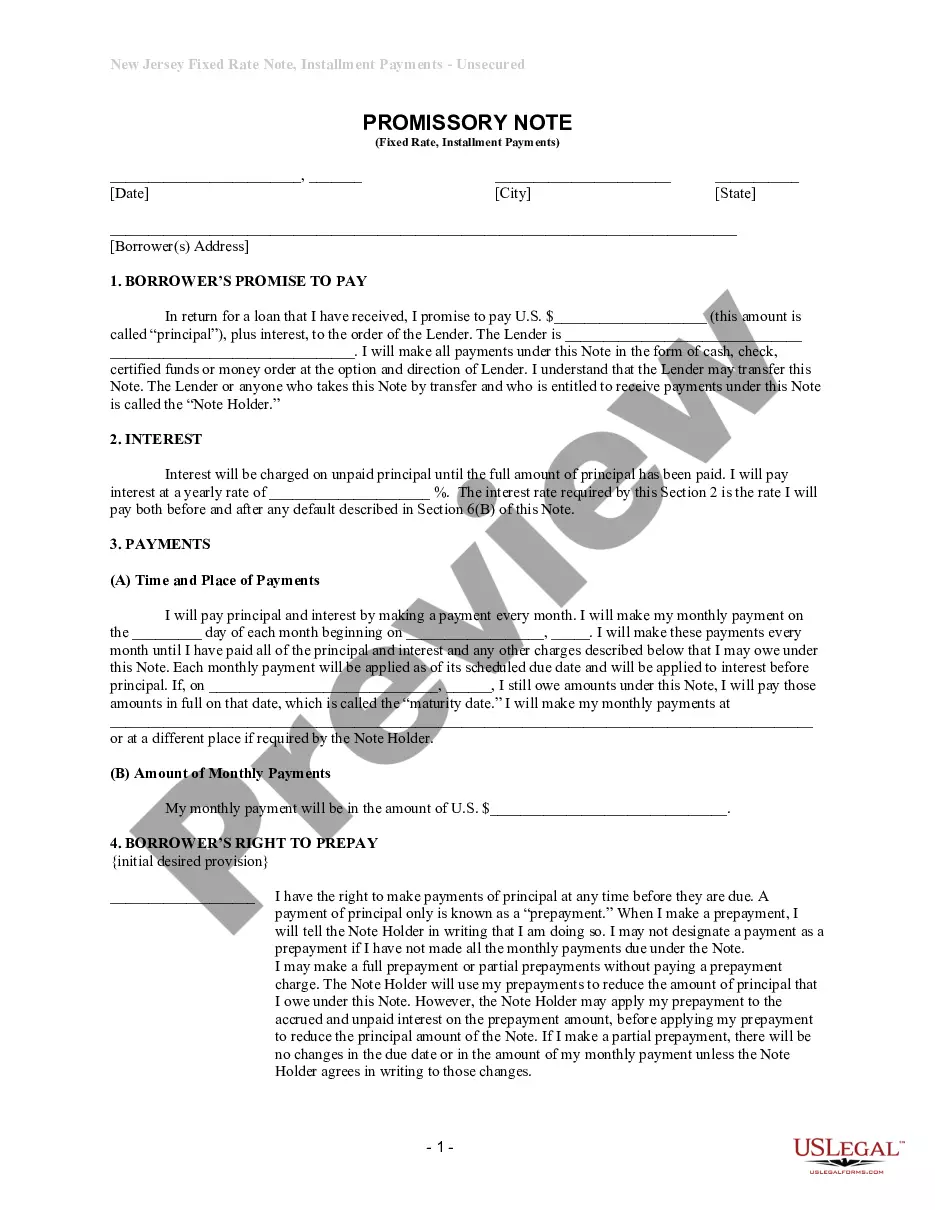

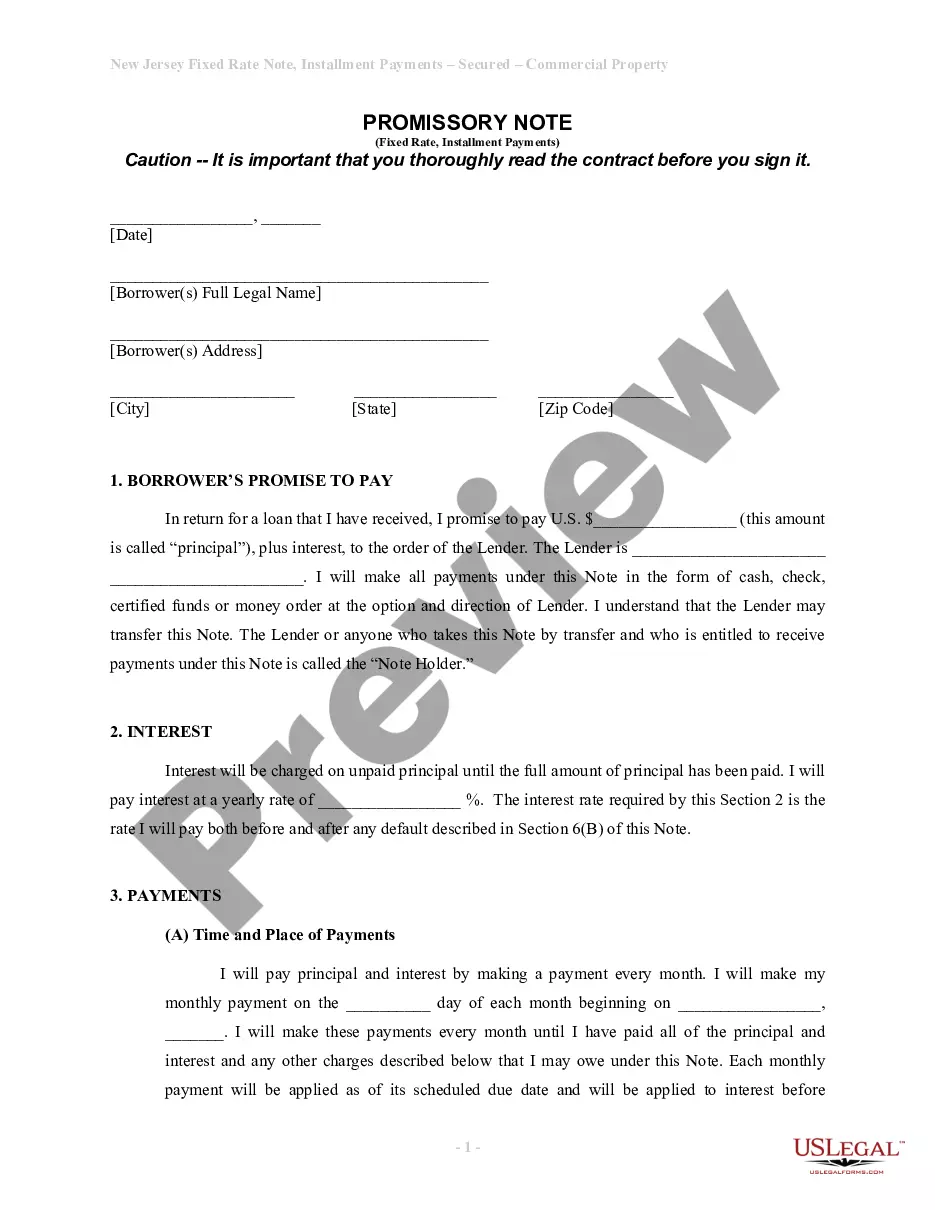

The document you are referring to is commonly known as a secured promissory note. In Paterson, New Jersey, this type of note allows a borrower to use personal property as collateral. By doing so, the lender gains an extra layer of security should the borrower default on payments. This structure often encourages more favorable terms for both parties involved.

A promissory note is accounted for as a financial asset for the lender and a liability for the borrower. It typically reflects any payments made towards the principal and interest. In the case of a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, accurate accounting ensures that both parties understand their financial commitments.

Reporting a promissory note depends on the jurisdiction and the specifics of the transaction. Generally, lenders may need to report interest income for taxation. A Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property should be documented carefully to ensure compliance with local regulations.

Recording a secured promissory note is not always required but is often recommended. It helps establish the lender's rights in case of default. For a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, proper recording can bolster legal protection and clarity in disputes.

Certainly, a promissory note can be secured by real property. This practice offers significant protection to lenders. While a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property often involves personal property, securing it with real estate provides additional assurance.

Yes, a promissory note can be secured. This means that the borrower provides collateral that can be claimed by the lender in case of default. A Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property allows for added security, offering peace of mind to lenders during the transaction.

Yes, promissory notes can be secured by collateral, which adds an additional layer of security for the lender. In the case of a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, backing the note with personal property can offer greater assurance of repayment. This security can make the agreement more appealing to lenders.

The statute of limitations for enforcing a promissory note in New Jersey is typically six years. This time frame begins from the date of default or when the holder could have reasonably filed a claim. For a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, it's essential to keep this timeline in mind to ensure prompt action if needed.

Yes, a properly drafted promissory note can hold up in a court of law if all necessary legal criteria are met. The court evaluates the terms and agreements within the note, particularly when it is a Paterson New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property. Clear documentation enhances your chances of a favorable outcome.