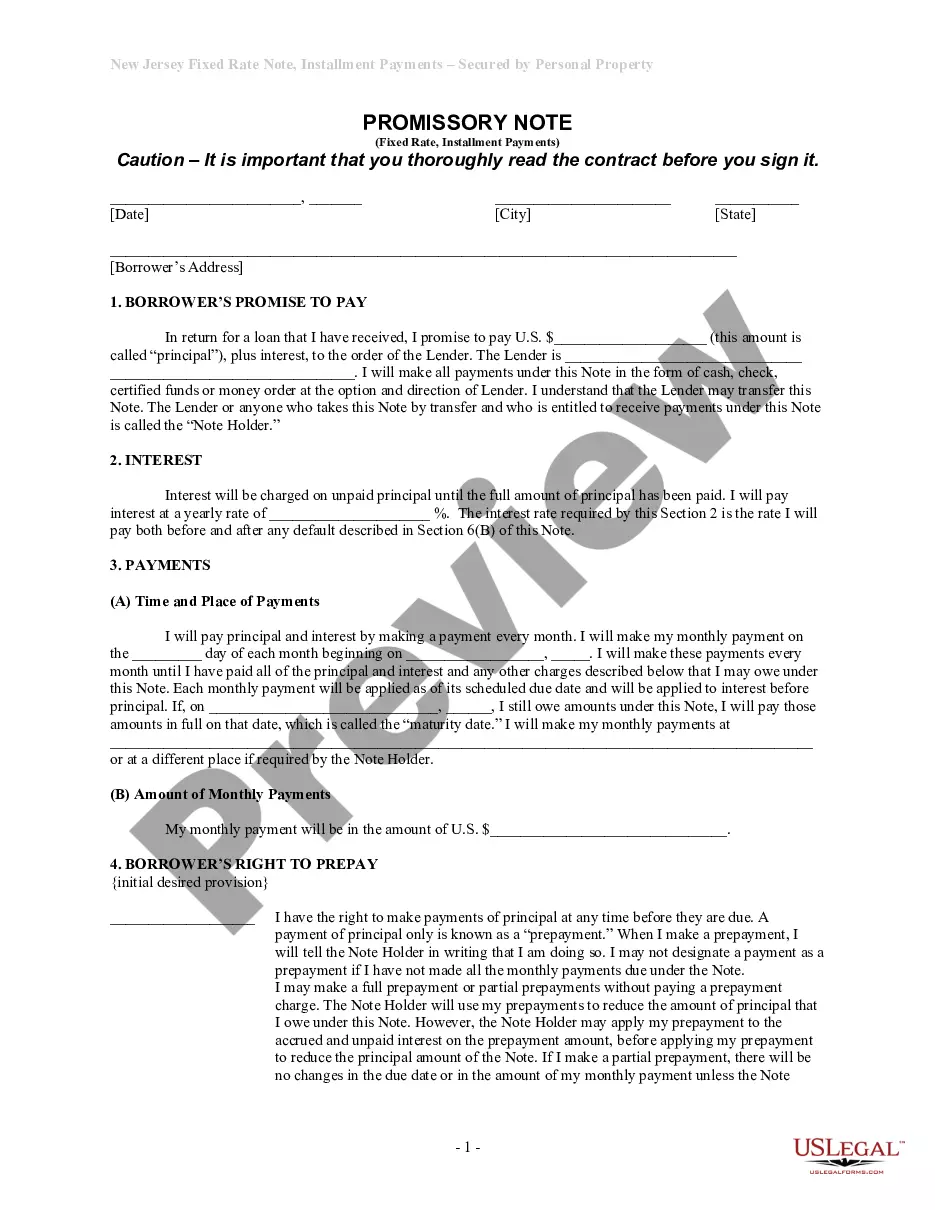

New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

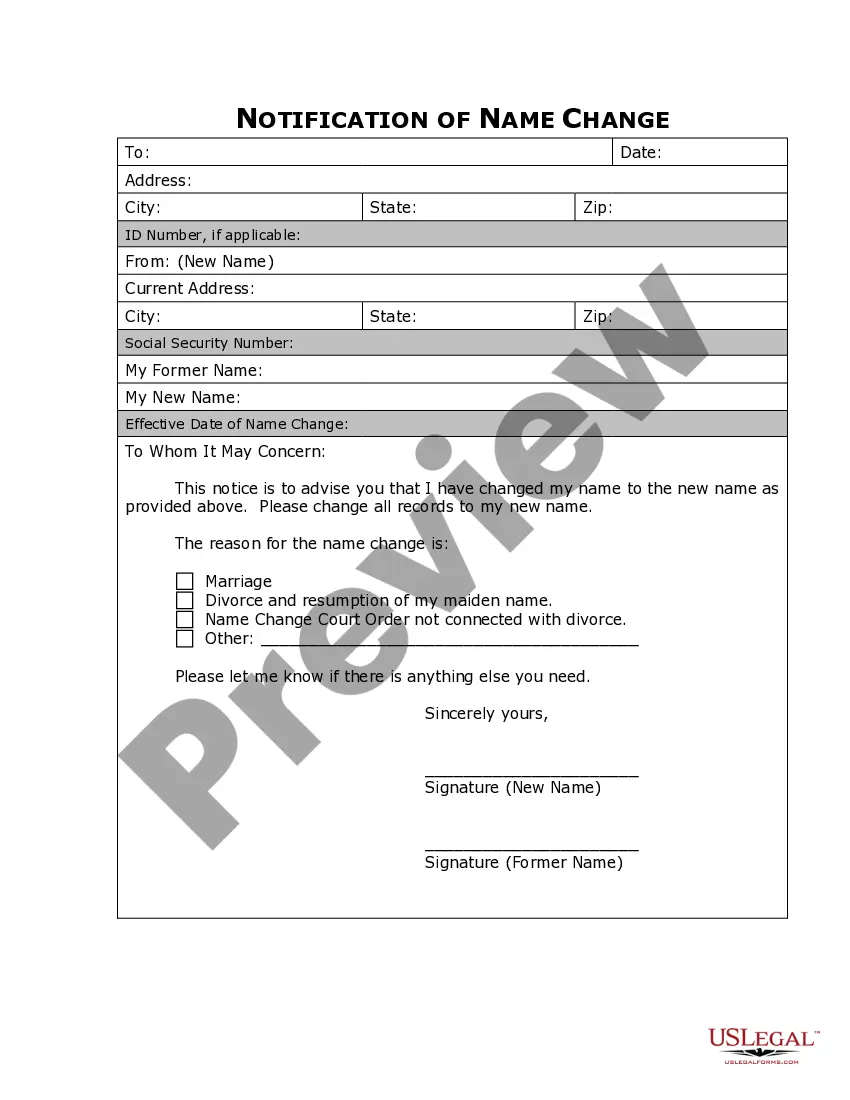

Looking for another form?

How to fill out New Jersey Installments Fixed Rate Promissory Note Secured By Personal Property?

US Legal Forms is actually a special system to find any legal or tax document for submitting, such as New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property. If you’re tired with wasting time searching for perfect samples and paying money on record preparation/lawyer charges, then US Legal Forms is exactly what you’re looking for.

To reap all the service’s advantages, you don't need to download any software but just choose a subscription plan and create your account. If you have one, just log in and find an appropriate sample, download it, and fill it out. Saved files are saved in the My Forms folder.

If you don't have a subscription but need New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property, check out the recommendations listed below:

- make sure that the form you’re taking a look at is valid in the state you want it in.

- Preview the example and look at its description.

- Click on Buy Now button to reach the register webpage.

- Select a pricing plan and proceed signing up by entering some information.

- Pick a payment method to complete the sign up.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, complete the file online or print out it. If you feel uncertain about your New Jersey Installments Fixed Rate Promissory Note Secured by Personal Property template, speak to a lawyer to examine it before you decide to send out or file it. Begin without hassles!

Form popularity

FAQ

These terms all mean the same thing. A mortgage is a loan secured by property that is used as collateral, which the lender can seize if the borrower defaults on the loan. The promissory note is exactly what it sounds like the borrower's written, signed promise to repay the loan.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

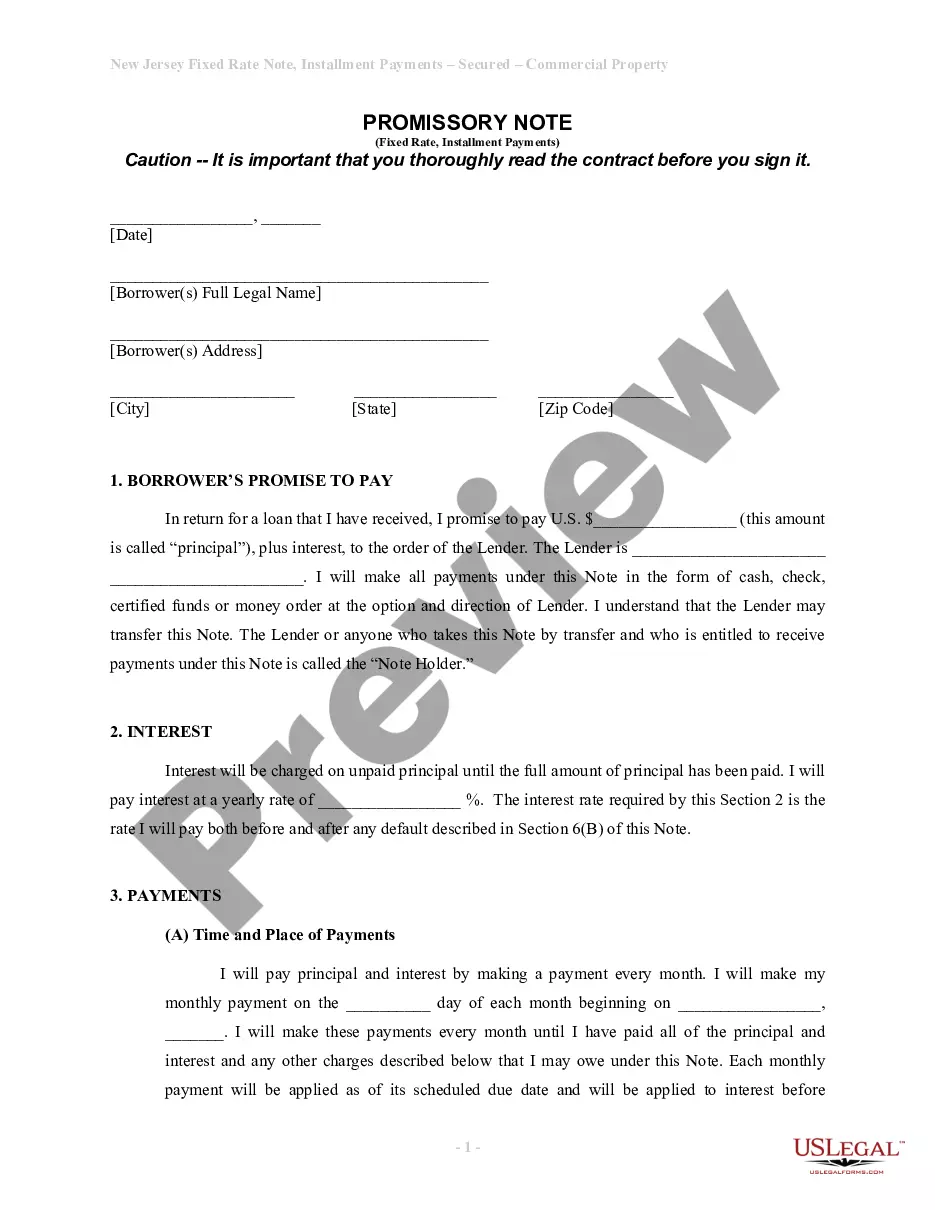

Promissory notes are ideal for individuals who do not qualify for traditional mortgages because they allow them to purchase a home by using the seller as the source of the loan and the purchased home as the source of the collateral.

It includes land and buildings, for example. Personal property typically includes furniture, fixtures, tools, vehicles, and machinery and equipment. All of these items can be moved.

To secure a promissory note means that you identify some specific property and attach it to the note. Then, if the borrower defaults on the loan, you will be able to repossess the collateral as compensation for the loan.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

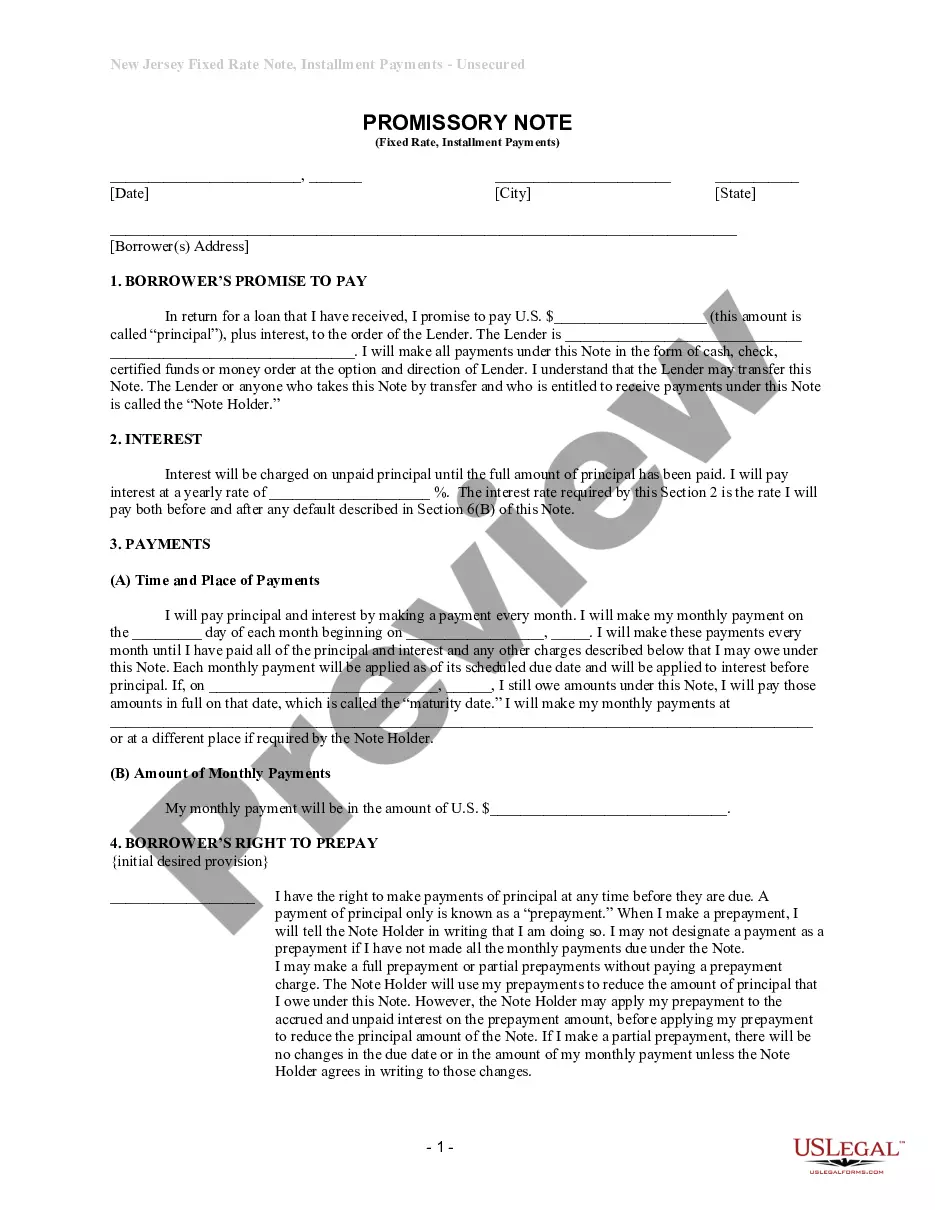

Secured or unsecured? Generally, promissory notes are unsecured which means it is more like a formal IOU. However, lenders can request some security for the loan. For personal secured promissory notes, a house or car is often used as collateral.

Unlike a mortgage or deed of trust, the promissory note isn't recorded in the county land records. The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Examples of tangible personal property are your household goods and motor vehicles.Examples of intangible personal property are stocks, bonds, mutual funds, and securities. In addition, if a person owes you money, you may have a promissory note which describes the loan and amount of money the individual owes you.