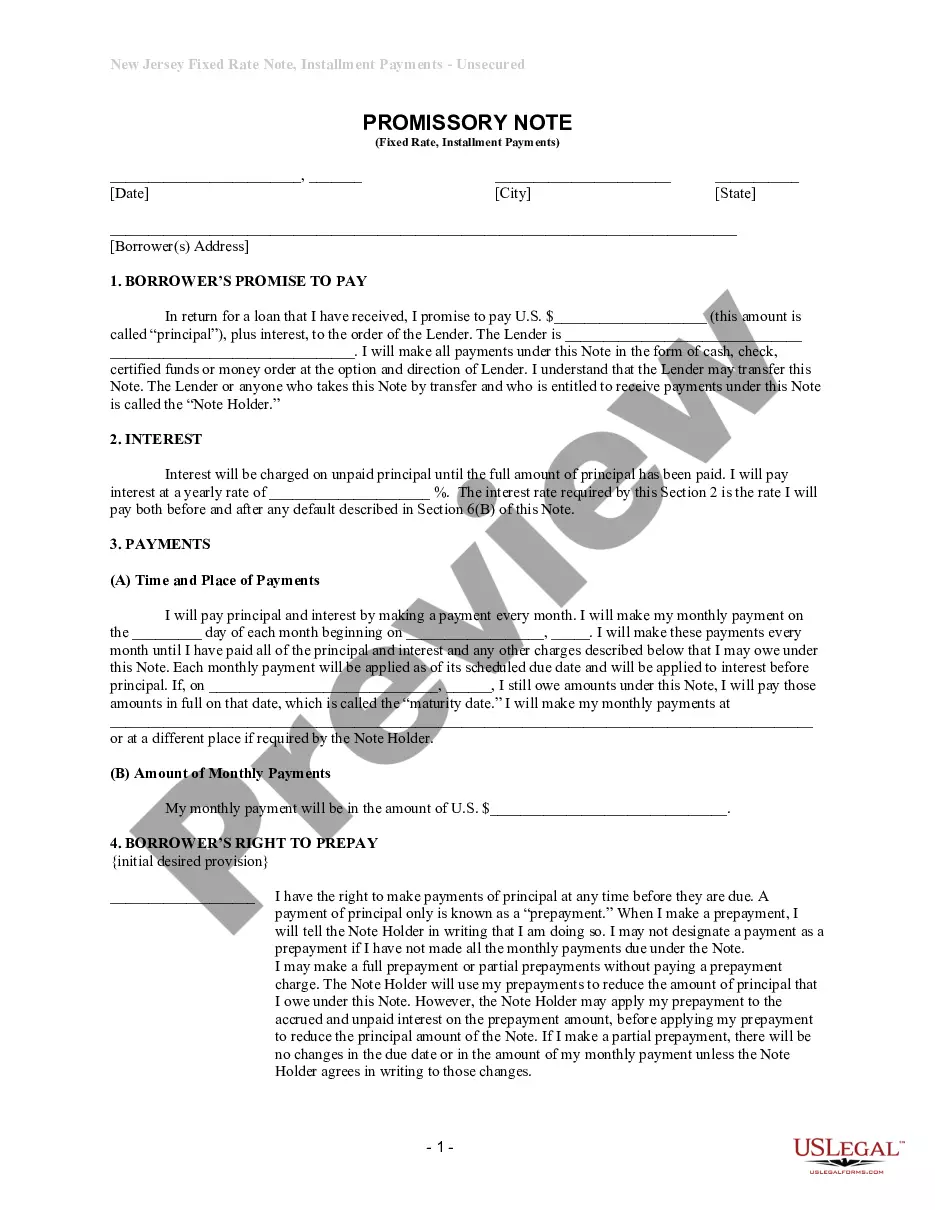

Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out New Jersey Unsecured Installment Payment Promissory Note For Fixed Rate?

We consistently endeavor to reduce or evade legal repercussions when navigating intricate legal or financial matters.

To accomplish this, we seek legal solutions from attorneys that are generally quite costly.

However, not every legal matter is equally complicated; many can be addressed independently.

US Legal Forms is an online repository of current DIY legal forms, encompassing everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Should you misplace the document, you can always retrieve it again from the My documents tab. The procedure is equally straightforward even if you're not familiar with the platform! You can set up your account in a few minutes.

- Our service empowers you to manage your own matters without the need for attorney services.

- We provide access to legal form templates that may not always be readily available.

- Our templates are tailored to specific states and regions, significantly simplifying the search process.

- Leverage US Legal Forms whenever you need to swiftly and securely acquire and download the Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate or any other form.

- Just Log In to your account and click the Get button adjacent to it.

Form popularity

FAQ

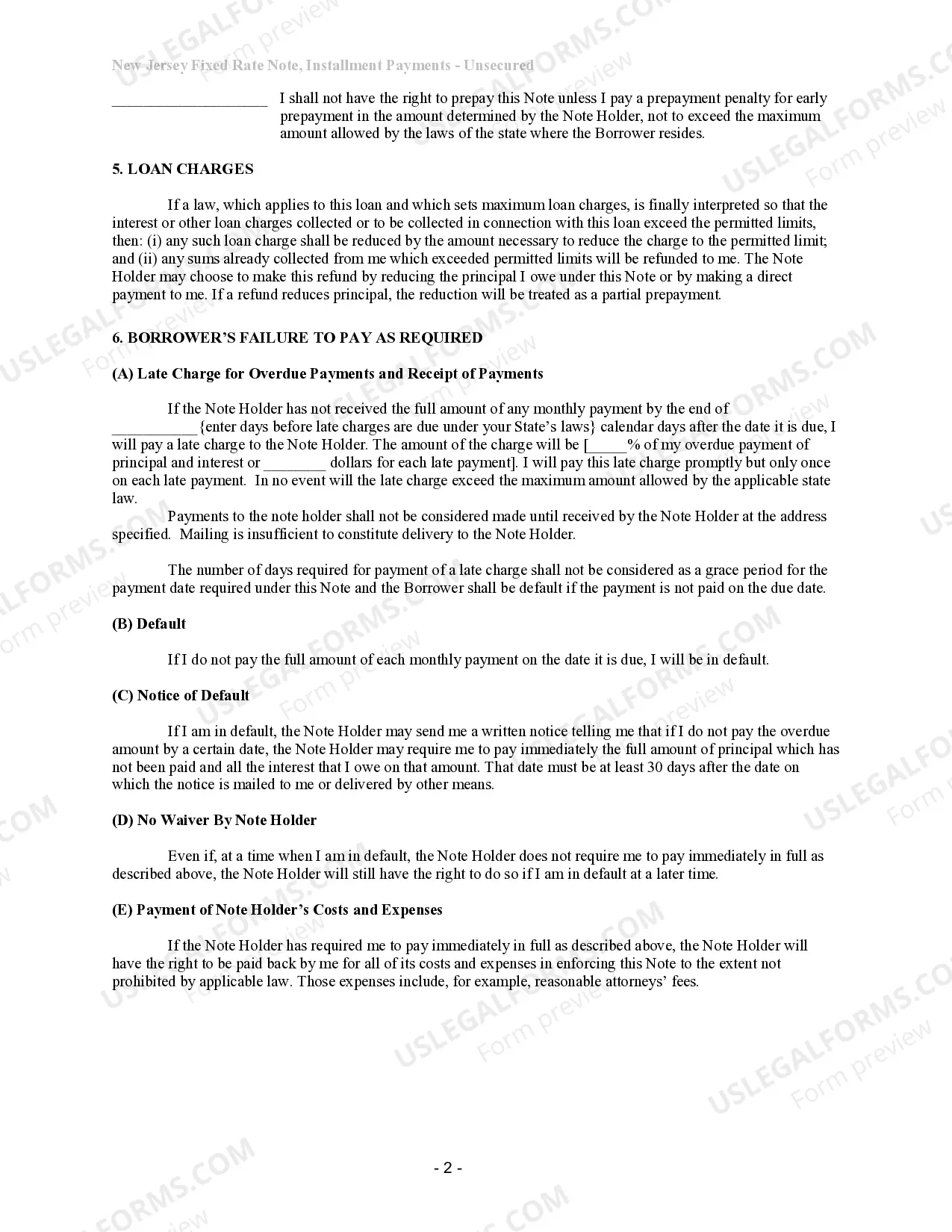

An installment note in real estate refers to a financial agreement where payments for property are made in installments over a set term. This type of note often includes interest, and payments are typically made monthly. If you're exploring options for a Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, this can help you manage your finances effectively while purchasing or financing a property.

An installment note requires borrowers to make regular payments over time, while a traditional promissory note may not specify a payment schedule. Both serve as legal documents ensuring repayment, but the installment note offers structured repayment terms. When opting for a Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, expect clear repayment timelines that could simplify your budgeting process.

Whether something is better than a promissory note depends on individual circumstances and needs. Alternatives might include secured loans or other financing methods that might provide lower interest rates or easier terms. If you are considering a Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, think about your financial goals and compare options to determine what meets your needs best.

An installment note is a type of promissory note that requires repayment in regular installments over time. In contrast, a standard promissory note may require a lump-sum payment at maturity. When considering a Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, understand that it combines both features, providing structured payments while still being a formal promise to repay.

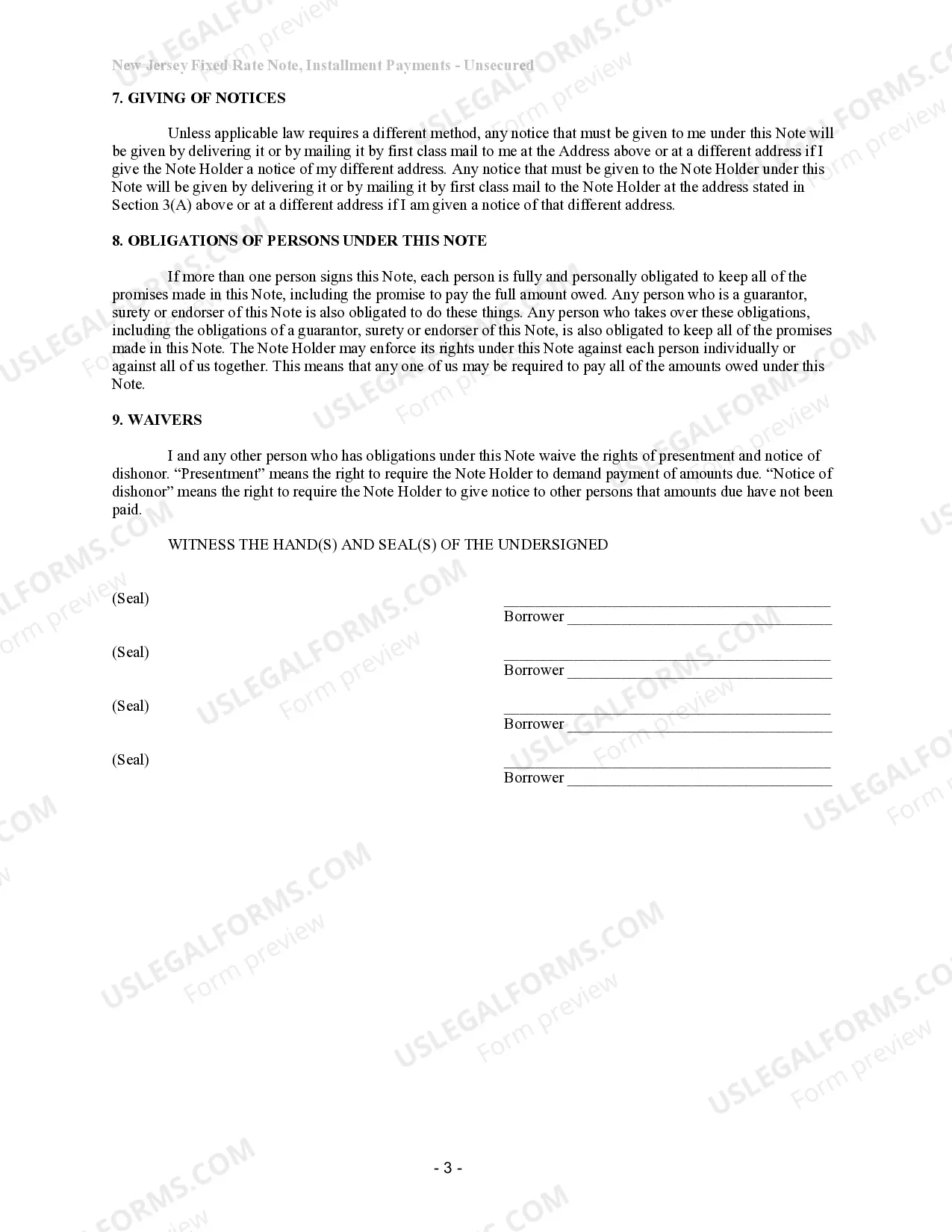

Yes, a promissory note can hold up in a court of law if it meets legal requirements. It must clearly outline the terms of the agreement and be signed by both parties. Ensure your Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate is well-drafted to enhance its enforceability.

An unsecured promissory note is not backed by collateral, meaning the lender relies solely on the borrower’s promise to repay. This type of note can carry higher risk for lenders. When crafting a Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, be clear about the terms to protect both parties.

Yes, you can write your own promissory note. However, it's essential to follow legal guidelines to ensure its enforceability. Using resources from platforms like uslegalforms can help you create a comprehensive and valid Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate.

A promissory note is generally considered a legally binding agreement. Its enforceability depends on the clarity of its terms and adherence to state laws. For your Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, ensure all conditions and signatures are correctly laid out.

Yes, promissory notes are legal documents in New Jersey. They are widely used for personal and business transactions, establishing a clear agreement between parties. A properly drafted Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate is enforceable in court.

In New Jersey, it is not mandatory for a promissory note to be notarized. However, notarization can lend extra credibility and serve as proof in disputes. If you are creating a Paterson New Jersey Unsecured Installment Payment Promissory Note for Fixed Rate, consider notarization for added security.