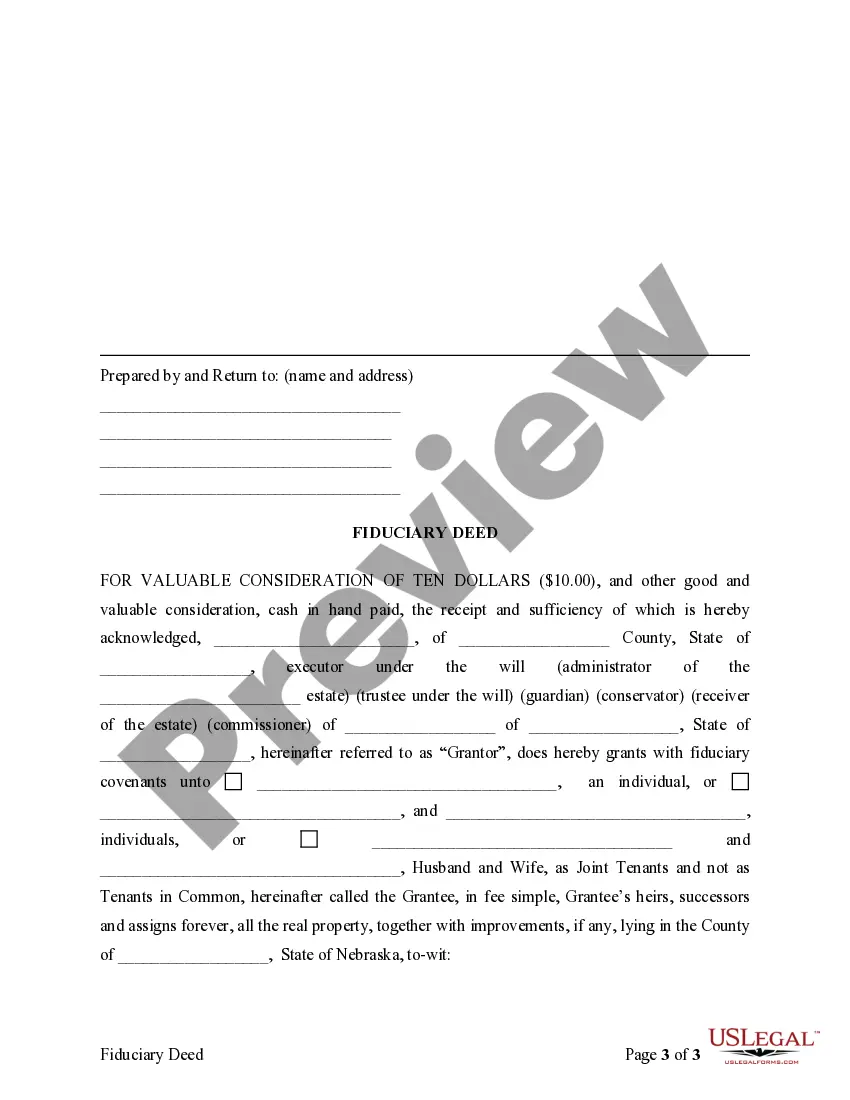

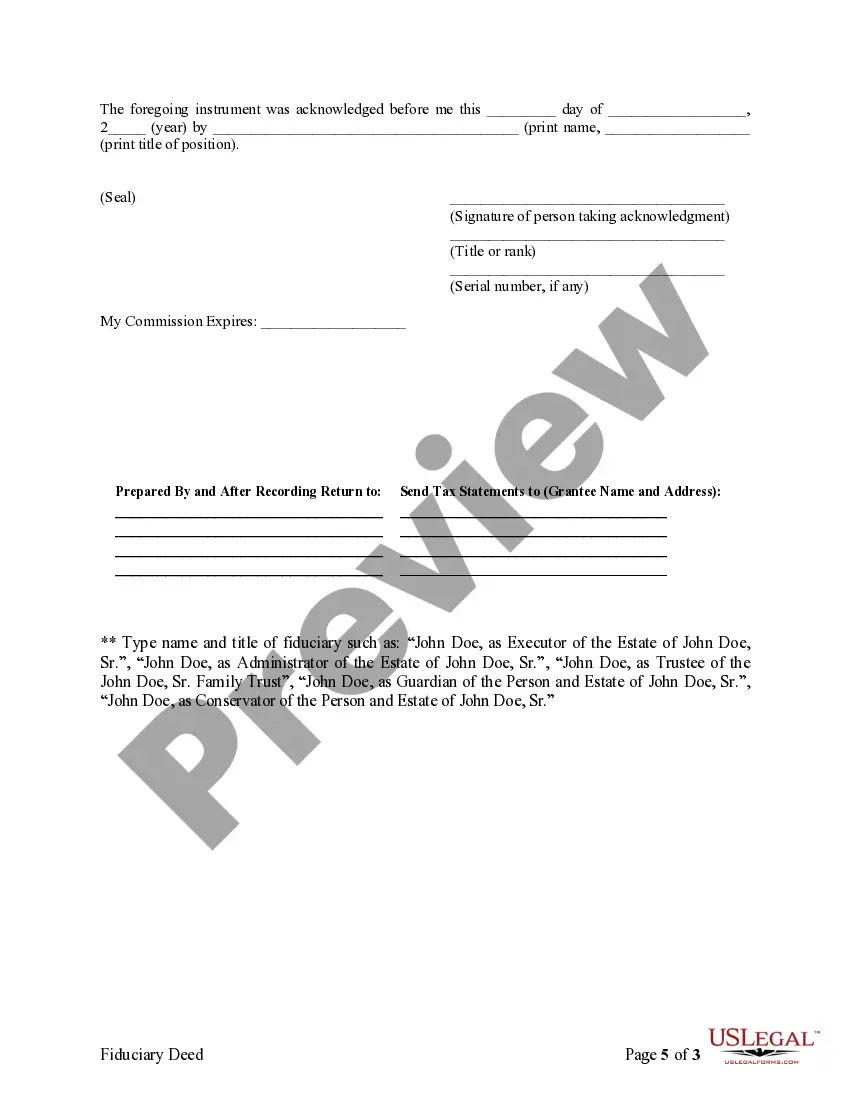

This form is a Fiduciary Deed where the grantor may be an executor of a will, trustee, guardian, or conservator.

Omaha Nebraska Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Description

How to fill out Nebraska Fiduciary Deed For Use By Executors, Trustees, Trustors, Administrators And Other Fiduciaries?

If you are seeking a legitimate form template, it’s remarkably challenging to select a more user-friendly service than the US Legal Forms website – probably one of the most extensive libraries available online.

Here you can discover a vast array of form samples for both business and personal needs categorized by types and regions, or keywords.

Utilizing our sophisticated search functionality, acquiring the latest Omaha Nebraska Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries is as simple as 1-2-3.

Verify your selection. Click on the Buy now button. After that, choose your desired subscription plan and provide details to create an account.

Complete the purchase. Utilize your credit card or PayPal account to finish the registration process.

- Furthermore, the accuracy of each document is validated by a team of professional attorneys who routinely examine the templates on our site and update them according to the latest state and county standards.

- If you are already familiar with our platform and possess an account, all you need to do to obtain the Omaha Nebraska Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators, and other Fiduciaries is to Log In to your user profile and click the Download button.

- If this is your initial experience with US Legal Forms, simply follow the steps outlined below.

- Ensure that you have opened the form you need. Read its description and use the Preview feature to review its contents.

- If it doesn’t fulfill your needs, utilize the Search box located at the top of the page to locate the necessary document.

Form popularity

FAQ

A Fiduciary refers to any individual acting on behalf of another, and in Estate Planning this often means in a legal capacity. An Executor, on the other hand, is a much more narrow responsibility. Executors can only act on the terms laid out in a Will.

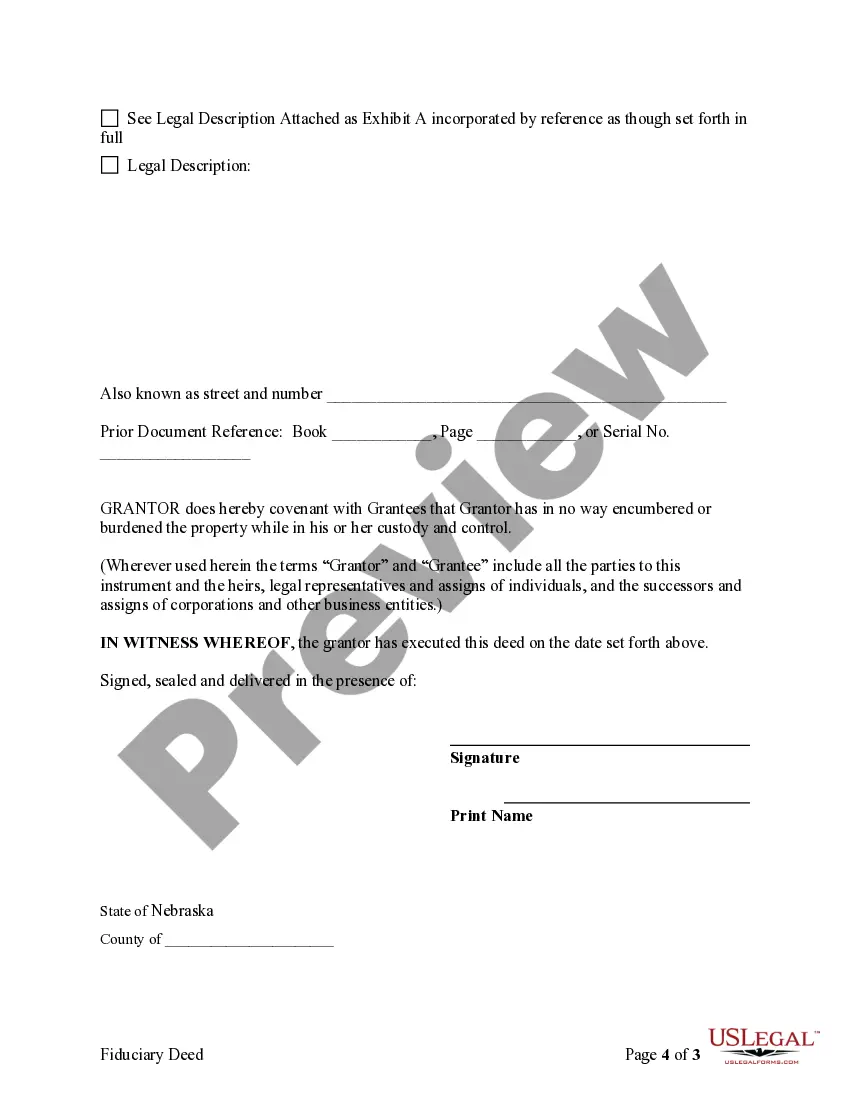

The fiduciary is responsible for collecting, appraising and having an inventory of the estate; paying bills, taxes and other expenses belonging to the decedent; and transferring property based on the will or the law. Being a fiduciary is a major responsibility and can be difficult.

An individual named as a trust or estate trustee is the fiduciary, and the beneficiary is the principal. Under a trustee/beneficiary duty, the fiduciary has legal ownership of the property or assets and holds the power necessary to handle assets held in the name of the trust.

Upon the death of a beneficiary who has a valid will or heirs, the fiduciary must hold the remaining funds under management in trust for the deceased beneficiary's estate until the will is probated or heirs are ascertained, and disburse the funds according to applicable state law.

An individual named as a trust or estate trustee is the fiduciary, and the beneficiary is the principal. Under a trustee/beneficiary duty, the fiduciary has legal ownership of the property or assets and holds the power necessary to handle assets held in the name of the trust.

An executor has a fiduciary duty to act in the best interests of the estate and its beneficiaries. They can face legal liability if they fail to meet this duty, such as when they act in their own interests or allow the assets in the estate to decay.

A ?Fiduciary? is a person or an institution you choose to entrust with the management of your property. Included among Fiduciaries are Executors and Trustees. An Executor is a person you appoint to settle your estate and to carry out the terms of your Will after your death.

A Fiduciary refers to any individual acting on behalf of another, and in Estate Planning this often means in a legal capacity. An Executor, on the other hand, is a much more narrow responsibility. Executors can only act on the terms laid out in a Will.

A ?Fiduciary? is a person or an institution you choose to entrust with the management of your property. Included among Fiduciaries are Executors and Trustees. An Executor is a person you appoint to settle your estate and to carry out the terms of your Will after your death.

When there are multiple trustees appointed to manage a trust, they are called co-trustees. A trustee manages and administers a trust, including selling and distributing trust property, and filing taxes for trust income when necessary.