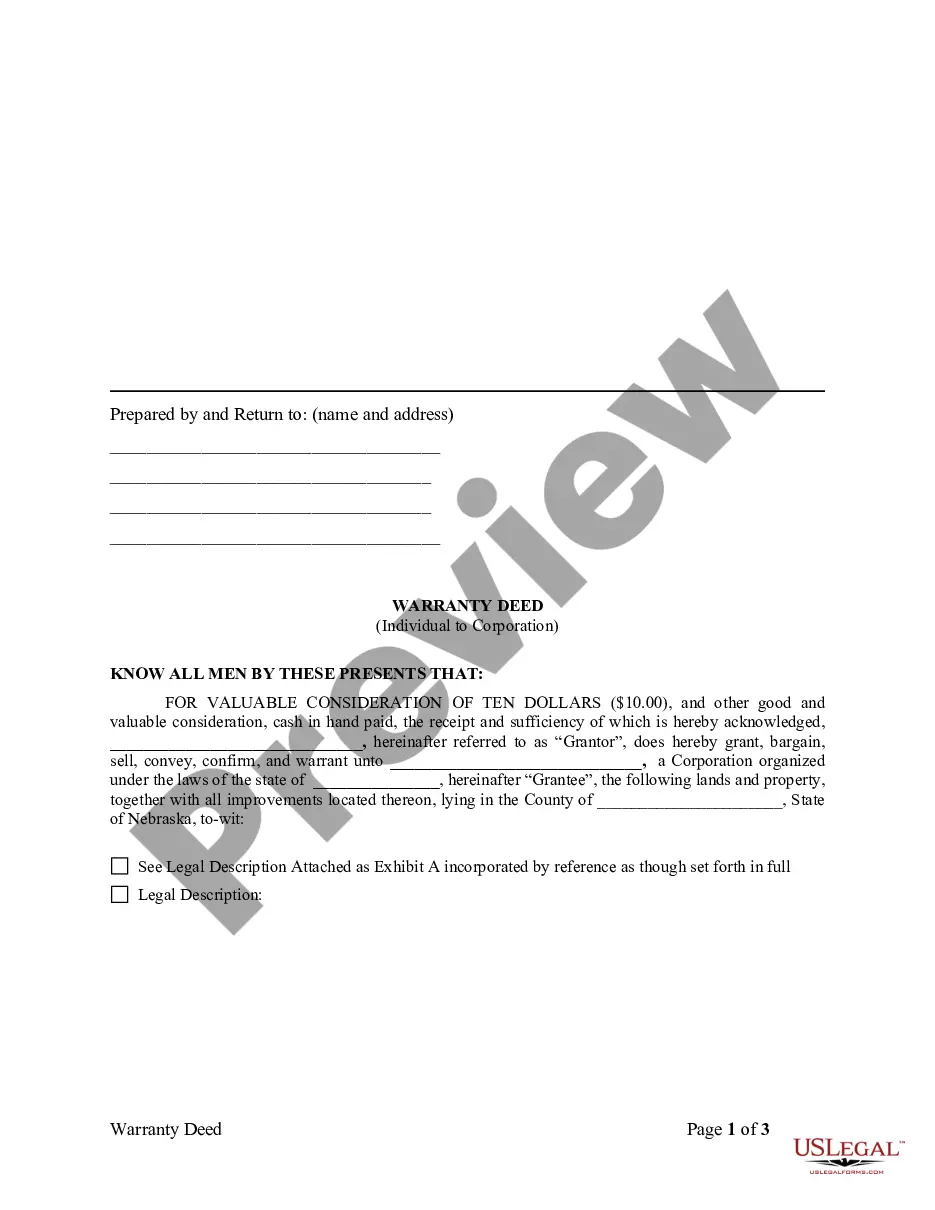

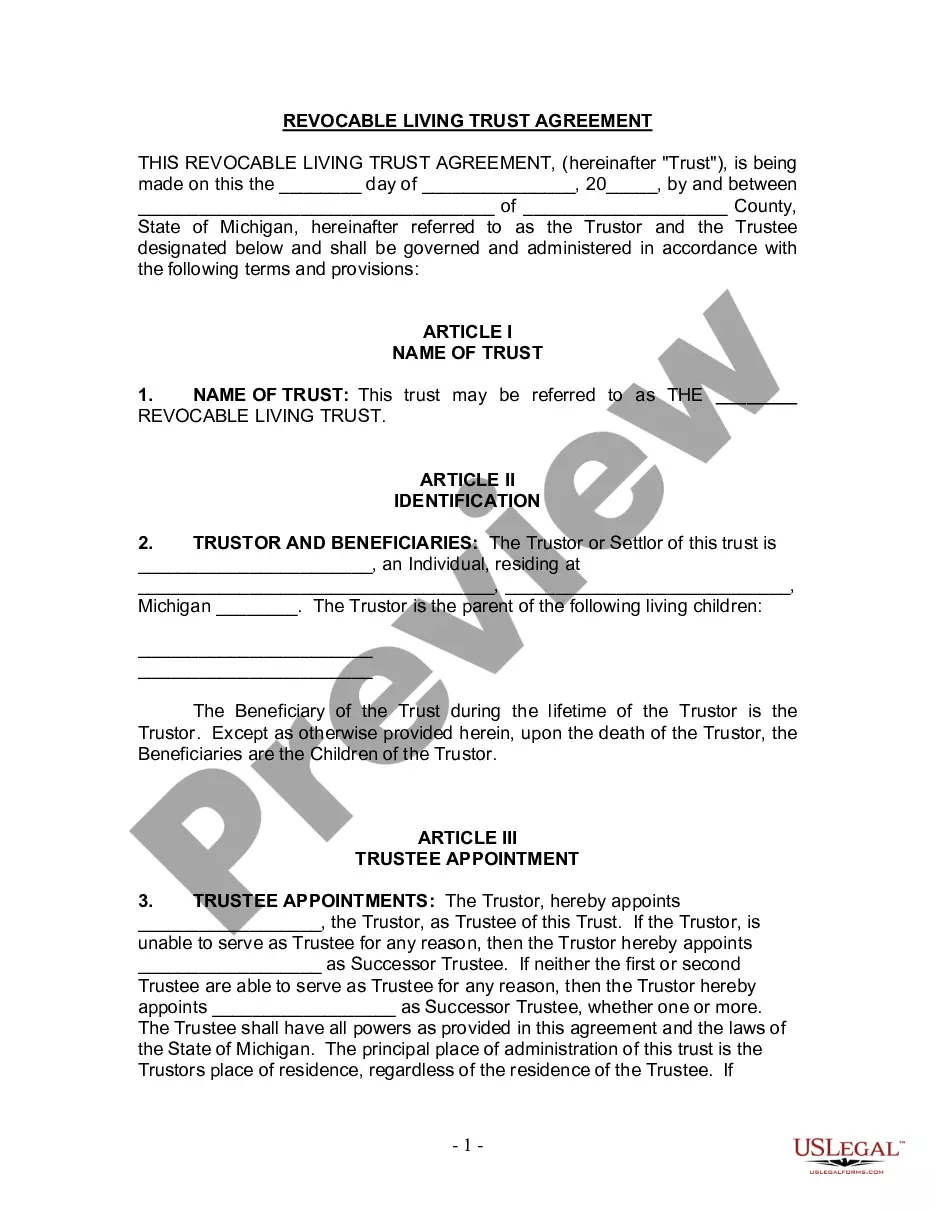

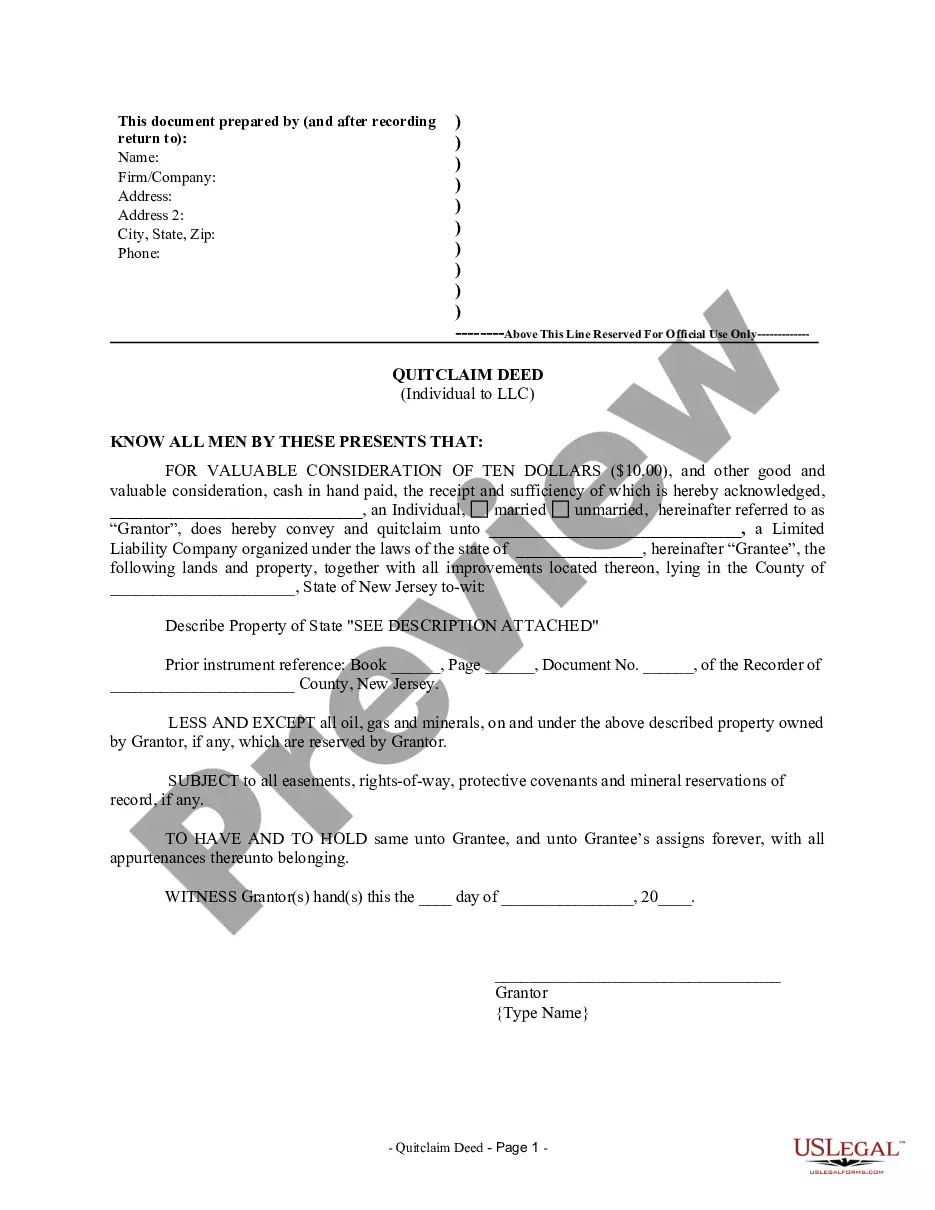

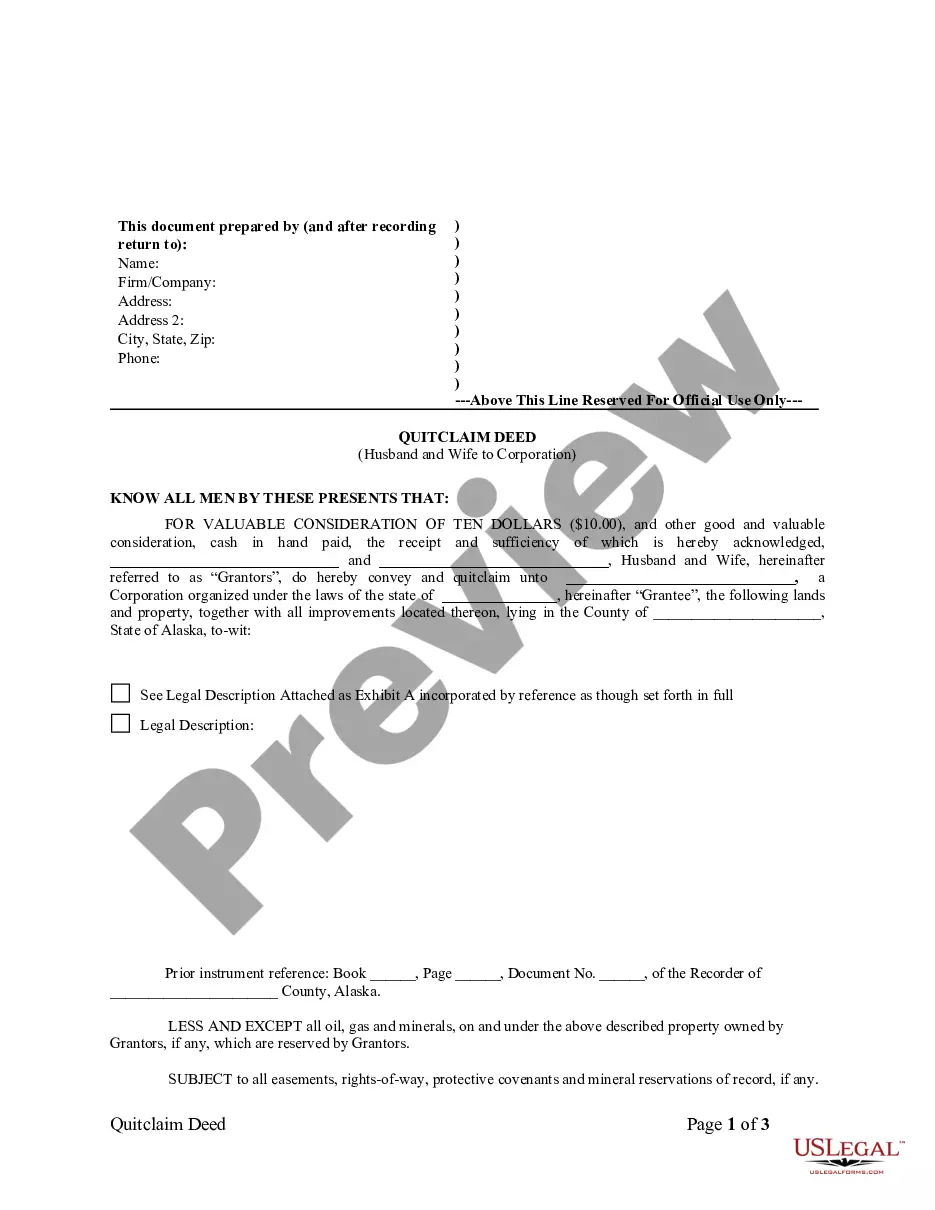

This Warranty Deed from Individual to Corporation form is a Warranty Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Omaha Nebraska Warranty Deed from Individual to Corporation

Description

How to fill out Nebraska Warranty Deed From Individual To Corporation?

If you are in search of an appropriate form template, it’s impossible to discover a superior service than the US Legal Forms website – likely the most comprehensive libraries available online.

Here you can obtain a vast number of document samples for organizational and personal purposes categorized by types and states or keywords.

With the enhanced search feature, obtaining the latest Omaha Nebraska Warranty Deed from Individual to Corporation is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Specify the file format and save it on your device. Edit the document. Complete, modify, print, and sign the obtained Omaha Nebraska Warranty Deed from Individual to Corporation.

- Moreover, the relevance of each file is guaranteed by a team of proficient lawyers who consistently examine the templates on our site and update them according to the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to do to get the Omaha Nebraska Warranty Deed from Individual to Corporation is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, just refer to the guidelines provided below.

- Ensure you have selected the sample you desire. Review its details and utilize the Preview option (if available) to evaluate its content. If it does not meet your requirements, use the Search field located at the top of the screen to find the suitable document.

- Validate your choice. Click the Buy now button. After that, select your preferred pricing plan and provide the necessary information to register for an account.

Form popularity

FAQ

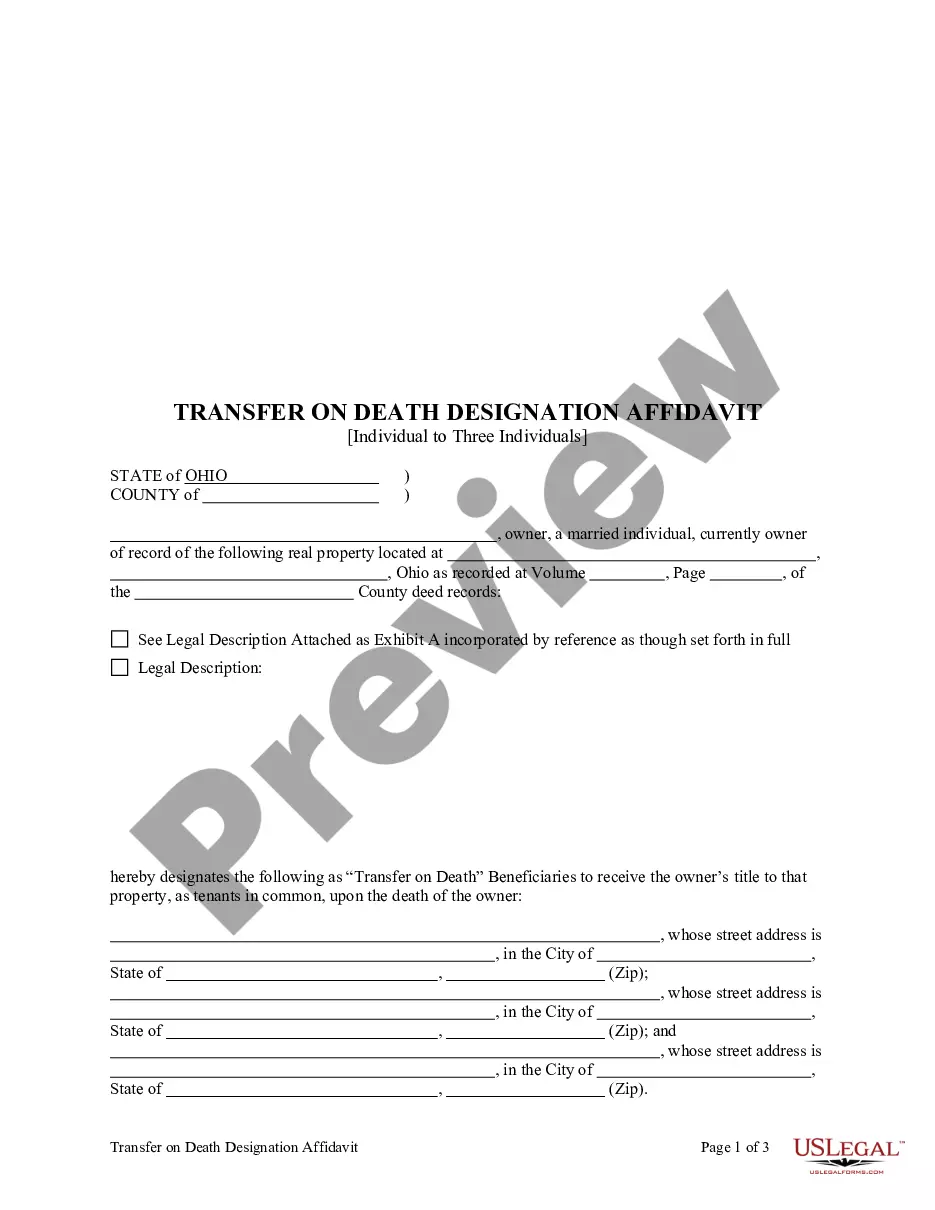

Stat. §§ 76-3401-76-3423 (the ?Act?). The Act allows an individual to transfer property located in Nebraska to one or more beneficiaries effective at the transferor's death through the use of a special deed referred to as a ?Transfer on Death Deed.?

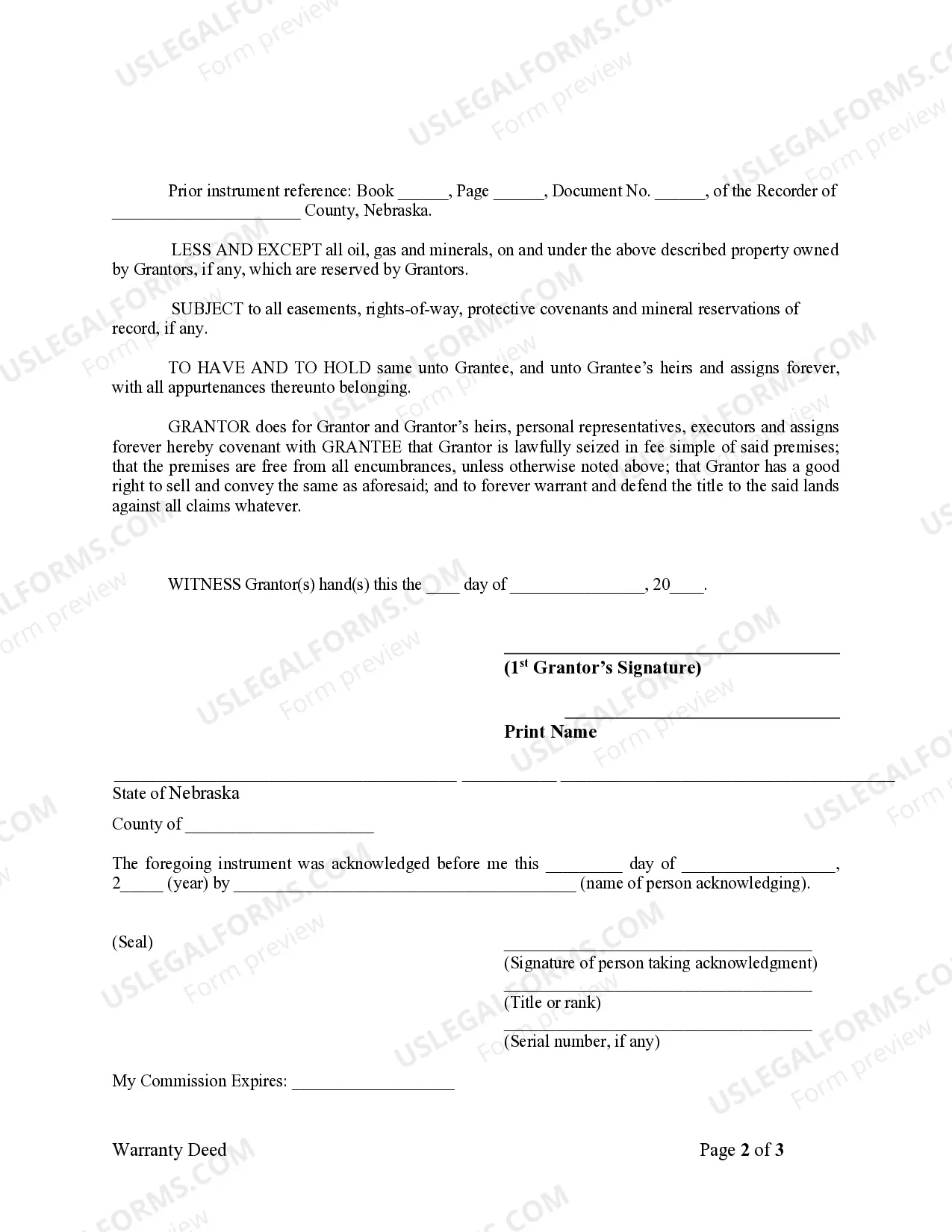

To complete the transfer, the deed must be recorded in the office of the Register of Deeds of the county where the property is located. All deeds also require a Form 521 - Real Estate Transfer Statement.

Land contracts, memoranda of contract, and death certificates being recorded pursuant to a transfer on death deed require a completed Form 521, which are not subject to the documentary stamp tax until the deed is presented for recording.

All parties just need to sign the transfer deed (TR1 form) and file it with the land registry. This needs to be accompanied by the land registry's AP1 form, and if the value of the transaction amounts to more than £40,000, then a stamp duty land tax certificate may also be required.

(b)(1) A transfer on death deed shall contain the following warnings: WARNING: The property transferred remains subject to inheritance taxation in Nebraska to the same extent as if owned by the transferor at death. Failure to timely pay inheritance taxes is subject to interest and penalties as provided by law.

Nebraska Quitclaim Deed Laws Signing - All quitclaim deeds written in the state must be signed by the individual(s) selling the property in the presence of a Notary Public (NRS 76-211) Recording - All quitclaim deeds must be filed in the County Recorder's Office in the city or county where the property is located.

12. Who benefits the most from recording a warranty deed? D. Explanation: The grantee is the one who has acquired an interest in the land, and she is the one who benefits the most from recording the deed to provide constructive (legal) notice of that interest.

The buyer, or grantee, of a property benefits the most from obtaining a warranty deed. Through the recording of a warranty deed, the seller is providing assurances to the buyer should anything unexpected happen.

A Nebraska warranty deed form?sometimes called a general warranty deed?transfers real estate guaranteed to have a good, clear title. The current owner provides warranty of title?a legal promise that the property's title is subject to no liens, mortgages, conflicting ownership claims, or other defects.

When the owner dies, a Nebraska TOD deed transfers title to the beneficiary named in the deed. The beneficiary formally takes title by recording the owner's death certificate and a cover sheet with the register of deeds.