Greensboro North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out North Carolina Last Will And Testament With All Property To Trust Called A Pour Over Will?

Locating verified templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

This is an online repository featuring over 85,000 legal forms for personal and professional requirements as well as various real-life situations.

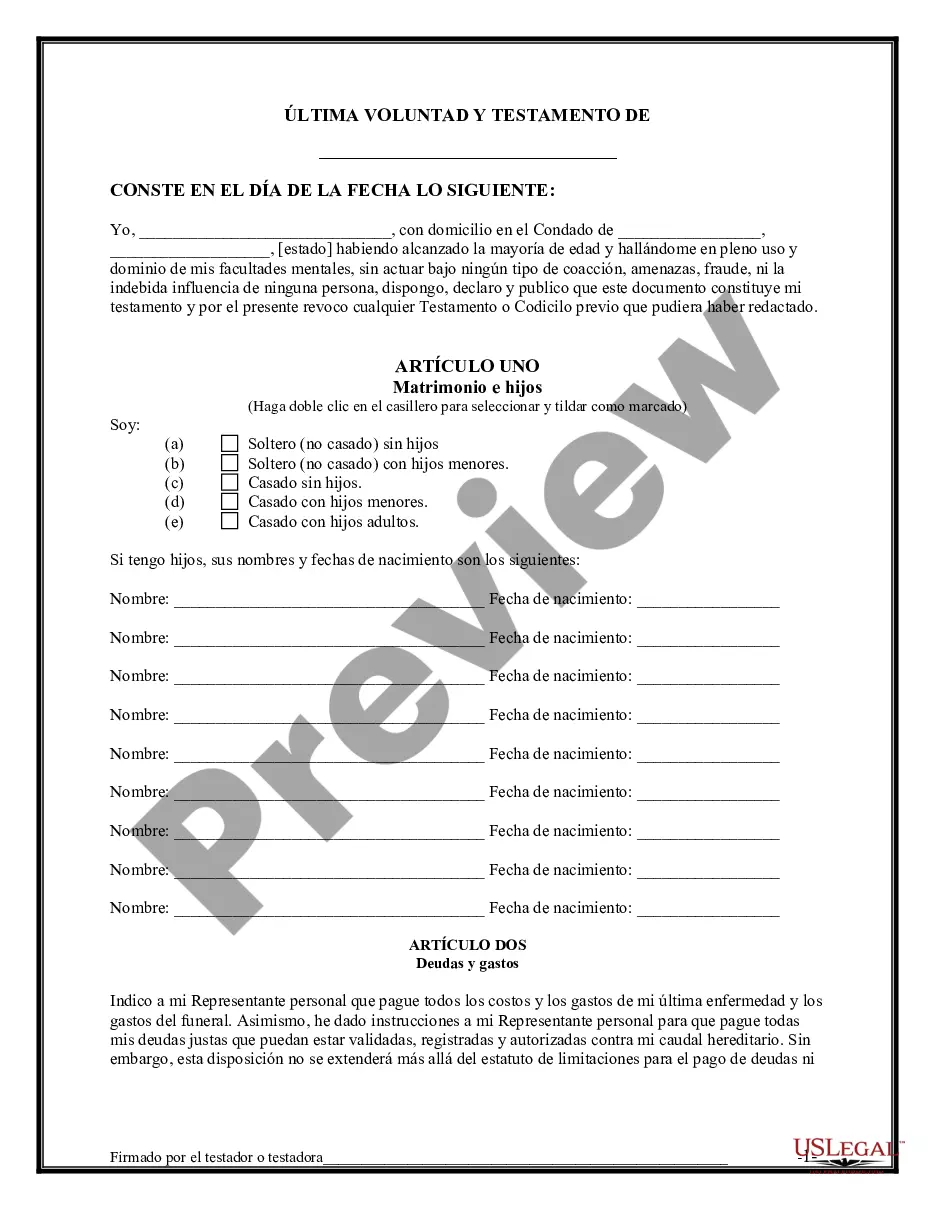

All documents are accurately organized by usage area and jurisdiction, making it simple to find the Greensboro North Carolina Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will.

Maintaining documentation organized and compliant with legal standards is crucial. Utilize the US Legal Forms library to always have vital document templates readily available for any requirements!

- For existing users familiar with our service, acquiring the Greensboro North Carolina Legal Last Will and Testament Form with All Property to Trust called a Pour Over Will only requires a few clicks.

- You simply need to Log In to your account, select the document, then click Download to save it on your device.

- New users will have to perform a few additional actions to complete the process.

- Follow the instructions below to begin with the most comprehensive online form library.

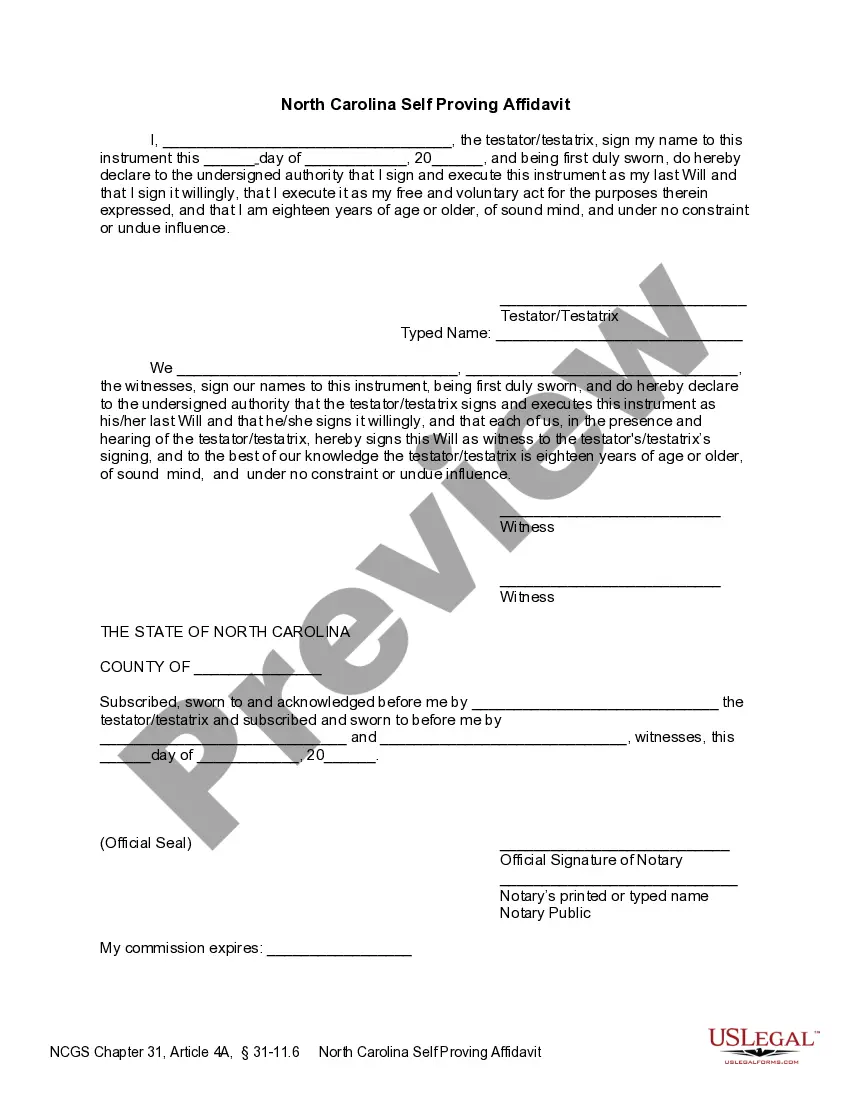

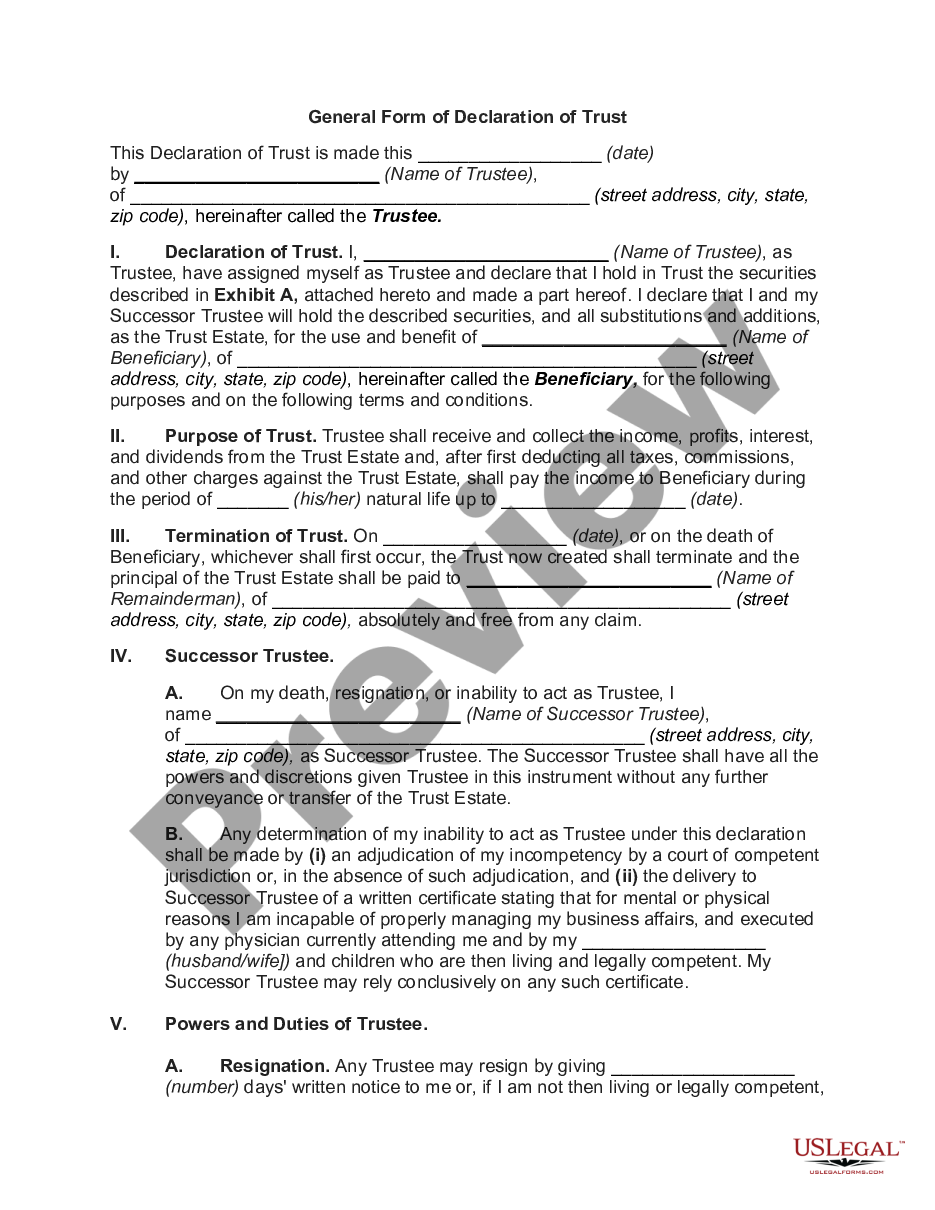

- Review the Preview mode and form description. Ensure that you’ve selected the right one that fulfills your needs and completely aligns with your local jurisdiction criteria.

Form popularity

FAQ

Yes, a trust can indeed bypass a last will and testament with all property to trust, known as a pour-over will. Assets held in the trust do not undergo the probate process and go directly to your beneficiaries. This feature of trusts allows for quicker distribution of assets and maintains privacy, making them a beneficial option for estate planning in Greensboro, North Carolina.

A last will and testament with all property to trust, called a pour-over will, generally does not override a trust. Instead, it serves as a safety net, directing any assets not included in the trust into the trust upon your passing. Therefore, it is important to ensure that your trust is funded correctly to avoid conflicts and ensure a seamless transition of your assets.

Yes, a pour-over will is a specific type of last will and testament designed to transfer any remaining assets to your trust upon your death. In Greensboro, North Carolina, using a pour-over will ensures that any assets not previously placed in your trust are still distributed according to your wishes. This document complements the trust by filling in the gaps, making it an essential part of your estate plan.

A trust is generally considered more powerful than a last will and testament with all property to trust, called a pour-over will. Trusts provide benefits like bypassing probate, maintaining privacy, and allowing for more control over asset distribution. This means you can dictate how and when your beneficiaries receive their inheritances. While a will is still necessary, a trust often offers broader benefits.

In most cases, a trust takes precedence over a last will and testament with all property to trust, known as a pour-over will. The assets in a trust bypass probate and go directly to the beneficiaries, reflecting your wishes as stated in the trust document. However, any assets not placed in the trust must be addressed in the will. Therefore, the coordination of both documents is vital in your estate planning.

In Greensboro, North Carolina, a last will and testament with all property to trust, called a pour-over will, cannot simply overturn a trust. Instead, it works alongside the trust to ensure your wishes are honored after your passing. A will can outline how assets not included in the trust are to be managed, but it does not invalidate the trust. Thus, it is essential to ensure both documents align with your intentions.

While putting property in trust can provide benefits like avoiding probate, it can also lead to drawbacks, such as loss of control and potential tax implications. Specifically, a Greensboro North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will can ensure your assets are managed according to your wishes, but it may limit how you can use those assets during your lifetime. Proper planning with legal guidance is essential to address these potential disadvantages.

A trust can override a last will and testament to the extent that any assets placed in the trust will be distributed according to the trust's terms rather than the will's directives. This is particularly relevant in cases where a Greensboro North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will is involved, as it may direct that certain assets pour into the trust upon your passing. Therefore, it is crucial to ensure your wishes are clearly specified in your estate planning documents.

People might choose a trust over a will for several reasons, including the desire to avoid probate, which can be a lengthy and public process. A Greensboro North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will can facilitate this process by funneling assets directly into a trust, allowing for privacy and efficiency. Additionally, trusts provide better control over how and when beneficiaries receive assets.

One major disadvantage of a trust is its initial setup and maintenance costs; it often requires legal assistance to create properly. While a Greensboro North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will may offer a simpler alternative, trusts can incur additional fees over time, like tax implications and trustee management fees. You should weigh these factors carefully against the benefits of having a trust.