North Carolina Last Will and Testament with All Property to Trust called a Pour Over Will

Description

How to fill out North Carolina Last Will And Testament With All Property To Trust Called A Pour Over Will?

Steer clear of expensive lawyers and discover the North Carolina Legal Last Will and Testament Form with All Property to Trust referred to as a Pour Over Will that you require at an economical rate on the US Legal Forms site.

Utilize our straightforward groups feature to search for and download legal and tax documents. Review their descriptions and preview them before downloading.

Choose to receive the form in PDF or DOCX format. Click Download and locate your template in the My documents section. You can save the form to your device or print it out. After downloading, you can fill out the North Carolina Legal Last Will and Testament Form with All Property to Trust, also known as a Pour Over Will, either manually or using an editing software application. Print it out and reuse the template multiple times. Achieve more while spending less with US Legal Forms!

- Additionally, US Legal Forms offers users detailed guidance on how to acquire and complete each template.

- US Legal Forms clients only need to Log In and download the particular document they require to their My documents section.

- Those who haven't subscribed yet should follow the instructions outlined below.

- Confirm that the North Carolina Legal Last Will and Testament Form with All Property to Trust, known as a Pour Over Will, is valid for use in your area.

- If possible, read the description and utilize the Preview feature before downloading the templates.

- If you are confident the document meets your requirements, click on Purchase Now.

- If the form is incorrect, use the search tool to locate the appropriate one.

- Then, create your account and select a subscription option.

- Make your payment via credit card or PayPal.

Form popularity

FAQ

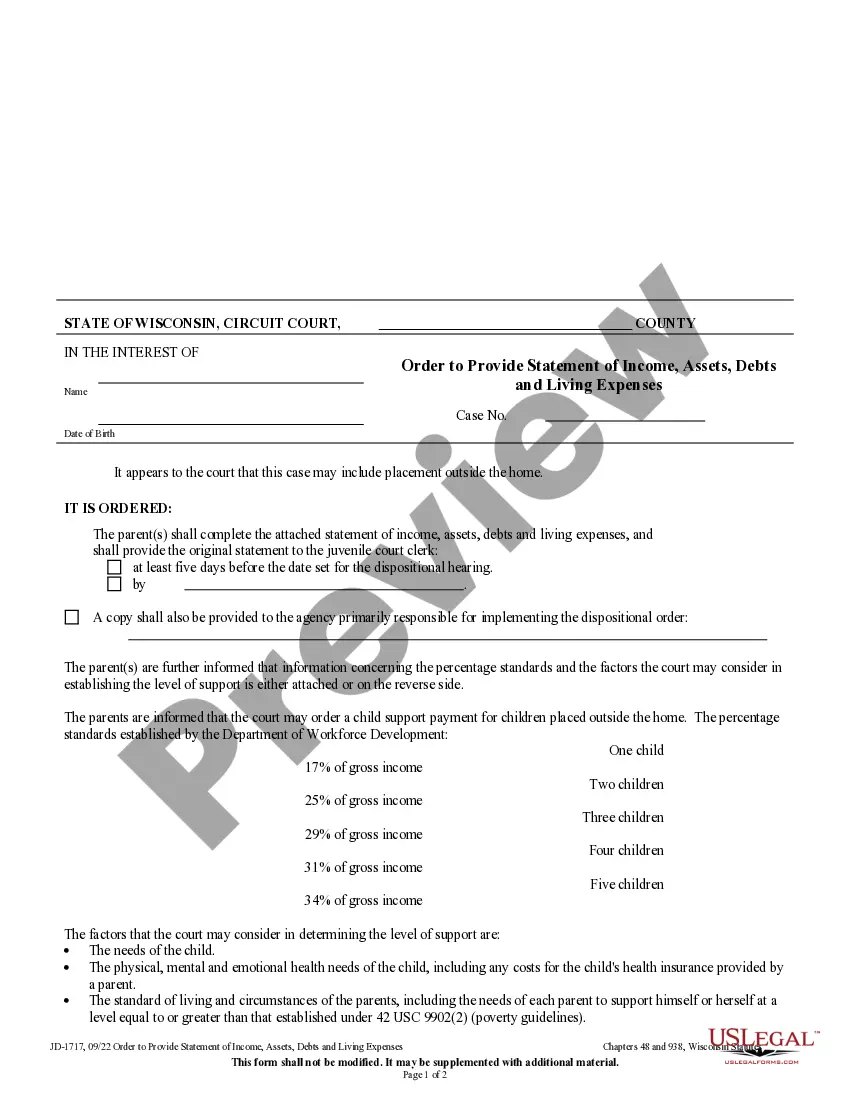

Pour-over wills are subject to probate since the assets have not yet been transferred into the trust. Some states also require your assets to go through the probate process any time your assets or property are over a certain value.Even though pour-over wills don't avoid probate, there is still a measure of privacy.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

If you make a living trust, you might well think that you don't need to also make a will. After all, a living trust basically serves the same purpose as a will: it's a legal document in which you leave your property to whomever you choose.But even if you make a living trust, you should make a will as well.

A Living Trust is a document that allows individual(s), or 'Grantor', to place their assets to the benefit of someone else at their death or incapacitation. Unlike a Will, a Trust does not go through the probate process with the court.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.

Both are useful estate planning devices that serve different purposes, and both can work together to create a complete estate plan. One main difference between a will and a trust is that a will goes into effect only after you die, while a trust takes effect as soon as you create it.

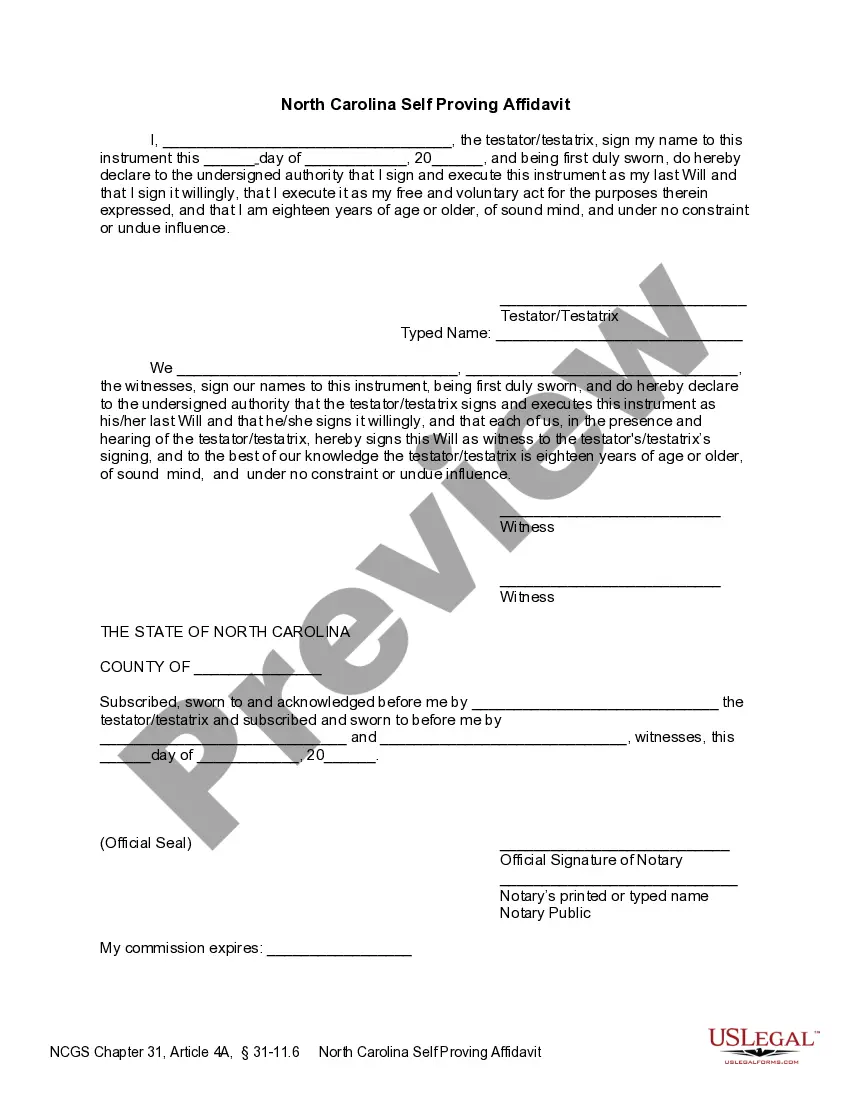

When people make revocable living trusts to avoid probate, it's common for them to also make what's called a "pour-over will." The will directs that if any property passes through the will at the person's death, it should be transferred to (poured into) the trust, and then distributed to the beneficiaries of the trust.

A pour-over will is a testamentary device wherein the writer of a will creates a trust, and decrees in the will that the property in his or her estate at the time of his or her death shall be distributed to the Trustee of the trust.

After reading about the benefits of a revocable living trust, you may wonder, Why do I need a pour-over will if I have a living trust? A pour-over will is necessary in the event that you do not fully or properly fund your trust.Your trust agreement can only control the assets that the trust owns.