Greensboro North Carolina Assignment to Living Trust

Description

How to fill out North Carolina Assignment To Living Trust?

If you are on the lookout for a pertinent form template, it’s exceedingly challenging to locate a superior service than the US Legal Forms website – one of the most extensive collections available online.

With this collection, you can obtain a vast array of form samples for organizational and individual needs categorized by types and regions, or keywords.

With our sophisticated search feature, finding the latest Greensboro North Carolina Assignment to Living Trust is as simple as 1-2-3.

Execute the payment transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Select the format and download it to your device.

- Furthermore, the pertinence of each document is validated by a team of professional attorneys who consistently review the templates on our site and update them in line with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to acquire the Greensboro North Carolina Assignment to Living Trust is to Log In to your profile and select the Download option.

- If you are utilizing US Legal Forms for the first time, just refer to the instructions below.

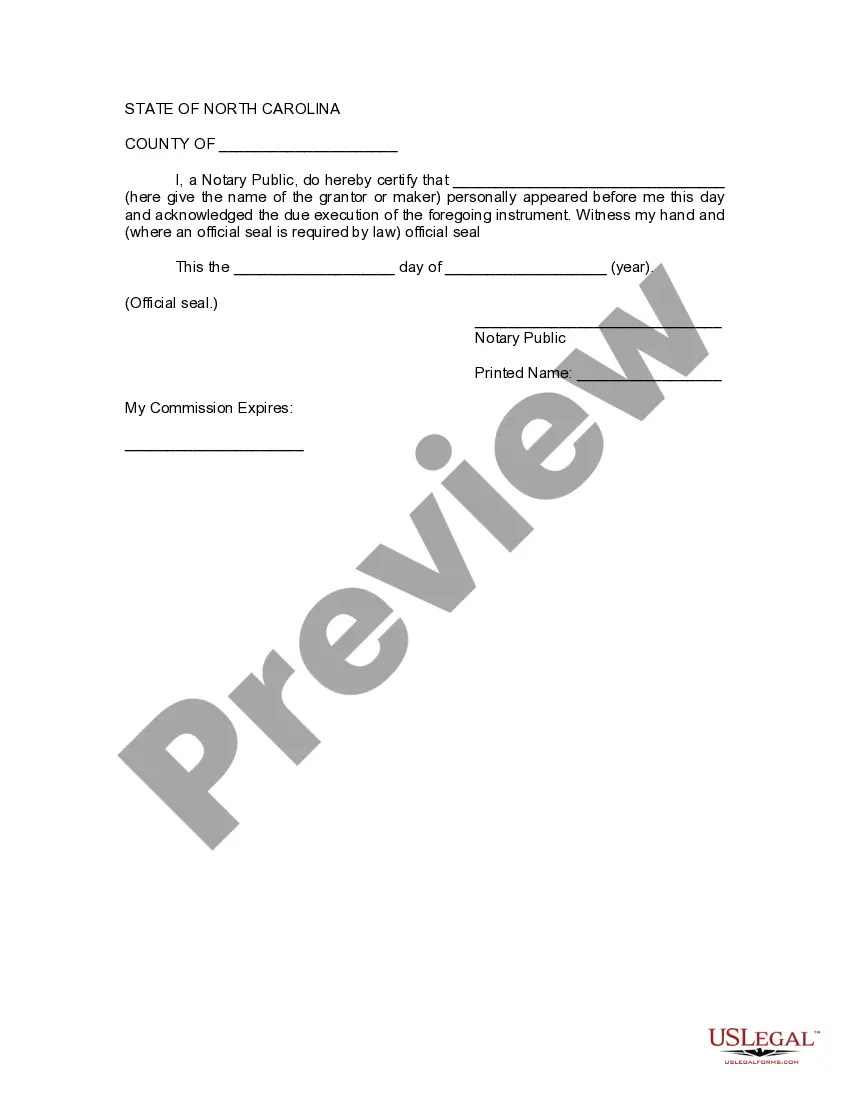

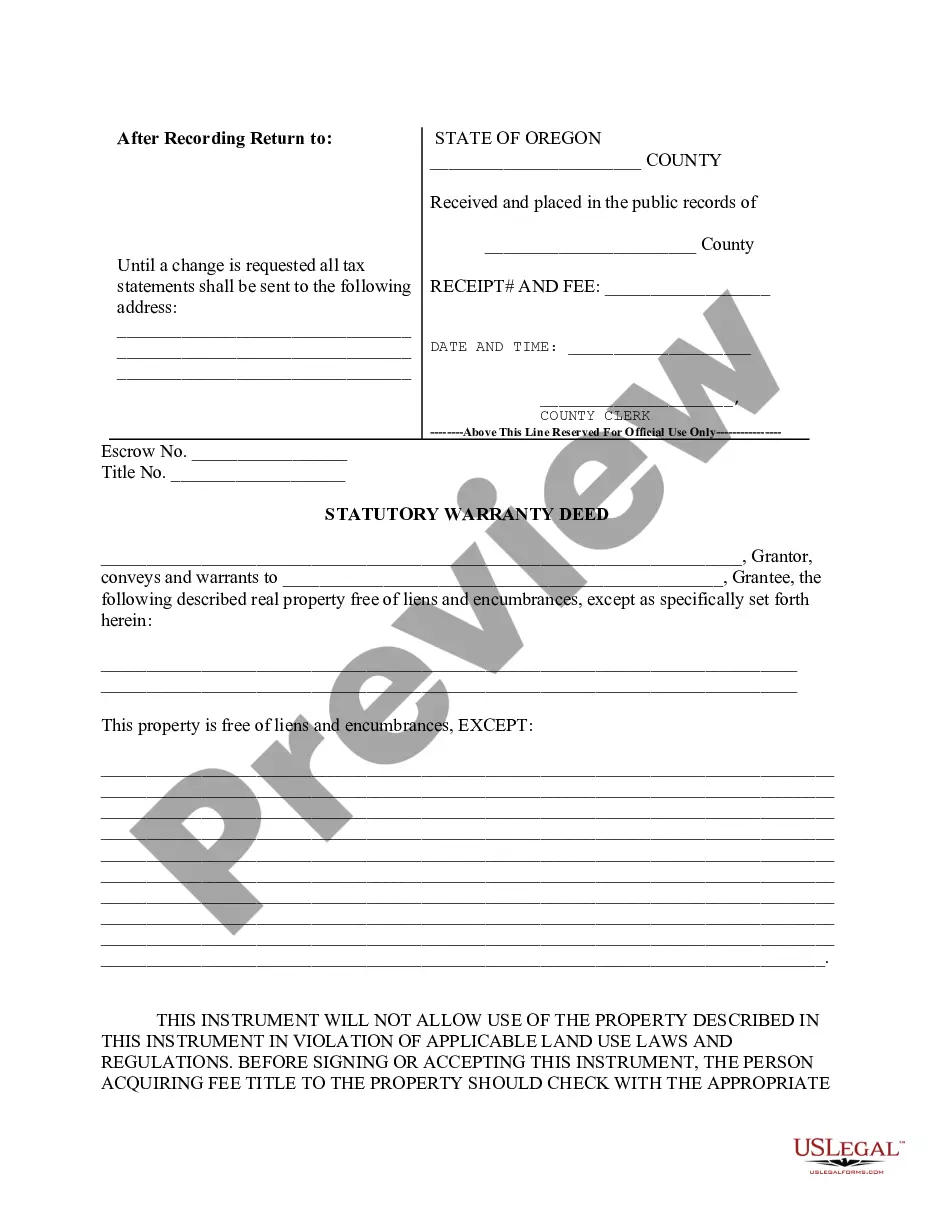

- Ensure you have identified the form you wish to obtain. Review its details and utilize the Preview function to examine its contents. If it does not fulfill your requirements, use the Search bar at the top of the page to find the appropriate document.

- Verify your selection. Click the Buy now option. Afterwards, choose your desired subscription plan and provide credentials to register for an account.

Form popularity

FAQ

Setting up a living trust in North Carolina involves a few key steps. First, you need to decide on the assets you wish to include in your Greensboro North Carolina Assignment to Living Trust. Next, you should create the trust document, which outlines your wishes and designates a trustee. Using resources from USLegalForms can simplify this process and help you navigate the legal requirements effectively.

Yes, you can create your own living trust in North Carolina. This process allows you to establish a Greensboro North Carolina Assignment to Living Trust tailored to your wishes. However, it is important to follow specific legal guidelines to ensure your trust is valid and effective. Utilizing platforms like USLegalForms can provide you with the necessary documents and guidance to facilitate this process.

While putting your house in a trust has many advantages, some disadvantages include potential costs associated with setting up and maintaining the trust. Additionally, you might lose some control over the property as the trust becomes a separate legal entity. It’s wise to consider these factors when opting for a Greensboro North Carolina Assignment to Living Trust, and consulting with experts can help you make the right decision.

Transferring property to a trust provides various benefits, including avoiding probate and protecting the asset from creditors. It can also simplify the management of your property and ensure your wishes are followed after your passing. A Greensboro North Carolina Assignment to Living Trust allows for smooth asset distribution and offers peace of mind for your loved ones.

Transferring property to a trust in North Carolina involves creating a trust document and completing a deed transfer. You must sign the deed and record it in the county where the property is located. For a smooth process, consider using US Legal Forms, which can assist you with your Greensboro North Carolina Assignment to Living Trust and help ensure that all legal requirements are met.

To put your house in a trust in North Carolina, you need to create a trust document that outlines the terms of the trust. After that's done, you will execute a deed transferring your property from your name to the trust's name. By leveraging resources like US Legal Forms, you can efficiently manage your Greensboro North Carolina Assignment to Living Trust and ensure compliance with state laws.

To transfer assets into a trust, you first need to identify the assets you wish to include, such as property, bank accounts, or investment accounts. Then, you'll prepare and execute the necessary legal documents to assign these assets to the trust. Utilizing services like US Legal Forms can streamline this process, ensuring your Greensboro North Carolina Assignment to Living Trust is set up accurately and effectively.

A disadvantage of a family trust is the potential for disputes among family members regarding trust management and distributions. With a Greensboro North Carolina Assignment to Living Trust, there can also be ongoing expenses related to its operation. Additionally, if not properly structured, a family trust may fail to meet its intended purpose, which emphasizes the importance of choosing a reliable platform like uslegalforms for guidance.

Deciding whether your parents should put their assets in a trust like a Greensboro North Carolina Assignment to Living Trust involves assessing their unique financial situation. A trust can provide benefits such as avoiding probate and protecting assets; however, it may also introduce complexities. It’s wise to consult with a legal professional to explore all available options, ensuring they make the best choice for their legacy.

A major downfall of having a trust, such as a Greensboro North Carolina Assignment to Living Trust, is the complexity involved in managing it. Trusts require detailed record-keeping and compliance with legal standards, which can be overwhelming for some individuals. Moreover, transferring assets into the trust may also trigger tax implications that need to be carefully evaluated by a professional.