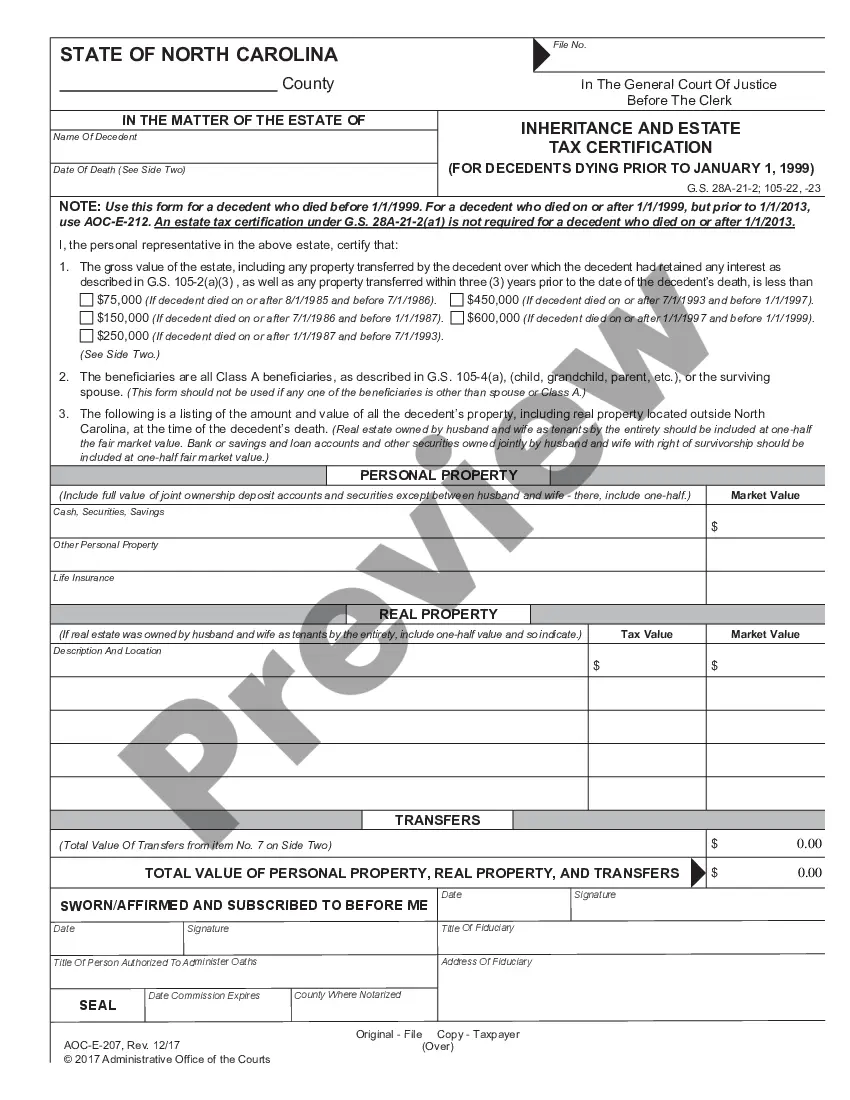

Estate Tax Certification (For Decedents Dying On Or After 1/1/99): This is an official form from the North Carolina Administration of the Courts (AOC), which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by North Carolina statutes and law.

High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After

Description

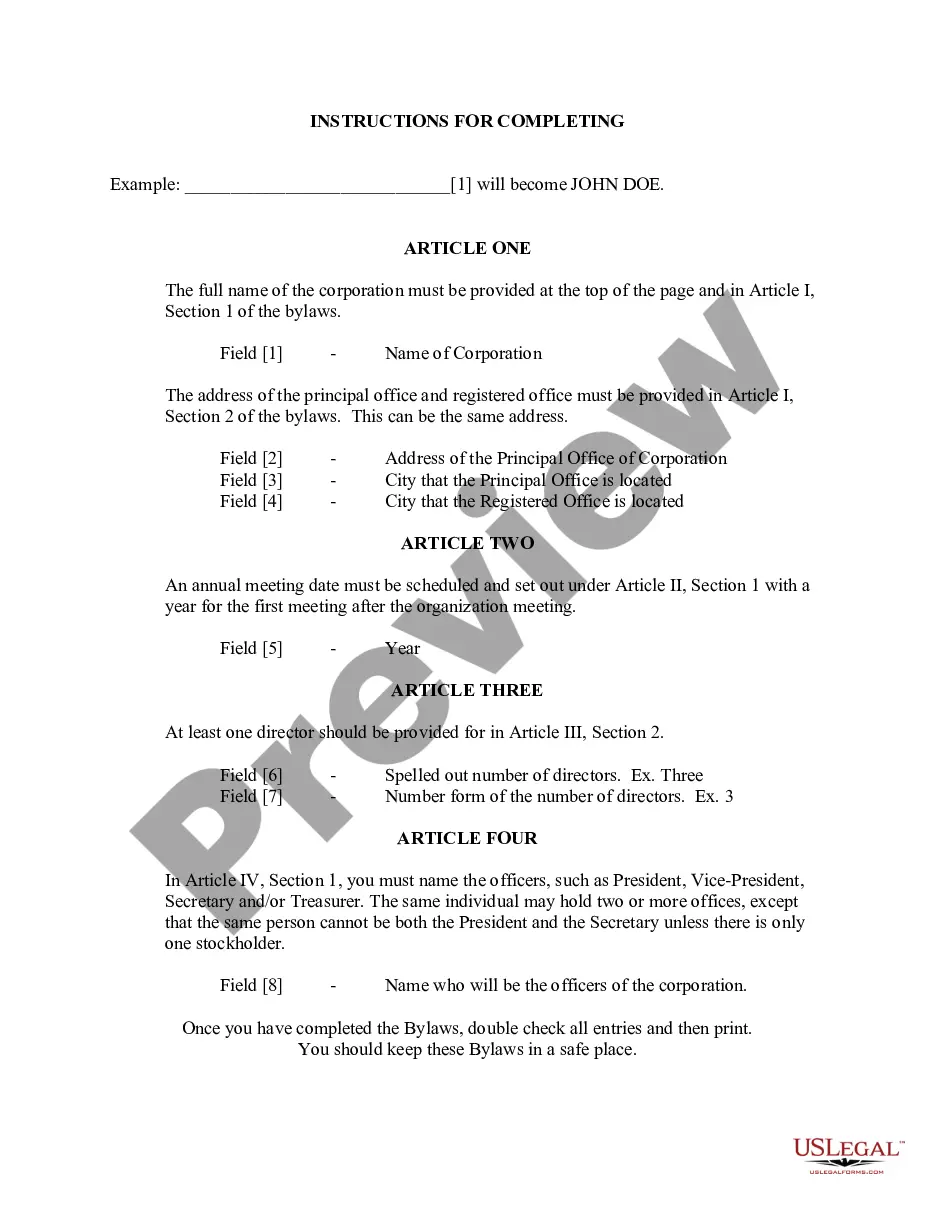

How to fill out North Carolina Estate Tax Certification - For Decedents Dying On Or After?

Are you in need of a reliable and reasonably priced provider of legal forms to obtain the High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After? US Legal Forms is your ideal resource.

Whether you need a straightforward agreement to establish guidelines for living together with your partner or a collection of forms to facilitate your separation or divorce through the legal system, we've got you covered. Our website features over 85,000 current legal document templates for personal and business applications. All templates we provide are specifically crafted and tailored to the needs of individual states and regions.

To acquire the document, you must Log In to your account, locate the necessary form, and click the Download button adjacent to it. Keep in mind that you can download your previously obtained document templates at any time in the My documents tab.

Is this your first visit to our site? No problem. You can effortlessly create an account, but before you proceed, ensure you do the following.

Now you can register your account. Choose the subscription option and move forward with the payment. Once the payment is processed, download the High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After in any of the available file formats. You are welcome to revisit the website at any time and redownload the document at no additional cost.

Acquiring current legal forms has never been simpler. Try US Legal Forms today, and stop wasting your precious time searching for legal documents online.

- Verify if the High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After aligns with the regulations of your state and locality.

- Review the form's description (if available) to understand who and what the document is intended for.

- If the form does not fit your specific needs, restart your search.

Form popularity

FAQ

In North Carolina, you typically have a maximum of 60 days to file a probate petition after death, though it can vary based on circumstances. Timely filing helps ensure that the estate settles smoothly and all debts and taxes can be addressed properly. If you navigate this process with the High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After, you can better manage probate expectations and responsibilities.

To avoid paying capital gains tax on inherited property in North Carolina, you should consider the stepped-up basis rule. When you inherit property, its value is usually adjusted to the market value on the date of the decedent's death. This means that if you sell the property shortly afterward, you may not owe capital gains tax. Utilizing the High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After can help clarify your tax obligations and maximize your benefits.

In North Carolina, no state estate tax is imposed on the deceased's estate due to the repeal of the estate tax in 2013. However, federal estate tax regulations may still need consideration depending on the estate size. Understanding the implications of High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After can provide clarity and ensure compliance.

Yes, in North Carolina, you must file an estate if the deceased owned assets that require legal probate. This process ensures the orderly distribution of property and settlement of debts. Utilizing resources such as the High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After can streamline this filing.

In North Carolina, beneficiaries can inherit without paying state estate taxes since there is no estate tax. However, any applicable federal taxes depend on the total value of the estate exceeding certain thresholds. Secure your understanding of High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After to navigate these details efficiently.

North Carolina does not currently impose a state estate tax, which can greatly benefit heirs and the overall administration of estates. However, federal estate tax obligations may still apply depending on the estate's value. Knowing about the High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After can help clarify your responsibilities.

Yes, in North Carolina, you may need to file an estate tax return if the estate surpasses the state's exemption limit. It's crucial to review the estate's assets thoroughly to determine if filing is necessary. Obtaining High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After will guide you through this process.

An estate tax return is generally triggered when the value of the deceased's estate exceeds the exemption limit set by the state. In North Carolina, this means evaluating all assets at the time of death. Understanding these thresholds is critical for High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After and ensures compliance with state laws.

Failing to file an estate tax return can lead to significant penalties and interest on any taxes owed. The state may impose additional fines for noncompliance. It's important to consider High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After, as filing correctly can help you avoid legal complications.

North Carolina does not currently impose an inheritance tax; therefore, there is no requirement for an inheritance tax waiver. However, obtaining a High Point North Carolina Estate Tax Certification - For Decedents Dying On Or After is still necessary to ensure proper handling of any estate tax obligations. Make sure to keep abreast of any changes in legislation that may affect this in the future.