Charlotte North Carolina Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out North Carolina Dissolution Package To Dissolve Limited Liability Company LLC?

If you are looking for a suitable form template, it’s difficult to find a more user-friendly platform than the US Legal Forms website – one of the largest collections on the web.

Here, you can discover numerous form examples for business and personal use categorized by types and states, or specific keywords.

With the exceptional search functionality, locating the most up-to-date Charlotte North Carolina Dissolution Package to Dissolve Limited Liability Company LLC is as straightforward as 1-2-3.

Retrieve the template. Specify the format and save it to your device.

Modify as needed. Complete, alter, print, and sign the obtained Charlotte North Carolina Dissolution Package to Dissolve Limited Liability Company LLC.

- If you are already familiar with our system and possess an account, all you need to access the Charlotte North Carolina Dissolution Package to Dissolve Limited Liability Company LLC is to Log In to your account and click the Download option.

- If you are utilizing US Legal Forms for the first time, simply adhere to the directions provided below.

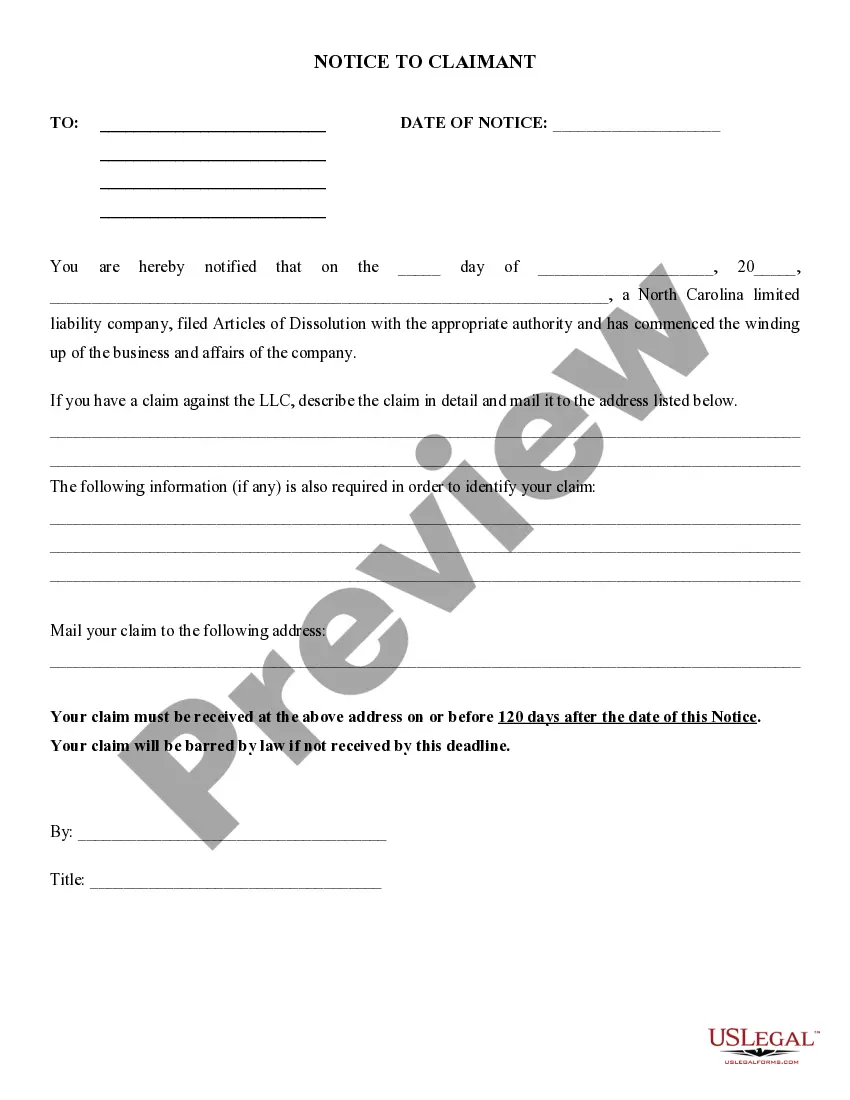

- Ensure you have selected the template you desire. Review its details and use the Preview feature (if available) to examine its contents. If it doesn’t meet your expectations, utilize the Search option located at the top of the page to locate the appropriate document.

- Confirm your choice. Click the Buy now button. Next, select your desired pricing plan and enter your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

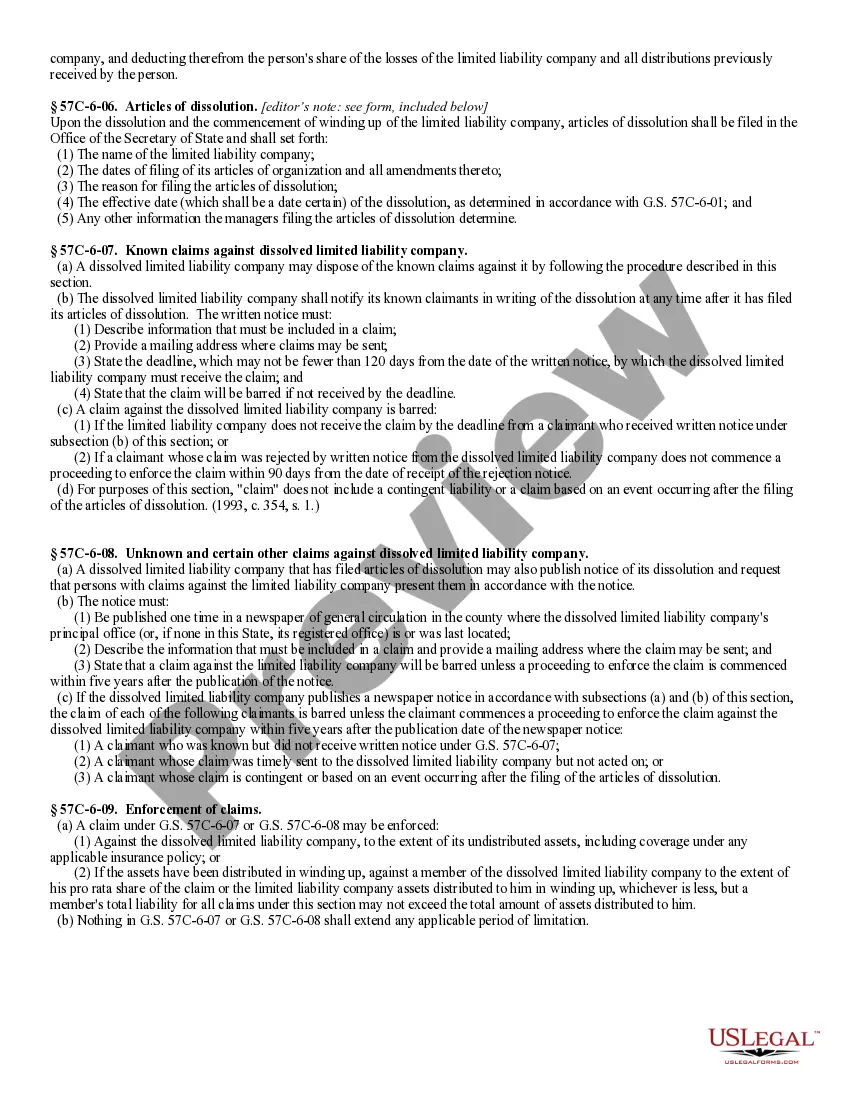

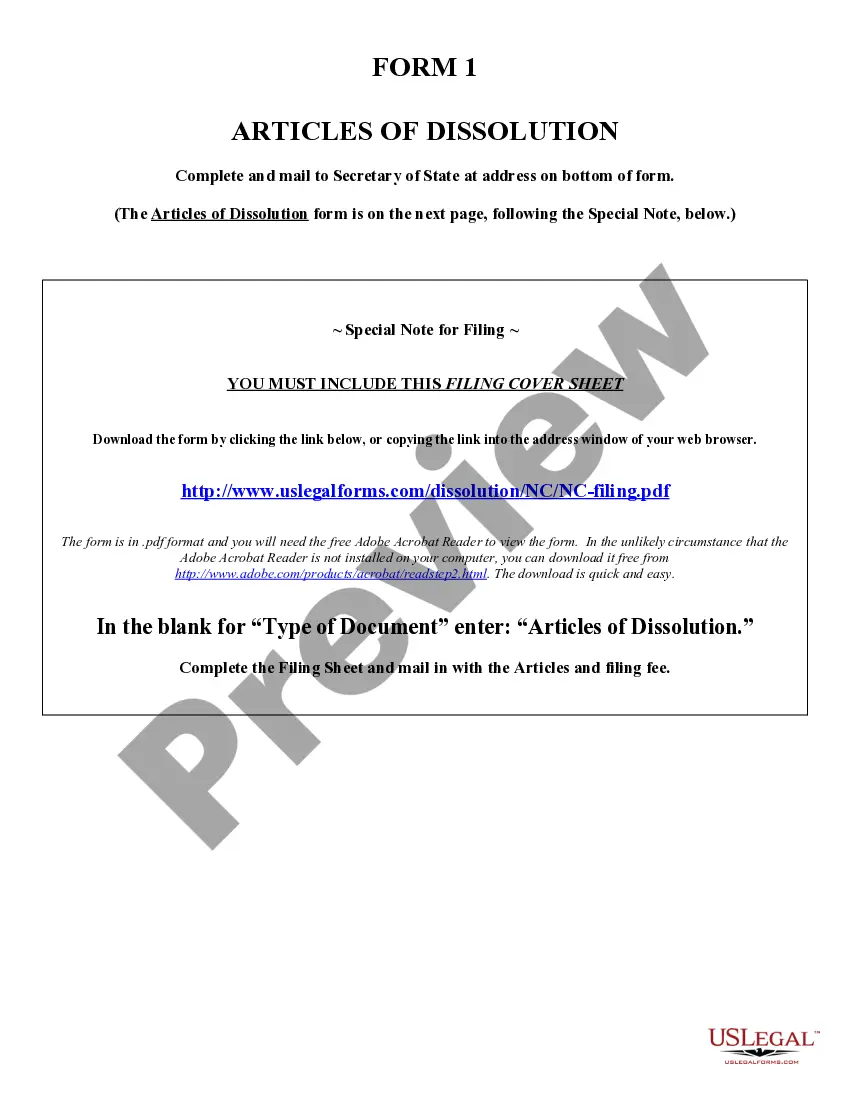

1. Filing fee is $30. This document must be filed with the Secretary of State. 2.

While both words are concerned with the end of a business partnership, dissolution refers to the process itself, and usually to the departure (or death) of one or more individuals from the entity, while termination refers to the cessation of all operations, including the disposal of all assets.

The Certificate of Dissolution puts all on notice that the LLC has elected to wind up the business of the LLC and is in the process of paying liabilities and distributing assets. In order to terminate the LLC, the LLC also must file a Certificate of Cancellation (Form LLC-4/7).

Your filing usually will be processed within seven to ten business days. You may pay additional fees for expedited processing. The SOS has an articles of dissolution form available for download. Be aware that your business name will become available for use by others 120 after the effective date of dissolution.

Limited Liability Company FormDocument NameFeeL-07Articles of Dissolution$30.00

The dissolution process is more than just closing down your LLC. It also includes filling out paperwork to officially terminate the company's status in the eyes of the state. Once the LLC is dissolved, you'll be taxed as an individual and no more business reporting will be required.

If you want to close a North Carolina business, you do so by voluntarily filing Articles of Dissolution for the entity type (Business Corporation, Nonprofit Corporation, Limited Liability Company (LLC)).

Dissolution: The beginning of the end, not the end itself. What it is and what it isn't. Dissolution is the first step in the termination process is to dissolve the LLC. Although some people confuse dissolution and termination, dissolution does not terminate an LLC's existence.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.

How long does it take the state to process the filing? Online filings are processed in 3-5 business days. Documents for LLC or corporation dissolution are processed by the North Carolina SOS in seven to ten business days when mailed. Same day expedited service costs an additional $200.