Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates

Description

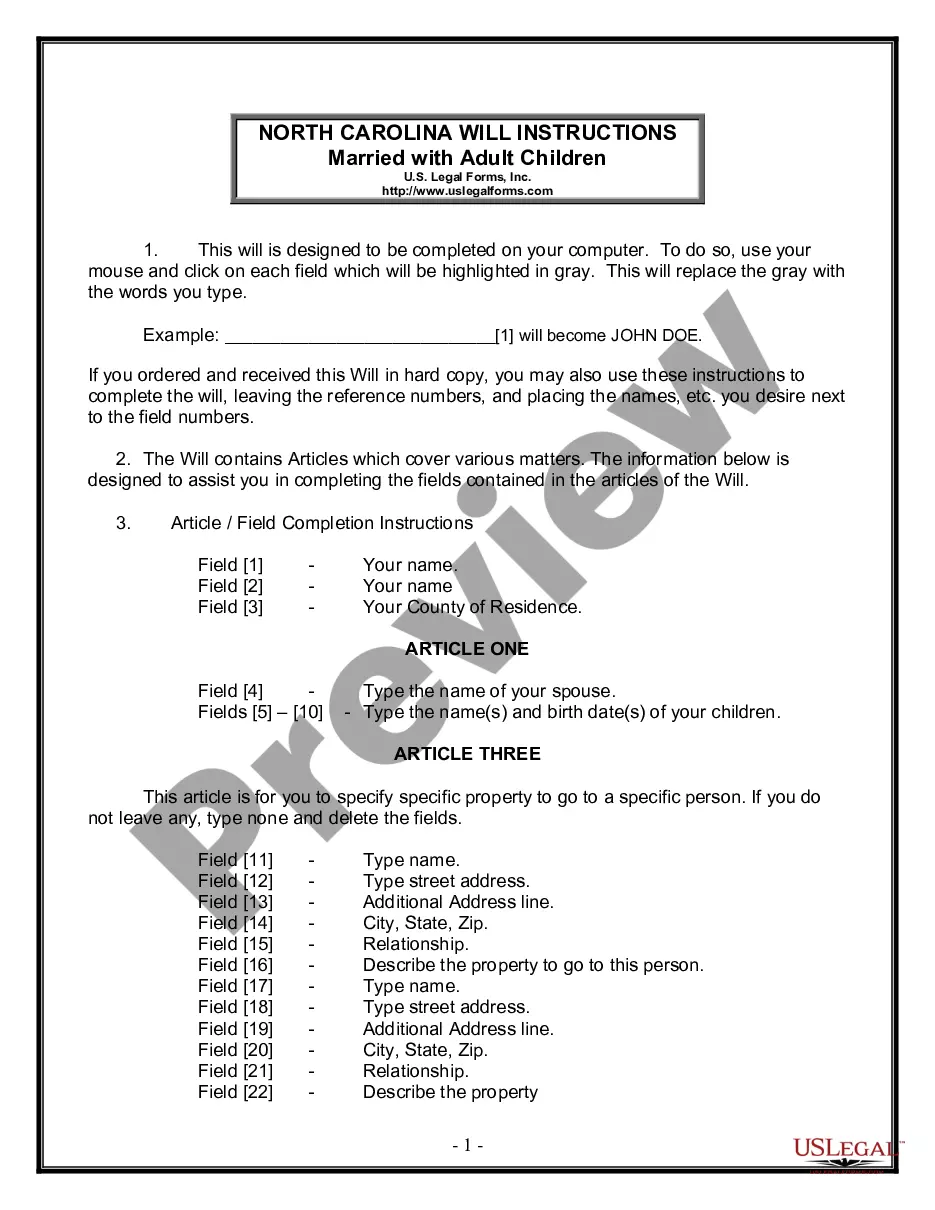

How to fill out North Carolina Complex Will With Credit Shelter Marital Trust For Large Estates?

If you are looking for a pertinent form template, it’s exceedingly challenging to uncover a superior platform than the US Legal Forms website – likely the most extensive online collections.

Here you can locate thousands of form examples for corporate and individual purposes categorized by types and states, or keywords.

Utilizing our enhanced search feature, discovering the latest Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the registration process.

Acquire the form. Choose the format and download it to your device. Edit. Fill in, modify, print, and sign the obtained Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates.

- Moreover, the relevance of each document is verified by a team of specialist attorneys who regularly review the templates on our platform and amend them based on the latest state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to acquire the Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates is to Log In to your user profile and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the instructions below.

- Ensure you have found the sample you desire. Review its description and utilize the Preview feature (if accessible) to examine its contents. If it doesn’t satisfy your requirements, utilize the Search option at the top of the page to find the suitable document.

- Confirm your selection. Click the Buy now button. After that, choose your desired pricing plan and provide details to register for an account.

Form popularity

FAQ

A marital trust, also known as a spousal trust, allows the surviving spouse to benefit from the trust assets during their lifetime, after which the assets go to other beneficiaries. Conversely, a credit shelter trust, established under tools like a Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates, protects a portion of the estate from estate taxes while providing for the surviving spouse. Choosing between these two options depends on your financial goals and family dynamics, making it crucial to consult with legal professionals. Both trusts serve important, yet distinct, purposes in estate planning.

The beneficiaries of a credit shelter trust generally include the surviving spouse and children, as well as other family members or entities designated in the trust document. In a Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates, the primary goal is to provide financial support to the surviving spouse while safeguarding the remainder of the trust for the heirs. This allows for the estate to benefit from tax savings and ensures that your loved ones receive their intended share. Therefore, planning with a trust can aid in maintaining family wealth.

When one spouse in a marriage passes away, a trust can efficiently manage and distribute the estate. In the context of a Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates, the surviving spouse may receive benefits while also preserving estate value. The trust allows for assets to be protected from taxes, which can be especially beneficial in larger estates. By using a trust, you ensure a seamless transition of assets as per your wishes.

A credit trust is a type of trust that allows individuals to pass assets to beneficiaries while minimizing estate taxes. It only comes into effect upon the death of the grantor, preserving the asset for heirs and protecting it from taxes. Including a credit trust in your estate plan, such as in a Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates, can offer significant benefits for large estates. Understanding how a credit trust works is crucial for effective financial planning and asset distribution.

The main difference between a credit trust and a marital trust lies in their purposes and benefits. A credit trust is designed to shield assets from estate taxes, while a marital trust provides financial support to the surviving spouse, often using income generated from the trust. The Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates effectively integrates these trusts for optimal estate planning. This structure can help you maximize the inheritance for your heirs while minimizing tax liabilities.

A marital trust is not the same as a credit shelter trust. In a credit shelter trust, assets pass to beneficiaries after the grantor's death, while a marital trust allows assets to benefit the surviving spouse during their lifetime. The Wake North Carolina Complex Will with Credit Shelter Marital Trust for Large Estates combines both trusts, allowing for effective estate management and potential tax benefits. It's essential to understand these differences to make informed decisions.

The beneficiaries of a credit shelter trust are typically the children or other designated heirs of the deceased spouse. This setup aims to provide financial support while minimizing estate taxes. Crafting a Wake North Carolina Complex Will with a Credit Shelter Marital Trust for Large Estates clearly outlines the beneficiaries to ensure your wishes are honored and your family’s future is secure.

One disadvantage of a credit shelter trust is the complexity involved in its creation and management. It often requires careful structuring to comply with tax laws and regulations. However, when you navigate the process with assistance from platforms like uslegalforms, a Wake North Carolina Complex Will with a Credit Shelter Marital Trust for Large Estates can become a robust tool for effective estate planning.

The main difference lies in their function and tax implications. A marital trust allows the surviving spouse to access trust assets without incurring estate taxes, while a credit shelter trust preserves the estate tax exemption for the deceased spouse’s estate. Utilizing a Wake North Carolina Complex Will with a Credit Shelter Marital Trust for Large Estates offers a strategic way to blend these options for optimal financial planning.

While marital trusts can be beneficial, they have some disadvantages. One notable disadvantage is that they do not provide tax benefits after the surviving spouse's death, as assets are included in the surviving spouse’s estate. When you create a Wake North Carolina Complex Will with a Credit Shelter Marital Trust for Large Estates, you can mitigate these issues and plan effectively for your heirs.