Wake North Carolina Complex Will - Maximum Unified Credit to Spouse

Description

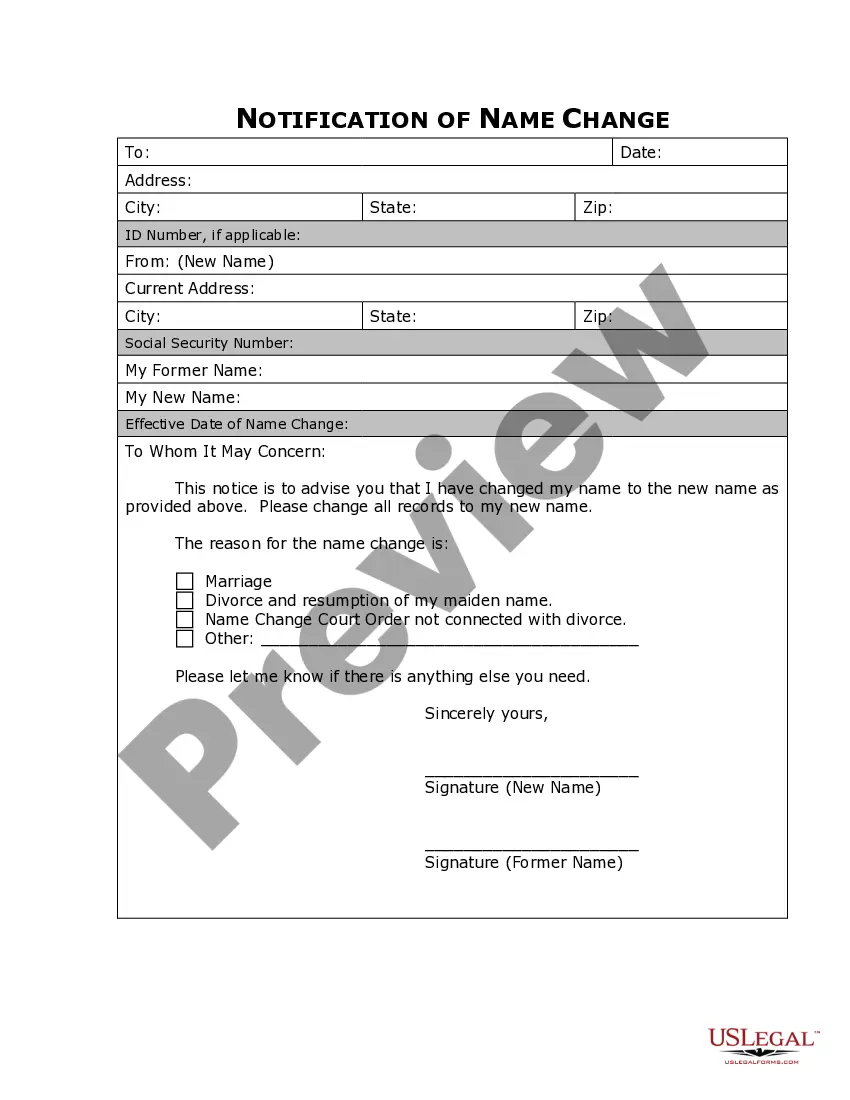

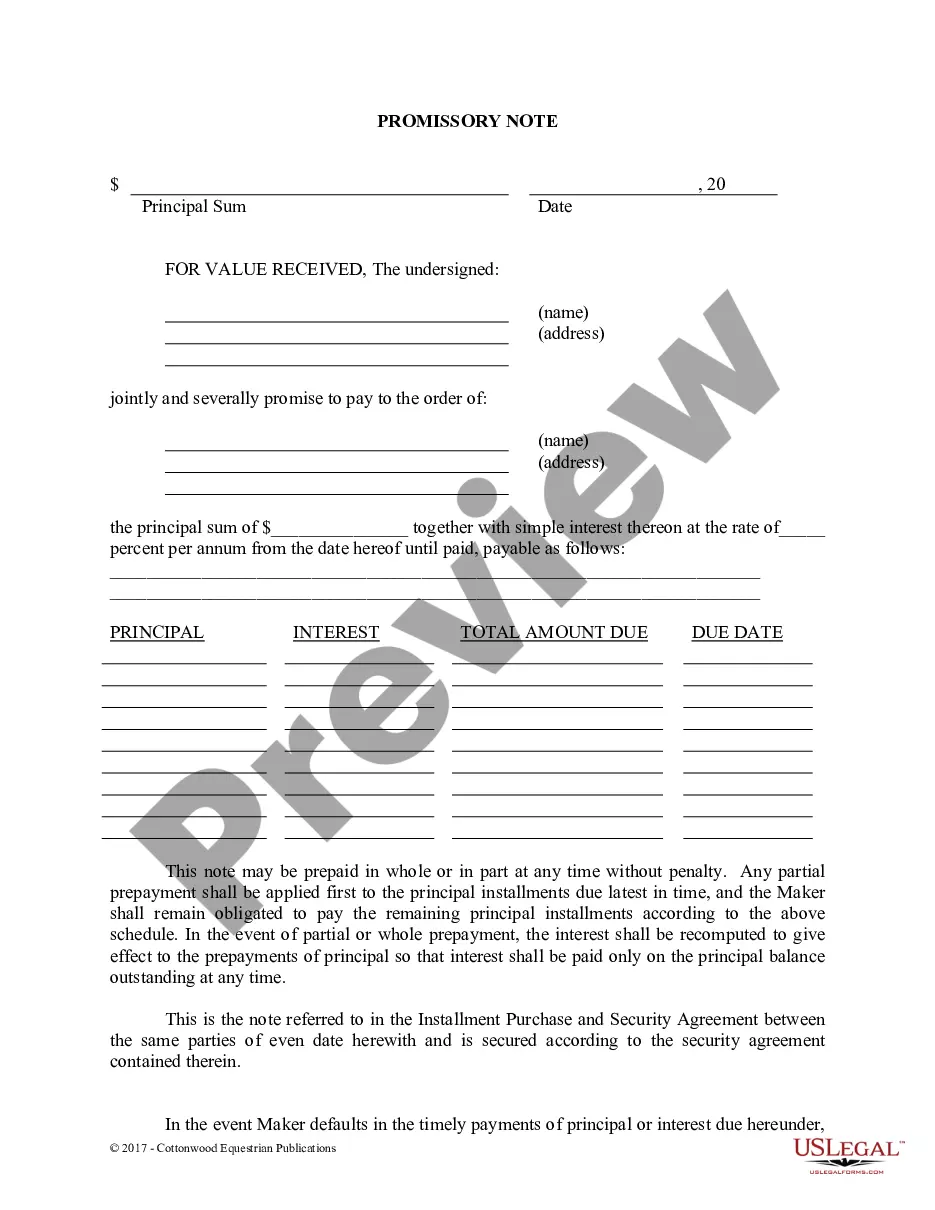

How to fill out Complex Will - Maximum Unified Credit To Spouse?

If you are searching for a trustworthy legal document provider to locate the Wake Complex Will - Maximum Unified Credit to Spouse, consider US Legal Forms. Whether you intend to launch your LLC enterprise or handle your asset allocation, we are here to assist you. You don’t need to be an expert in law to find and retrieve the suitable form.

Simply choose to search for or browse the Wake Complex Will - Maximum Unified Credit to Spouse, either by a keyword or by the state/county the document is designed for.

After locating the required document, you can Log In and download it or save it in the My documents section.

Don’t have an account? It’s simple to get started! Just find the Wake Complex Will - Maximum Unified Credit to Spouse template and review the form’s preview and description (if available). If you’re confident in the template’s legal language, proceed to hit Buy now. Create an account and choose a subscription plan. The template will be ready for download immediately after the payment is processed. Then you can fill out the document.

Managing your legal affairs doesn’t have to be expensive or time-consuming. US Legal Forms is here to prove it. Our extensive selection of legal documents makes this process more affordable and less burdensome. Start your first business, arrange your advance care planning, draft a real estate agreement, or complete the Wake Complex Will - Maximum Unified Credit to Spouse - all from the ease of your home. Sign up for US Legal Forms today!

- You can explore from over 85,000 documents categorized by state/county and case.

- The user-friendly interface, extensive learning materials, and dedicated assistance make it easy to acquire and complete various documents.

- US Legal Forms is a reliable service providing legal documents to millions of clients since 1997.

Form popularity

FAQ

The amount that your beneficiaries can inherit from you without having to pay federal estate taxes. Applicable exemption amount varies depending on the year. Unified credit: The applicable exemption (exclusion) amount that serves as a credit, thereby reducing the tax on an estate.

The unified tax credit gives a set dollar amount that an individual can gift during their lifetime and pass on to heirs before any gift or estate taxes apply. The tax credit unifies the gift and estate taxes into one tax system that decreases the tax bill of the individual or estate, dollar for dollar.

The applicable exclusion amount (also known as unified credit) refers to the total gifts and estate transfers exempted from an individual's gift and estate taxes. Every U.S. citizen has an applicable exclusion amount for all gifts made inter vivos or estate transfers at death.

As of 2021, you are able to give $15,000 per year to any individual, as a tax-exempt gift. This means that you can give $15,000 every year to each of your 10 children, without being subject to gift taxes on that $150,000.

The unlimited marital deduction is a provision in the U.S. Estate and Gift Tax Law that allows individuals to transfer an unrestricted amount of assets to their spouse at any time, free from tax.

The basic exclusion amount for determining the unified credit against the estate tax will be $11,580,000 for decedents dying in calendar year 2020, up from $11,400,000 in 2019.

The lifetime gift tax exclusion was expanded under the Tax Cuts and Jobs Act, and with an inflation adjustment in 2020 increased to $11.58 million for individuals and $23.16 million for a married couple.

Key Takeaways. The unified tax credit gives a set dollar amount that an individual can gift during their lifetime and pass on to heirs before any gift or estate taxes apply. The tax credit unifies the gift and estate taxes into one tax system that decreases the tax bill of the individual or estate, dollar for dollar.

The basic exclusion amount for determining the unified credit against the estate tax will be $11,580,000 for decedents dying in calendar year 2020, up from $11,400,000 in 2019.

The IRS allows a lifetime tax exemption on gifts and estates, up to a certain limit, which is adjusted yearly to keep pace with inflation. For 2021, an individual's combined lifetime exemption from federal gift or estate taxes is $11.7 million. If married, the joint exemption is $23.4 million.