Wake North Carolina Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

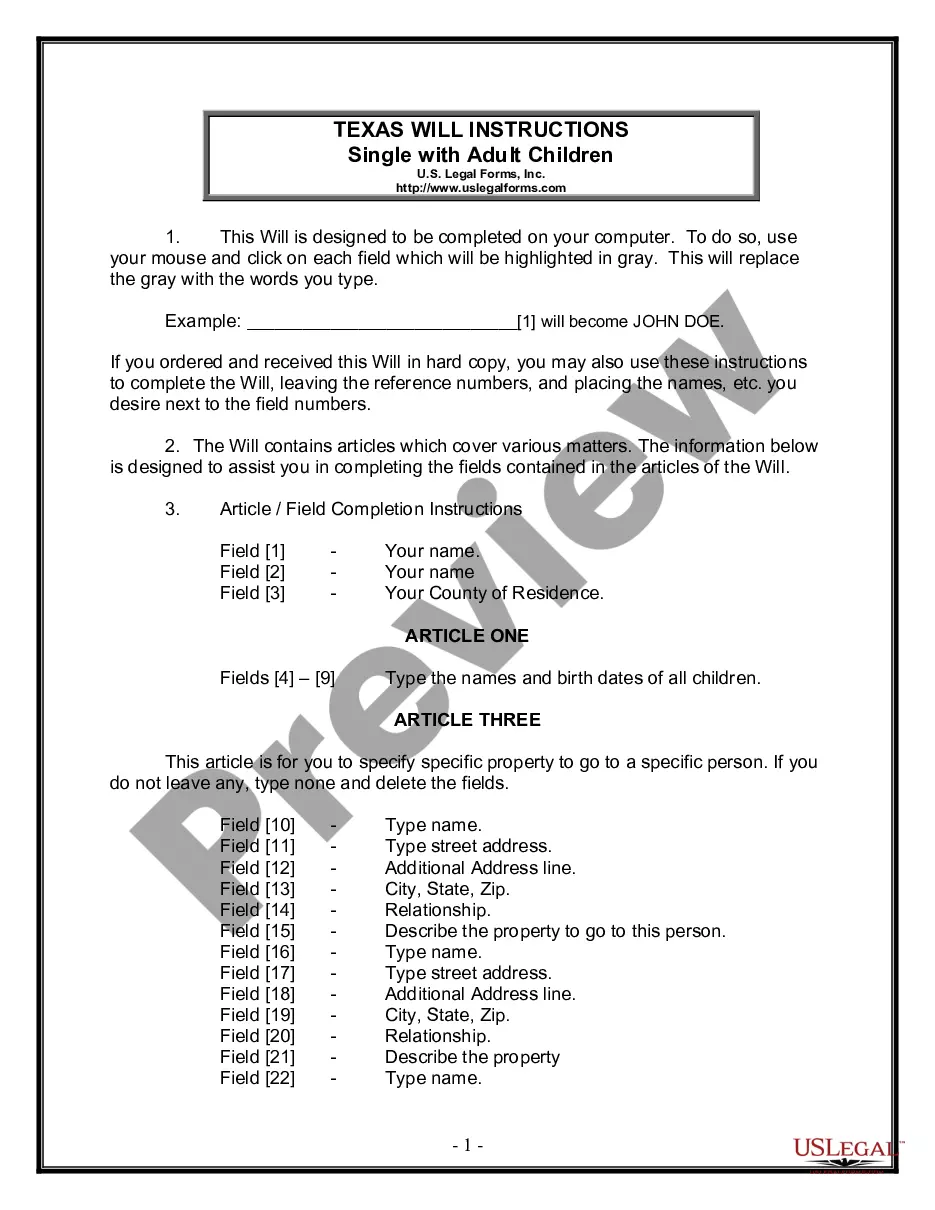

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Whether you plan to launch your enterprise, enter into a contract, request the renewal of your identification, or address familial legal matters, you need to prepare specific documentation that complies with your local laws and statutes.

Locating the appropriate documents can be time-consuming and labor-intensive unless you utilize the US Legal Forms library.

The platform offers users access to more than 85,000 professionally composed and verified legal templates suitable for any personal or commercial situation. All documents are organized by state and area of applicability, making it straightforward to select a form such as Wake Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse.

Templates available on our site can be used multiple times. With an active subscription, you can access all your previously obtained documents whenever necessary in the My documents section of your profile. Stop spending time on a never-ending search for updated formal documentation. Register for the US Legal Forms platform and keep your paperwork organized with the most extensive online collection of forms!

- Ensure the template meets your personal requirements and complies with state regulations.

- Review the form description and view the Preview if available on the page.

- Utilize the search function to find another template by entering your state above.

- Click Buy Now to obtain the document once you identify the appropriate one.

- Select the subscription plan that best fits your needs to proceed.

- Log in to your account and make the payment using a credit card or PayPal.

- Download the Wake Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse in your preferred file format.

- Print the document or fill it out and sign it electronically using an online editor to save time.

Form popularity

FAQ

For a married couple, the marital deduction/bypass trust, sometimes referred to as an AB trust, can take the form of a revocable living trust created by each spouse as grantor, or a joint revocable trust created by both spouses as grantors.

Upon the death of the trust grantor, trust assets pass on to the surviving spouse tax free. This means the IRS won't level federal estate taxes on those assets. So neither spouse owes taxes on the transfer.

The marital deduction is determinable from the overall gross estate. The total value of the assets passed on to the spouse is subtracted from that amount, giving us the marital deduction. This inter-spousal transfer can occur during the couple's lifetime or after one spouse's death, according to a will.

It allows one marriage partner to transfer an unlimited amount of assets to his or her spouse without incurring a tax. The marital deduction is determinable from the overall gross estate. The total value of the assets passed on to the spouse is subtracted from that amount, giving us the marital deduction.

The effect of the marital deduction trust is that it shields both spouse's assets and estates from federal estate taxes because when the first spouse dies, the assets indicated by the settlor (the spouse who created the trust) pass to the marital trust free and clear of any and all federal estate taxes.

Two common trusts qualify for the marital deduction: power of appointment trusts and qualified terminable interest property (QTIP) trusts. An important difference between the two types of trusts concerns the surviving spouse's ability to appoint the stock to someone else during life or at death.

This technique is novel because normally, gifts between spouses qualify for the federal estate and gift tax marital deduction and must be included in the spouse's estate at death. Gifts made to an Irrevocable Spousal Trust are not taxed in the survivor's estate.

Property interests passing to a surviving spouse that are not included in the decedent's gross estate do not qualify for the marital deduction. Expenses, indebtedness, taxes, and losses chargeable against property passing to the surviving spouse will reduce the marital deduction.

The portion that isn't passing to your spouse (and thus won't be subject to estate tax in your spouse's estate) is often known as the Residuary Trust (though it's also called a bypass trust, a credit shelter trust, or other names).