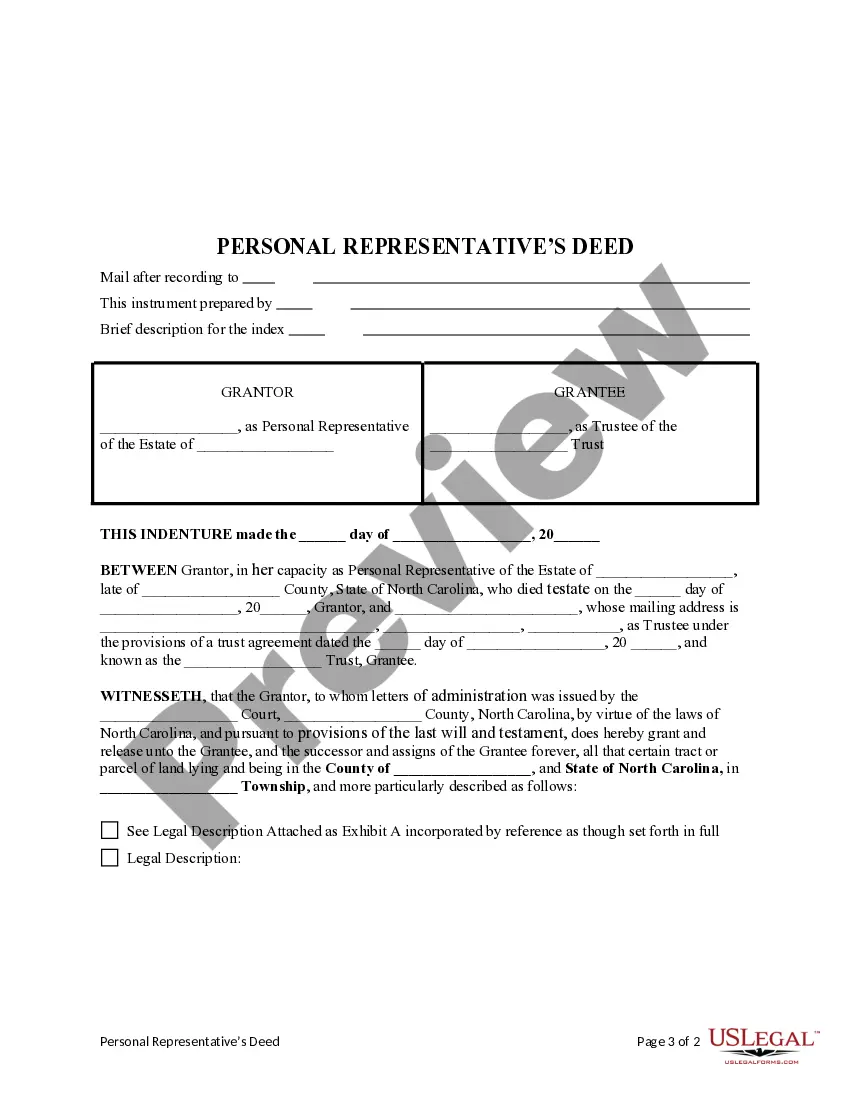

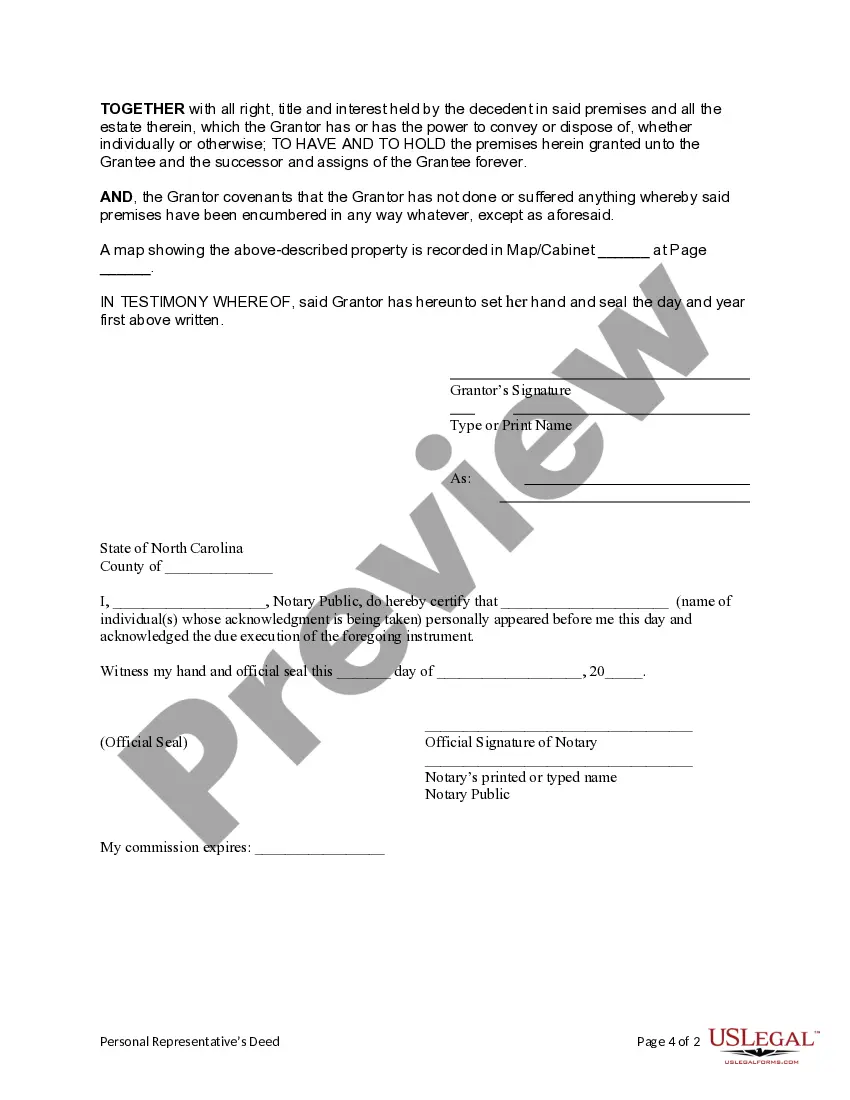

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is a trust for the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Charlotte North Carolina Personal Representative's Deed to a Trust

Description

How to fill out North Carolina Personal Representative's Deed To A Trust?

Regardless of one's social or professional standing, completing legal documentation is an unfortunate obligation in the contemporary world.

Frequently, it’s nearly unfeasible for an individual lacking any legal experience to generate such documents from the ground up, primarily due to the intricate language and legal subtleties they encompass.

This is where US Legal Forms can be a lifesaver.

Verify that the template you’ve located is tailored to your region, as the regulations of one state or area may not apply in another.

If the form you selected doesn’t fulfill your requirements, you can restart and search for the necessary form.

- Our service offers a vast array of over 85,000 ready-to-use documents specific to each state, suitable for nearly any legal matter.

- US Legal Forms also proves to be an excellent resource for associates or legal advisors seeking to enhance their efficiency using our DIY forms.

- If you need the Charlotte North Carolina Personal Representative's Deed to a Trust or any other paperwork applicable in your state or locality, US Legal Forms has everything available.

- Here’s how to obtain the Charlotte North Carolina Personal Representative's Deed to a Trust promptly using our trustworthy platform.

- If you are already a member, feel free to Log In to your account to retrieve the required form.

- However, if you are new to our collection, make sure to follow these steps before obtaining the Charlotte North Carolina Personal Representative's Deed to a Trust.

Form popularity

FAQ

Formal Probate Most Michigan probate cases can be wrapped up within seven months to a year after the personal representative is appointed. After notice of the probate is given, creditors have four months to file a claim.

Unlike South Carolina and many other states, real property in North Carolina does not typically pass through probate. When a decedent dies intestate (without a Will), title to the decedent's non-survivorship real property is vested in his or heir heirs as of the time of death G.S. 28A-15-2(b).

Indiana probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Who Can Serve As A Personal Representative? An individual appointed as Personal Representative in the decedent's Will. The surviving spouse, if the spouse is a beneficiary under the Will. Other beneficiaries of the Will. The surviving spouse if he or she is not a beneficiary under the Will. Other heirs of the decedent.

A Grant of Representation provides authority to the personal representative to deal with the estate including selling any property and closing any accounts. A Grant of Representation is known as a Grant of Probate (where there is a Will) or a Grant of Letters of Administration (where there is no Will).

North Carolina does not allow real estate to be transferred with transfer-on-death deeds.

Any individual who is at least 18 years old who is a resident of Florida at the time of the decedent's death, is qualified to act as the personal representative.

The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

The requirements of a personal representative in Maryland are that a personal representative is over the age of 18, is detail-oriented, has not committed any serious crimes, is a U.S. citizen or legal resident, is able to qualify for a bond, and someone who has not been subject to bankruptcy.

As long as they meet the legal requirements of being an executor?being of age and capable of carrying out an executor's duties?a beneficiary can be an estate's executor.