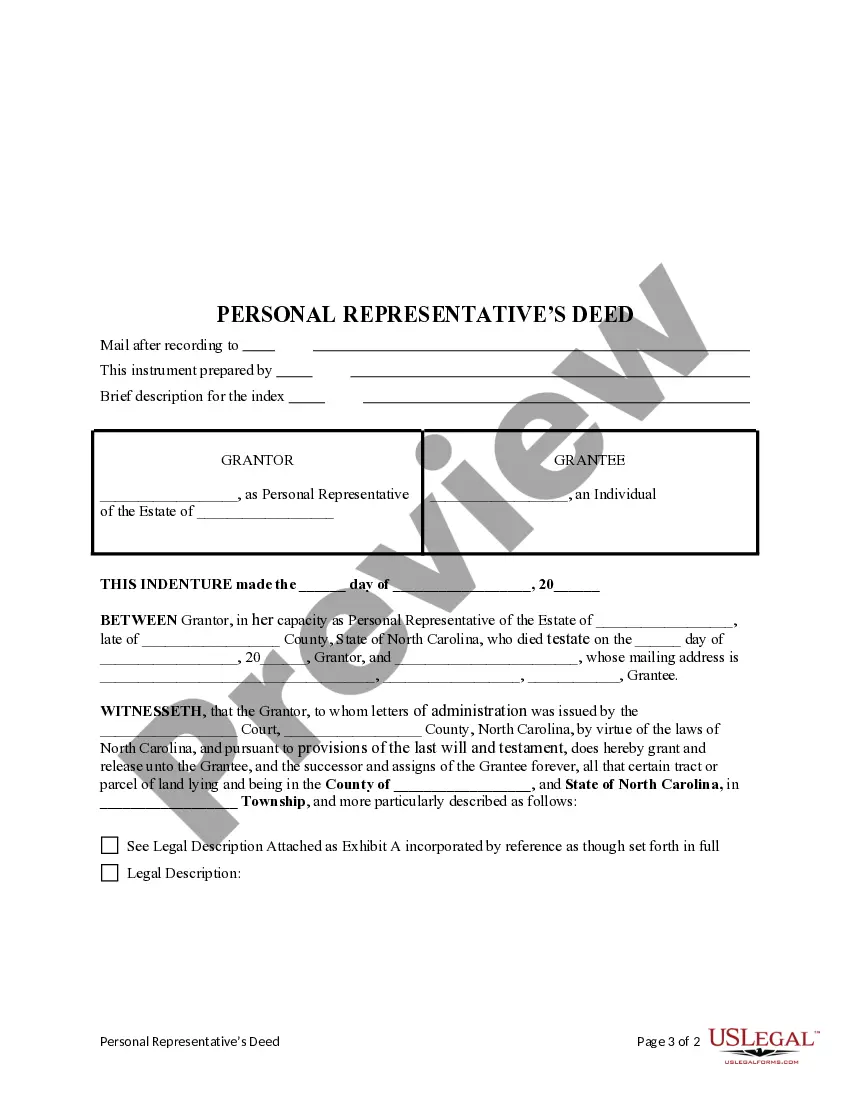

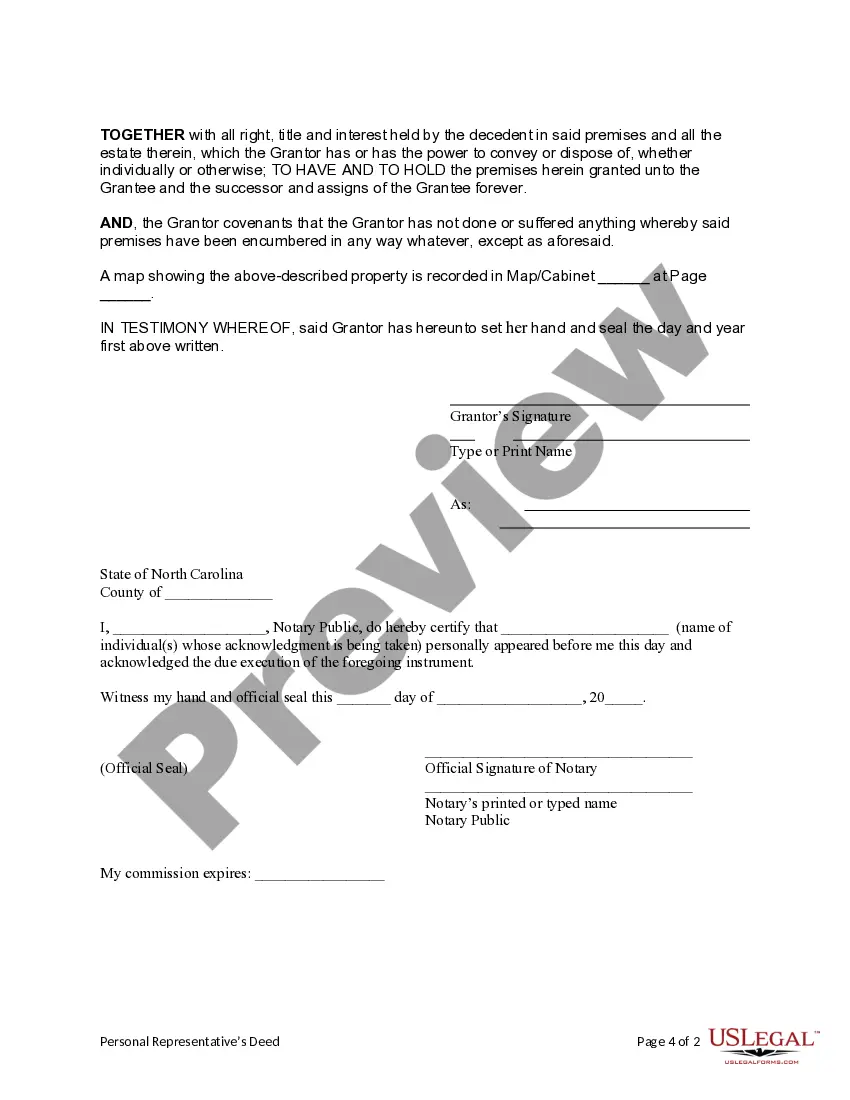

This form is an Personal Representatives's Deed where the grantor is the individual appointed as Personal Representative of an estate and the Grantee is the beneficiary under law. Grantor conveys the described property to Grantee and only covenants that the transfer is authorized by the Court and that the Grantor has done nothing while serving as personal representative to encumber the property. This deed complies with all state statutory laws.

Charlotte North Carolina Personal Representative's Deed to an Individual

Description

How to fill out North Carolina Personal Representative's Deed To An Individual?

If you’ve previously utilized our service, Log In to your account and retrieve the Charlotte North Carolina Personal Representative's Deed to an Individual on your device by selecting the Download button. Ensure that your subscription remains active. If not, renew it according to your payment plan.

If this is your inaugural experience with our service, adhere to these straightforward steps to acquire your document.

You have ongoing access to every document you have bought: you can find it in your profile under the My documents menu whenever you need to use it again. Make the most of the US Legal Forms service to efficiently locate and save any template for your personal or business requirements!

- Confirm you’ve identified the correct document. Review the description and utilize the Preview feature, if available, to verify if it satisfies your needs. If it’s unsuitable, employ the Search tab above to discover the appropriate one.

- Obtain the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your Charlotte North Carolina Personal Representative's Deed to an Individual. Choose your document's file format and save it to your device.

- Finalize your sample. Print it out or take advantage of professional online editors to complete and sign it electronically.

Form popularity

FAQ

Within three (3) months from the date of qualification, the personal representative must file with the Clerk of Superior Court's office an accurate inventory of the estate, giving descriptions and values of all real and personal property of the decedent as of the date of death.

While there are exceptions, it is expected that probate will be filed within 60 days of a person's death. During that period, a death certificate and copy of the will should be obtained and all paperwork filed with the court, including the appointment of the executor or personal representative.

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person

While there is no set deadline for when an executor must settle an estate in North Carolina, as previously stated it can take several years for this to happen, the executor is responsible for meeting several key deadlines throughout probate proceedings.

Probate is generally required in North Carolina only when a decedent owned property in their name alone. Assets that were owned with a spouse, for which beneficiaries were named outside of a will, or held in revocable living trusts, generally do not need to go through probate.

Can a personal representative be a beneficiary of a will? Yes. A personal representative can also be a named beneficiary in the decedent's will. For example, in a family with four siblings, one of the siblings or even the spouse may act as a personal representative.

The answer is yes, it's perfectly normal (and perfectly legal) to name the same person as an executor and a beneficiary in your will.

Section 28A-19-1 - Manner of presentation of claims (a) A claim against a decedent's estate must be in writing and state the amount or item claimed, or other relief sought, the basis for the claim, and the name and address of the claimant; and must be presented by one of the following methods: (1) By delivery in person

As long as they meet the legal requirements of being an executor?being of age and capable of carrying out an executor's duties?a beneficiary can be an estate's executor.

The institution will turn the property over to you or issue a new title document showing you as the owner. If no one has initiated a probate proceeding, the person who files the affidavit collects the personal property, pays debts of the estate, and distributes what's left to the people who inherit it.