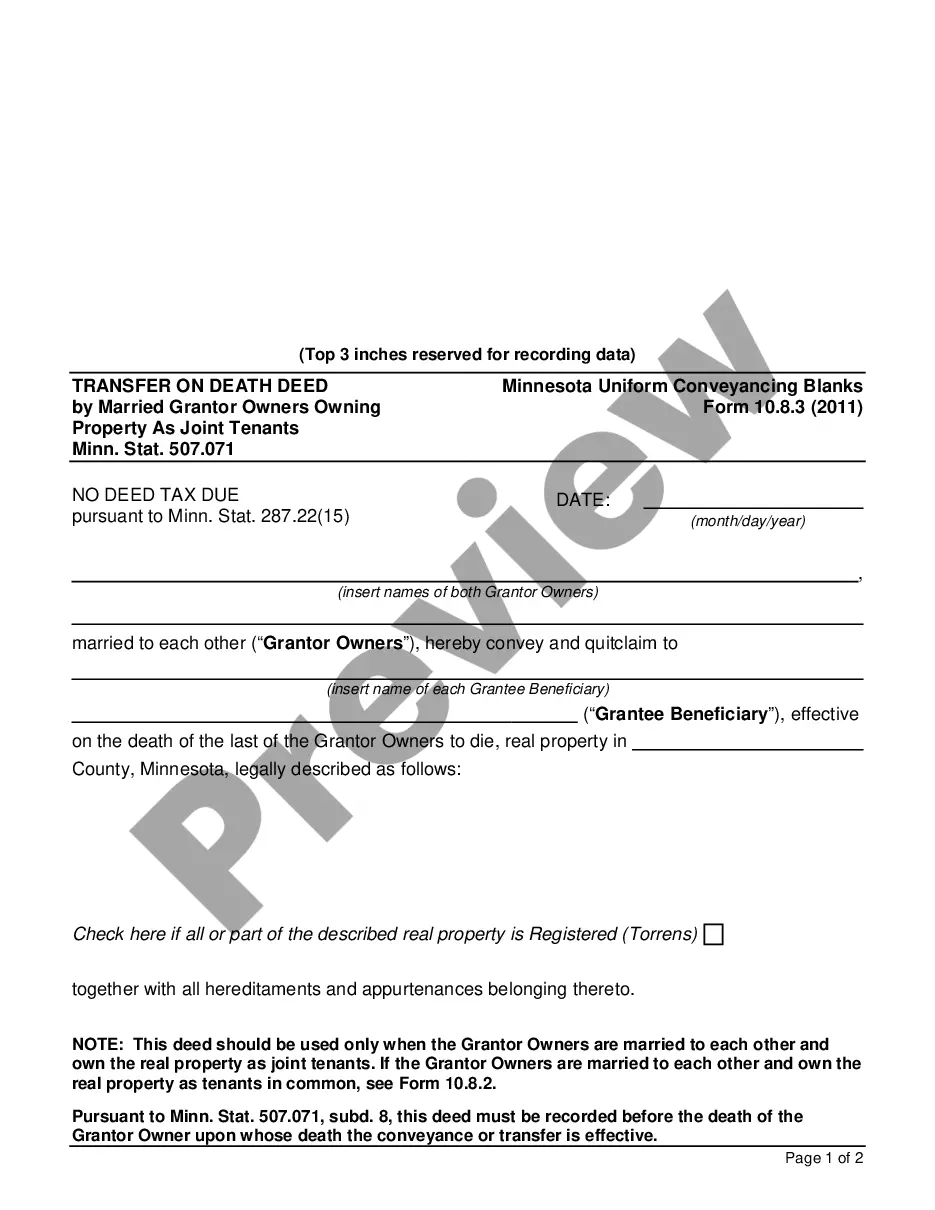

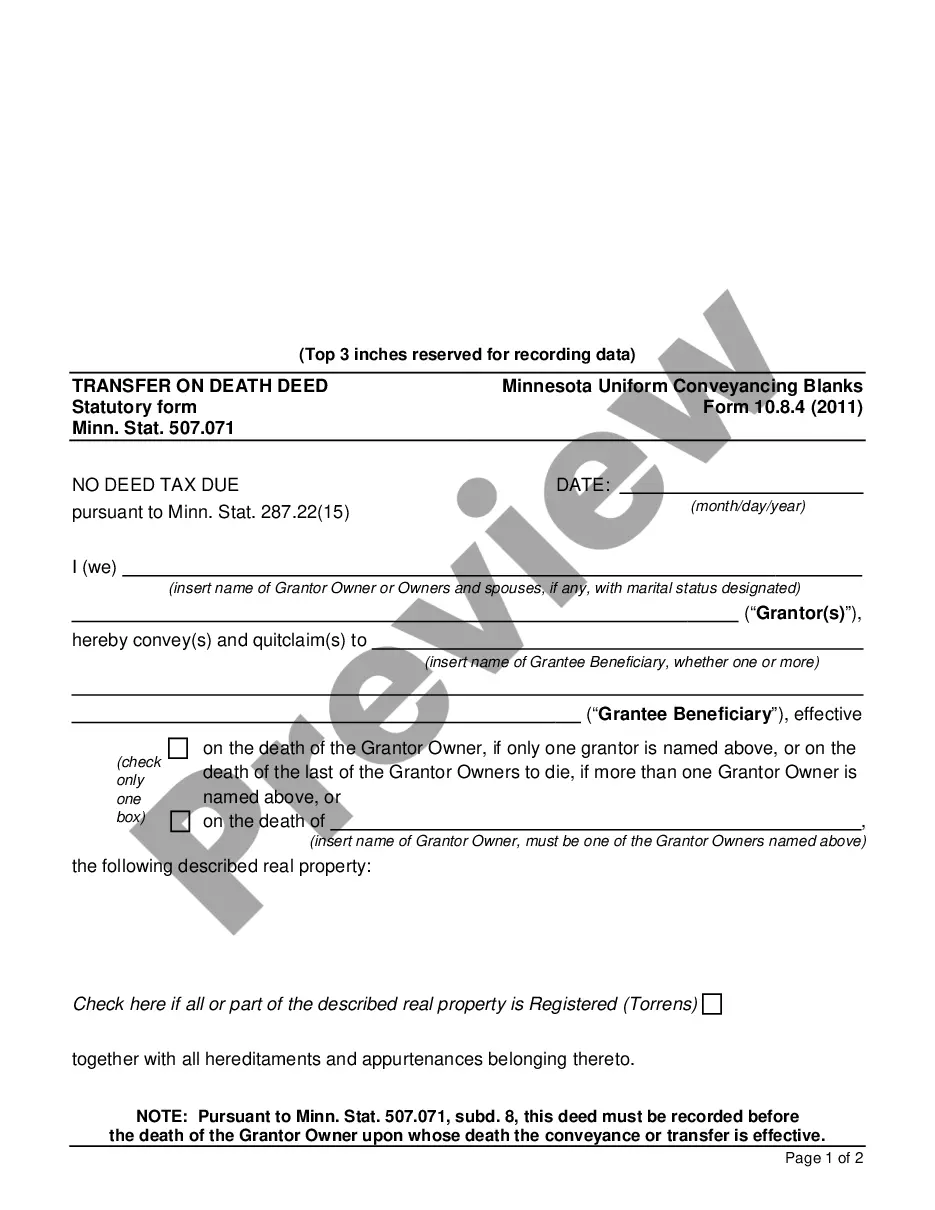

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Minneapolis Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071

Description

How to fill out Minnesota Affidavit Of Identity And Survivorship For Transfer On Death Deed Minn. Stat. 507.071?

Are you in search of a reliable and cost-effective legal forms provider to obtain the Minneapolis Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071? US Legal Forms is the perfect choice for you.

Whether you require a straightforward agreement to establish guidelines for living together with your partner or a collection of documents to facilitate your divorce through the legal system, we have everything you need. Our site features over 85,000 current legal document templates for both personal and business purposes. All templates we provide are not generic and are tailored to meet the requirements of specific states and regions.

To acquire the document, you must Log In to your account, find the desired template, and click the Download button adjacent to it. Please remember that you can retrieve your previously purchased form templates at any time from the My documents section.

Is this your first visit to our site? No need to worry. You can easily create an account, but first, ensure that you do the following.

Now you can create your account. Then select the subscription option and proceed to payment. Once the payment is finalized, download the Minneapolis Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071 in any available file format. You can revisit the website as needed and redownload the document at no extra cost.

Locating current legal documents has never been simpler. Try US Legal Forms today, and forget about wasting your precious time trying to understand legal documentation online forever.

- Verify that the Minneapolis Minnesota Affidavit of Identity and Survivorship for Transfer on Death Deed Minn. Stat. 507.071 complies with your state and local regulations.

- Review the form's description (if available) to understand the intended purpose and audience of the document.

- Restart your search if the template does not fit your particular needs.

Form popularity

FAQ

A transfer on death deed must comply with all provisions of Minnesota law applicable to deeds of real property including, but not limited to, the provisions of sections 507.02, 507.24, 507.34, 508.48, and 508A.

Property Transfer in Minnesota The grantor must sign the deed and have their signature notarized in order to accomplish a transfer of property. The Minnesota deed is then recorded in the county where the property is located.

Yes. A beneficiary who inherits property under a Minnesota TOD deed takes the property subject to any mortgage or deed of trust on it. As long as the beneficiary is related to the owner, the TOD deed should not affect the existing mortgage.

How to Write a Minnesota Quitclaim Deed Preparer's name and address. Name and address of the person to whom the recorded deed should be returned. County where the property is located. The consideration paid for the property. Grantor's name and address. The legal description of the property. Well disclosure statement.

Any person claiming an interest in real property conveyed or transferred by a transfer on death deed, or the person's attorney or other agent, may apply to the county agency in the county in which the real property is located for a clearance certificate for the real property described in the transfer on death deed.

State deed tax (SDT) SDT is paid when recording an instrument conveying Minnesota real property. The rate is 0.0033 of the purchase price. SDT for deeds with consideration of $3,000 or less is $1.70. Hennepin County adds an additional .

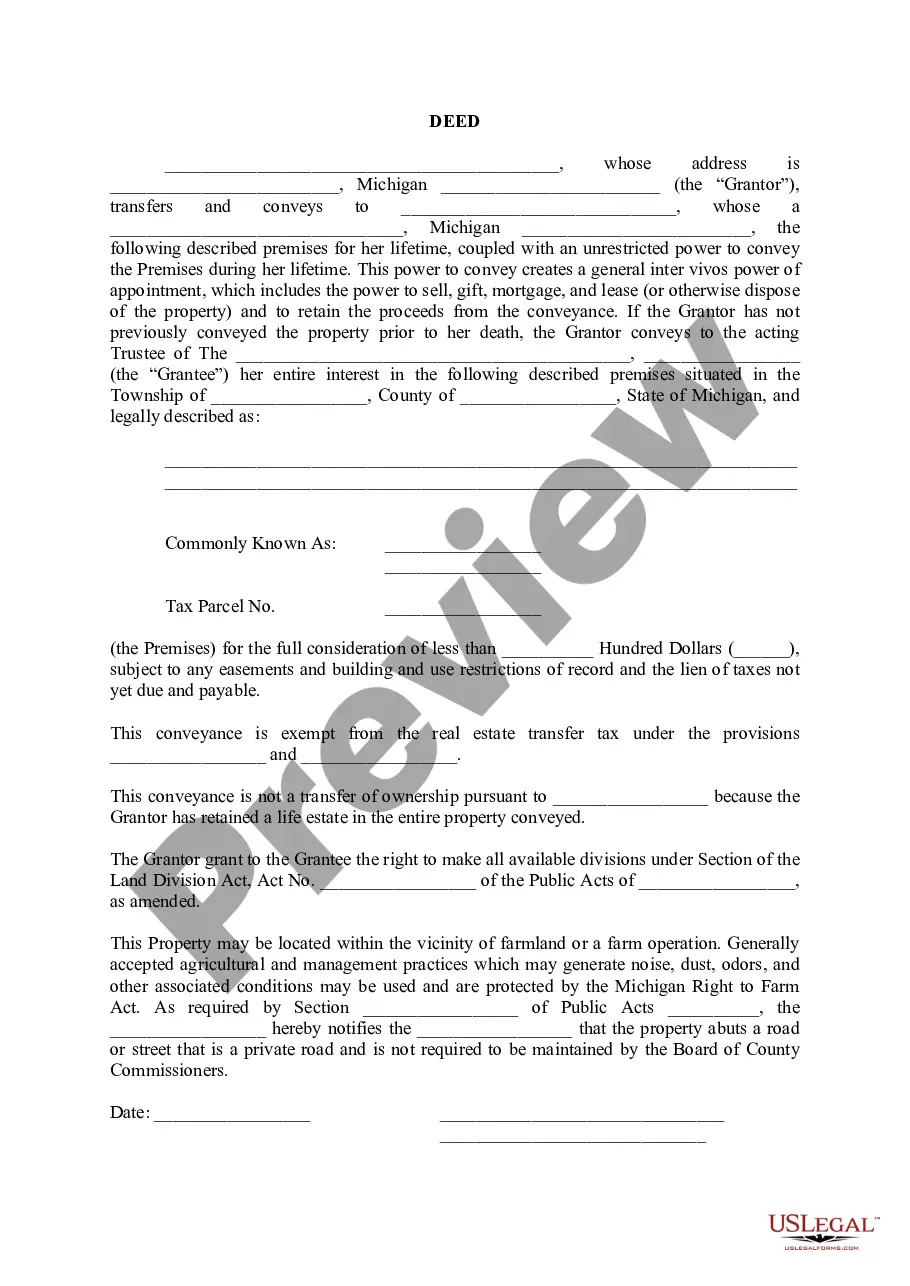

Minnesota law allows people to establish living trusts to avoid probate for most every asset that you own. This includes real estate, vehicles, bank accounts, art collections, and more. In order to create a living trust, a trust document needs to be established. This is similar to a will.

Average Title transfer service fee is ?20,000 for properties within Metro Manila and ?30,000 for properties outside of Metro Manila.

There is a $50.00 fee for filing the WDC with the county recorder. A WDC is not required if the property has no wells or if a disclosure was previously recorded for the property and the number and status of wells has not changed.

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.