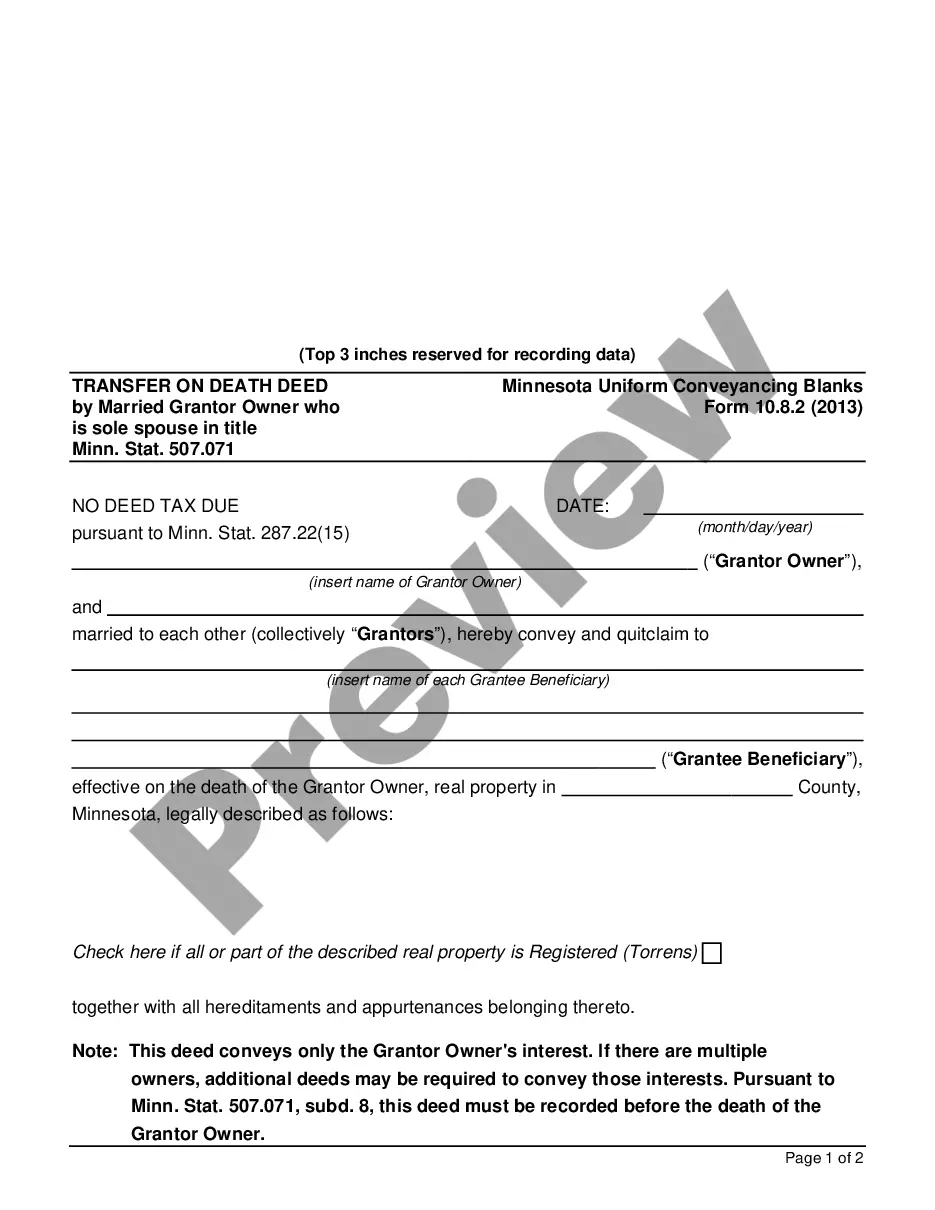

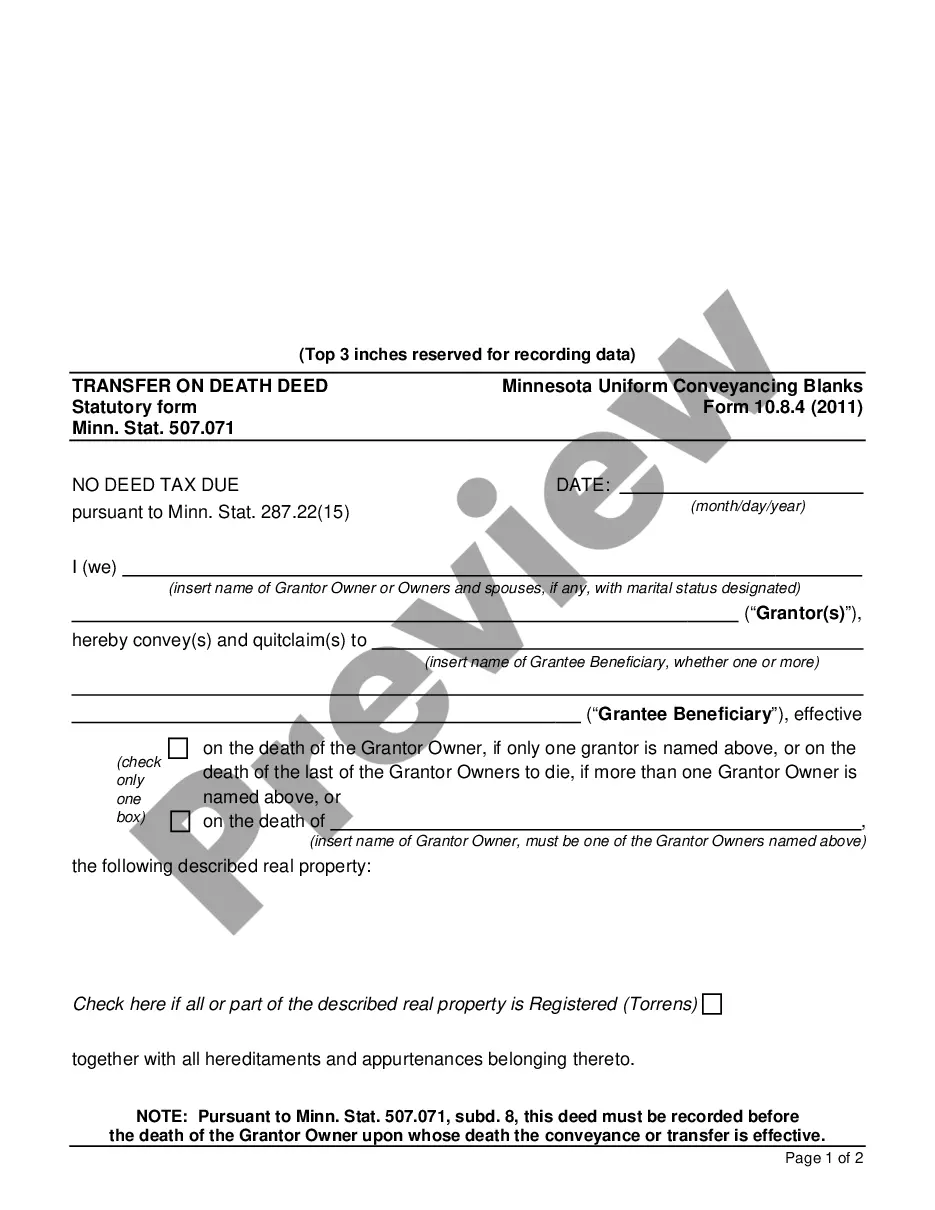

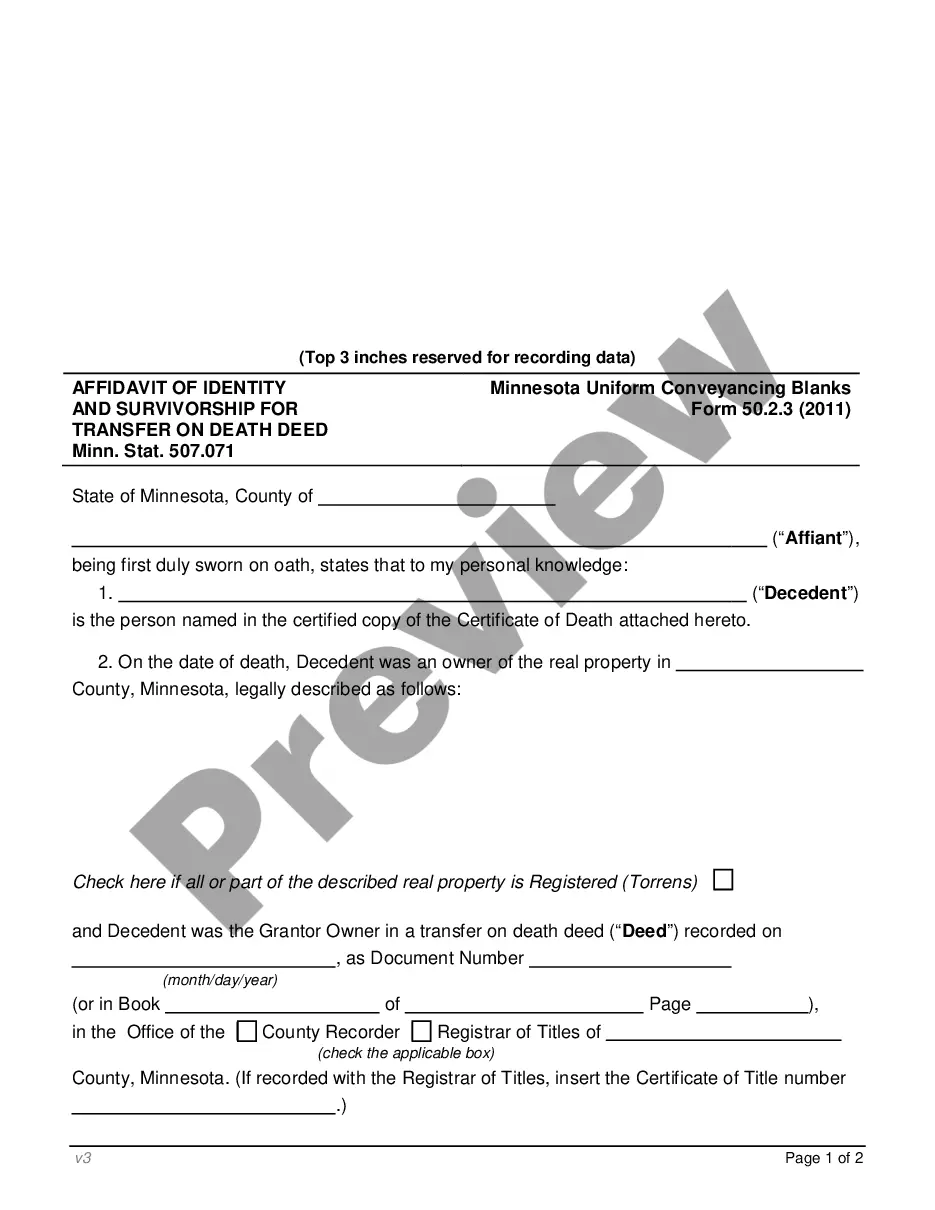

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071

Description

How to fill out Minnesota Transfer On Death Deed By Married Grantor Owners Owning Property As Joint Tenants Minn. Stat. 507.071?

Do you require a reliable and affordable provider of legal documents to obtain the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071? US Legal Forms is your preferred solution.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our platform offers over 85,000 current legal document templates for both personal and commercial use. All templates we provide are not generic and are tailored to meet the needs of particular states and areas.

To acquire the form, you must Log In to your account, locate the required form, and click the Download button next to it. Please remember that you can retrieve your previously bought document templates at any time from the My documents section.

Are you a newcomer to our platform? No problem. You can set up an account in just a few minutes, but first, ensure that you do the following.

Now you can register for your account. Then select the subscription option and move to payment. Once the payment is completed, download the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 in any available format. You can return to the website whenever needed and redownload the form without incurring any additional fees.

Locating current legal documents has never been simpler. Try US Legal Forms today, and say goodbye to wasting your valuable time learning about legal paperwork online for good.

- Check if the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 aligns with the laws of your state and local area.

- Review the form’s specifics (if available) to understand who and what the form is designed for.

- Restart your search if the form does not fit your particular situation.

Form popularity

FAQ

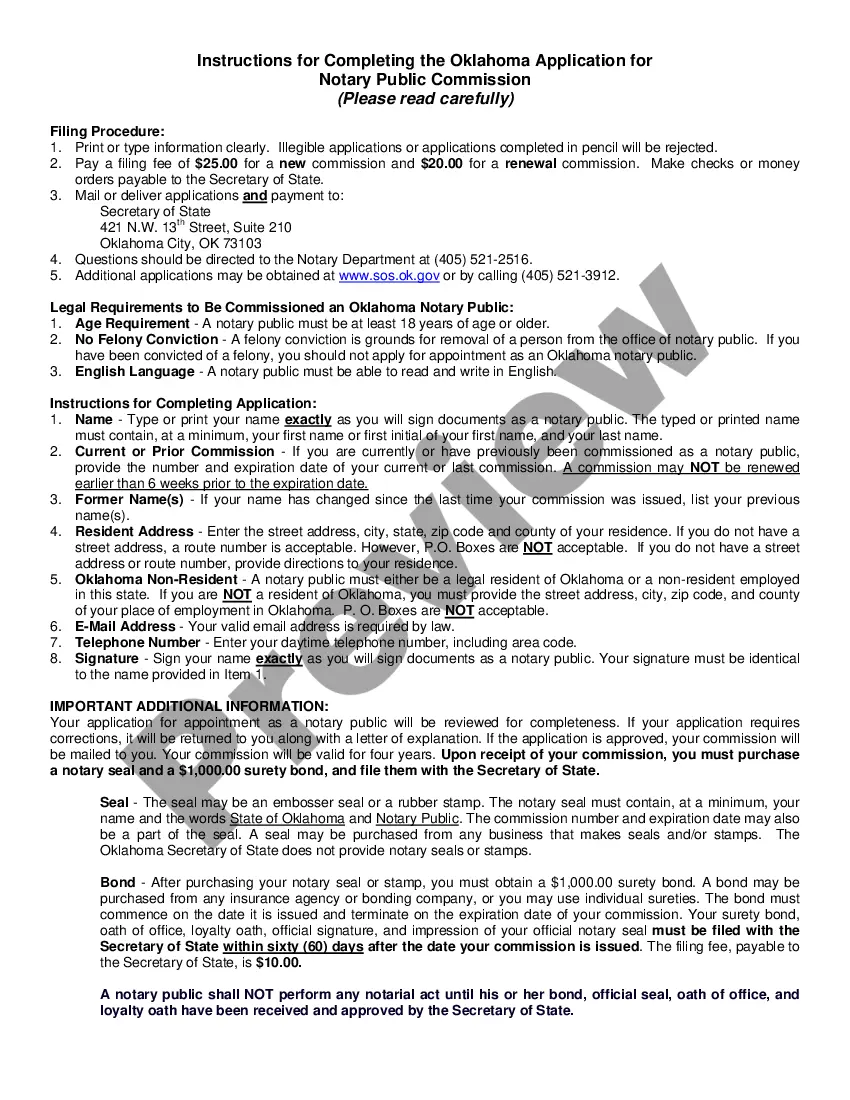

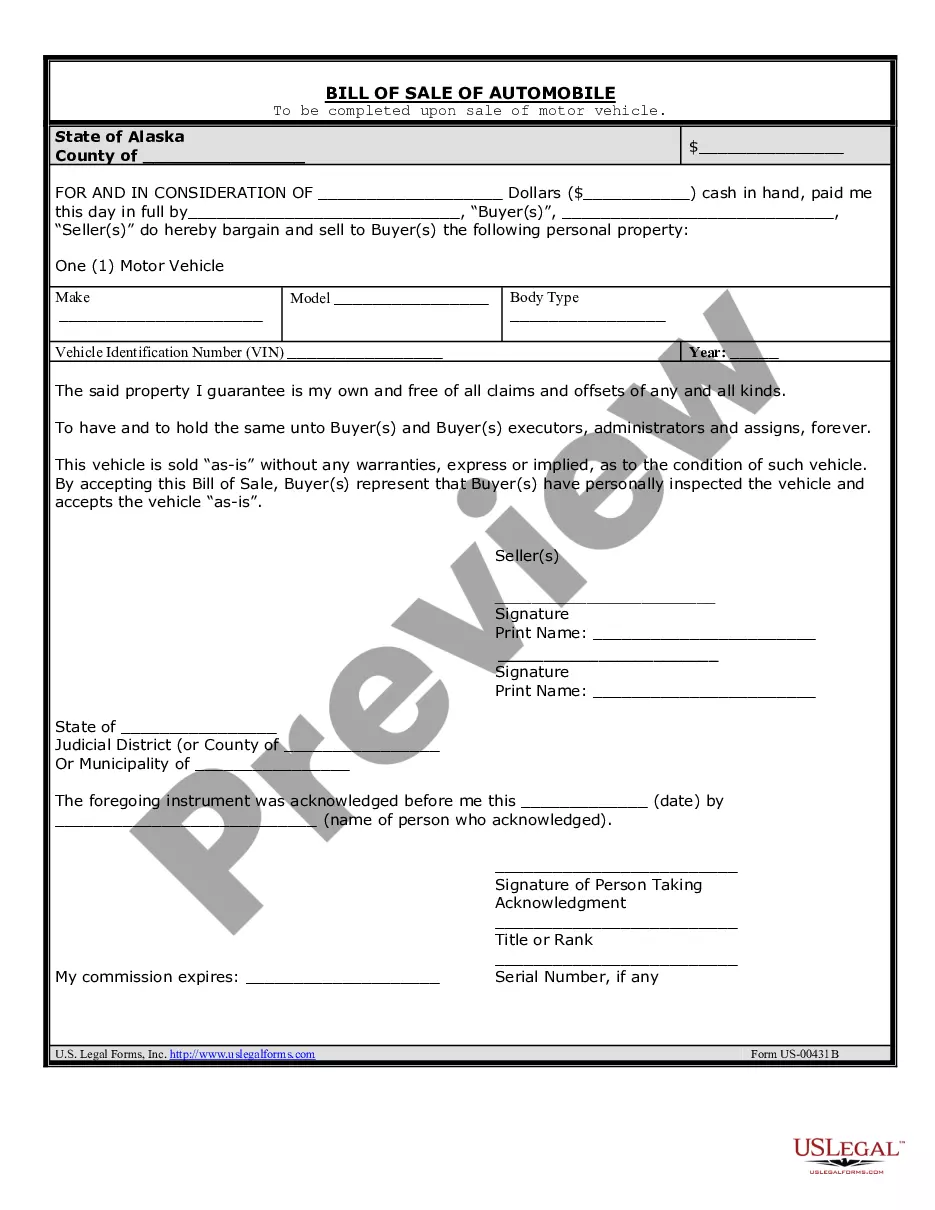

Filling out a Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 involves several straightforward steps. First, you need to provide the names of the grantors and the intended beneficiaries. Next, include a legal description of the property. Finally, you must sign the deed in the presence of a notary and record it with your local county office. For assistance, consider visiting USLegalForms, where you can find templates and guidance to ensure accuracy.

Yes, a Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 allows property to pass directly to the beneficiaries without going through probate. This process simplifies the transfer of property after the owner's death, saving time and expenses associated with probate. By using this deed, you ensure a quicker and more efficient transition for your loved ones.

As previously mentioned, while an attorney is not required to create a transfer on death deed, their assistance can be invaluable. They can help clarify the nuances of the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071, and ensure your deed is legally sound. Thus, it may save you time and prevent issues in the future.

To change the deed on a house after the death of a spouse in Minnesota, you need to follow specific legal procedures. Typically, you will need to obtain a certified death certificate and complete a new deed to transfer ownership according to the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071. Using platforms like USLegalForms can simplify this process and provide the necessary documents.

While hiring a lawyer is not mandatory to create a transfer on death deed, it is highly recommended. A legal expert can guide you through the intricacies of the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071, ensuring your deed is drafted correctly and complies with all Minnesota laws.

Yes, Minnesota allows a transfer on death deed. This legal document enables property owners, including married grantor owners holding property as joint tenants, to transfer their property to beneficiaries upon their death. Understanding the specifics of the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 is essential to effectively utilize this option.

You might not need an attorney to transfer a deed in Minnesota. However, navigating the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants under Minn. Stat. 507.071 can be complex. It’s wise to consult with a legal professional to ensure all requirements are met and the paperwork is completed accurately.

Some disadvantages of the Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 include a lack of control over the property after death and possible disputes among heirs. The deed does not account for a beneficiary’s financial situation, which could lead to future complications. Utilizing uslegalforms can help streamline the process and ensure that you understand the terms before committing.

Choosing between a Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 and a trust depends on your individual circumstances. A transfer on death deed is simpler and less expensive to implement, while a trust offers more extensive protections and can handle more complex estate planning situations. Assessing your goals can help determine which option is best for you.

While a Hennepin Minnesota Transfer on Death Deed by Married Grantor Owners Owning Property as Joint Tenants Minn. Stat. 507.071 may defer property transfer taxes until death, it does not necessarily avoid capital gains taxes. Beneficiaries may still be responsible for taxes if the property appreciates significantly in value. Consulting with a tax professional can provide clarity on how this deed impacts taxes in your unique situation.