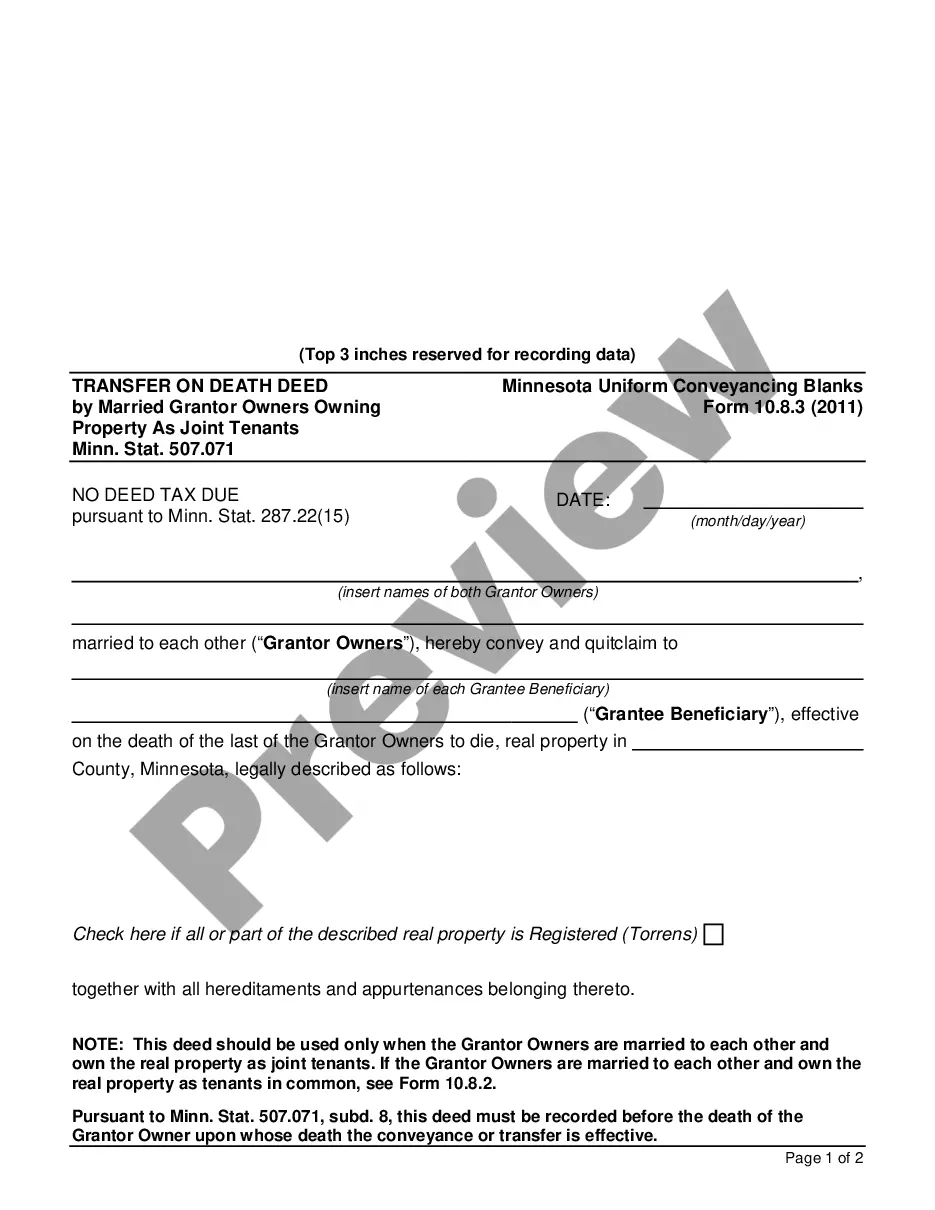

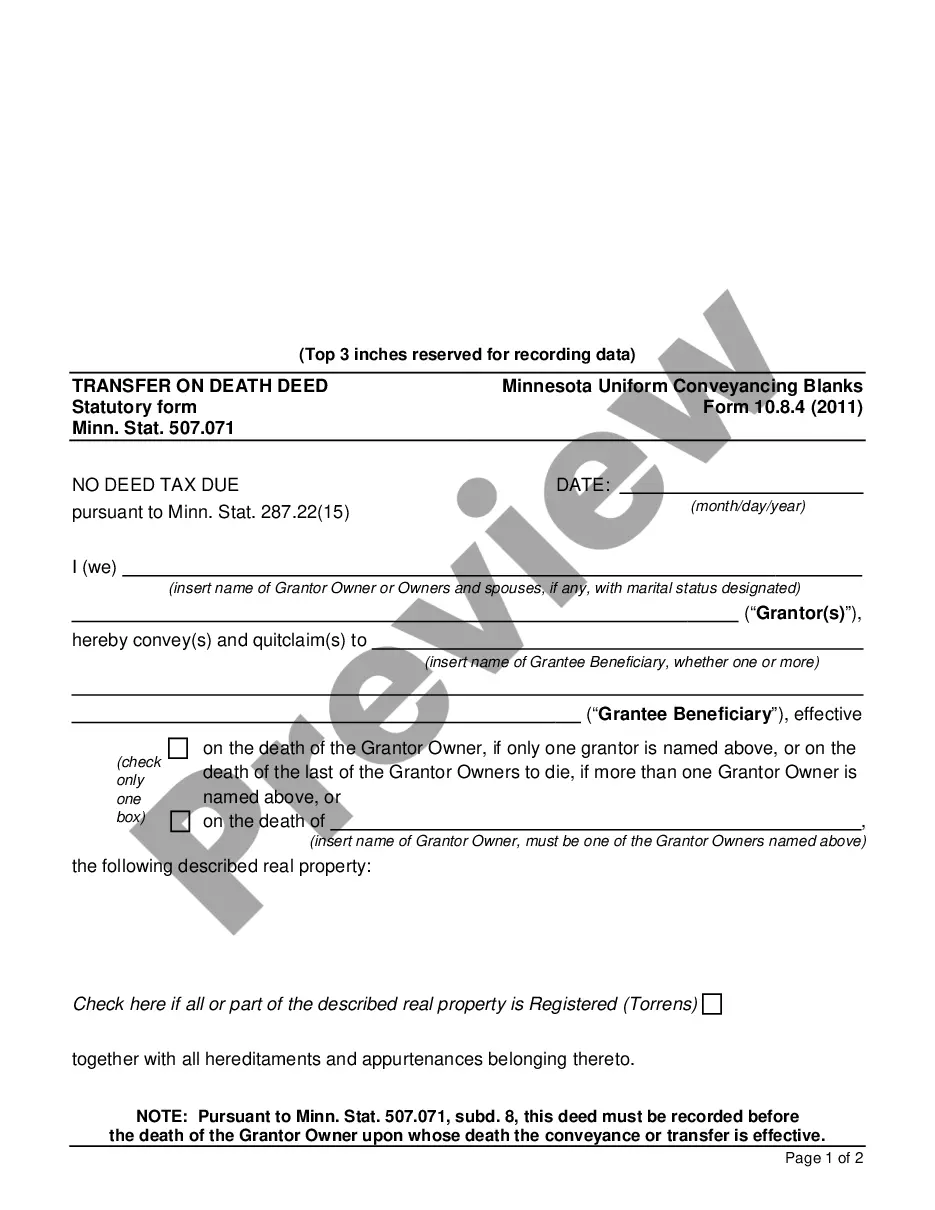

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce. The form is available here in PDF format.

Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071

Description

How to fill out Minnesota Transfer On Death Deed By Married Grantor Owner Who Is Sole Spouse In Title Minn. Stat. 507.071?

Do you require a reliable and cost-effective provider for legal documents to obtain the Saint Paul Minnesota Transfer on Death Deed by the Married Grantor Owner who is the sole spouse in title as per Minn. Stat. 507.071? US Legal Forms is your ideal selection.

Whether you need a simple contract to establish guidelines for living with your partner or a collection of documents to facilitate your separation or divorce through the judicial system, we have you covered. Our site features over 85,000 current legal document templates for both personal and commercial use. All templates we provide access to are not generic and are tailored to meet the requirements of specific states and counties.

To obtain the document, you must Log In, find the required form, and click the Download button adjacent to it. Please note that you can retrieve your previously acquired form templates at any time from the My documents section.

Is this your first visit to our website? No problem. You can easily establish an account, but before doing so, ensure to.

Now, you can set up your account. Then select the subscription plan and proceed to make the payment. Once the payment is processed, download the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 in any of the available formats. You can return to the website at any time and redownload the form at no additional charge.

Locating current legal documents has never been simpler. Try US Legal Forms now and say goodbye to spending hours searching for legal papers online.

- Verify that the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 complies with your state and local laws.

- Examine the specifics of the form (if available) to understand who and what the document is designed for.

- Reinitiate the search if the form does not meet your particular needs.

Form popularity

FAQ

To transfer a deed after death in Minnesota, you typically need to prepare and file a new deed that names the new owner. Ensure you have proper documentation, such as the will or death certificate, to substantiate the transfer. For married grantor owners, considering the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 can help streamline this process, making it easier to handle.

Changing the deed after the death of a spouse in Minnesota usually requires filing a new deed that reflects the current ownership. You may need to provide a death certificate and other necessary documents. Utilizing the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 can simplify future changes, making sure you are prepared.

The transfer on death deed in Minnesota is governed by Minn. Stat. 507.071. This statute outlines the requirements and benefits of a TOD deed, making it easier for property to pass directly to a beneficiary upon the grantor's death. Understanding these statutes is crucial for effective estate planning in Saint Paul, especially for married grantor owners.

The primary drawback of a transfer on death deed lies in its lack of comprehensive estate planning. If the property is not properly maintained or if your beneficiary predeceases you, it can lead to complications. Additionally, engaging with professional services like US Legal Forms can help mitigate these issues when dealing with the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071.

A transfer on death deed does not typically avoid inheritance tax, as inheritance tax is based on the value of the estate at death. However, Minnesota does not impose an inheritance tax on property transferred through a transfer on death deed. By using the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071, your property can pass with less tax burden.

While a transfer on death deed offers benefits, it also has some disadvantages. One issue is that creditors of the grantor can still claim against the property, even after death. Additionally, the process must be managed properly to avoid challenges, so using a reputable platform like US Legal Forms can help streamline this aspect when considering the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071.

If your husband's name is on the deed and you are not listed, it could create complications regarding ownership. In Minnesota, the rules of intestate succession apply, which might mean that different laws govern how the property is distributed. Utilizing a Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 can help avoid such situations in the future.

Generally, a transfer on death deed in Minnesota does not eliminate capital gains tax. However, when the property is transferred, the beneficiary receives a step-up in basis, which may reduce potential capital gains tax when they sell the property. Consulting with a tax professional familiar with the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071 can provide further insight.

Yes, Minnesota allows a transfer on death deed, making it an effective estate planning tool. This type of deed enables you to pass your property to a designated beneficiary without the lengthy probate process. It's particularly useful for married grantor owners in Saint Paul, as per Minn. Stat. 507.071.

A transfer on death deed may be a smart choice for many homeowners. It allows you to transfer property to a beneficiary without going through probate. By using the Saint Paul Minnesota Transfer on Death Deed by Married Grantor Owner who is sole spouse in title Minn. Stat. 507.071, you ensure your property goes directly to your spouse upon your passing, simplifying the process.