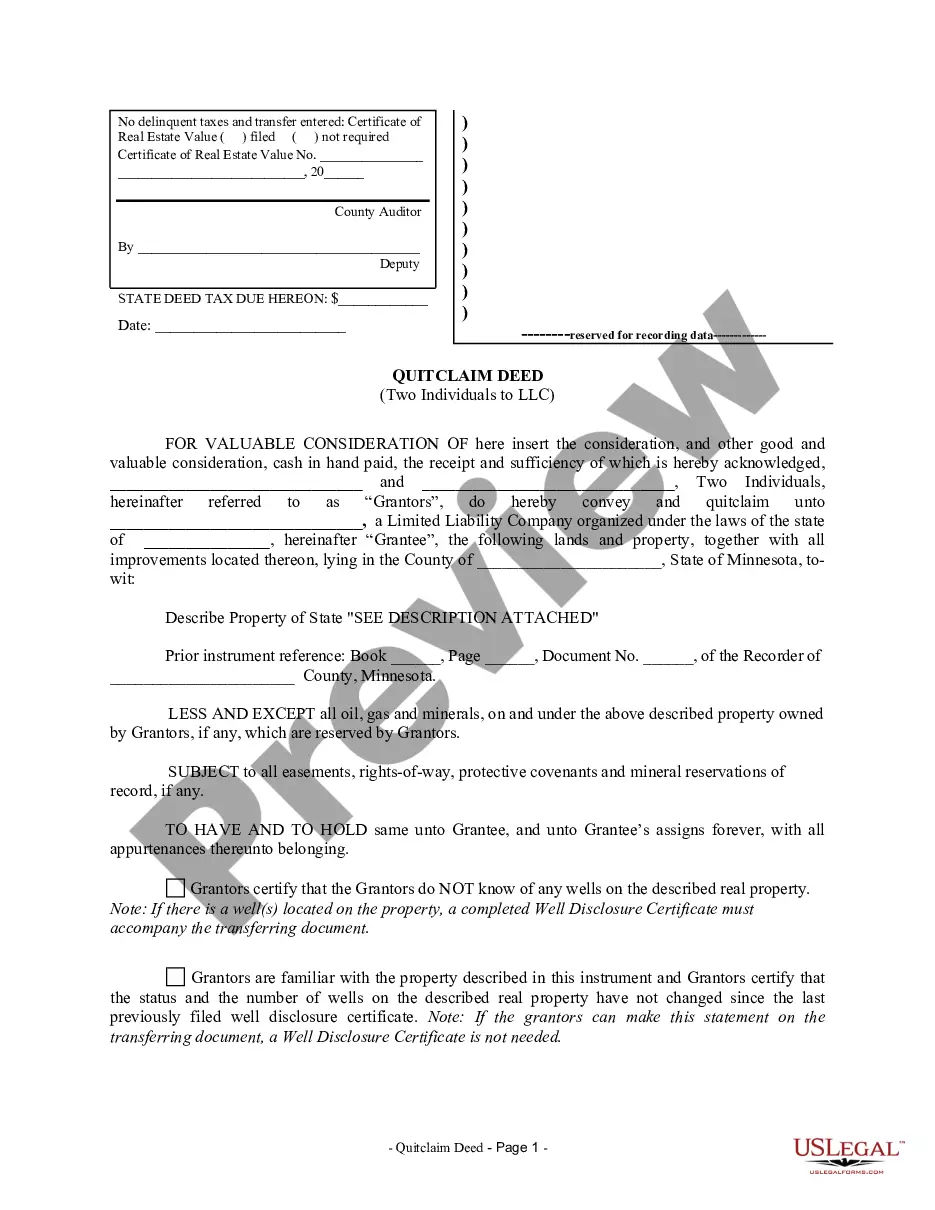

Minneapolis Minnesota Quitclaim Deed by Two Individuals to LLC

Description

How to fill out Minnesota Quitclaim Deed By Two Individuals To LLC?

Obtaining validated templates tailored to your regional regulations can be difficult unless you utilize the US Legal Forms library.

This is an online collection of over 85,000 legal forms catering to both personal and professional requirements across various real-life situations.

All documents are systematically organized by usage area and jurisdiction, making it straightforward and quick to find the Minneapolis Minnesota Quitclaim Deed from Two Individuals to an LLC.

Maintaining organized documentation and ensuring compliance with legal standards is crucial. Take advantage of the US Legal Forms library to always have essential document templates readily available for any needs!

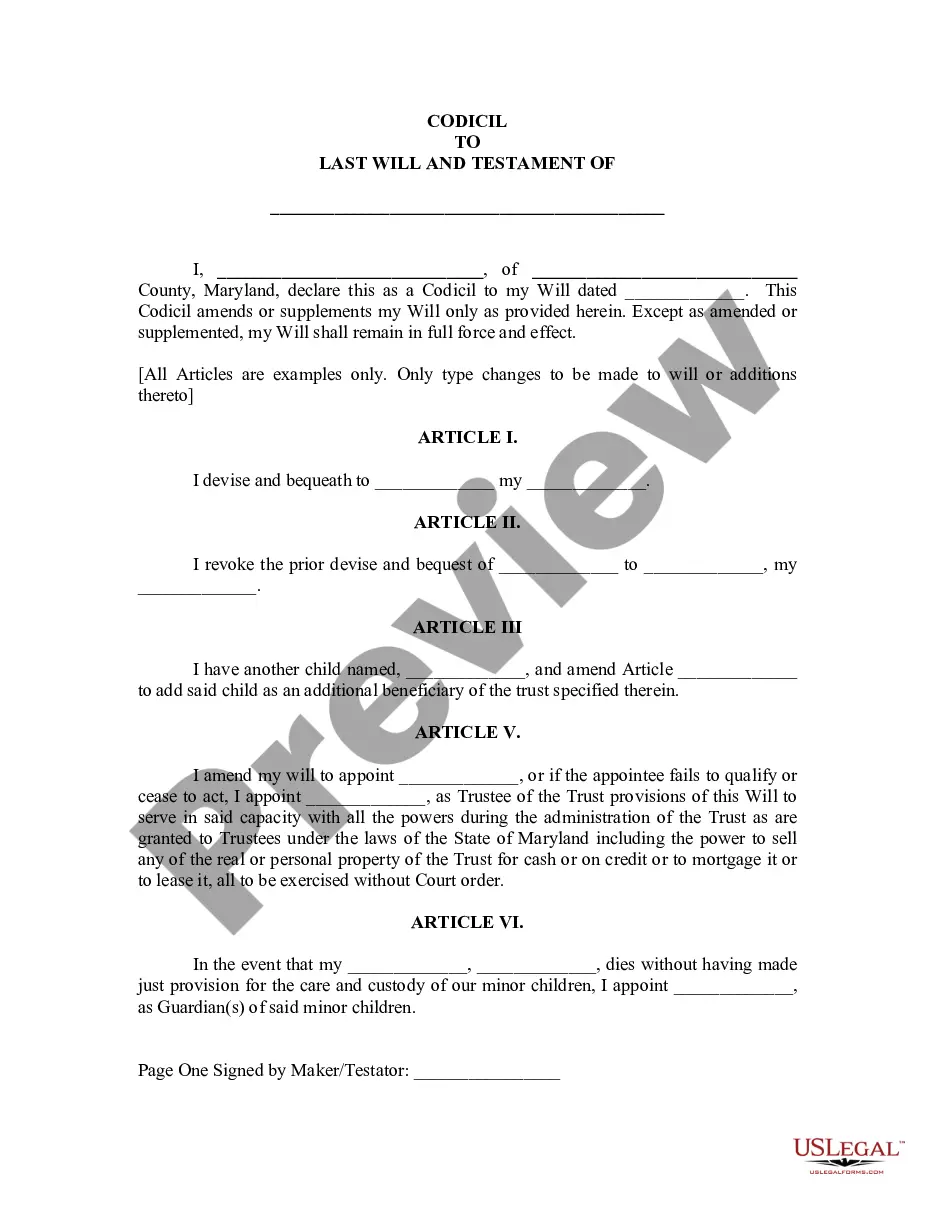

- Verify the Preview mode and form description.

- Ensure you've selected the correct one that aligns with your requirements and adheres to your local jurisdiction standards.

- Search for an alternative template, if necessary.

- If you notice any discrepancies, utilize the Search tab above to find the appropriate form.

- Should it be suitable, proceed to the next step.

Form popularity

FAQ

The transfer of the property is usually in the form of a donation (a gift) or the sale of the property to the child. A written contract must be entered into between the parent and child. The following should be carefully considered and the advice of an expert should be obtained.

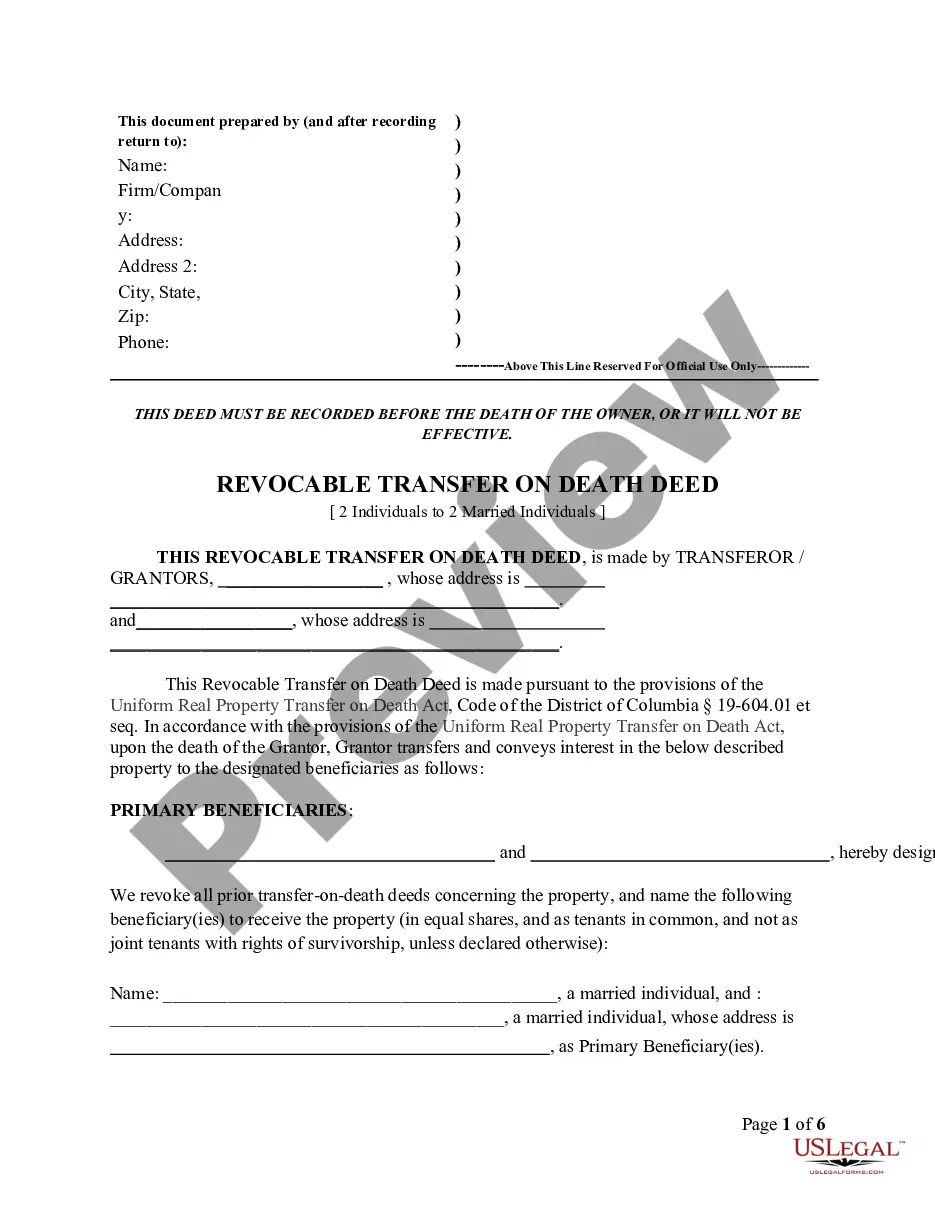

The deed tax is a transfer tax. It is imposed on the value of real property transferred. The deed tax rate is 0.33 percent of net consideration (i.e., the price paid for the real property).

In the case of property transfer by quit claim deed, the deed tax may be paid by the grantor and would amount to 0.0033 times the net consideration. The net consideration is the value of the real property minus any amount still owed on the mortgage, or the amount of the new mortgage acquired by the grantee.

What Is the Cost to File a Minnesota Deed? Minnesota charges a flat fee of $46.00 to record a deed.

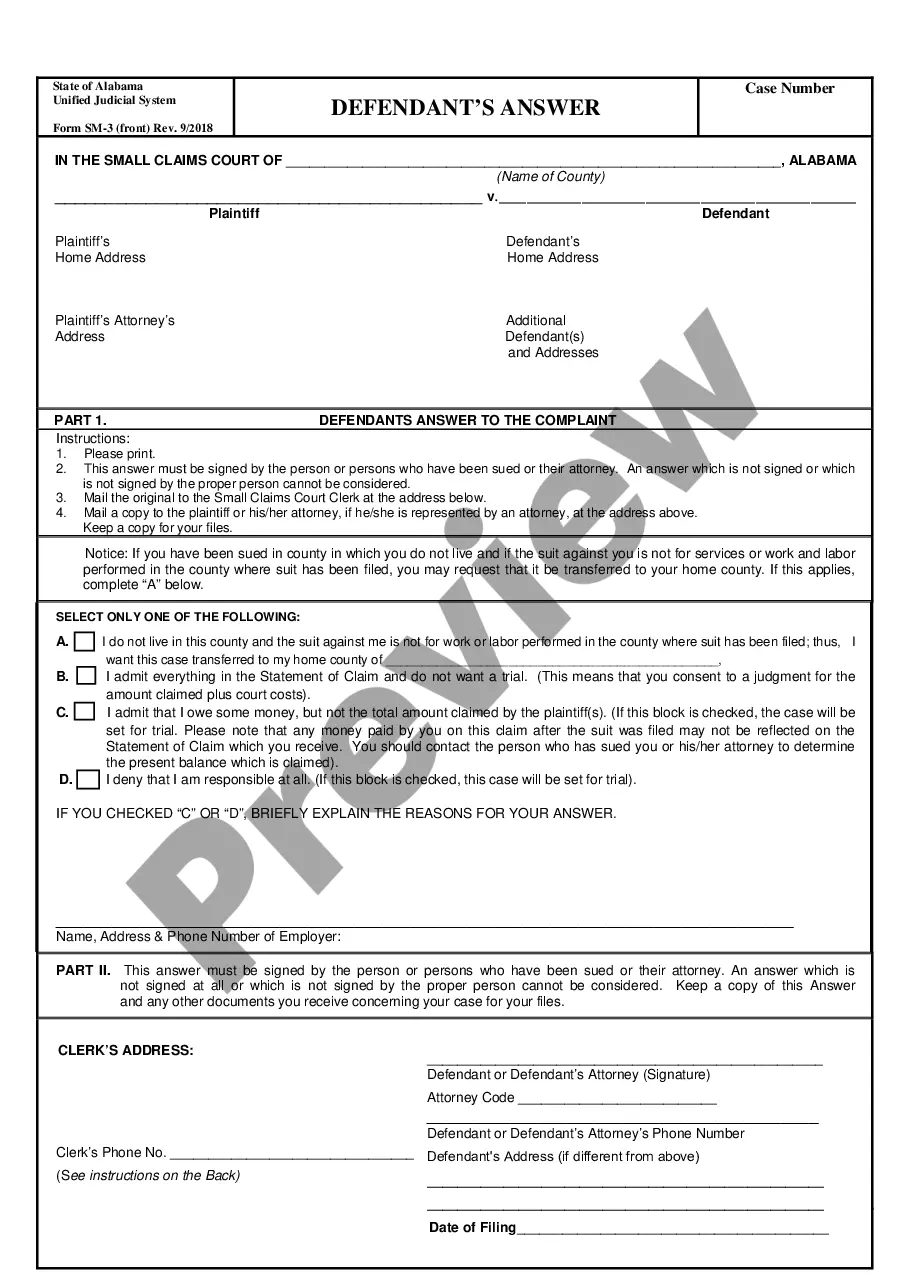

How to File a Quitclaim Deed Obtain a quitclaim deed form. Your very first step is obtaining your quitclaim deed.Fill out the quitclaim deed form.Get the quitclaim deed notarized.Take the quitclaim deed to the County Recorder's Office.File the appropriate paperwork.

Property Transfer in Minnesota The grantor must sign the deed and have their signature notarized in order to accomplish a transfer of property. The Minnesota deed is then recorded in the county where the property is located.

Signing - According to Minnesota Law, the quitclaim deed must be signed by the Grantor (the seller of the property) in the presence of a Notary Public (§ 507.24). Recording - All deeds filed in the state must be filed with the County Recorder's Office (§ 507.0944).