Topeka Kansas Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Kansas Assignment Of Mortgage By Individual Mortgage Holder?

We consistently aim to minimize or avert legal harm when handling intricate legal or financial matters.

To achieve this, we engage attorney services that are typically quite expensive.

Nevertheless, not every legal issue is this complicated.

Many of them can be managed independently.

Utilize US Legal Forms whenever you need to obtain and download the Topeka Kansas Assignment of Mortgage by Individual Mortgage Holder or any other form conveniently and securely.

- US Legal Forms is an online database of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and dissolution petitions.

- Our collection empowers you to manage your affairs without resorting to a lawyer's assistance.

- We offer access to legal form templates that are not always readily available.

- Our templates are tailored to specific states and regions, which significantly simplifies the search process.

Form popularity

FAQ

To discharge a mortgage assignment, the mortgage holder must provide a document called a discharge or satisfaction of mortgage. This document indicates that the borrower has repaid their mortgage fully, thus releasing their obligation. Filing this discharge with the local county recorder in Topeka ensures the public record reflects the current status of the mortgage. Utilizing our services can simplify the creation and filing of this important document.

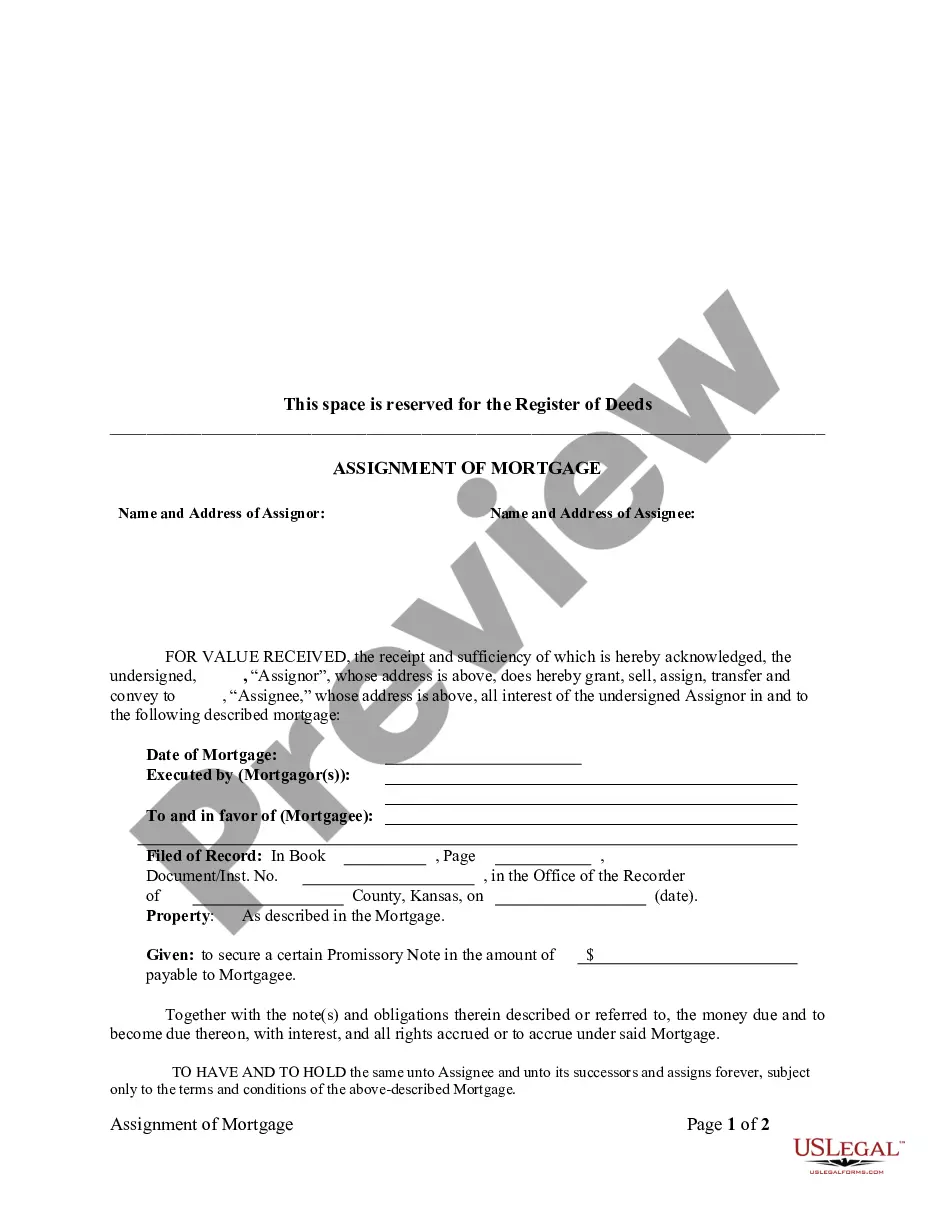

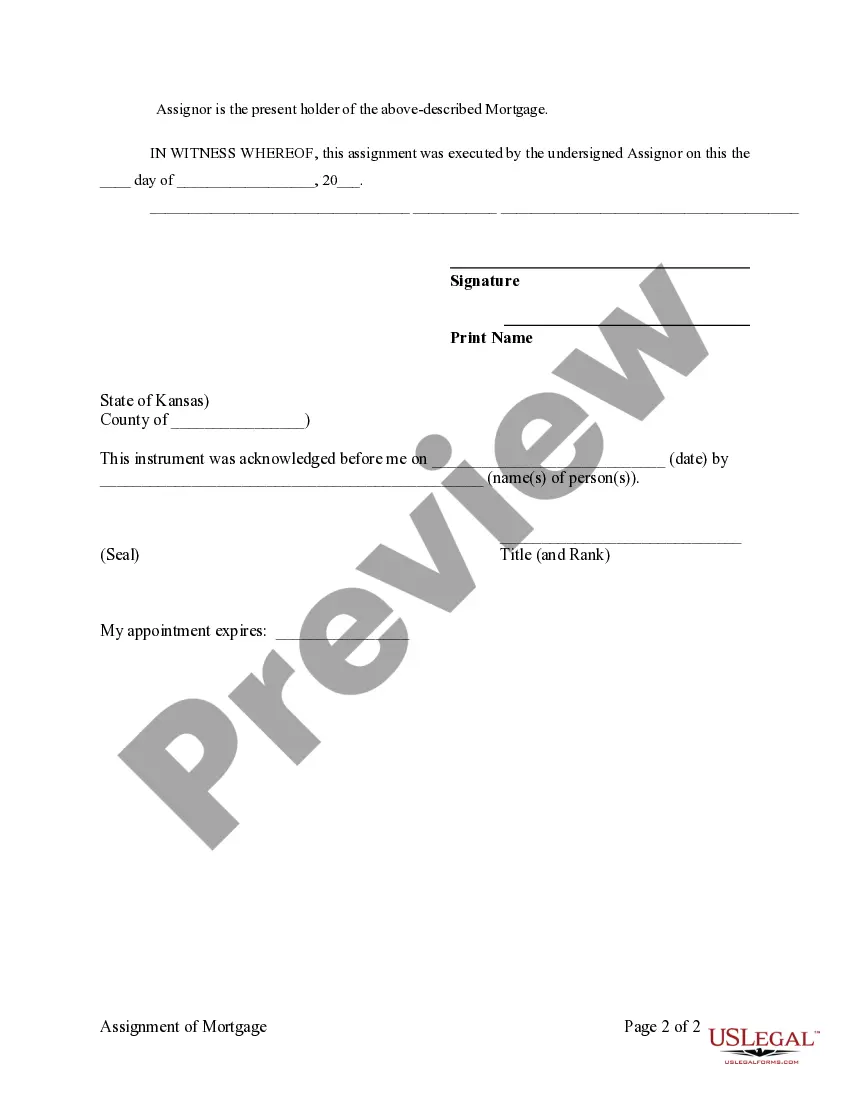

The assignment of a mortgage is usually signed by the mortgage holder, who is the original lender. This document may also need to be notarized or witnessed, which adds a layer of validity. If you are looking to create a Topeka Kansas Assignment of Mortgage by Individual Mortgage Holder, it's essential to follow the signing procedures outlined by state guidelines.

An assignment of mortgage generally includes several key components such as the names of the original borrower and lender, the legal description of the property, and the specifics of the assignment. It often has a title like 'Assignment of Mortgage', followed by signature lines for the original lender and any required witnesses. When preparing a Topeka Kansas Assignment of Mortgage by Individual Mortgage Holder, using a template from uslegalforms can ensure accuracy and completeness.

In the Topeka Kansas Assignment of Mortgage by Individual Mortgage Holder, the original mortgagee, or lender, typically signs the assignment. This document transfers the rights and interests in the mortgage to another party. The assignment may also require the signature of a witness or notary, depending on local laws. Always ensure compliance with state requirements when completing this process.

No, the assignment of mortgage does not mean foreclosure. Instead, this process refers to the transfer of mortgage rights from one party to another, often between lenders or investors. In Topeka, Kansas Assignment of Mortgage by Individual Mortgage Holder, the original lender may sell or transfer the mortgage to a new party, but this does not initiate foreclosure. If you have further questions or need assistance with your mortgage assignment, consider using US Legal Forms for reliable resources and guidance.

To transfer a house deed in Kansas, you typically need to prepare a deed that states the new ownership. This deed must be signed, witnessed, and notarized, followed by the filing of the deed with the county clerk’s office. In the context of Topeka Kansas Assignment of Mortgage by Individual Mortgage Holder, ensuring that the deed is accurately completed is critical to avoid any future disputes. Consider using US Legal Forms for comprehensive templates and step-by-step guidance.

Yes, you can assign your mortgage to someone else in Topeka, Kansas, but it requires careful consideration of the terms of the mortgage. Not all mortgages allow for assignment, so reviewing your contract is essential. This process may involve notifying the lender and completing certain paperwork to officially transfer the mortgage rights. For assistance with the legal documentation, US Legal Forms can provide the necessary resources.

Typically, the current mortgage holder, which may be an individual or a bank, is responsible for assigning a mortgage. In situations involving the Topeka Kansas Assignment of Mortgage by Individual Mortgage Holder, the individual needs to follow specific legal procedures to ensure the mortgage is properly assigned. It’s crucial to utilize the correct documentation to protect all parties involved. US Legal Forms offers templates that can streamline this process.

In Topeka, Kansas, any party involved in a contract can assign it, provided they have the legal authority to do so. This generally includes individuals or entities that hold a right or interest in the contract. It is important to check the terms of the contract to ensure assignment is allowed. If you need guidance on this process, consider using US Legal Forms to handle your assignment efficiently.

A release on a mortgage is a legal document that indicates the mortgage obligation has been fulfilled, thereby eliminating the lender's claim to the property. This release is crucial for ensuring that the property's title is clear. If you're navigating the Topeka Kansas Assignment of Mortgage by Individual Mortgage Holder, understanding this concept can provide peace of mind as you transition into new ownership.