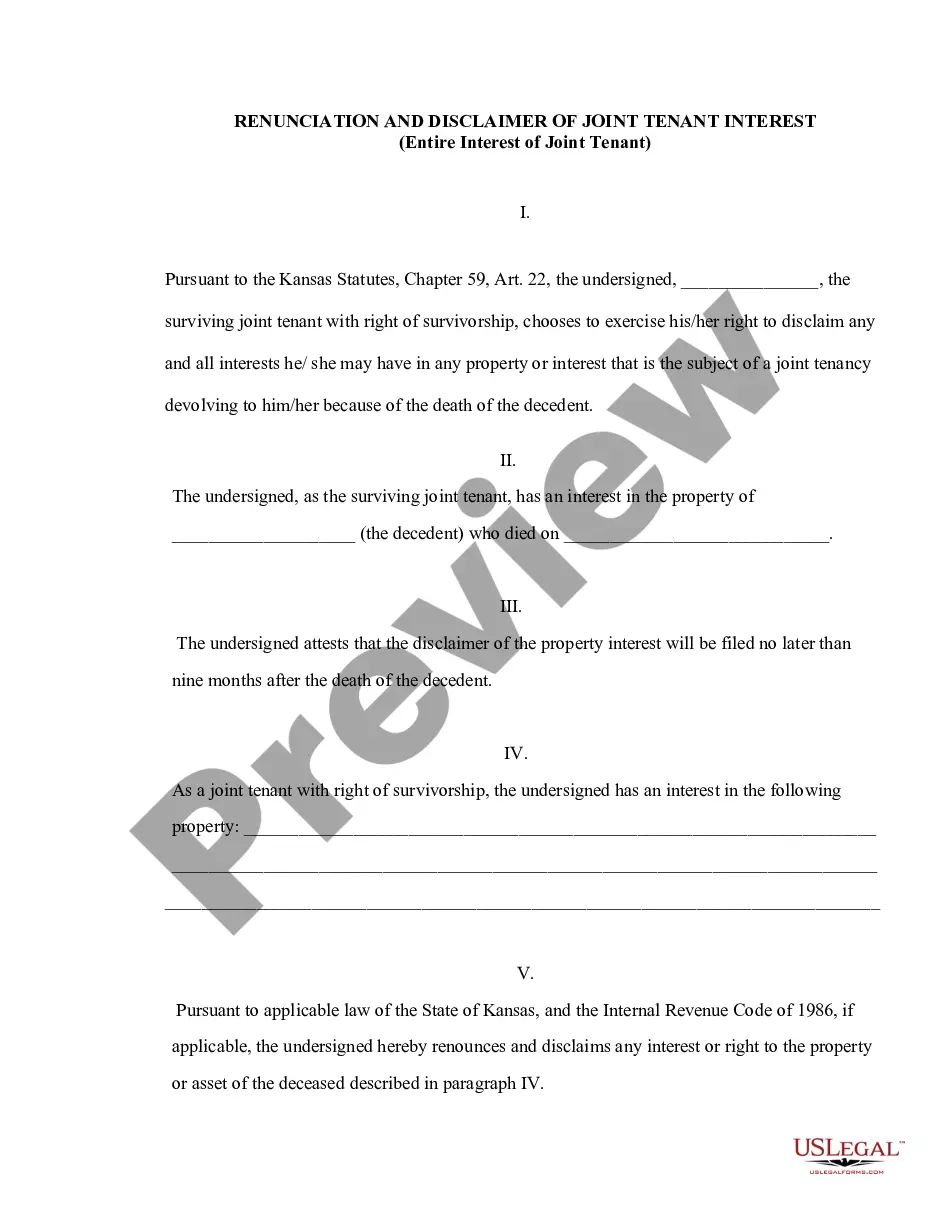

Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest

Description

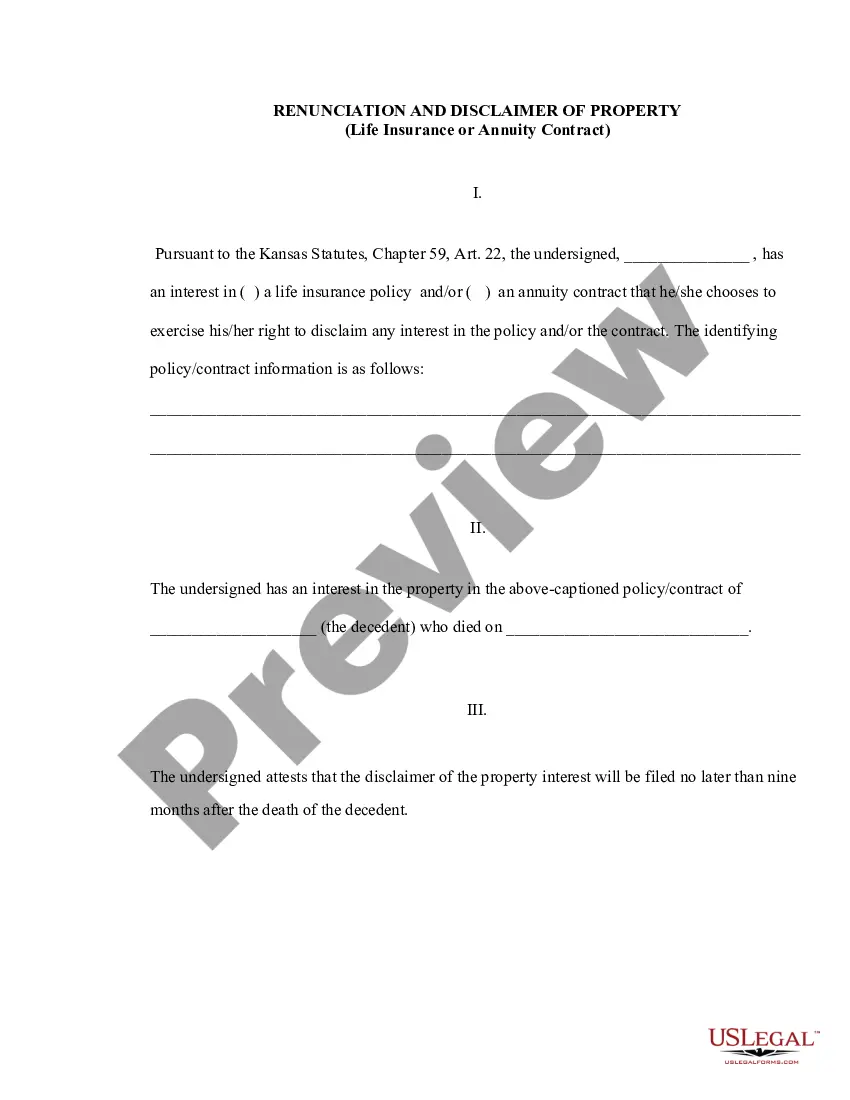

How to fill out Kansas Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

If you are looking for a legitimate form template, it’s quite challenging to find a superior platform compared to the US Legal Forms website – likely one of the most extensive libraries online.

Here, you can obtain numerous document samples for business and personal use categorized by types, regions, or keywords.

With our sophisticated search function, locating the latest Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest is as simple as 1-2-3.

Complete the payment procedure. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the file format and download it onto your device.

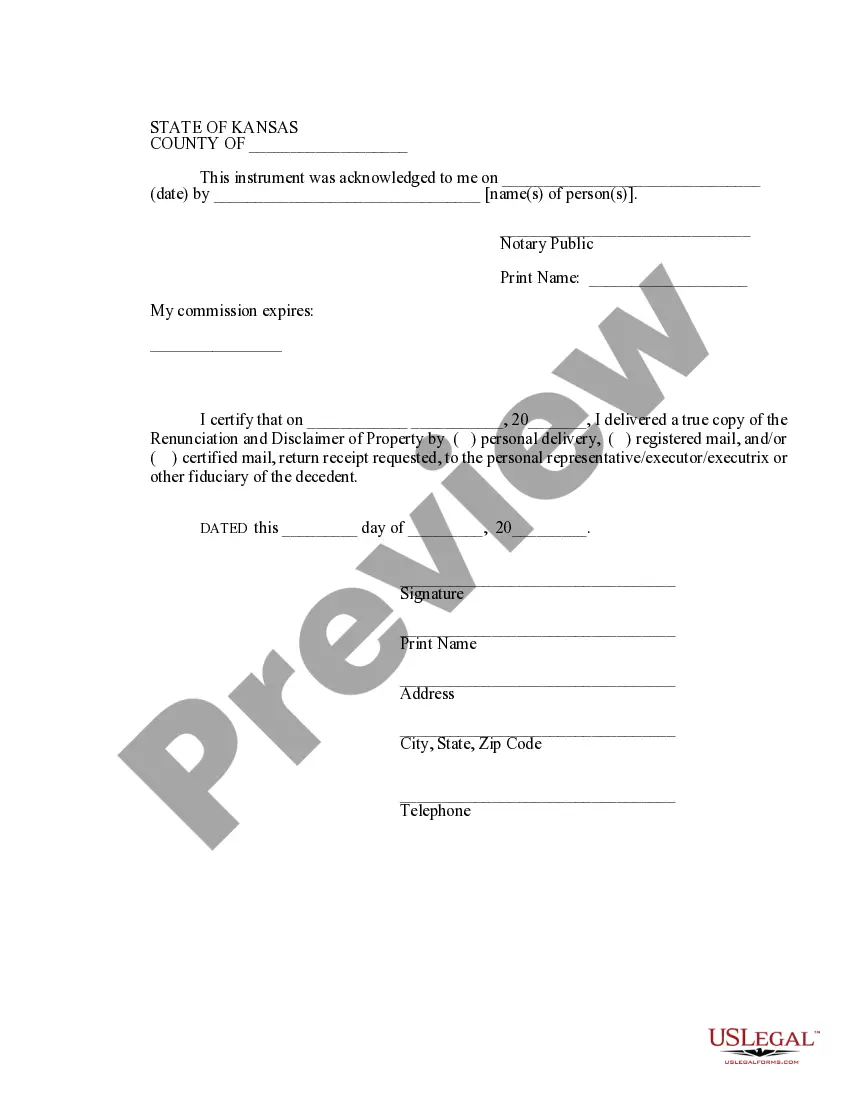

- Furthermore, the pertinence of each document is validated by a team of knowledgeable attorneys who routinely review the templates on our site and refresh them in accordance with the latest state and county regulations.

- If you are already acquainted with our platform and possess an account, all you have to do to obtain the Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest is to Log In to your account and click the Download button.

- In case you are using US Legal Forms for the first time, simply follow the instructions provided below.

- Ensure that you have selected the template you desire. Read its description and make use of the Preview option to review its content. If it does not fulfill your requirements, use the Search option at the top of the page to find the right document.

- Verify your selection. Click the Buy now button. Then, choose your preferred subscription plan and provide your details to create an account.

Form popularity

FAQ

The statute 21 5406 defines certain offenses related to property and ownership in Kansas. It plays a role in protecting property rights against unlawful claims and actions. Understanding this statute is essential when dealing with property transfers, including those involving the Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest, to ensure your rights are upheld.

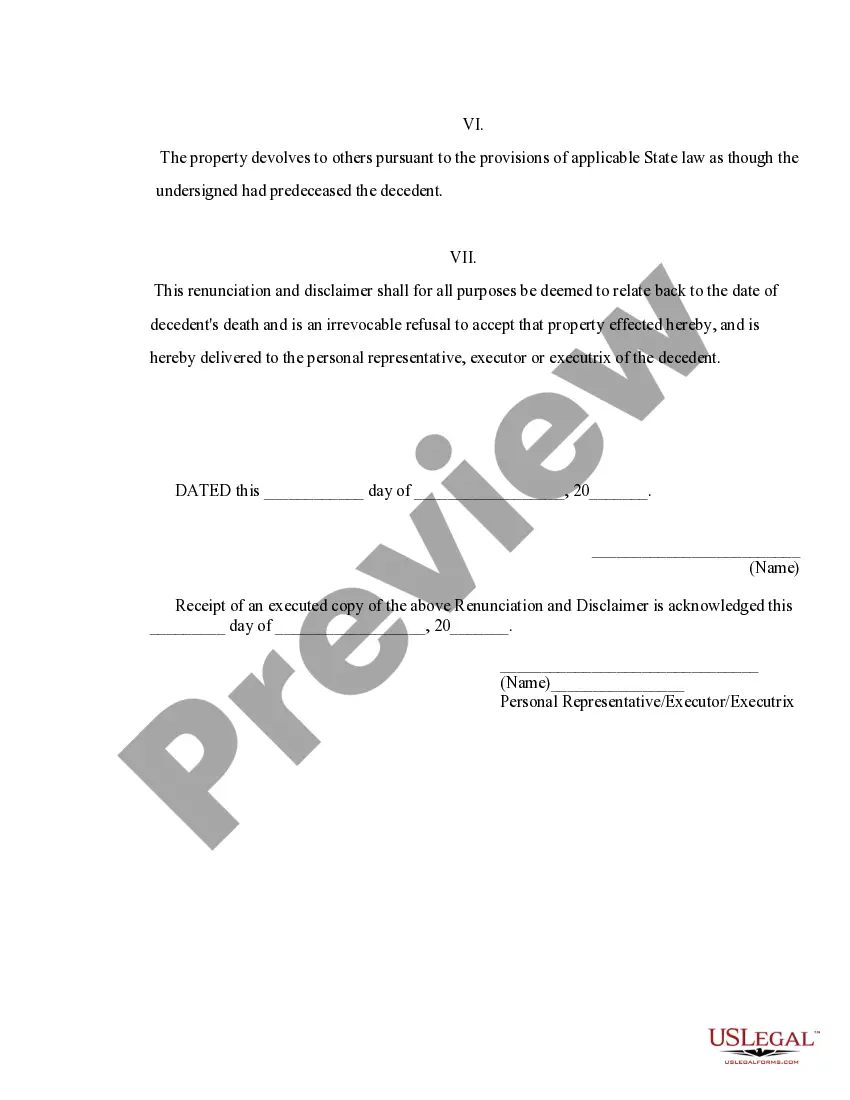

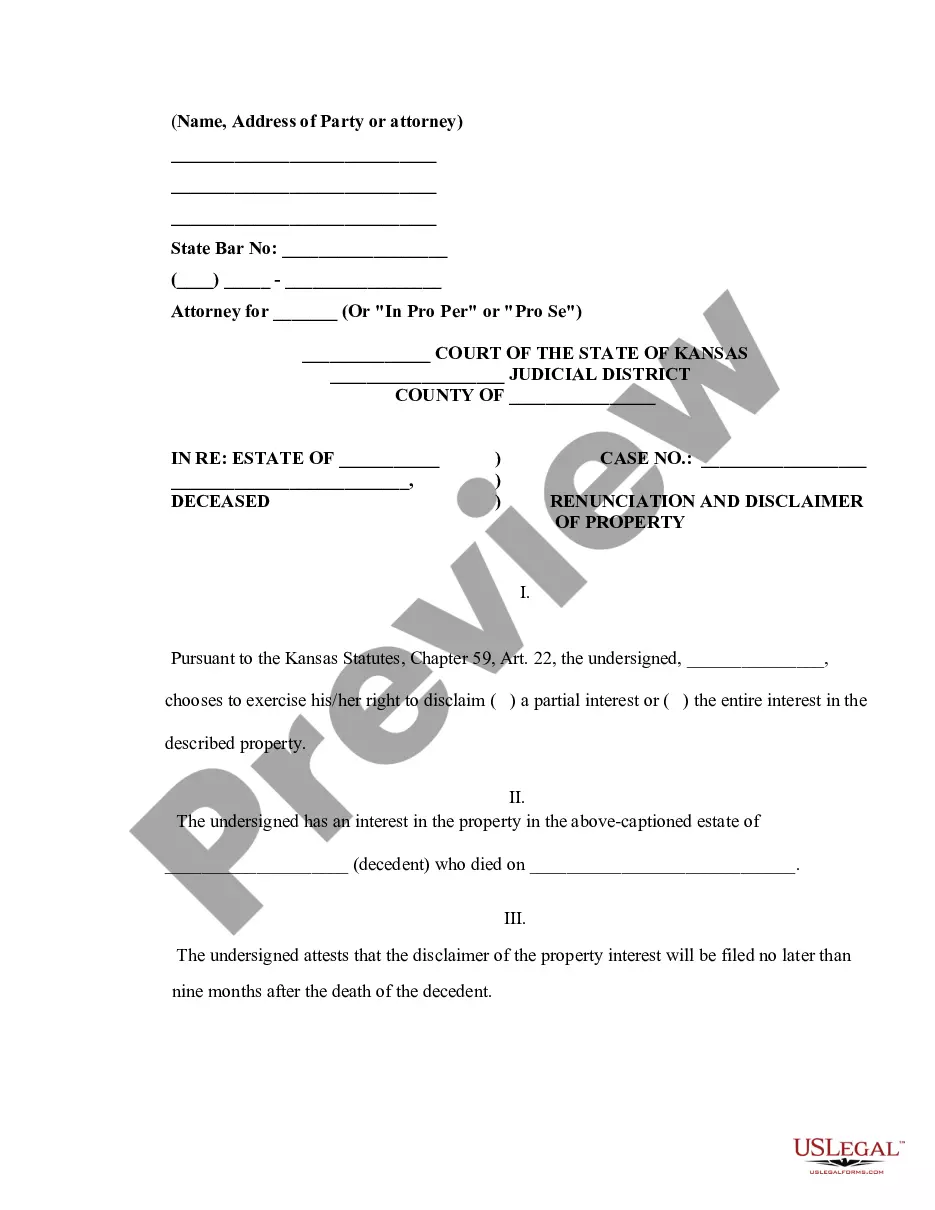

The joint tenancy law in Kansas allows two or more individuals to own property together with equal rights. This type of ownership includes the right of survivorship, meaning if one owner passes away, their share automatically goes to the surviving owner(s). If you find yourself needing to navigate the complexities of Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest, familiarize yourself with these laws to protect your interests.

The statute 47 645 pertains to the requirements for executing a warranty deed in Kansas. Knowing this statute is crucial for anyone looking to transfer property ownership reliably. For individuals interested in Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest, understanding this statute can ensure that property is transferred correctly and legally.

The disclaimer statute in Kansas enables individuals to refuse their interest in property under specific circumstances. This statute is critical for individuals looking to clarify their intentions regarding joint tenancy arrangements. Through the process of Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest, you can utilize this statute to facilitate a straightforward property transition.

The statute 21-5709 addresses issues related to the criminal code in Kansas, particularly concerning ownership rights and property disputes. While it may not be directly related to joint tenancy, understanding this statute can assist individuals navigating property ownership in Kansas. If you are dealing with property ownership questions, including Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest, seeking legal guidance regarding this statute is wise.

The statute 79 1460 in Kansas governs the renunciation of a joint tenancy interest. It allows a tenant to formally decline their interest in a property, which can help clarify ownership and intentions. This statute is particularly relevant in the context of Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest, ensuring that property matters are handled transparently.

In New Jersey, direct inheritances from parents fall under specific tax brackets. Each beneficiary can inherit up to $25,000 without incurring a state inheritance tax. However, additional amounts may be taxed depending on the total value received. Understanding the nuances of these limits is crucial, especially if you are considering Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest.

Yes, New Jersey requires an inheritance tax waiver form for certain beneficiaries before distributing an estate. This waiver confirms that any taxes owed have been settled, preventing potential delays in securing your inheritance. Ignoring this form can complicate the probate process. When discussing matters surrounding Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest, be sure to address the importance of this waiver.

In New Jersey, certain assets bypass probate, making the transfer process simpler. These include assets held in joint tenancy, life insurance proceeds with a named beneficiary, and retirement accounts. Additionally, assets in a trust do not go through probate. Understanding these exemptions can provide clarity when dealing with estate planning and may relate to Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest.

A disclaimer of interest in New Jersey allows an individual to refuse an inheritance or gift. This legal tool enables beneficiaries to avoid the responsibilities and liabilities associated with the asset. By formally renouncing an interest, you may also mitigate potential estate taxes. If you're exploring options related to Overland Park Kansas Renunciation and Disclaimer of Joint Tenant or Tenancy Interest, this disclaimer is a key process to understand.