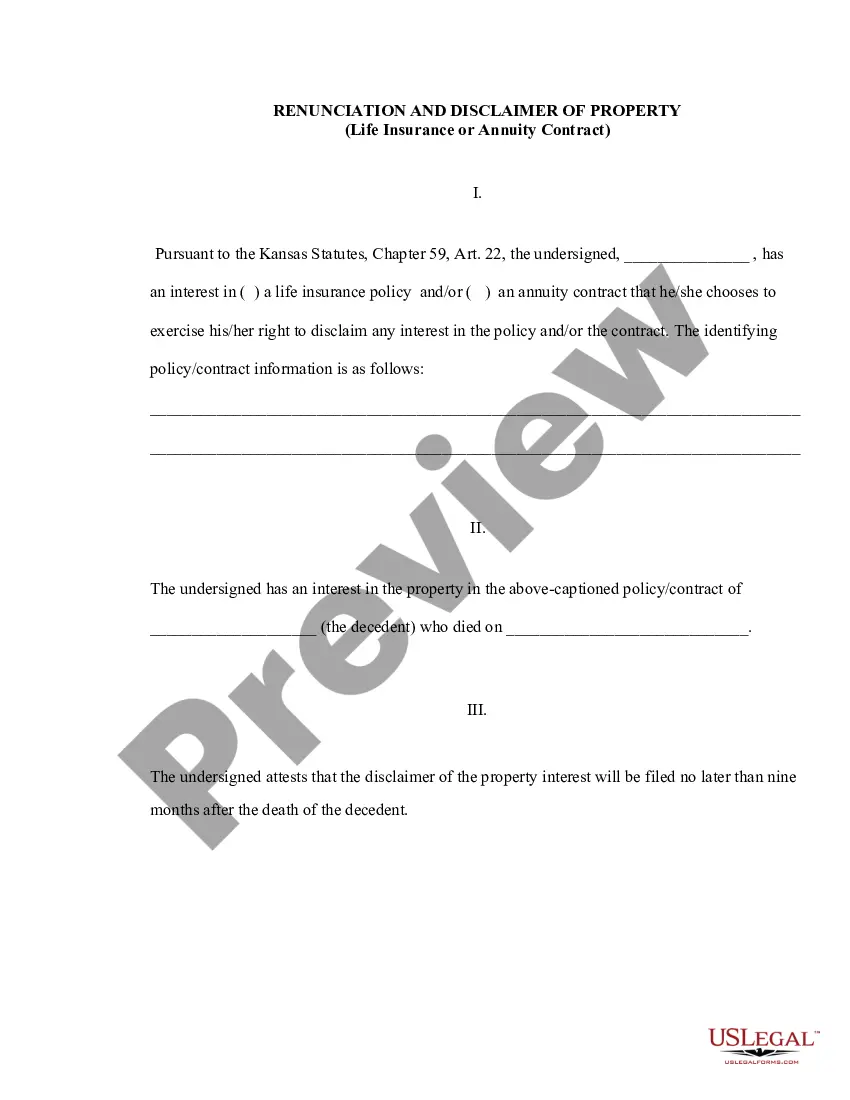

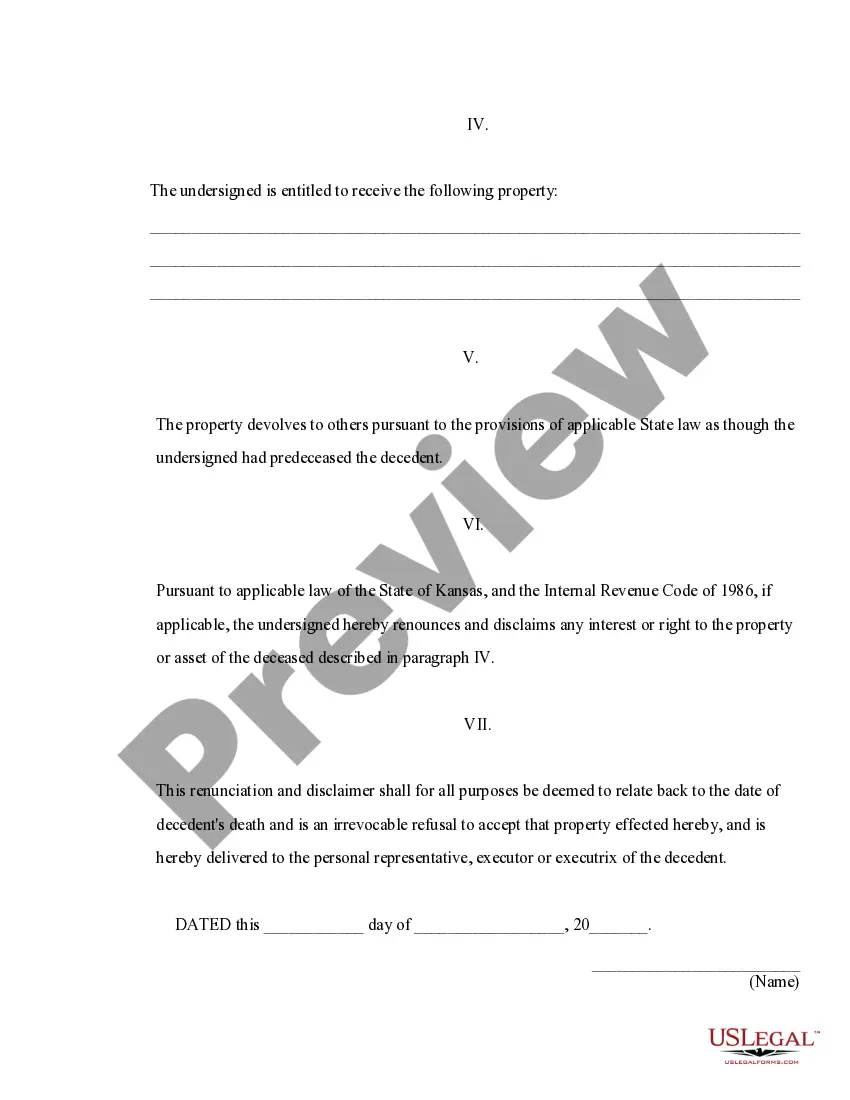

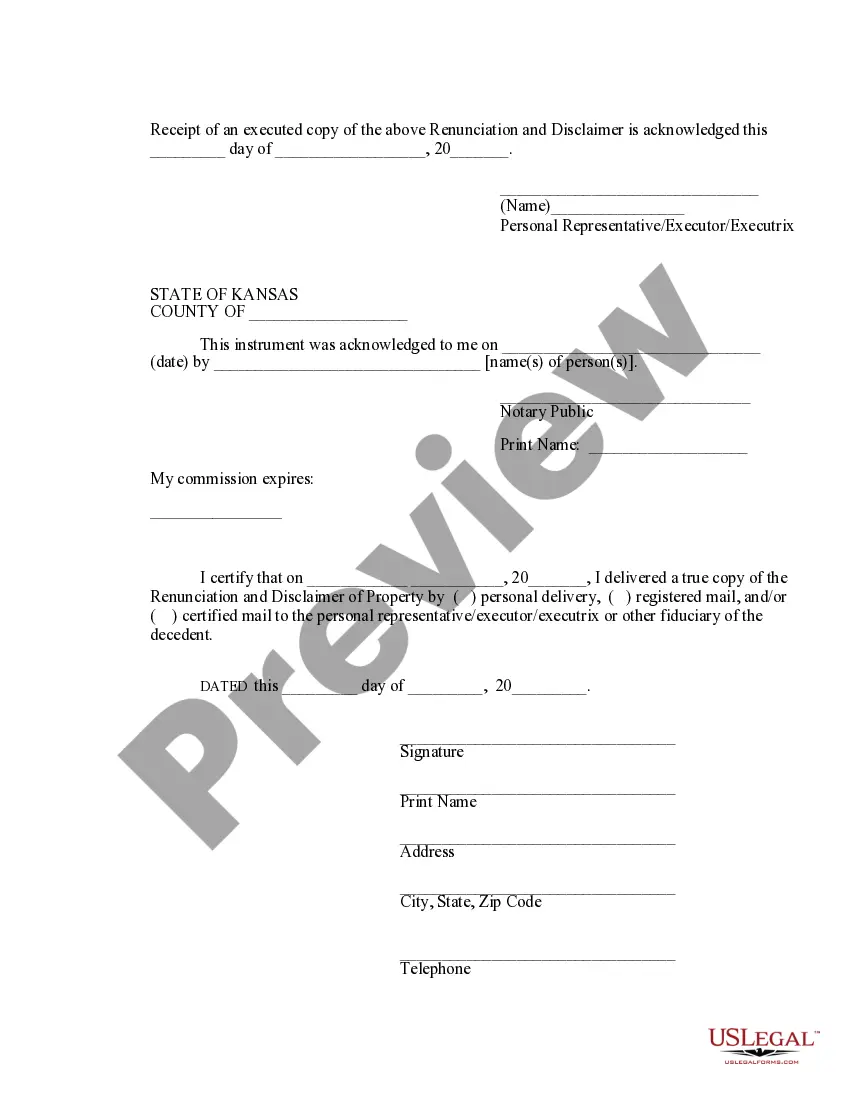

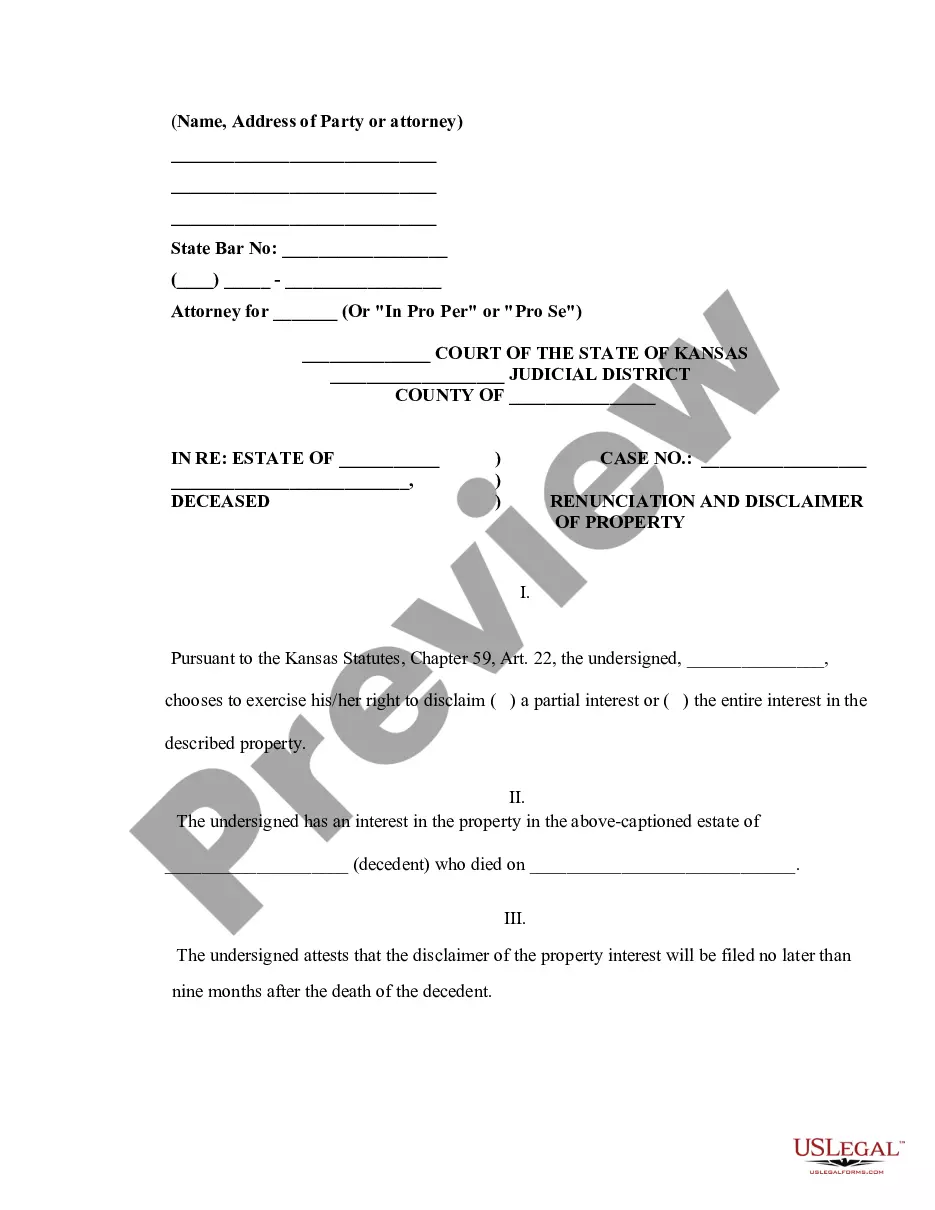

Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

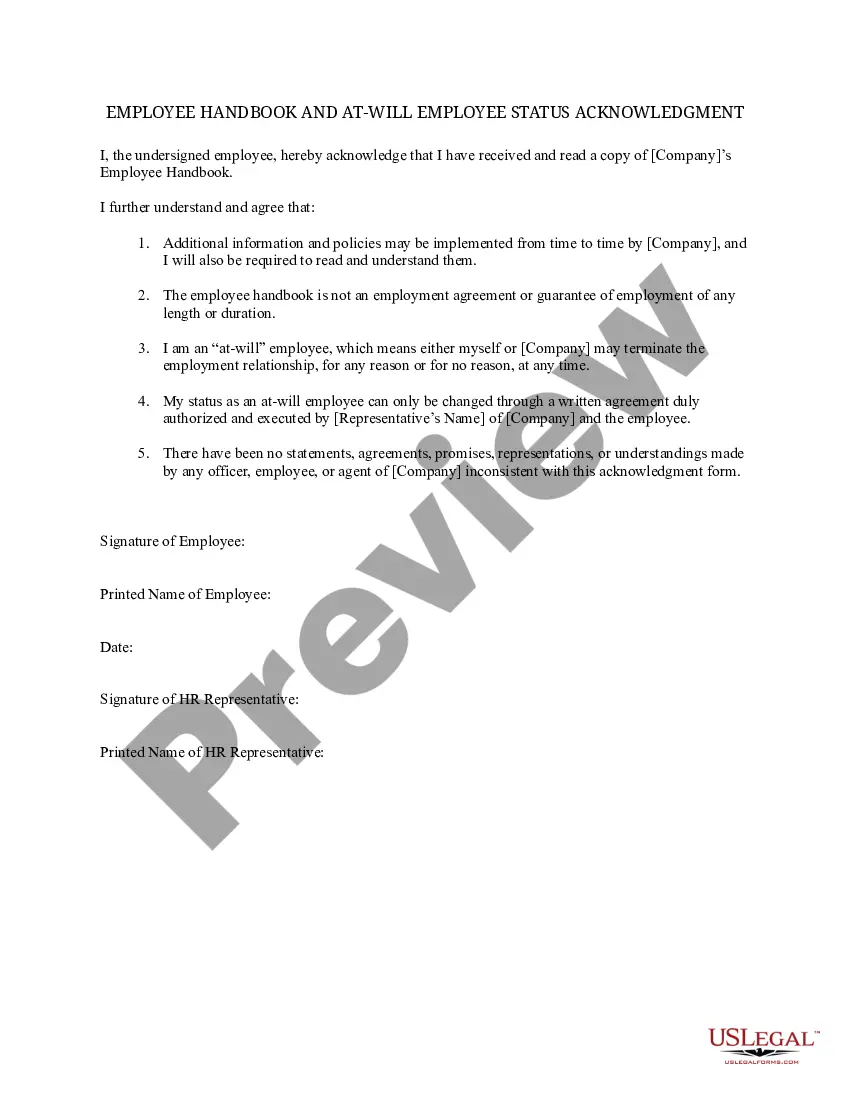

How to fill out Kansas Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

We consistently seek to mitigate or avert legal complications when navigating intricate legal or financial situations.

To achieve this, we seek legal services that are generally very expensive.

However, not all legal problems are of the same level of difficulty.

Many can be managed independently.

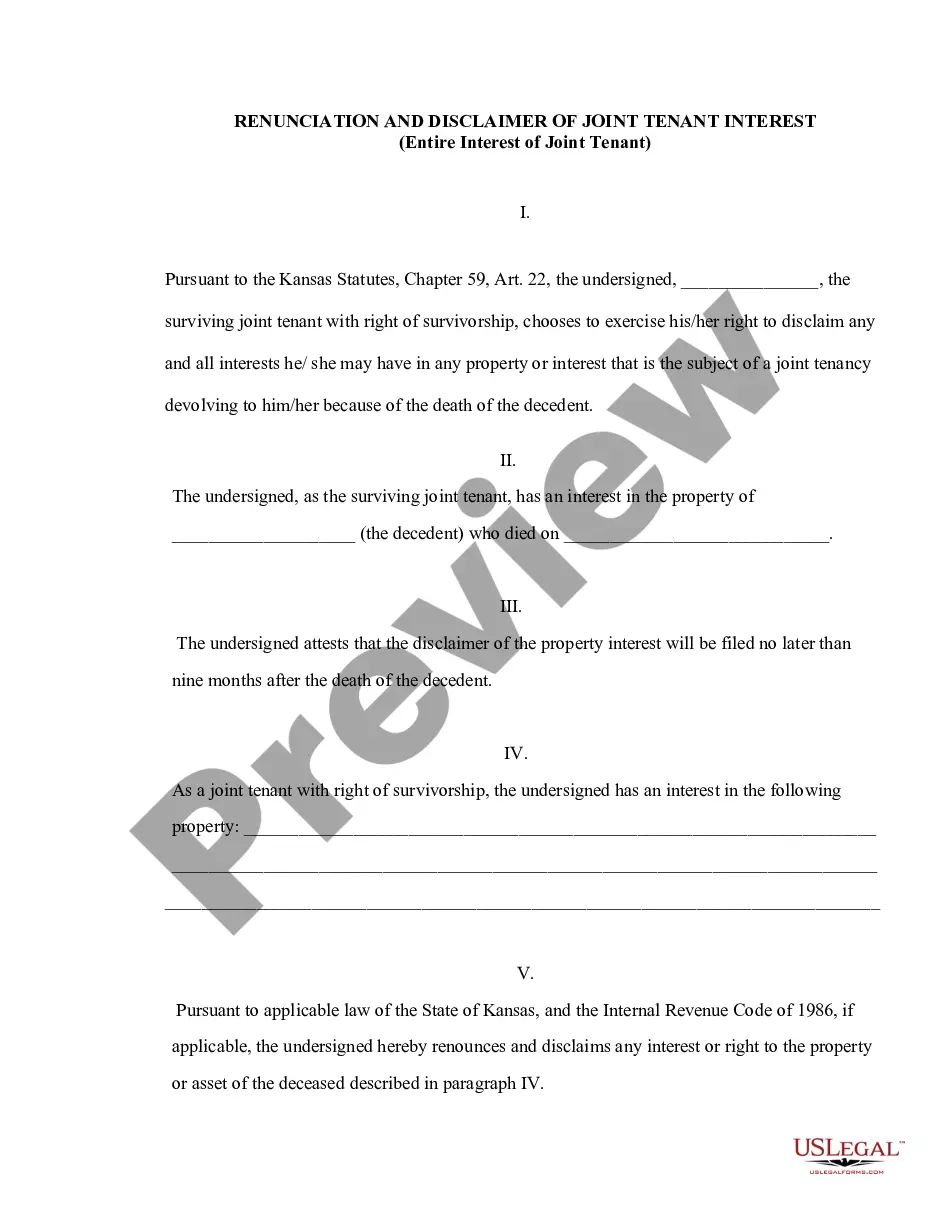

Utilize US Legal Forms whenever you need to quickly and securely locate and download the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract or any other document. Just Log In to your account and click the Get button beside it. If you misplace the document, you can always retrieve it again in the My documents section. The procedure is equally simple if you’re unfamiliar with the website! You can create your account in just a few minutes. Ensure that the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract adheres to the laws and regulations of your state and area. Moreover, it’s essential to review the form’s description (if available), and if you find any inconsistencies with what you originally wanted, seek a different form. Once you’ve verified that the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is suitable for you, you can choose a subscription plan and process the payment. Then you can download the document in any desired file format. For over 24 years, we’ve assisted millions by offering ready-to-customize and updated legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- US Legal Forms is an online repository of current DIY legal documents covering everything from wills and powers of attorney to articles of incorporation and petitions for dissolution.

- Our collection enables you to handle your affairs without needing to consult legal counsel.

- We provide access to legal document templates that aren’t always readily available to the public.

- Our templates are tailored to specific states and regions, which greatly simplifies the search process.

Form popularity

FAQ

Receiving a 1099-R from your life insurance policy indicates that you have received taxable distributions from your policy. It is essential to review the details regarding the type of distribution. Knowing the rules surrounding the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can help clarify your tax obligations.

Handling life insurance proceeds involves deciding whether to accept the benefits, disclaim them, or use them for specific financial needs. If you accept the proceeds, consult with a tax advisor regarding any potential tax implications. Understanding the principles of the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can aid in making these decisions.

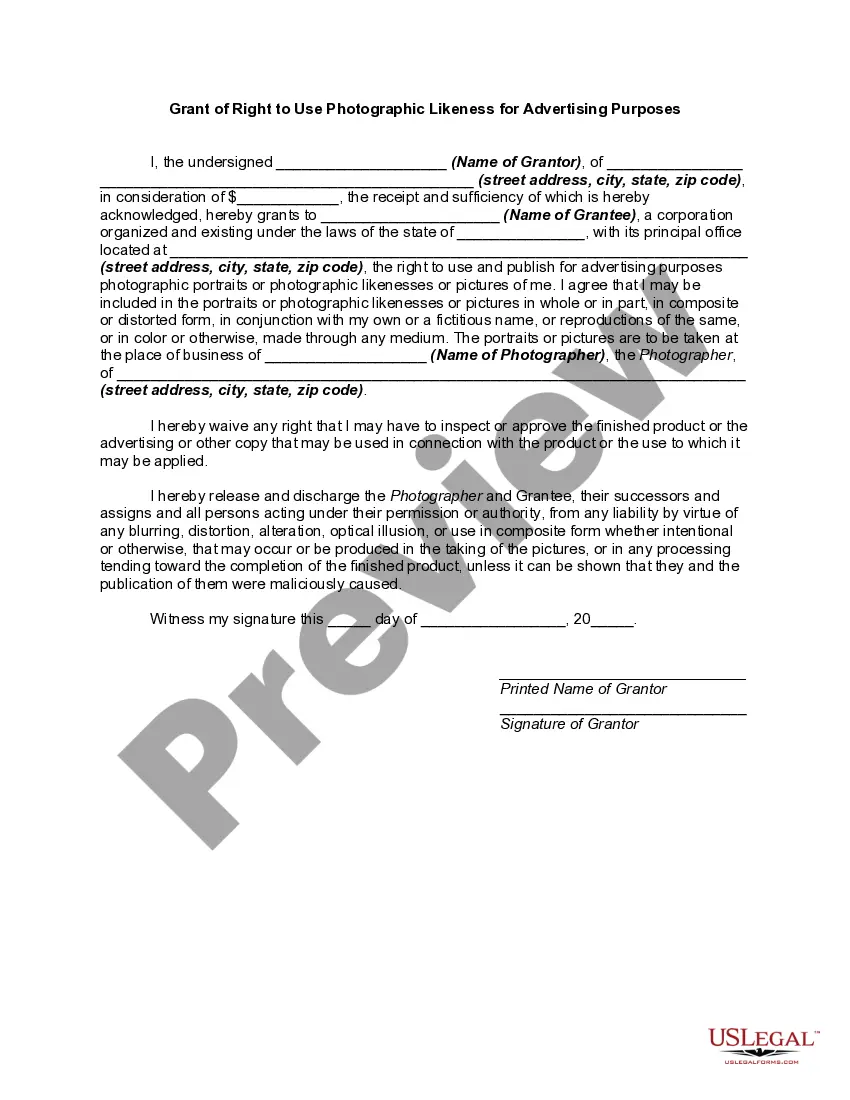

Yes, a beneficiary can disclaim life insurance proceeds if they choose not to accept them. This is done through a written statement provided to the insurer. It's important to consider the implications of the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, which may affect future estate planning.

When filling out a beneficiary designation form, ensure you provide accurate information regarding your beneficiaries, including names and relationships to you. Clearly state primary and contingent beneficiaries, if applicable. Familiarizing yourself with the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract can help you make informed choices.

To disclaim life insurance proceeds, you must submit a written disclaimer to the insurance company, stating your intention not to accept the benefits. This document should include your signature and details about the policy. Understanding the implications of the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract is vital when making such decisions.

Filling out a life insurance claim form involves providing necessary details such as the policy number, the deceased's information, and the beneficiary's identification. Make sure to include all supporting documents like the death certificate. If you need guidance, platforms like USlegalforms offer resources to assist with the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

To designate life insurance beneficiaries, you must complete a beneficiary designation form provided by your insurer. This form typically requires you to provide the name, relationship, and possibly the address of each beneficiary. It's crucial to keep this information updated to ensure your wishes align with the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

Life insurance may be denied for several reasons, such as inaccuracies in the application, exclusions for certain causes of death, or the policy holder not maintaining premium payments. It's essential to review your policy terms thoroughly. If you encounter a denial, consider seeking assistance with your rights under the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

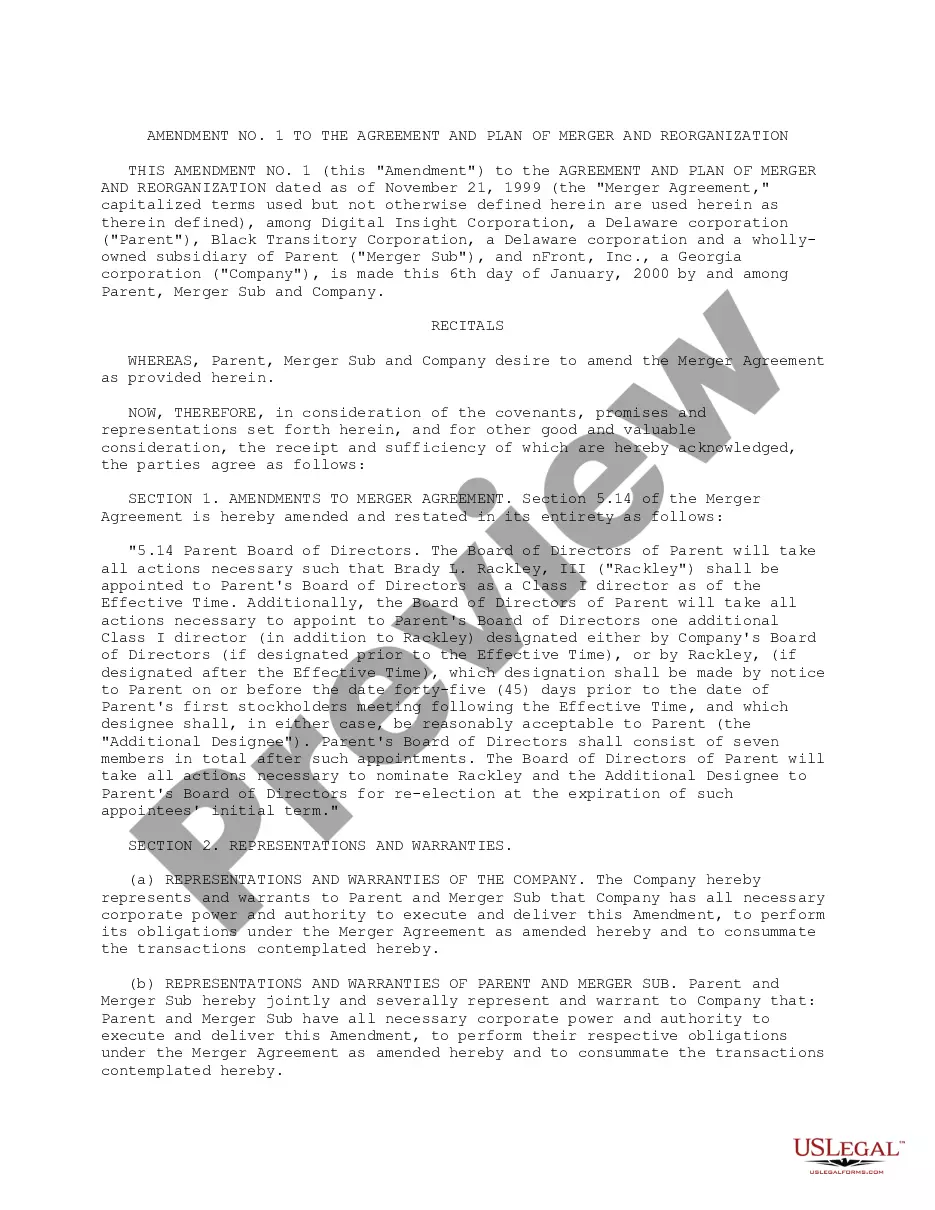

The timeframe to settle an estate in Kansas can vary significantly, usually ranging from several months to a couple of years. Factors such as asset complexity, beneficiary communication, and legal considerations can influence this timeline. If you are handling life insurance or annuity contracts, implementing the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract may help expedite the process. It's essential to stay organized to ensure a smoother settlement.

Settling an estate in Kansas involves several key steps, including filing the will, identifying assets, notifying beneficiaries, and paying debts. You may also need to handle assets outside of probate, such as those tied to life insurance or annuities. By following the guidelines of the Overland Park Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, you can manage these assets effectively. Consulting with a legal expert can provide clarity and direction.