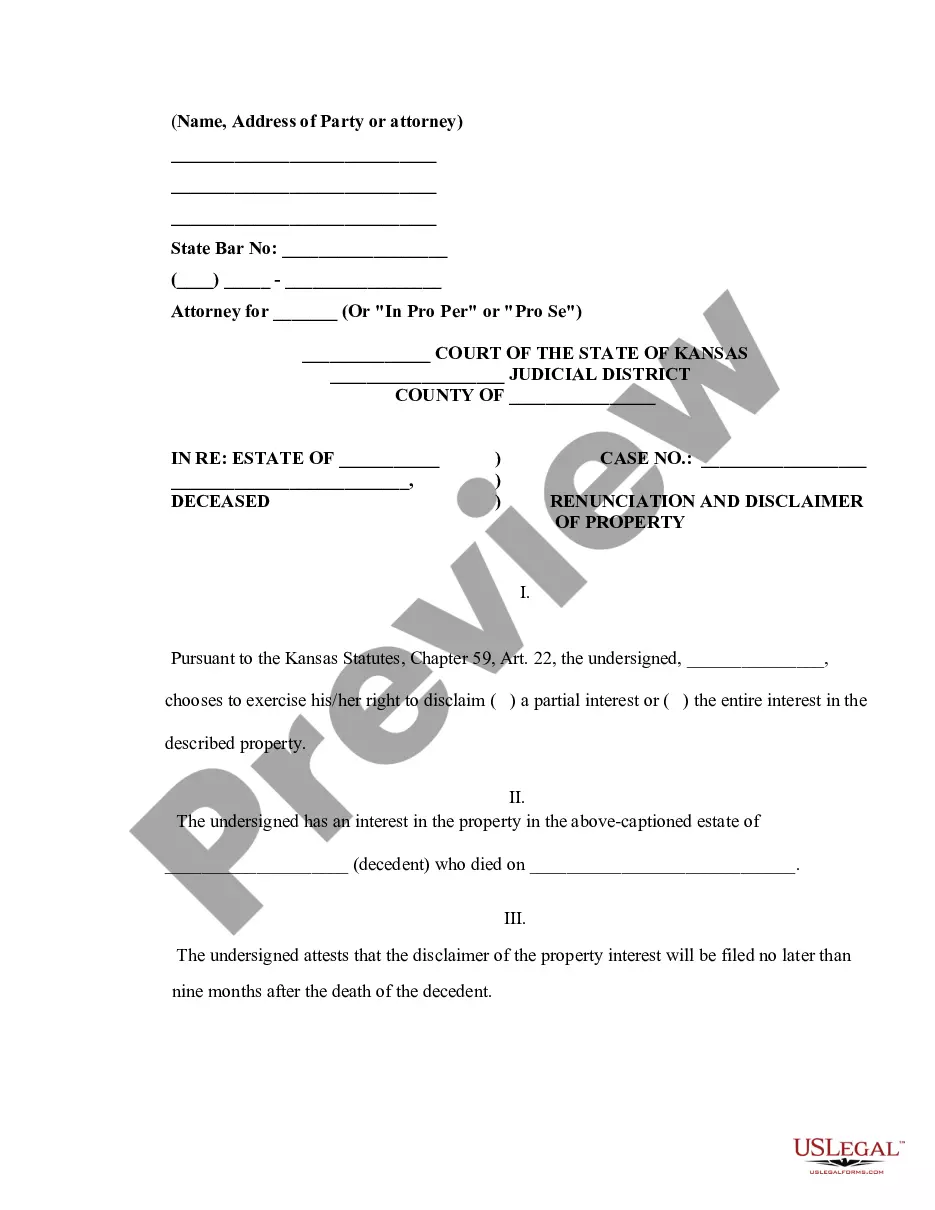

Wichita Kansas Renunciation and Disclaimer of Property from Will by Testate

Description

How to fill out Kansas Renunciation And Disclaimer Of Property From Will By Testate?

If you’ve previously utilized our service, Log In to your account and download the Wichita Kansas Renunciation and Disclaimer of Property from Will by Testate onto your device by clicking the Download button. Ensure your subscription is current. If it’s not, renew it according to your payment plan.

If this is your first time using our service, follow these straightforward steps to acquire your document.

You have continual access to each document you’ve purchased: you can find it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to effortlessly locate and save any template for your personal or professional needs!

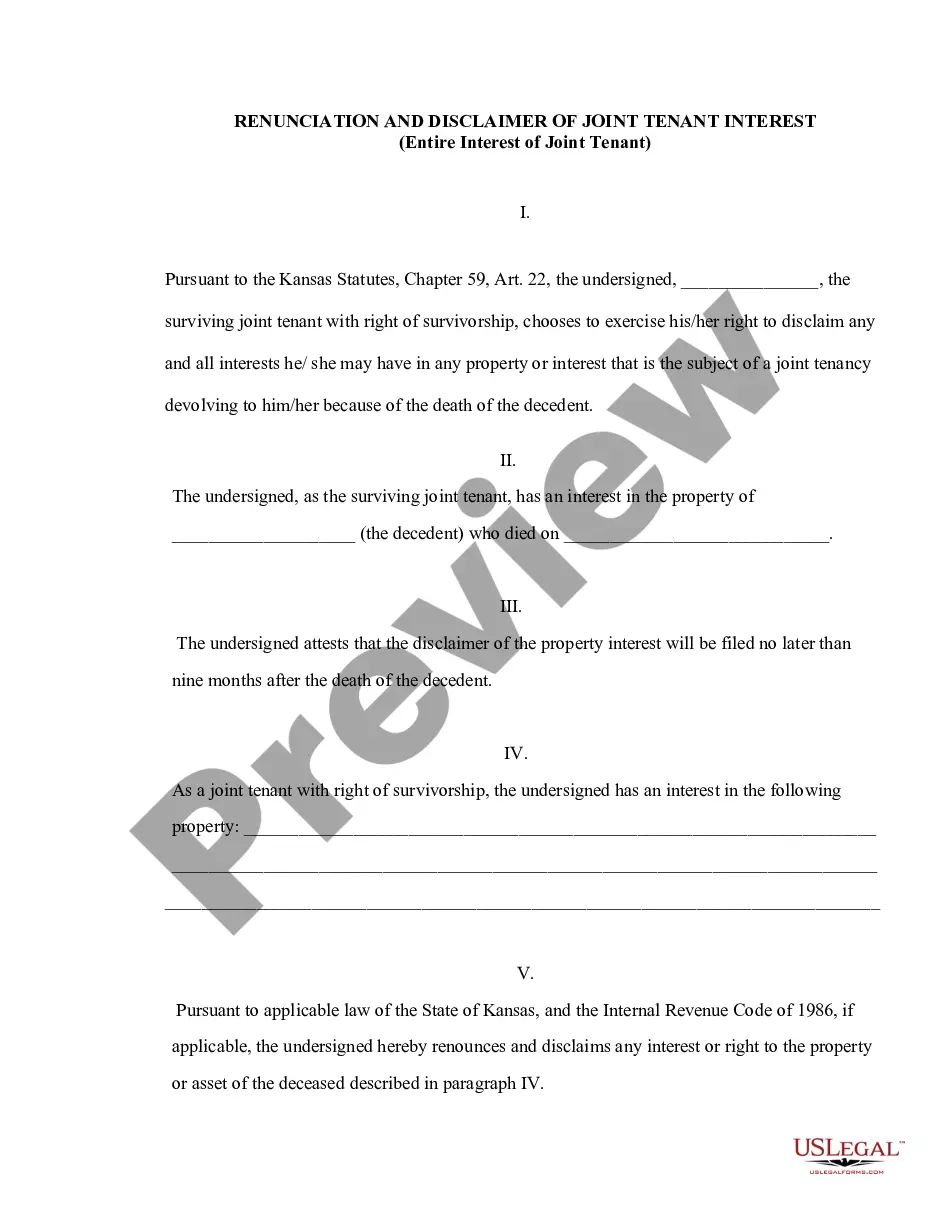

- Confirm that you’ve found the correct document. Browse through the description and use the Preview option, if available, to verify if it suits your requirements. If it doesn’t match your needs, utilize the Search tab above to discover the right one.

- Acquire the template. Click the Buy Now button and select a monthly or annual subscription option.

- Create an account and process your payment. Enter your credit card information or opt for PayPal to finalize the transaction.

- Receive your Wichita Kansas Renunciation and Disclaimer of Property from Will by Testate. Choose the file format for your document and save it onto your device.

- Finalize your sample. Print it out or use professional online editors to complete it and sign it electronically.

Form popularity

FAQ

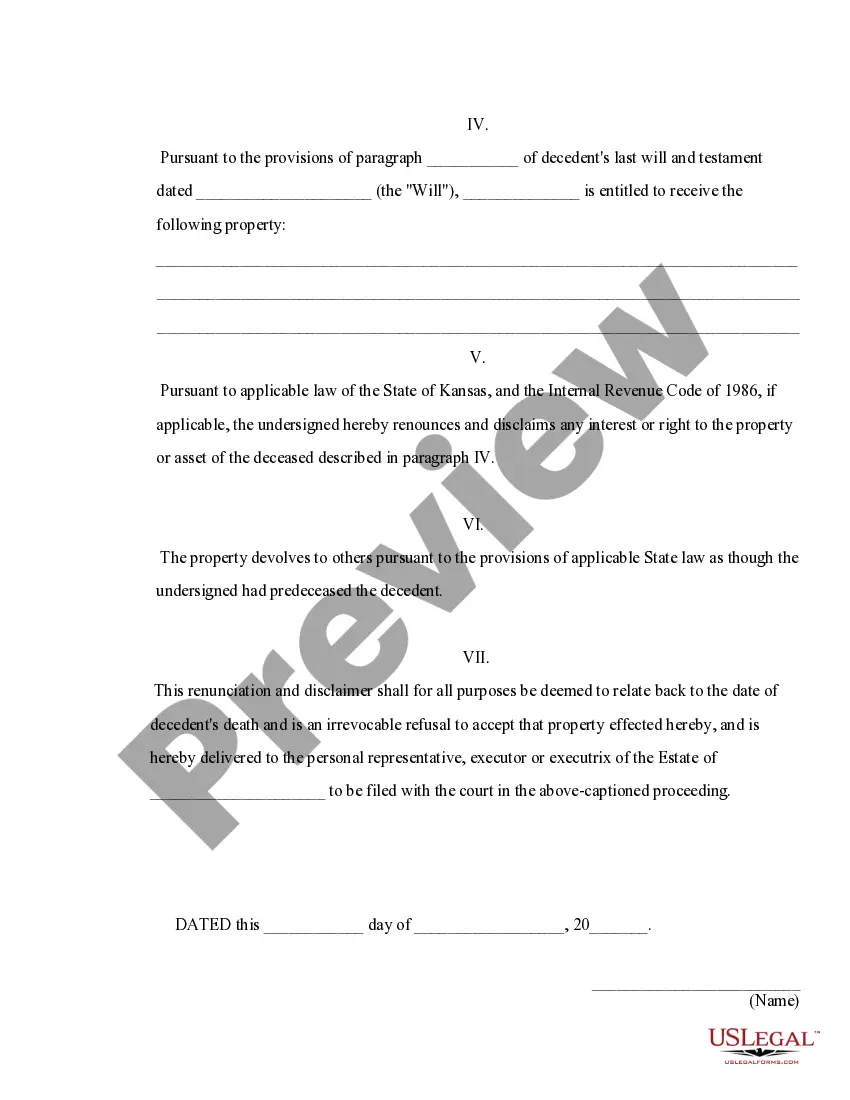

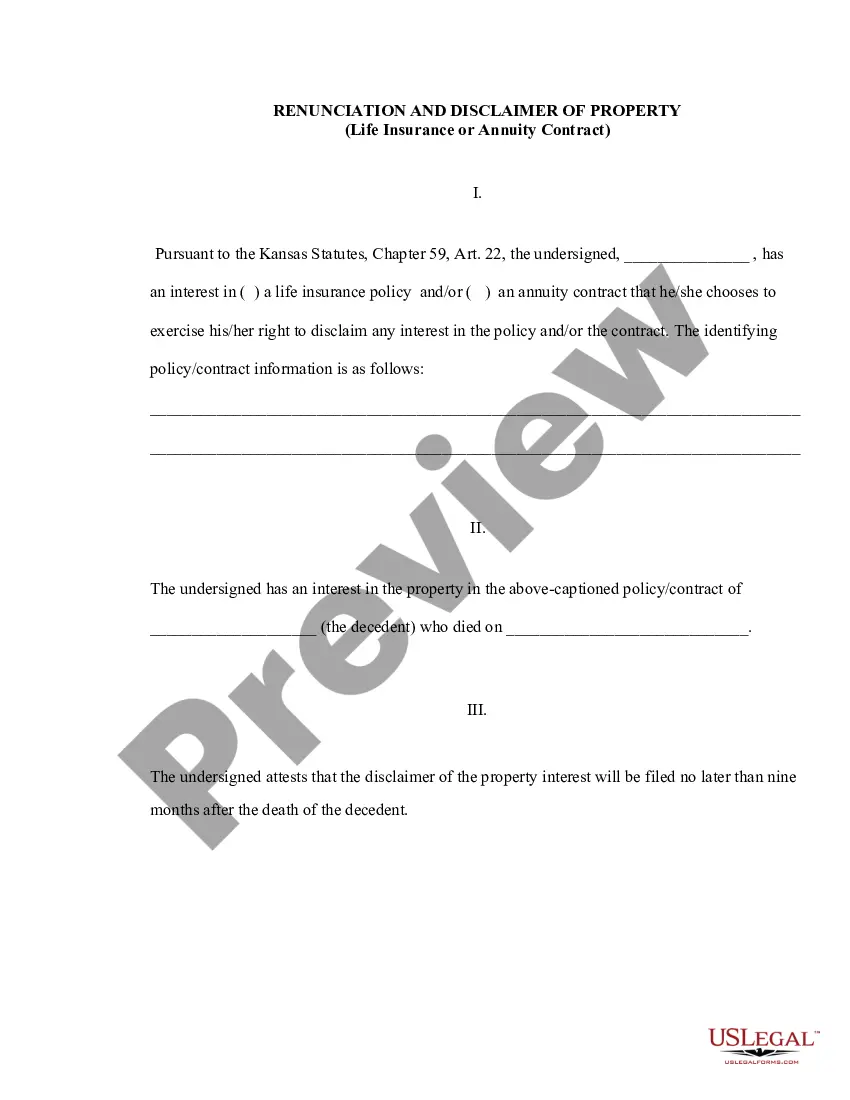

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

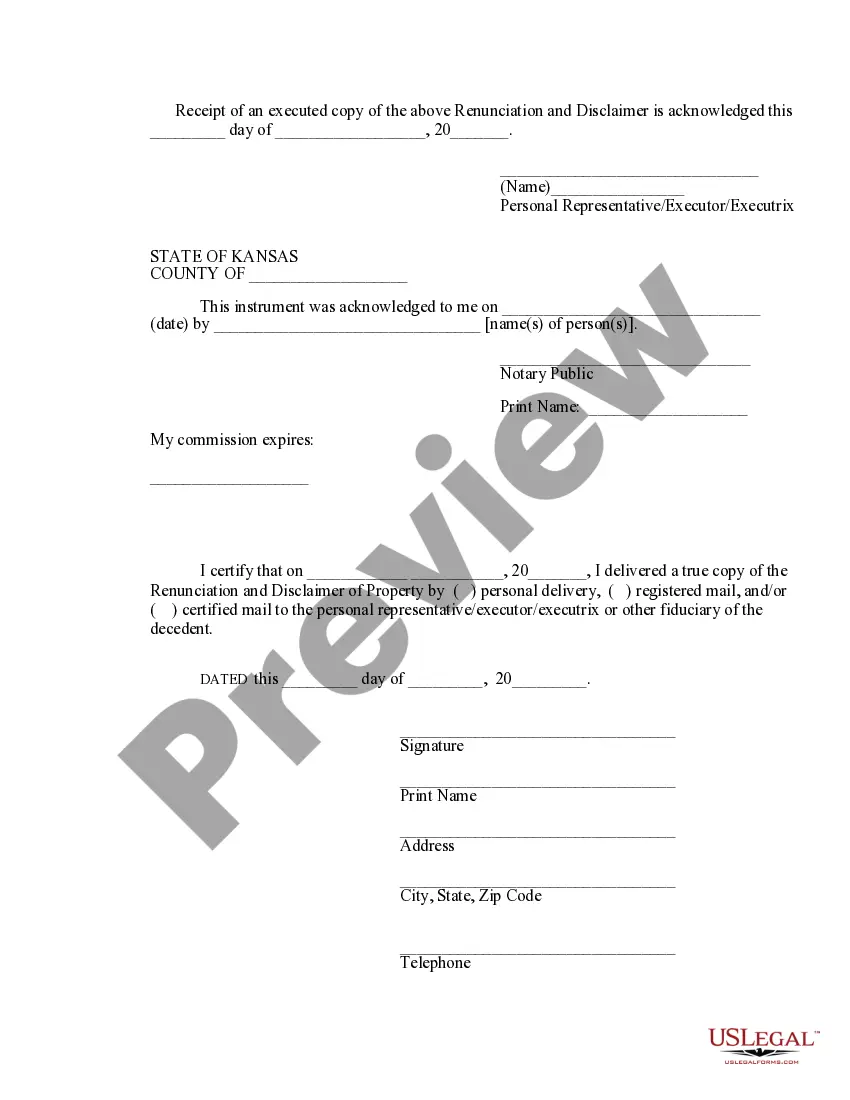

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

A disclaimer is when the recipient (called the ?donee?) refuses a bequest, for example, the donee refuses an inheritance left in a will or trust, refuses the proceeds from an account labeled as pay-on-death account when the original owner dies, or refuses the surviving interest in jointly owned property when one joint

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Description. The Uniform Disclaimer of Property Interests Act (UDPIA) provides definite, tax-sensitive rules governing refusals to accept transfers of property by gift or inheritance, and identifying who takes the gift in the event of disclaimer.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

A disclaimer trust is an estate planning technique in which a married couple incorporates an irrevocable trust in their planning, which is funded only if the surviving spouse chooses to ?disclaim,? or refuse to accept, the outright distribution of certain assets following the deceased spouse's death.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

A disclaimer is when the recipient (called the ?donee?) refuses a bequest, for example, the donee refuses an inheritance left in a will or trust, refuses the proceeds from an account labeled as pay-on-death account when the original owner dies, or refuses the surviving interest in jointly owned property when one joint