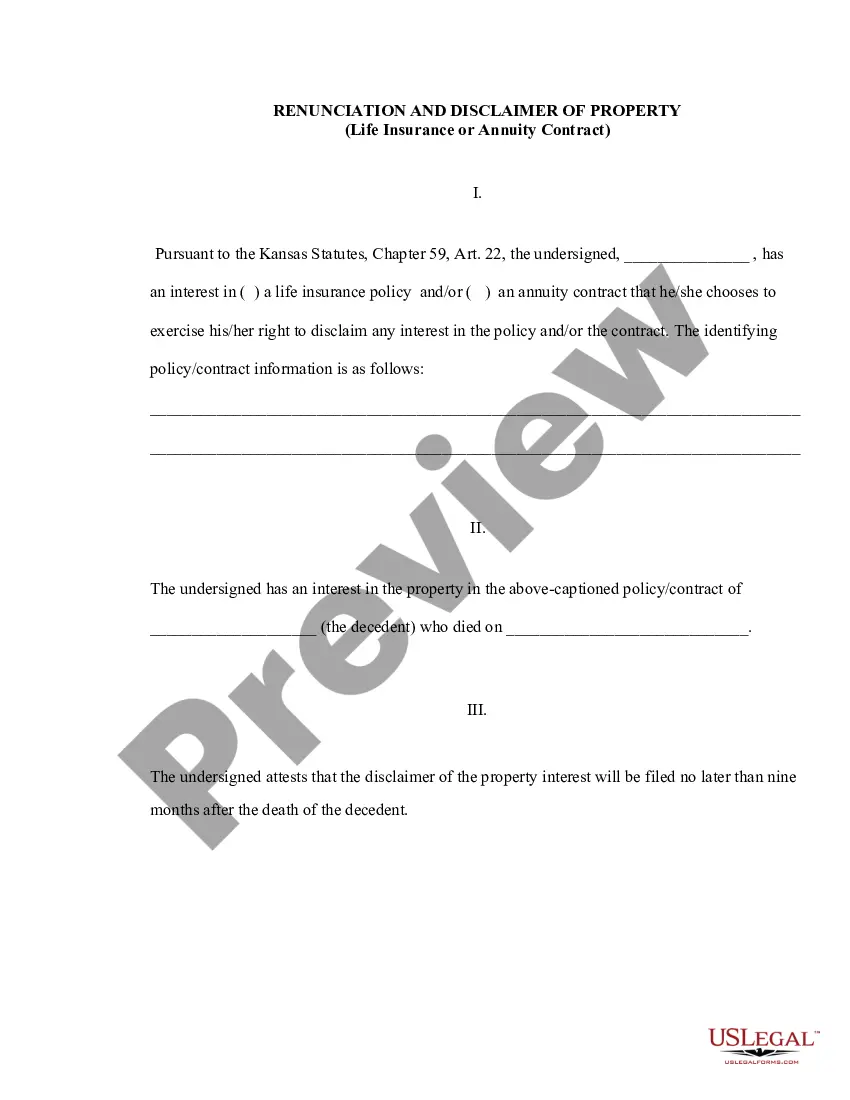

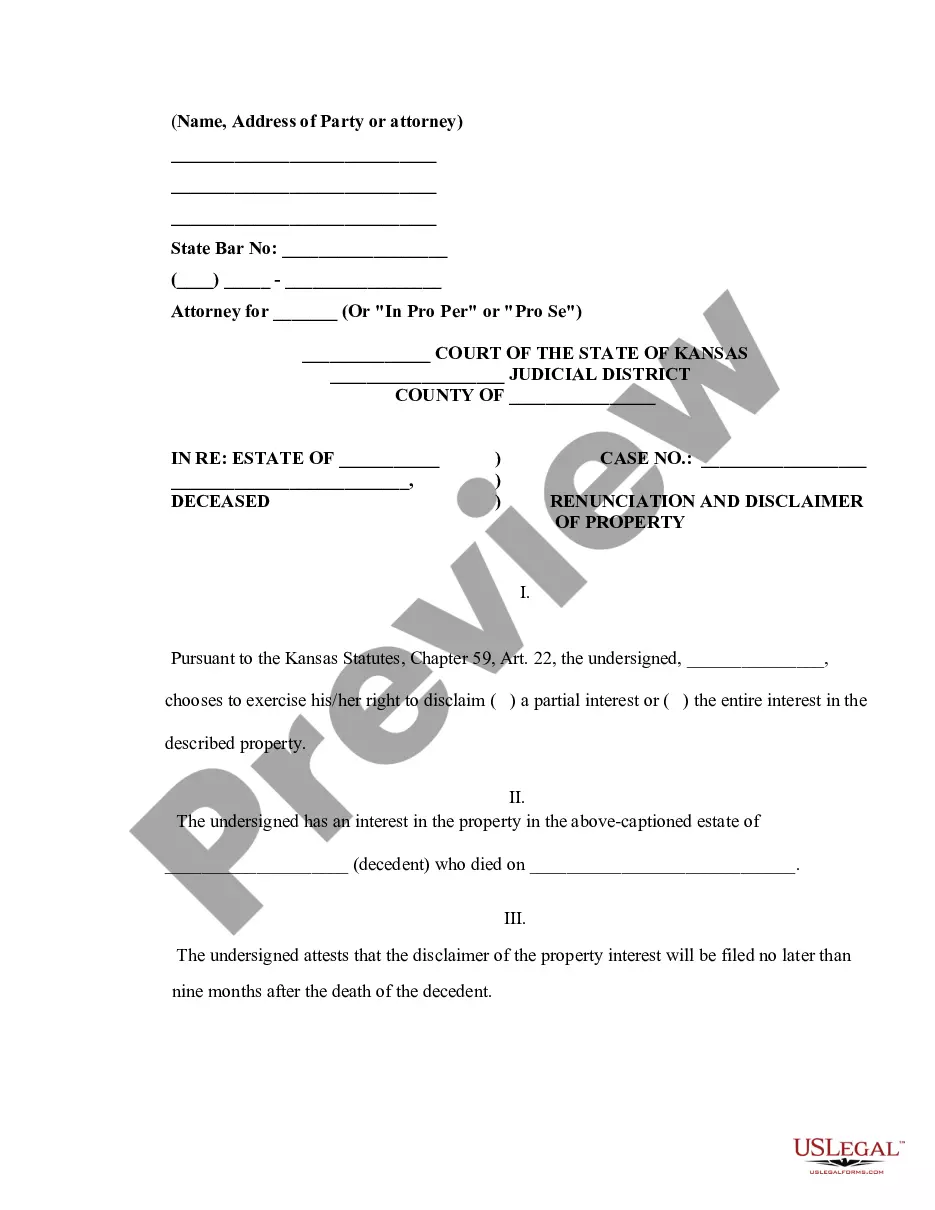

Wichita Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

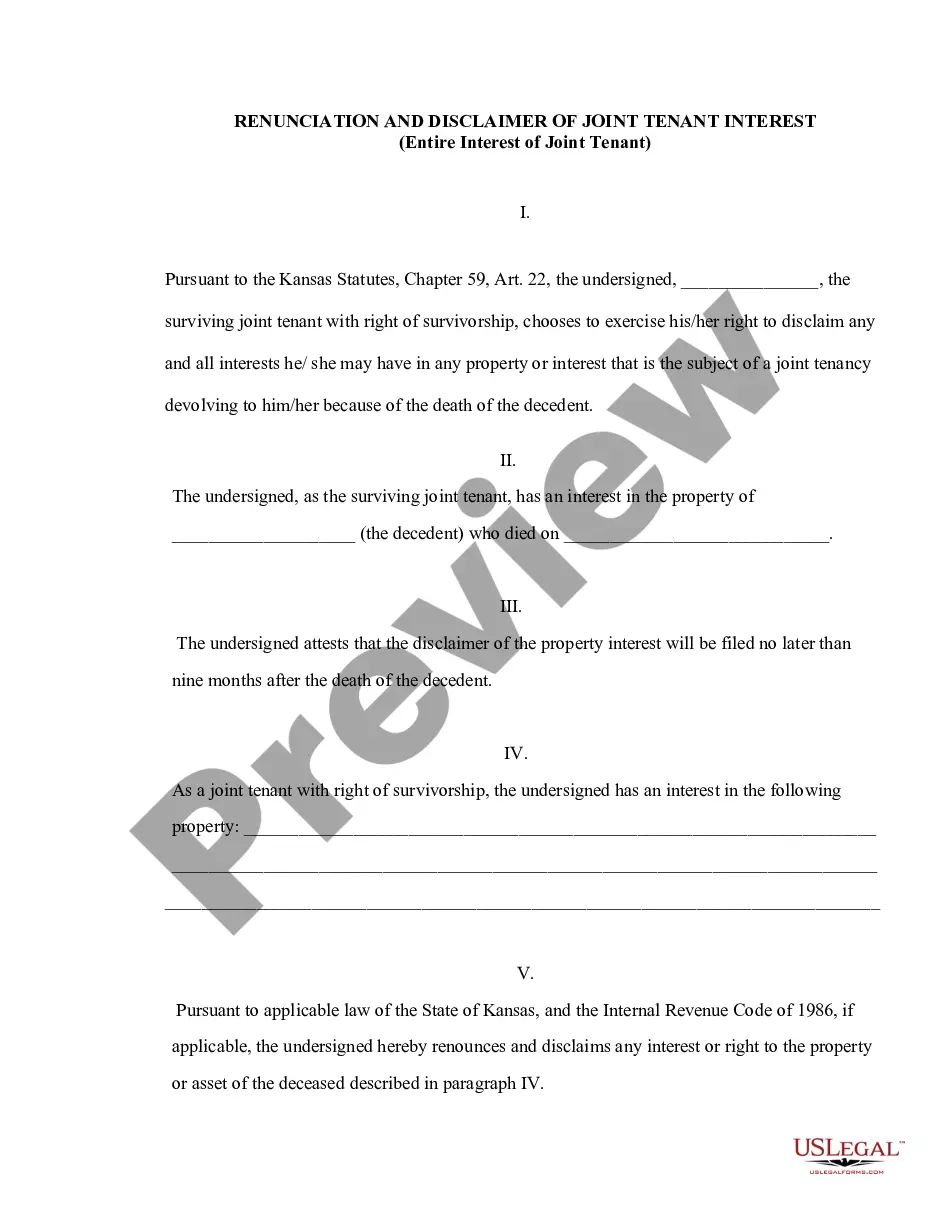

How to fill out Kansas Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Finding authenticated templates tailored to your local regulations can be difficult unless you utilize the US Legal Forms library.

It’s an online database of over 85,000 legal documents for both personal and professional requirements as well as any real-world scenarios.

All the records are correctly classified by area of use and jurisdiction, making it simple and quick to locate the Wichita Kansas Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

Keeping your documentation organized and compliant with legal standards is of utmost importance. Take advantage of the US Legal Forms library to always have crucial document templates readily available for any requirement!

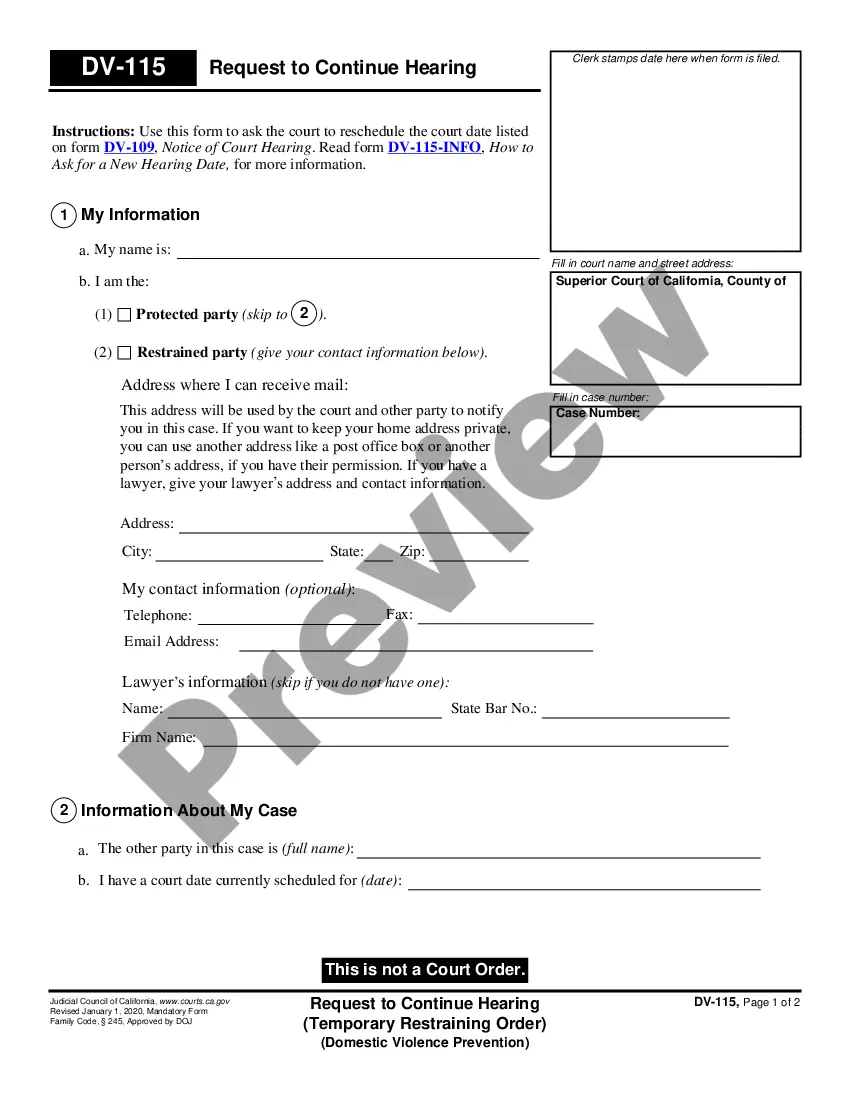

- Familiarize yourself with the Preview mode and document description.

- Ensure you’ve chosen the correct one that fulfills your specifications and complies fully with your local jurisdictional requirements.

- Look for another template, if necessary.

- If you encounter any discrepancy, use the Search tab above to locate the appropriate one. If it meets your needs, proceed to the next step.

- Purchase the document.

Form popularity

FAQ

A disclaimer is a refusal to accept property. When a beneficiary disclaims an annuity or qualified account, the death benefit will be paid to any surviving beneficiary(ies). If there is no remaining beneficiary, the property goes to the deceased's estate.

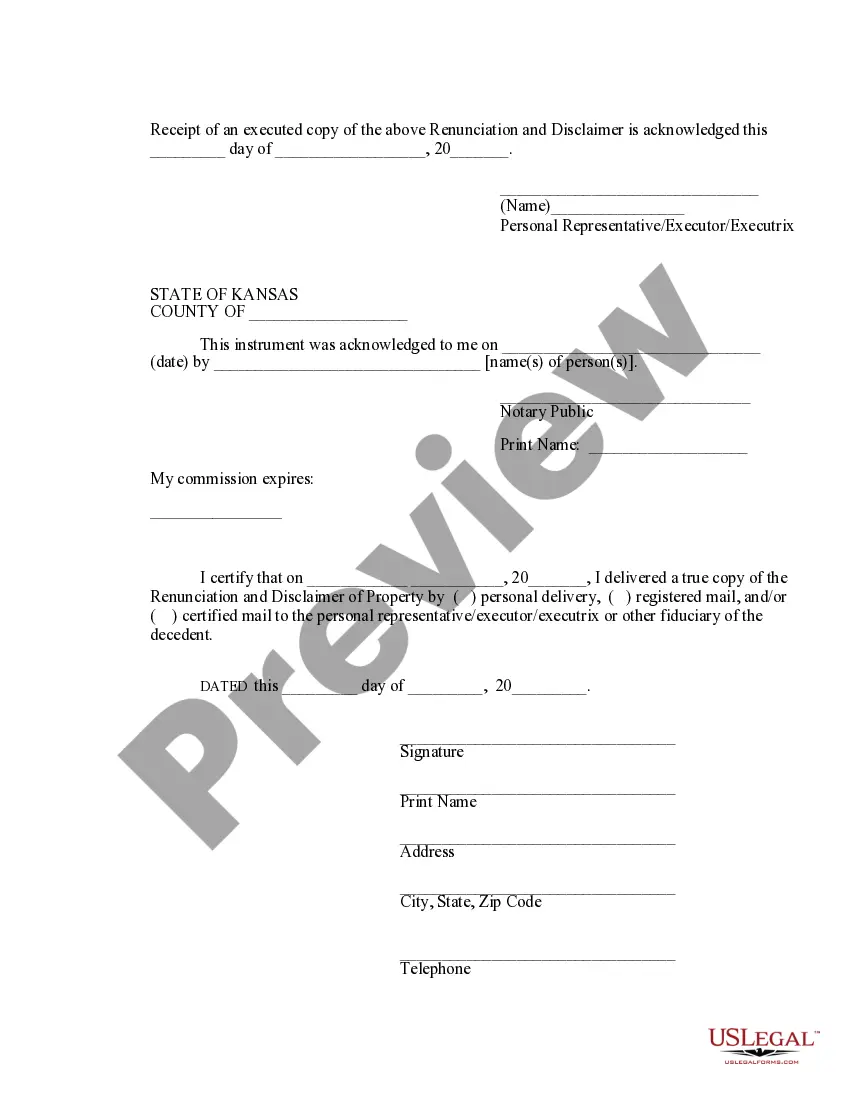

Generally, a disclaimer of this interest must be: (1) made within a reasonable time after knowledge of the existence of the transfer creating the interest to be disclaimed; (2) unequivocal; (3) effective under local law; and (4) made before the disclaimant has accepted the property (Treasury Regulations Section 25.2511

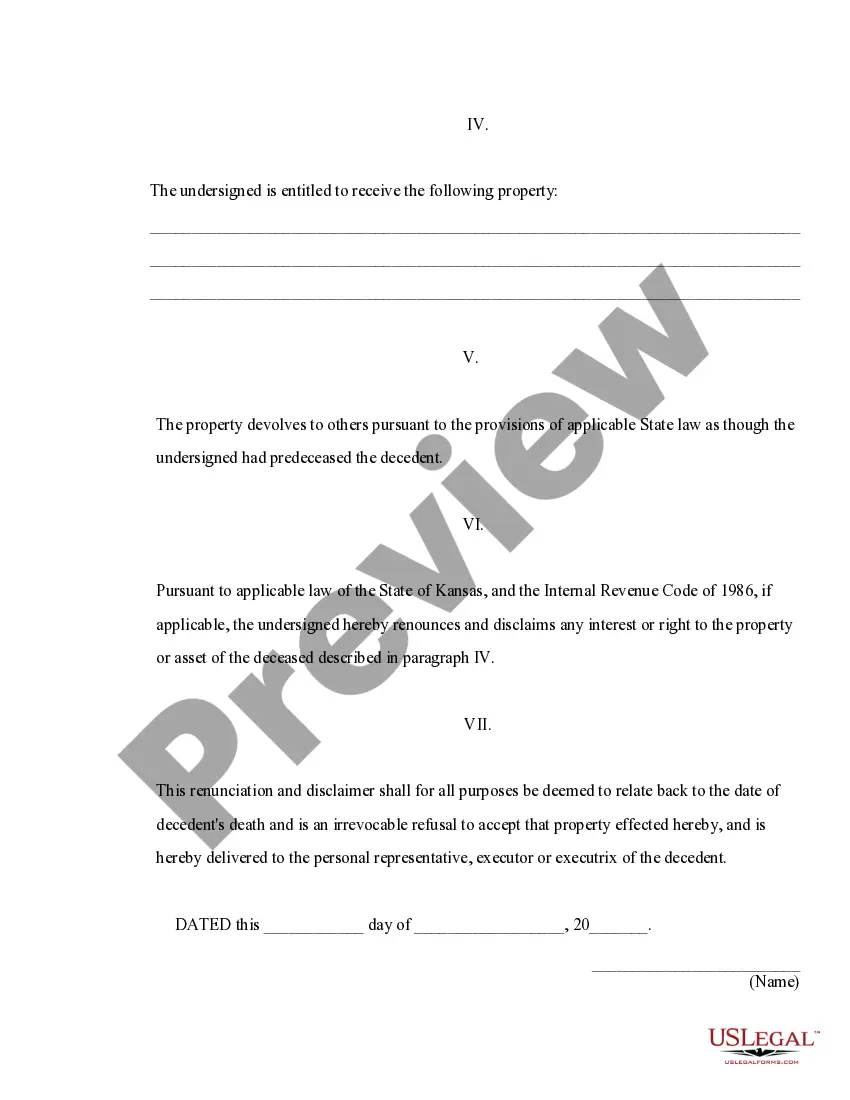

Key Takeaways. Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

How to Make a Disclaimer Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate?usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.Do not accept any benefit from the property you're disclaiming.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

Option #1: ?Disclaim? the inherited retirement account By disclaiming the asset, you can potentially pass these assets on to someone in a lower tax bracket. To disclaim, you need to make this choice within nine months of the original owner's death and before taking possession of any assets.

If a surviving spouse receives a distribution from his or her deceased spouse's IRA, it can be rolled over into an IRA of the surviving spouse within the 60-day time limit, as long as the distribution is not a required distribution, even if the surviving spouse is not the sole beneficiary of his or her deceased

If an annuity contract has a death-benefit provision, the owner can designate a beneficiary to inherit the remaining annuity payments after death. The earnings on an inherited annuity are taxable.

In the world of estates and trusts, a disclaimer is a refusal to accept a gift or a bequest. It may sound strange to refuse a gift but a disclaimer is a useful tool for tax, asset protection and estate planning.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.