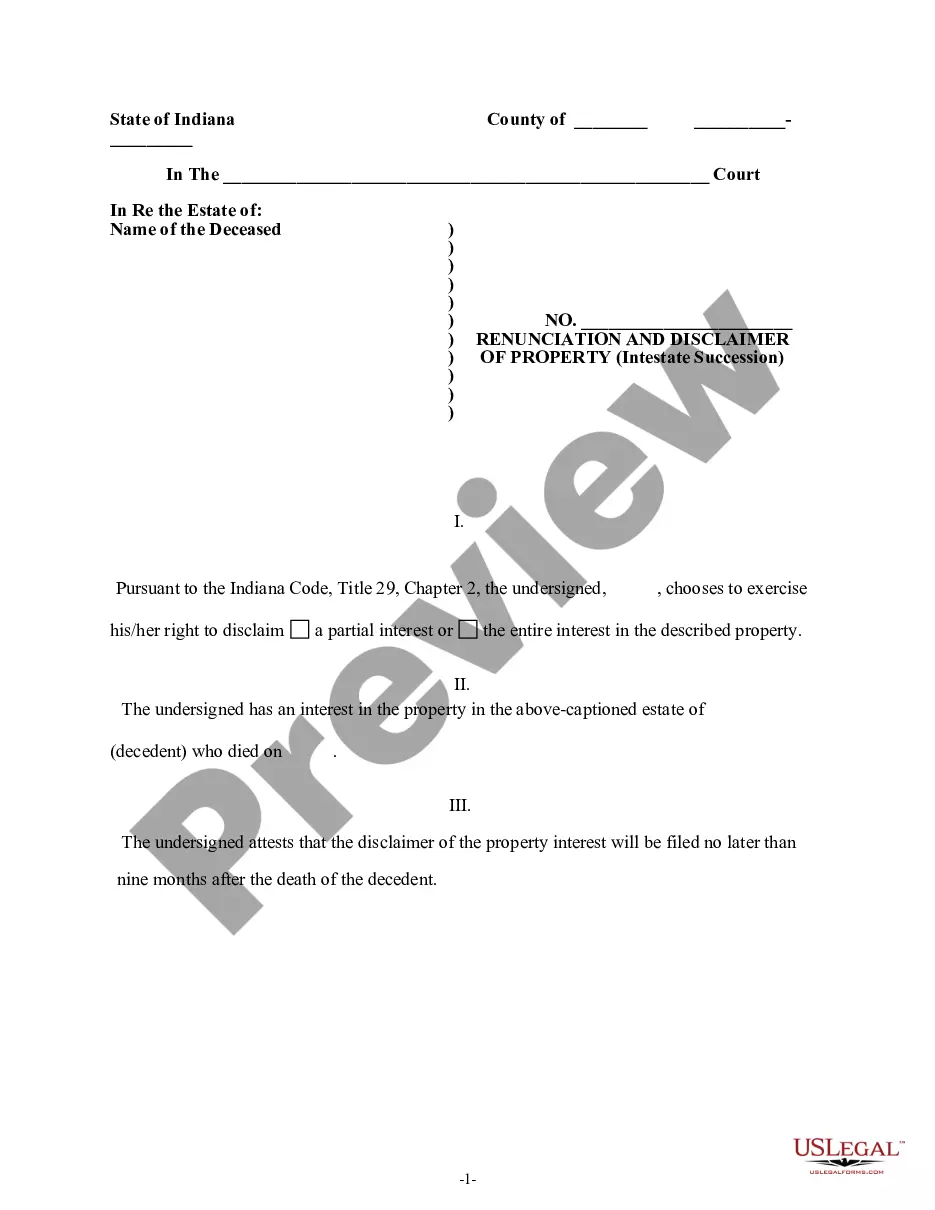

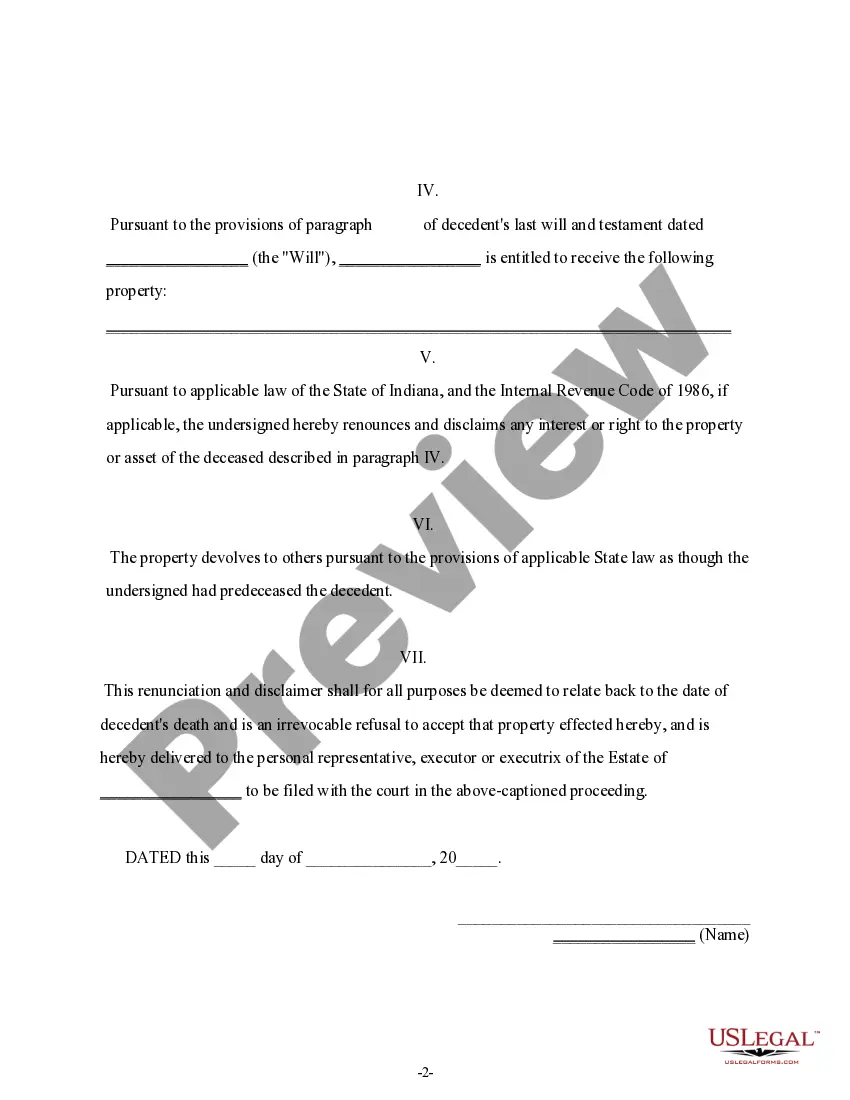

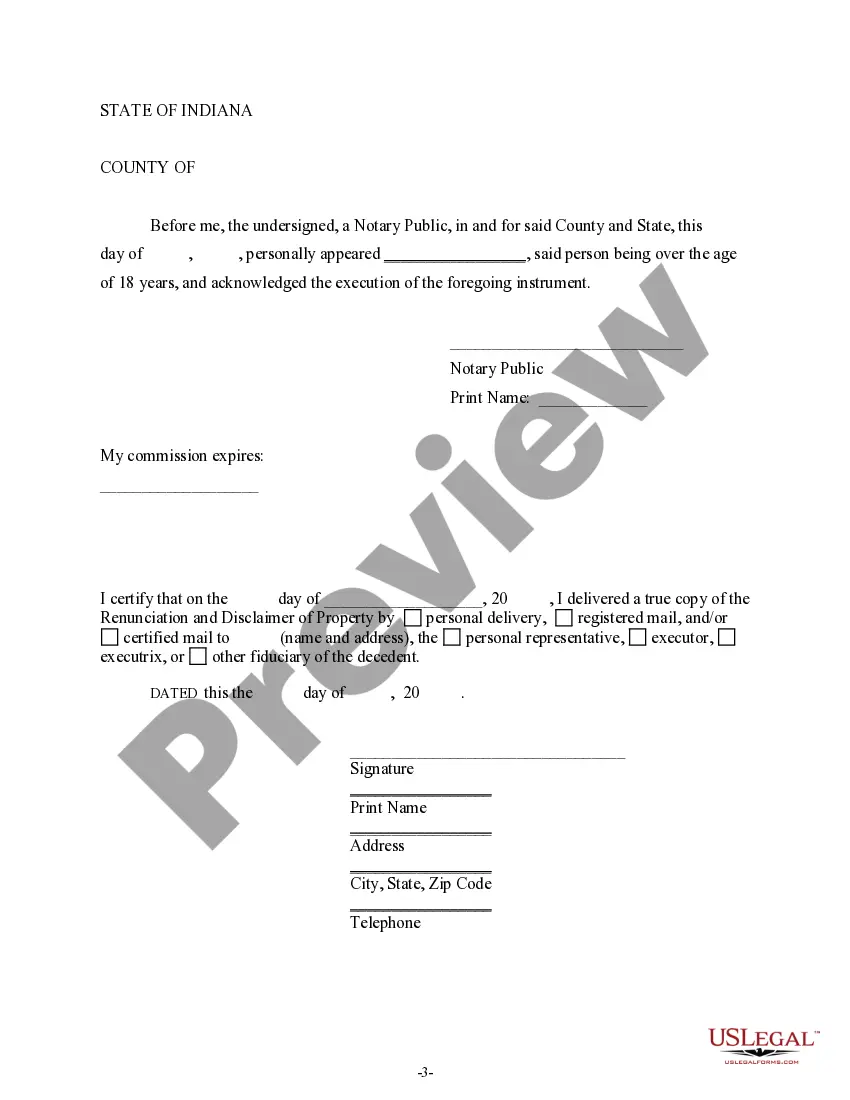

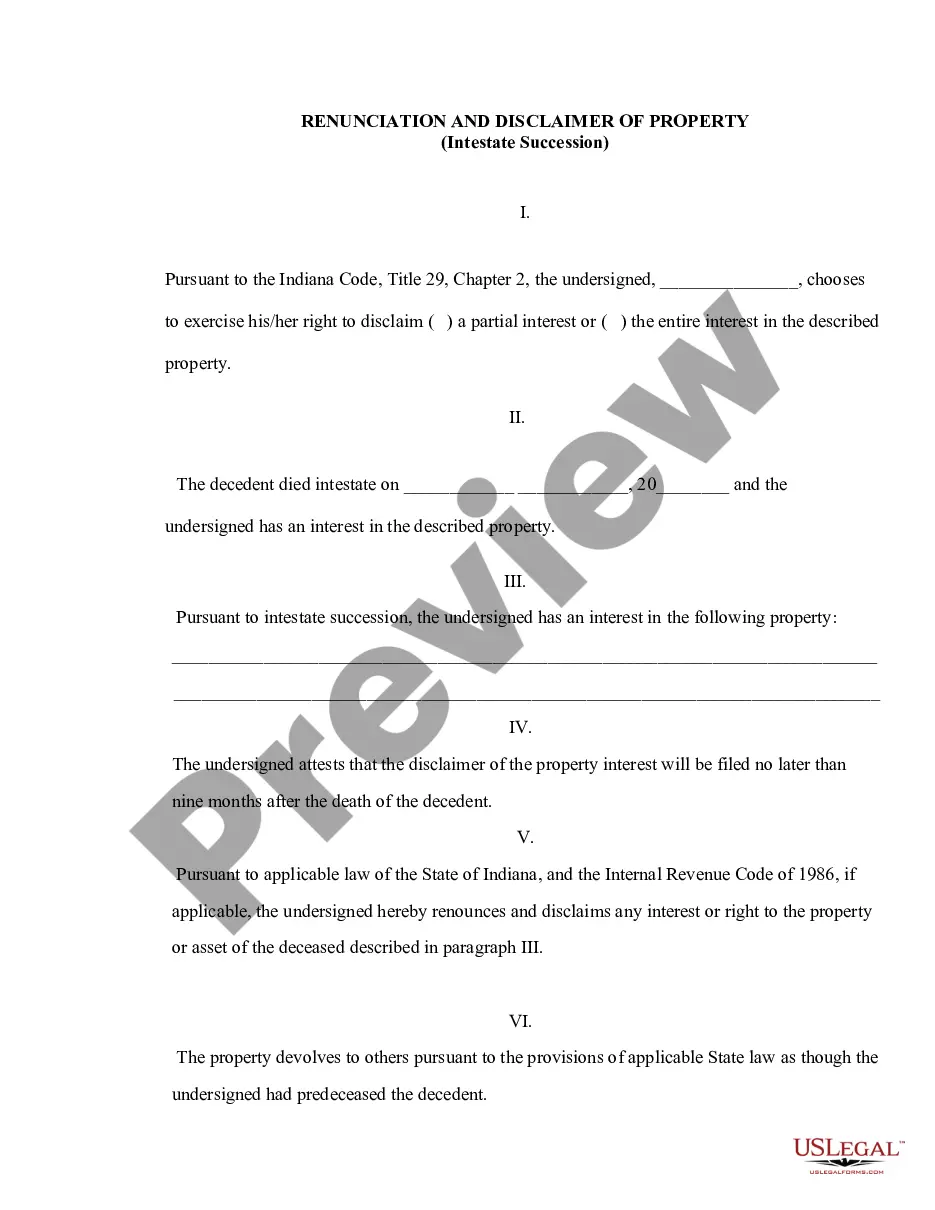

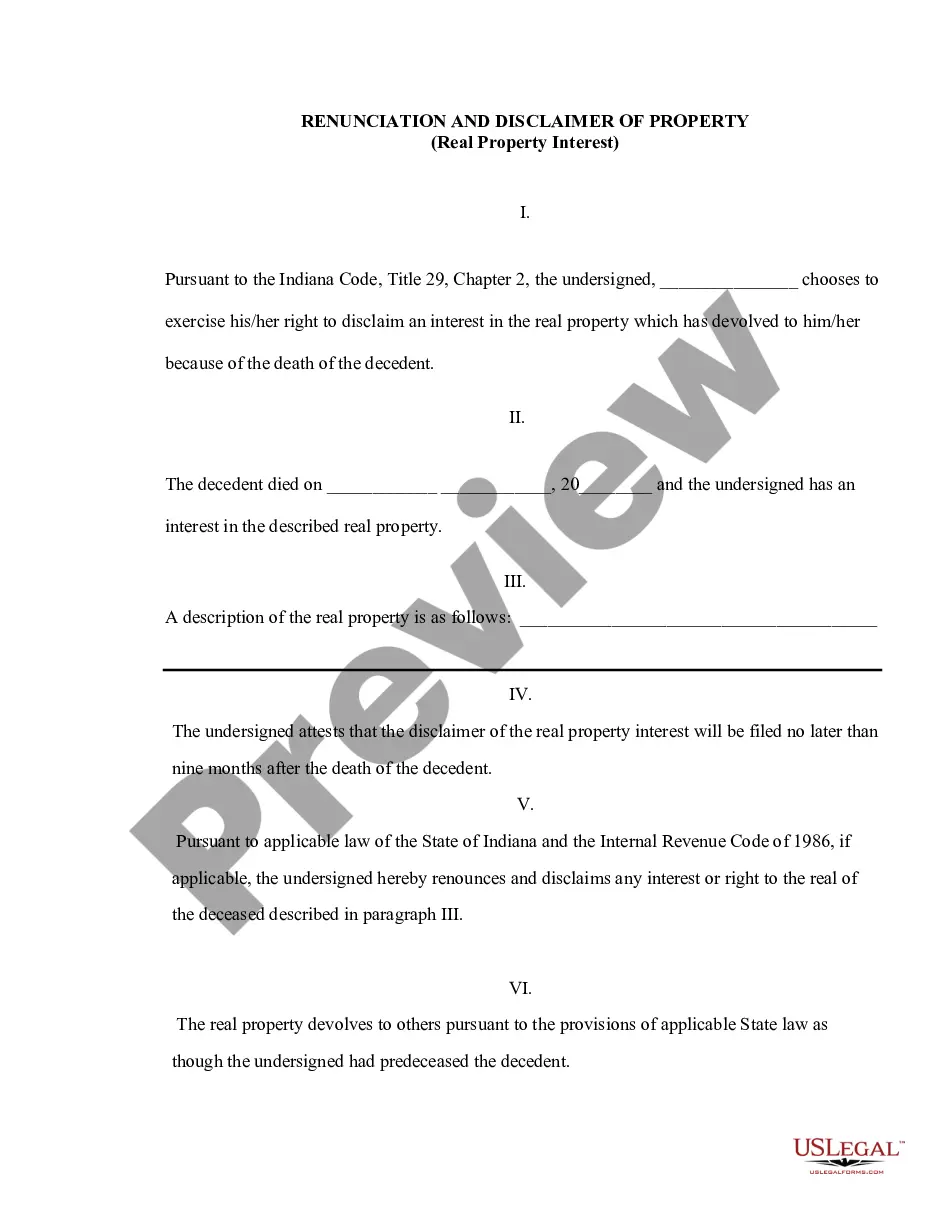

This form is a Renunciation and Disclaimer of Property acquired by intestate succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the property. However, according to the Indiana Code, Title 29, Chapter 2, the beneficiary wishes to disclaim a portion of, or the entire interest in the property. The beneficiary attests that the disclaimer will be filed no later than nine months after the death of the decedent. The form also contains an acknowledgment and a certificate to verify delivery.

South Bend Indiana Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Indiana Renunciation And Disclaimer Of Property Received By Intestate Succession?

Locating authenticated templates tailored to your regional regulations can be challenging unless you utilize the US Legal Forms library.

It is an online repository of over 85,000 legal documents catering to both individual and commercial needs and various real-world situations.

All papers are accurately categorized by field of application and jurisdiction, making it as straightforward as pie to search for the South Bend Indiana Renunciation and Disclaimer of Property acquired through Intestate Succession.

Acquire the document. Hit the Buy Now button and choose your preferred subscription plan. You will need to create an account to gain access to the library's offerings.

- For individuals already familiar with our collection and who have utilized it previously, securing the South Bend Indiana Renunciation and Disclaimer of Property obtained via Intestate Succession requires merely a few clicks.

- Simply Log In to your account, select the document, and hit Download to store it on your device.

- This procedure will involve just a few more steps for new users.

- Examine the Preview mode and form description. Ensure that you have selected the appropriate one that fulfills your needs and aligns with your local jurisdiction criteria.

- Search for an alternative template, if necessary. If you encounter any discrepancies, employ the Search tab above to find the correct one. If it meets your requirements, advance to the subsequent step.

Form popularity

FAQ

If you need to transfer heir property to your name without a will, you must navigate the intestate process in Indiana. This often involves determining your eligibility as an heir under state laws and filing necessary court documents. Furthermore, if you do not wish to keep the property, you might utilize the South Bend Indiana Renunciation and Disclaimer of Property received by Intestate Succession. This option allows you to renounce your claim and facilitate a smoother transition of property ownership.

When someone dies intestate in Indiana, their property is distributed according to state intestacy laws. Typically, the deceased's assets go to their closest relatives, such as spouses or children. If you've received such property and prefer not to accept it, you may consider the South Bend Indiana Renunciation and Disclaimer of Property received by Intestate Succession. This legal tool provides a means to pass the property to other family members.

Not all estates in Indiana must go through probate, but many do. Small estates, typically valued under a specific limit set by state law, might qualify for a simplified process. However, if you receive property through intestate succession and wish to disclaim it, understanding the South Bend Indiana Renunciation and Disclaimer of Property received by Intestate Succession is essential. This can facilitate your decision on how to manage the estate effectively.

Transferring property after death in Indiana usually involves the probate process. The executor of the estate files a petition in court to begin the probate proceedings, ensuring all debts are settled before distributing assets to beneficiaries. For those considering renouncing property, the South Bend Indiana Renunciation and Disclaimer of Property received by Intestate Succession can simplify this process. Utilizing the right forms can help you handle your inheritance smoothly.

When a homeowner dies intestate in Indiana, the property typically passes to their heirs according to state laws of intestate succession. This means the estate will be distributed in a predetermined manner, often to the surviving spouse or children. In South Bend, Indiana, if you receive property through this process but wish to renounce it, you can explore a South Bend Indiana Renunciation and Disclaimer of Property received by Intestate Succession. This action can allow you to decline the inheritance in favor of other heirs.

In South Bend, Indiana, the time limit for disclaiming an inheritance is generally nine months from the date of the decedent's death. If you wish to protect your interests and avoid potential tax implications, it is imperative to act quickly. By utilizing the South Bend Indiana Renunciation and Disclaimer of Property received by Intestate Succession form within this timeframe, you can effectively decline the property. Always consider consulting with a legal professional to ensure proper compliance and understanding.

To disclaim an inheritance in the context of the IRS, you must formally express your wish to refuse it. You should complete a South Bend Indiana Renunciation and Disclaimer of Property received by Intestate Succession form and submit it in writing. This document clearly states your intention to decline the inheritance. Additionally, it is essential to notify the estate administrator and any involved parties to ensure a smooth process.

An example of an estate disclaimer might involve a beneficiary renouncing their right to inherit a family home due to ongoing maintenance costs. The disclaimer would include their personal information, the deceased's name, and a statement indicating their refusal of any claim to the property received through intestate succession. This decision should be made with careful consideration, and utilizing uslegalforms can help streamline the process. Demonstrating clarity in your intentions helps in managing estate matters efficiently.

To write an inheritance disclaimer letter, start by addressing the appropriate parties, such as the executor of the will. Clearly state your intention to disclaim the inheritance, providing relevant details about the estate and the property in question. Keep the language straightforward, and consider using resources from uslegalforms to create a compliant disclaimer letter. This ensures that your intention is clearly communicated and legally recognized.

In South Bend Indiana, the rules for disclaiming inheritance involve specific procedures you must follow, such as acting within a certain time frame after the inheritance is accepted. Generally, disclaimers should be in writing and should clearly state your intention to renounce the inheritance. It’s essential to familiarize yourself with these regulations to avoid forfeiting your rights unintentionally. Consulting with a legal advisor can provide tailored guidance.