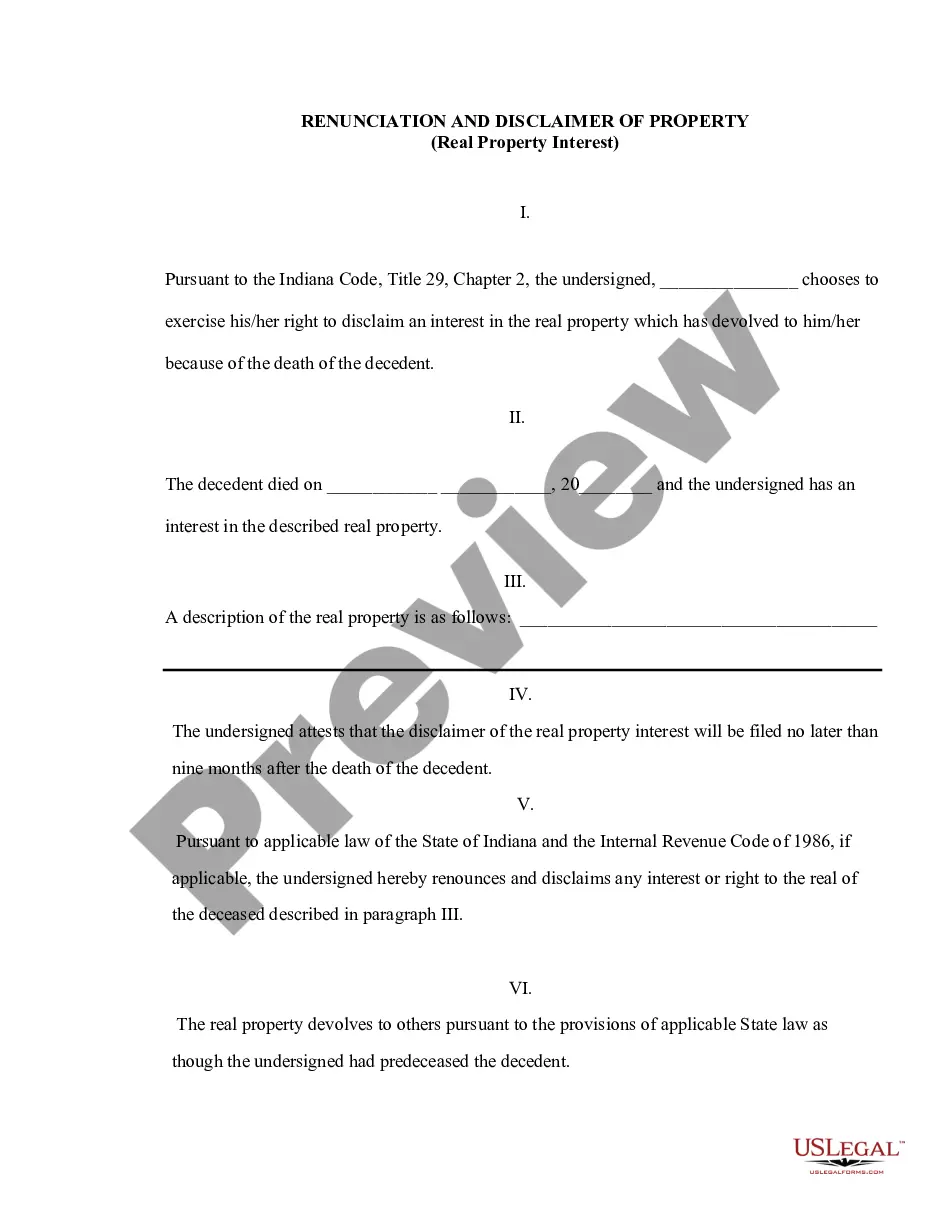

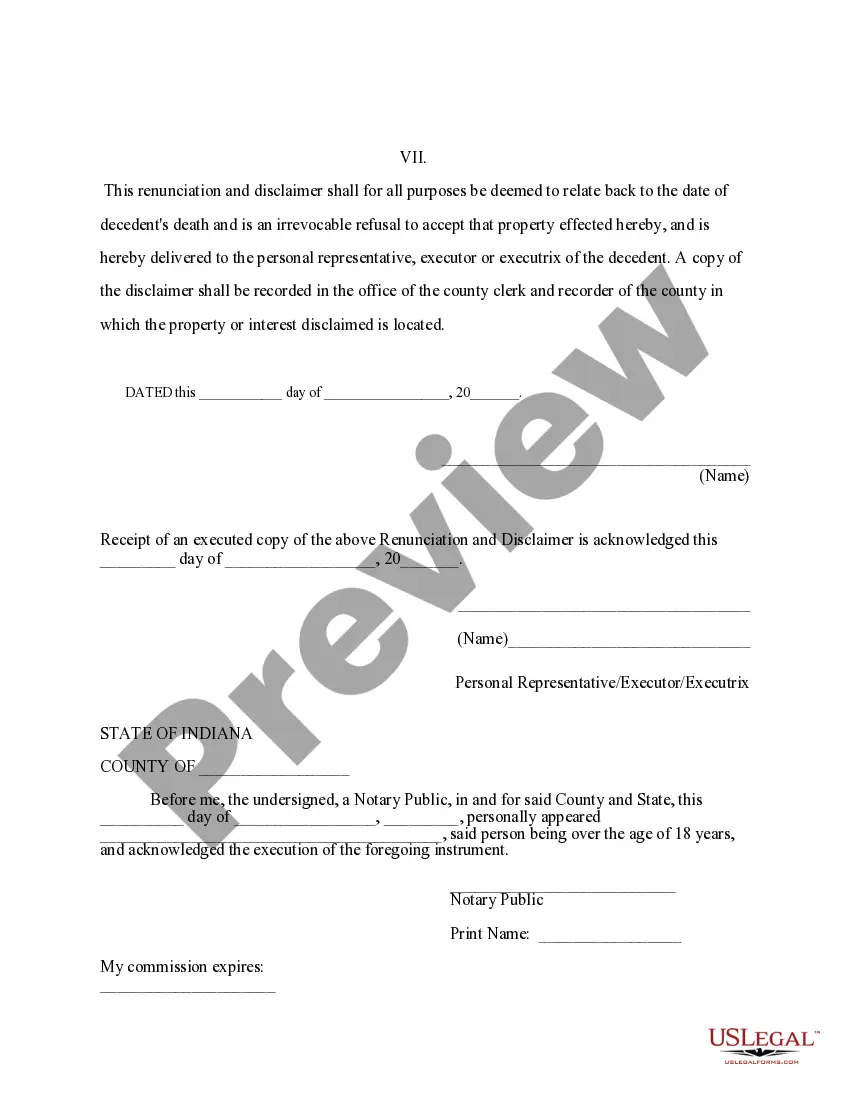

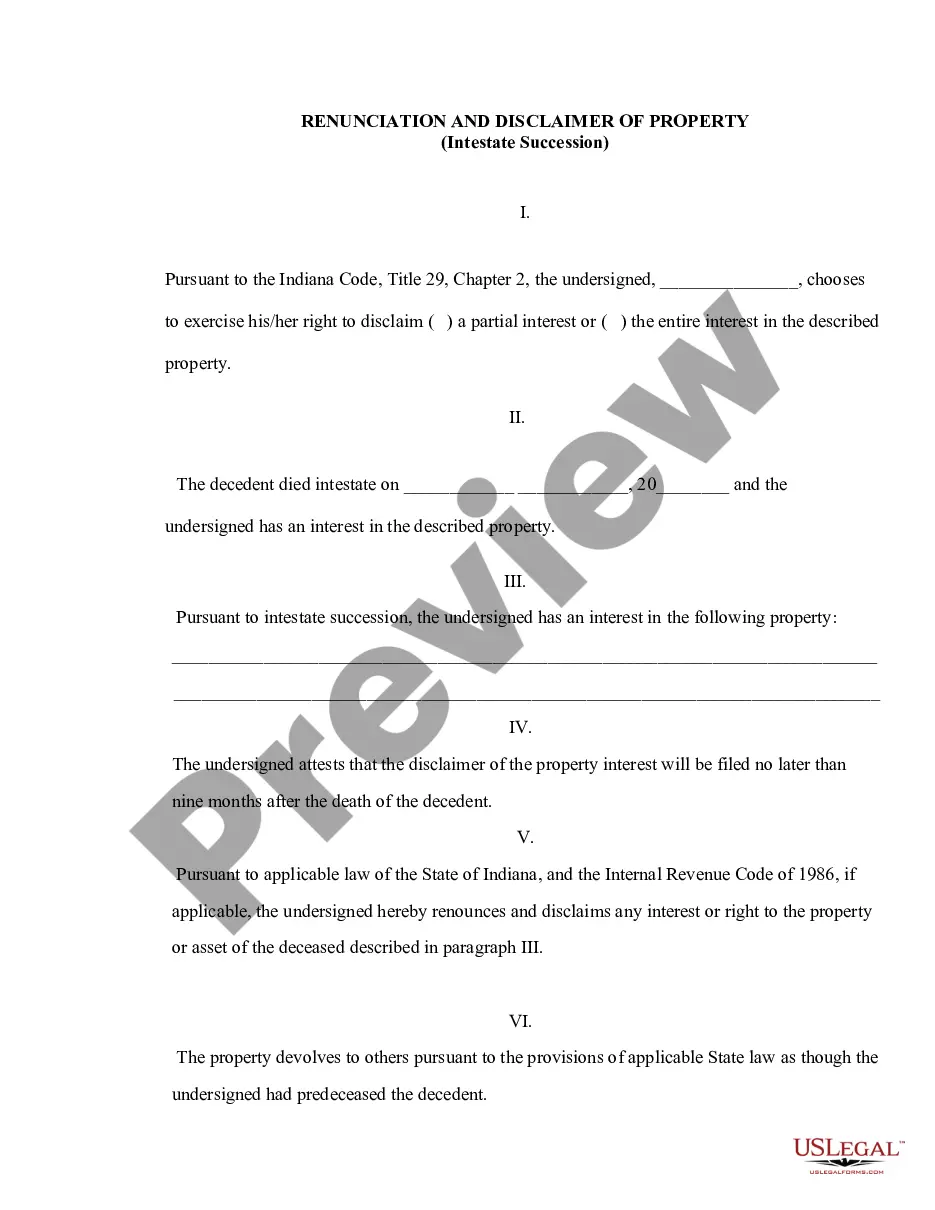

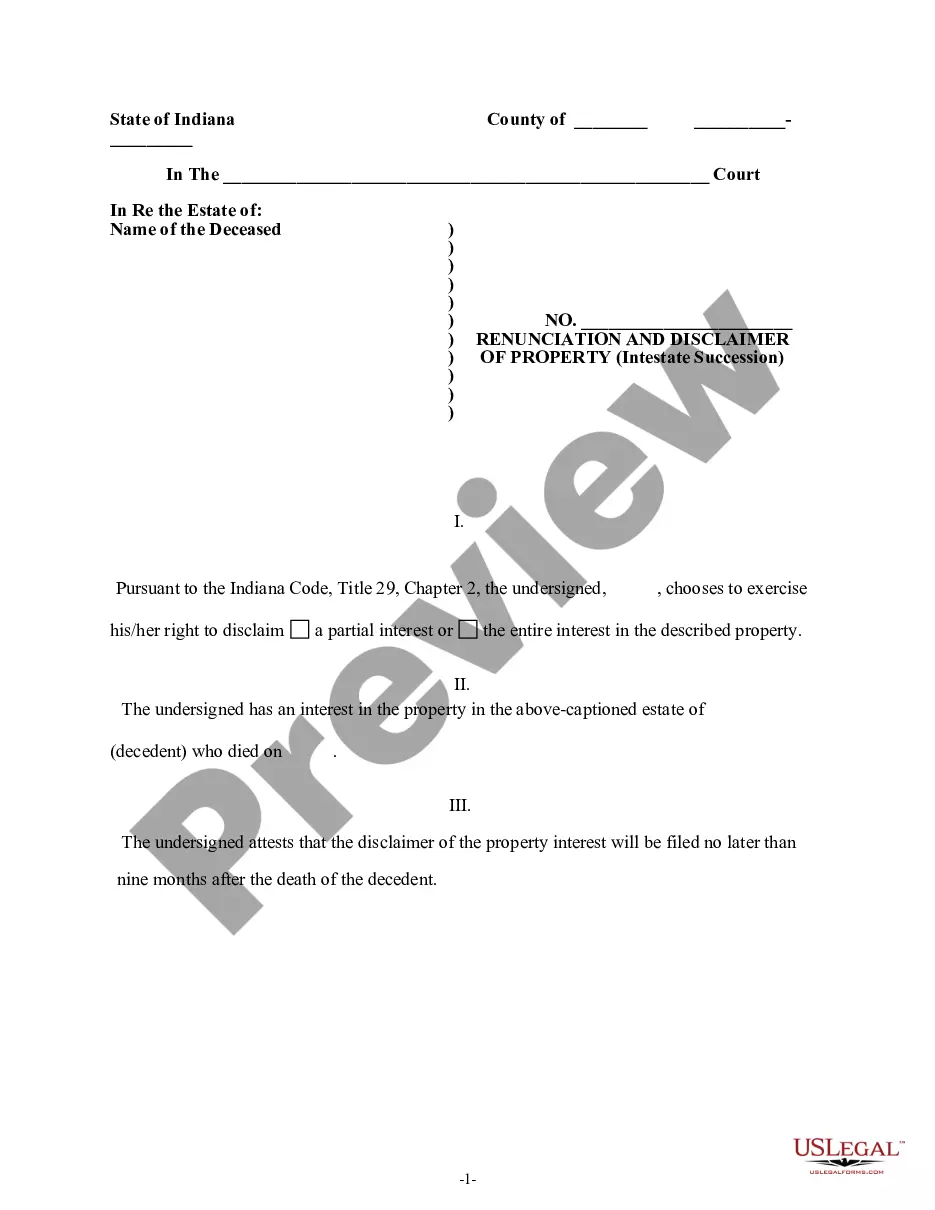

This form is a Renunciation and Disclaimer of a Real Property Interest held by the beneficiary. The beneficiary gained an interest in the described real property upon the death of the decedent. However, according to the Indiana Code, Title 29, Chapter 2, the beneficiary has decided to disclaim his/her interest in the real property. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Indianapolis Indiana Renunciation and Disclaimer of Real Property Interest

Description

How to fill out Indiana Renunciation And Disclaimer Of Real Property Interest?

If you have previously used our service, Log In to your account and download the Indianapolis Indiana Renunciation and Disclaimer of Real Property Interest onto your device by selecting the Download button. Ensure that your subscription is active. If not, renew it based on your payment schedule.

If this is your initial time using our service, follow these straightforward steps to acquire your document.

You have continuous access to every document you have purchased: you can find it in your profile under the My documents section whenever you wish to reuse it. Leverage the US Legal Forms service to efficiently discover and save any template for your personal or professional requirements!

- Ensure you have located the correct document. Review the description and use the Preview feature, if available, to verify if it aligns with your requirements. If it doesn’t fit your needs, utilize the Search tab above to find the suitable one.

- Buy the template. Select the Buy Now button and choose a monthly or yearly subscription plan.

- Establish an account and process a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Receive your Indianapolis Indiana Renunciation and Disclaimer of Real Property Interest. Choose the file format for your document and save it onto your device.

- Finish your document. Print it or utilize professional online editors to complete and electronically sign it.

Form popularity

FAQ

There is no prescribed form for drafting or implementing a disclaimer of inheritance. Generally, the waiver should be a written agreement, acknowledging the waiver of inheritance (preferably drafted by a lawyer). The disclaiming agreement should be signed by the beneficiary, and witnessed.

A person must occupy a property for at least ten years in Indiana to make an adverse possession claim. During this period, the person must also prove additional continuous actions that meet the other conditions necessary for an adverse possession claim. Exclusive and continuous possession is necessary to show control.

A disclaimer trust is an estate planning technique in which a married couple incorporates an irrevocable trust in their planning, which is funded only if the surviving spouse chooses to ?disclaim,? or refuse to accept, the outright distribution of certain assets following the deceased spouse's death.

In the context of a contract, a renunciation occurs when one party, by words or conduct, evinces an intention not to perform, or expressly declares that they will be unable to perform their obligations under the contract in some essential respect. The renunciation may occur before or at the time of performance.

§ 19?1502. (3) ?Disclaimer? means the refusal to accept an interest in or power over property. (4) ?Fiduciary? means a personal representative, trustee, agent acting under a power of attorney, or other person authorized to act as a fiduciary with respect to the property of another person.

If you are asked to sign a Disclaimer Deed proceed with caution. If you are told ?it's not a big deal? -think again! If you're the one signing a Disclaimer Deed to real property here's the deal: You affirmatively state that you have NO interest in the real property and NEVER had an interest in the real property.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

Often, the disclaimer must be delivered to the executor or other appropriate persons within 9 months of the date of transfer of the property. No disclaimer can be made if the heir has accepted an interest in the transfer of the estate assets.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

Indiana Code § 32-21-7-1 provides a party claiming title through adverse possession must demonstrate that he or she paid taxes on the disputed land.