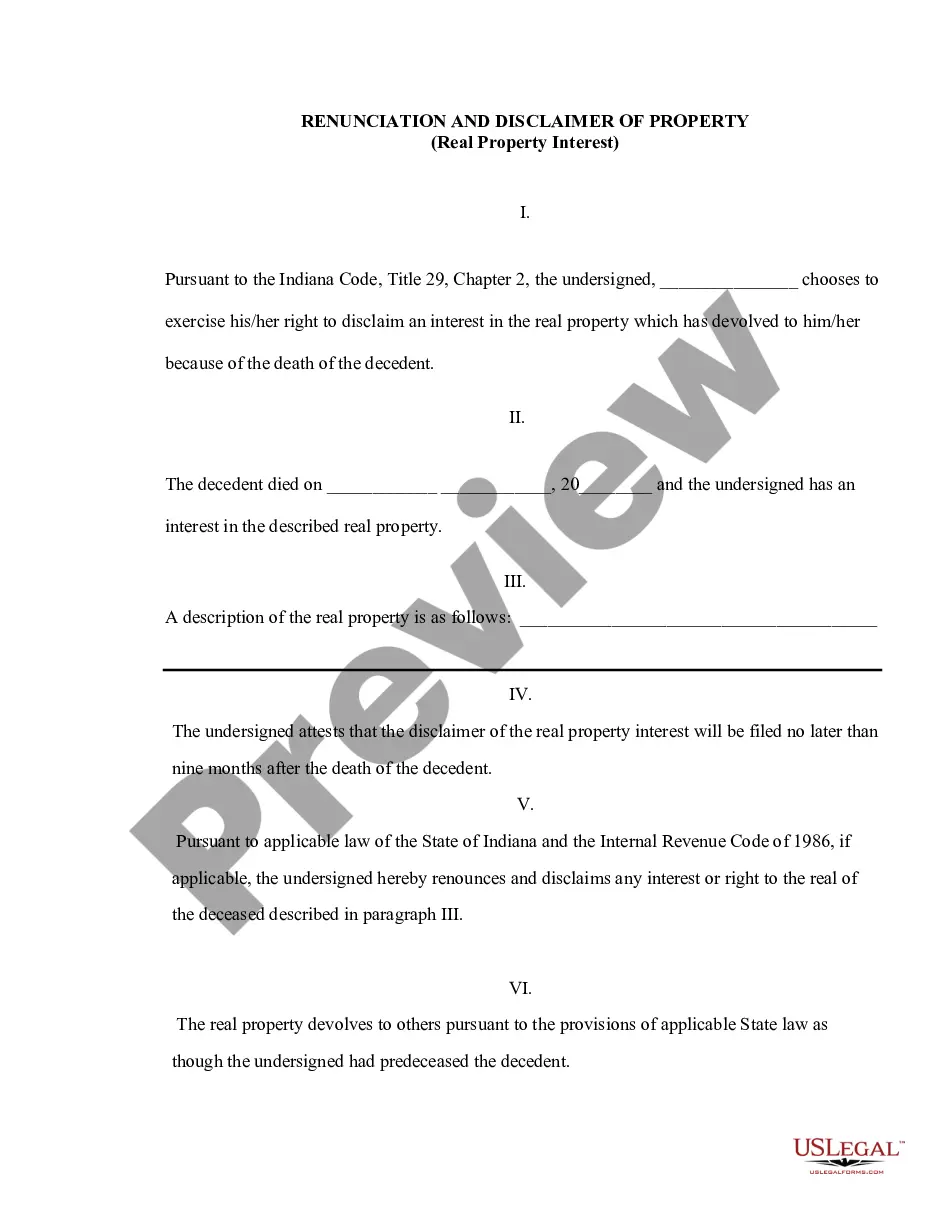

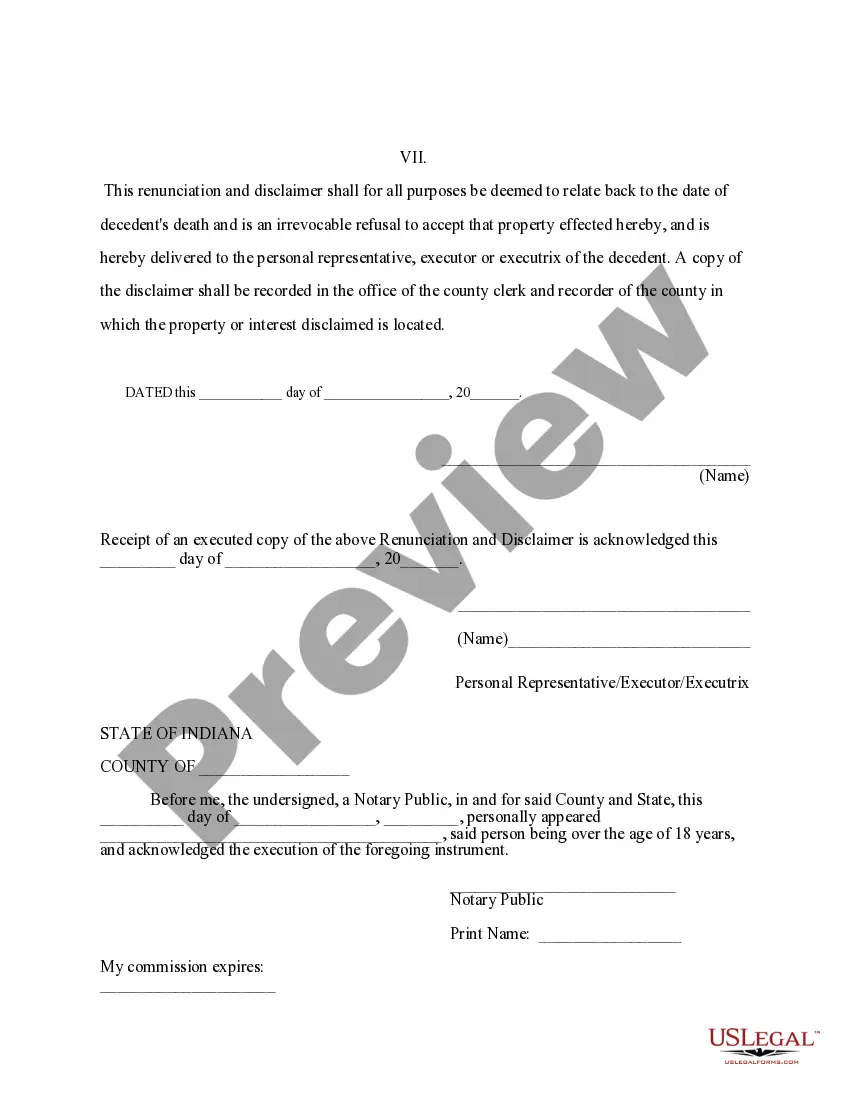

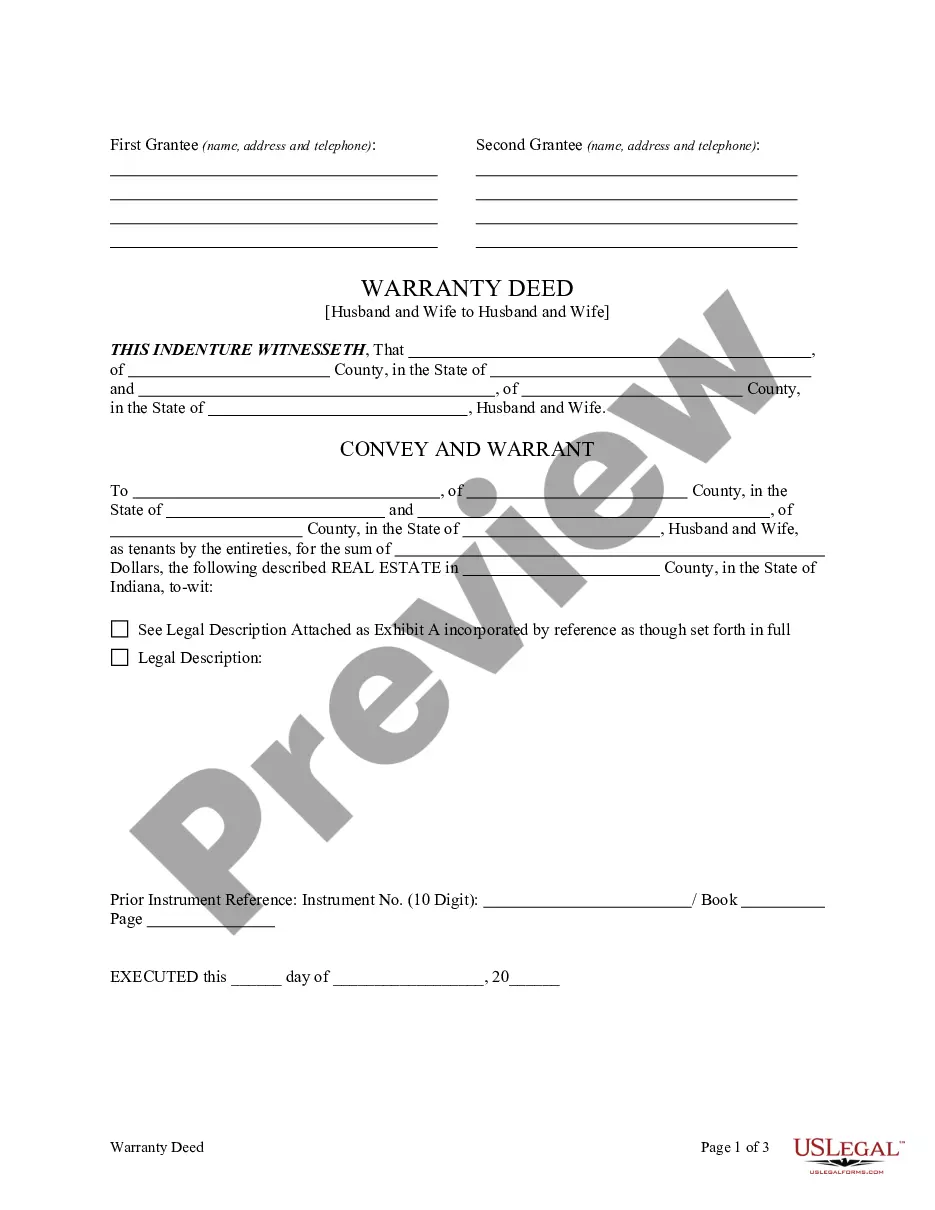

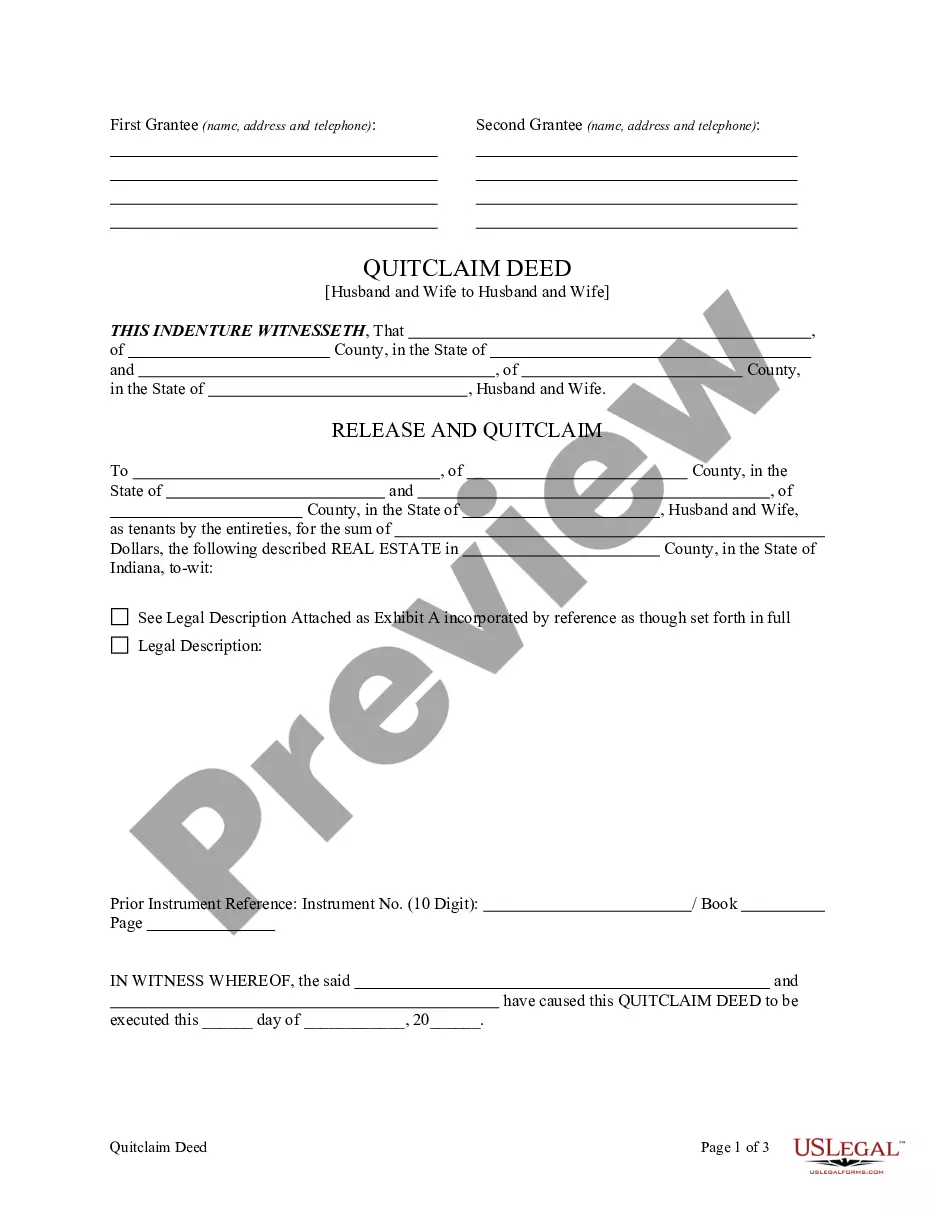

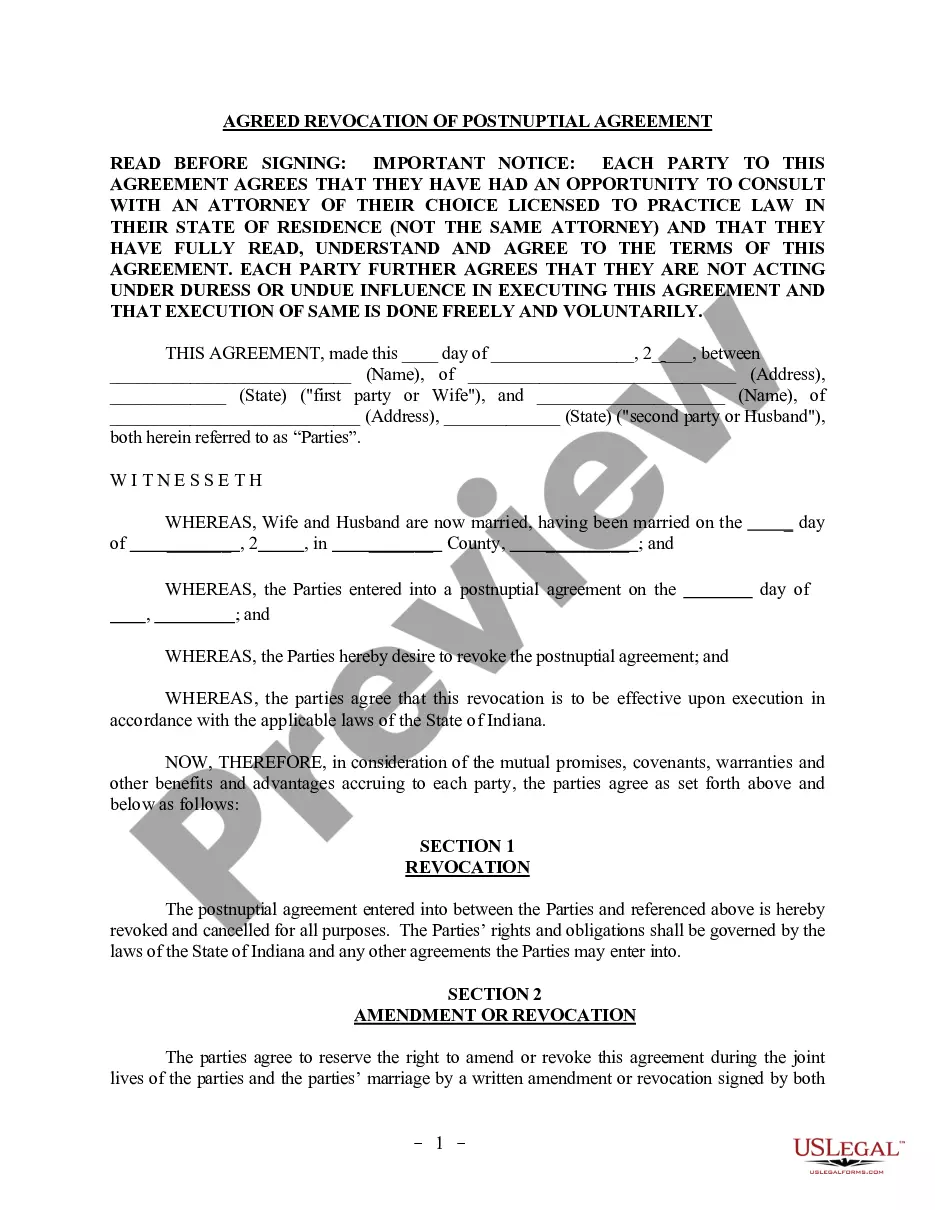

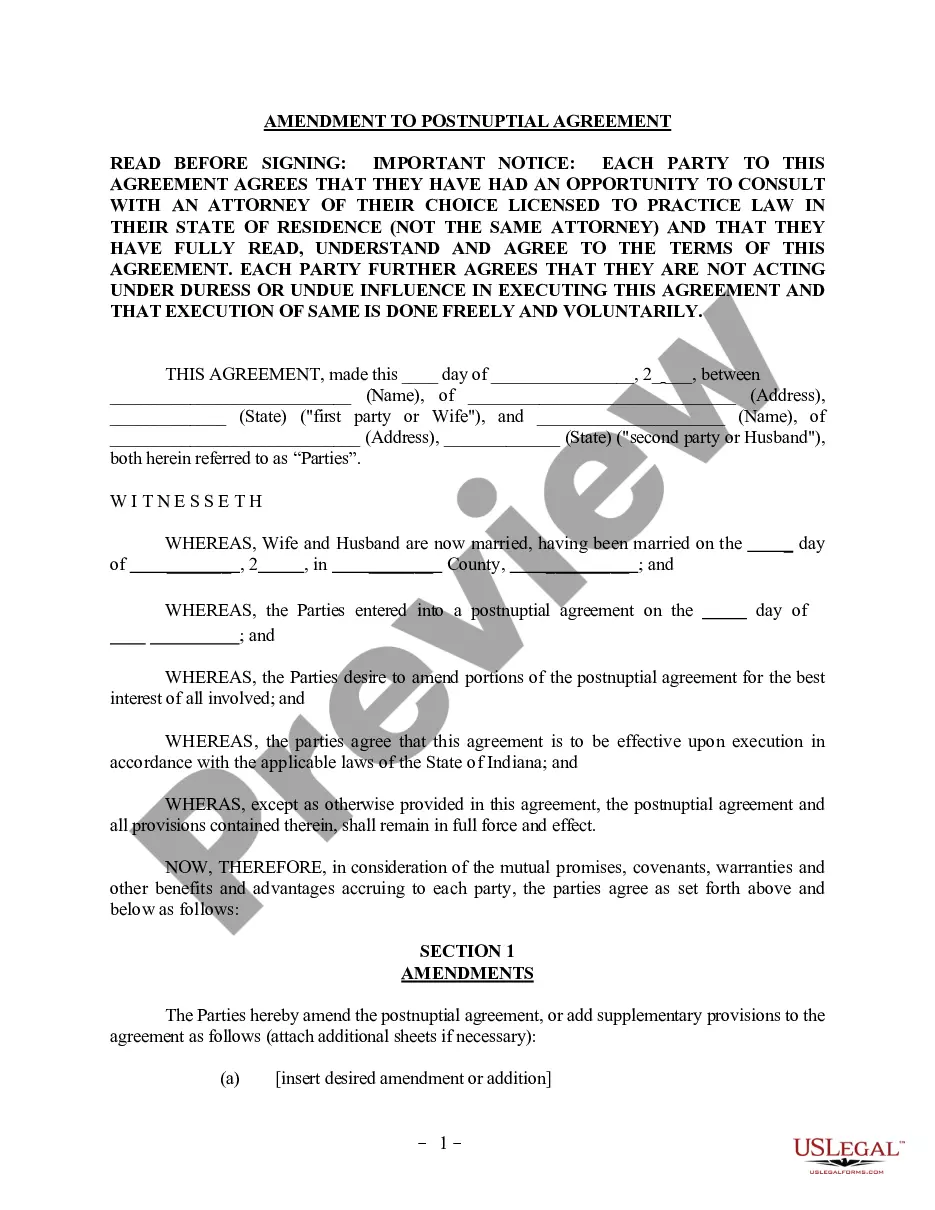

This form is a Renunciation and Disclaimer of a Real Property Interest held by the beneficiary. The beneficiary gained an interest in the described real property upon the death of the decedent. However, according to the Indiana Code, Title 29, Chapter 2, the beneficiary has decided to disclaim his/her interest in the real property. Therefore, the property will devolve to others as though the beneficiary predeceased the decedent. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Indiana Renunciation and Disclaimer of Real Property Interest

Description

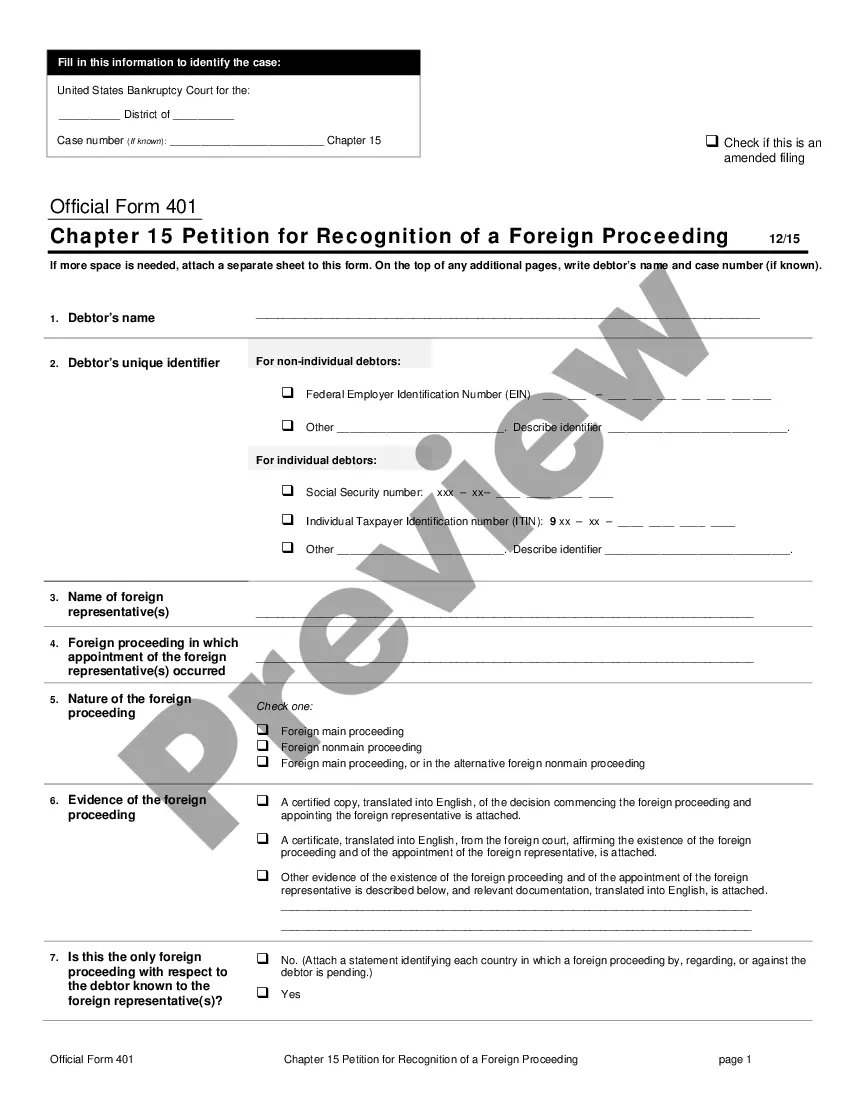

How to fill out Indiana Renunciation And Disclaimer Of Real Property Interest?

Looking for a sample of the Indiana Renunciation and Disclaimer of Real Property Interest and completing it can be rather difficult.

To conserve time, expenses, and effort, utilize US Legal Forms and select the appropriate sample specifically for your state in merely a few clicks.

Our attorneys prepare all documents, so you just need to complete them. It really is that simple.

Select your payment method by card or PayPal. Save the sample in your desired format. Now you can print the Indiana Renunciation and Disclaimer of Real Property Interest form or complete it using any online editor. No worries about typos because your template can be utilized and submitted, and published as frequently as you need. Explore US Legal Forms and gain access to approximately 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the sample.

- Your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you need to sign up.

- Review our detailed instructions on how to obtain the Indiana Renunciation and Disclaimer of Real Property Interest form within minutes.

- To acquire a valid form, verify its applicability for your state.

- View the sample using the Preview option (if available).

- If there’s a description, read it to understand the specifics.

- Click on the Buy Now button if you found what you are looking for.

Form popularity

FAQ

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

In law, a disclaimer is a statement denying responsibility intended to prevent civil liability arising for particular acts or omissions. Disclaimers are frequently made to escape the effects of the torts of negligence and of occupiers' liability towards visitors.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

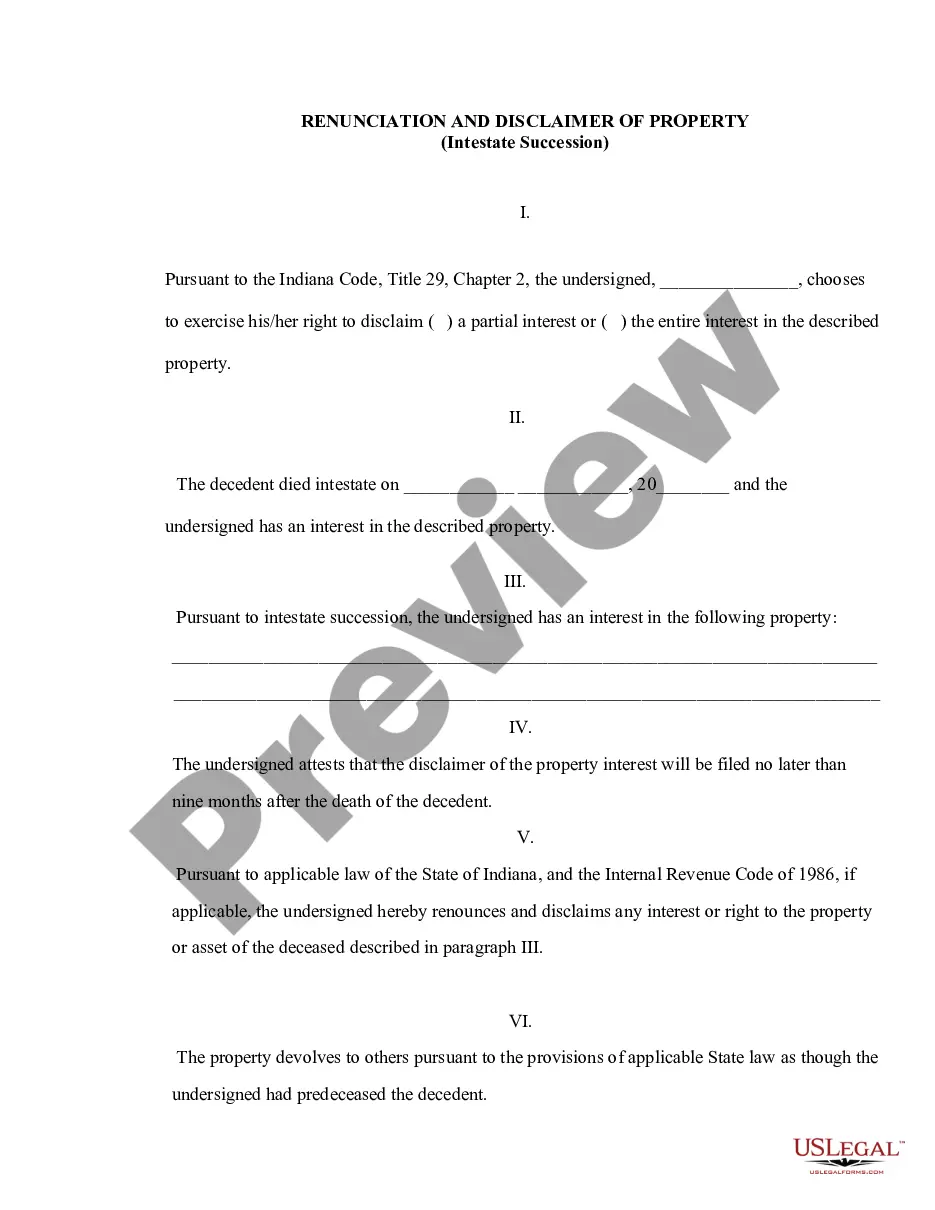

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

A beneficiary is always free to refuse to accept benefits under a trust or a will.The beneficiary may be willing to sign a disclaimer as she does not wish to accept the bequest. The disclaimer would protect you as Trustee from a breach of a fiduciary duty by distributing the assets to a different beneficiary.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.