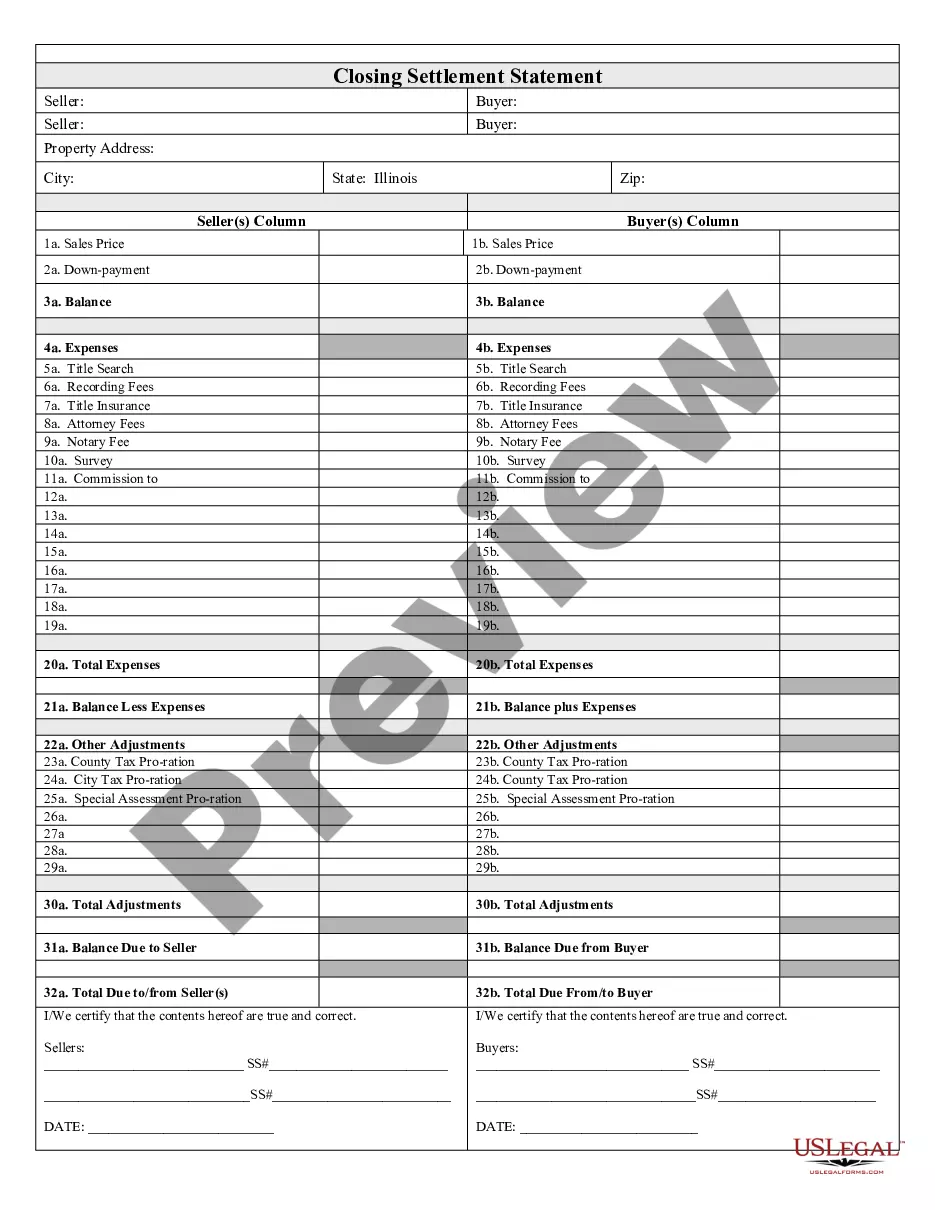

Chicago Illinois Closing Statement

Description

How to fill out Illinois Closing Statement?

Utilize the US Legal Forms and gain immediate access to any form sample you need.

Our advantageous website with a vast array of templates streamlines the method to search for and obtain nearly any document sample you desire.

You can download, fill out, and validate the Chicago Illinois Closing Statement in merely a few minutes instead of browsing the Internet for hours attempting to find the correct template.

Employing our collection is a fantastic way to enhance the security of your document submissions.

The Download button will show up on all the samples you view.

Moreover, you can locate all previously saved files in the My documents section.

- Our expert legal advisors routinely review all documents to guarantee that the forms are suitable for a specific area and adhere to new laws and regulations.

- How can you acquire the Chicago Illinois Closing Statement.

- If you possess a subscription, simply Log In to your account.

Form popularity

FAQ

What Is a Closing Statement? A closing statement is a document that records the details of a financial transaction. A homebuyer who finances the purchase will receive a closing statement from the bank, while the home seller will receive one from the real estate agent who handled the sale.

A settlement statement is a document listing the terms and conditions of a settlement agreement and details all related costs or credits due to each party. A mortgage loan settlement statement is commonly known as a closing statement.

Closing costs you can deduct in the year they're paid. Origination fees or points paid on a purchase. The IRS considers ?mortgage points? to be charges paid to take out a mortgage. They may include origination fees or discount points, and represent a percentage of your loan amount.

A closing statement is a form used in a real estate transaction that includes an itemized list of all the buying or selling costs associated with that transaction. It's a standard element of home sales, especially those that involve mortgages, and refinancings.

Closing arguments are the opportunity for each party to remind jurors about key evidence presented and to persuade them to adopt an interpretation favorable to their position.

Steps to Take to Close Your Business File a Final Return and Related Forms. Take Care of Your Employees. Pay the Tax You Owe. Report Payments to Contract Workers. Cancel Your EIN and Close Your IRS Business Account. Keep Your Records.

This form must be filed by the 15th day of the third month after you close your business. Corporations also need to file IRS Form 966, Corporate Dissolution or Liquidation, to report their dissolution. Reporting asset sales. You will experience a taxable gain or loss when you liquidate your business's assets.

To dissolve/terminate your domestic LLC in Illinois, you must submit the completed form LLC-35-15, Statement of Termination in duplicate to the Illinois Secretary of State by mail or in person along with the filing fee.

First, the creditor (i.e., mortgage lender) is now responsible for preparing and delivering the Closing Disclosure to the consumer. That said, the creditor is permitted to delegate these responsibilities to a title agent, although the creditor remains 100 percent liable for any violations of the new regulations.

How do you dissolve an Illinois Corporation? To dissolve your corporation in Illinois, you submit in duplicate the completed BCA 12.20, Articles of Dissolution form by mail or in person to the Secretary of State along with the filing fee.