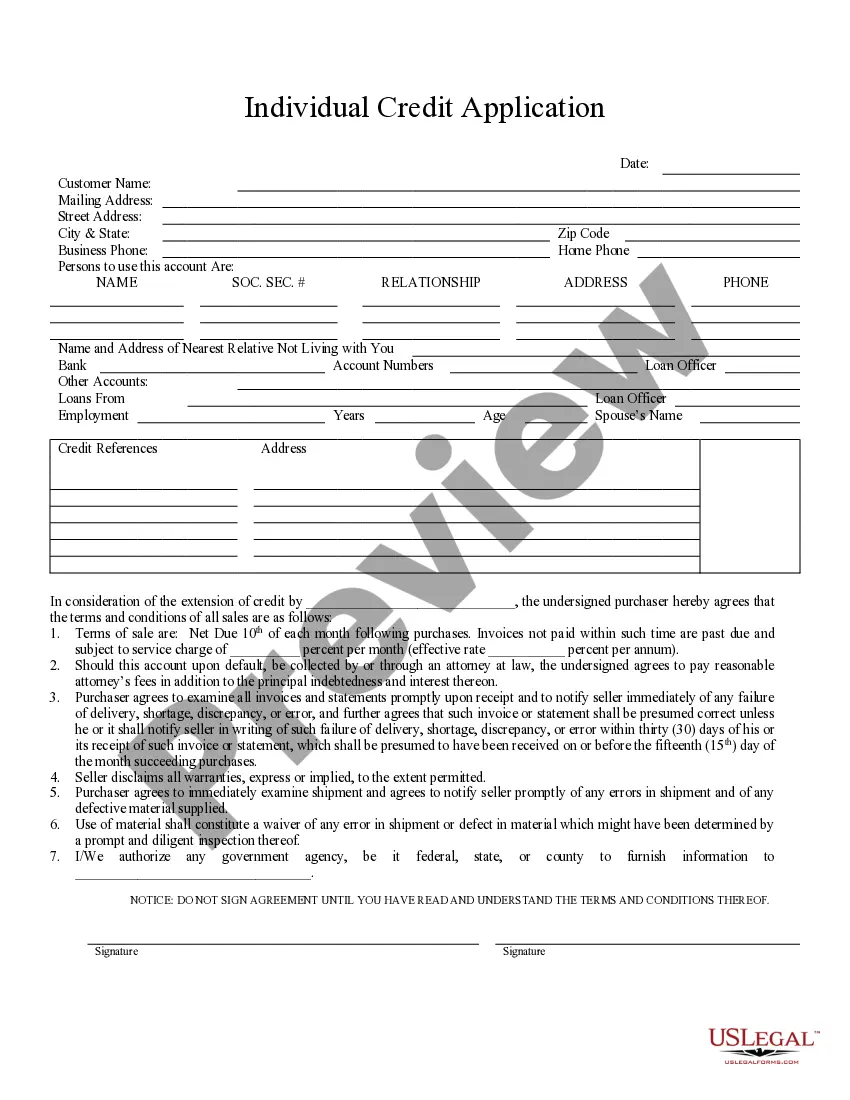

Elgin Illinois Individual Credit Application

Description

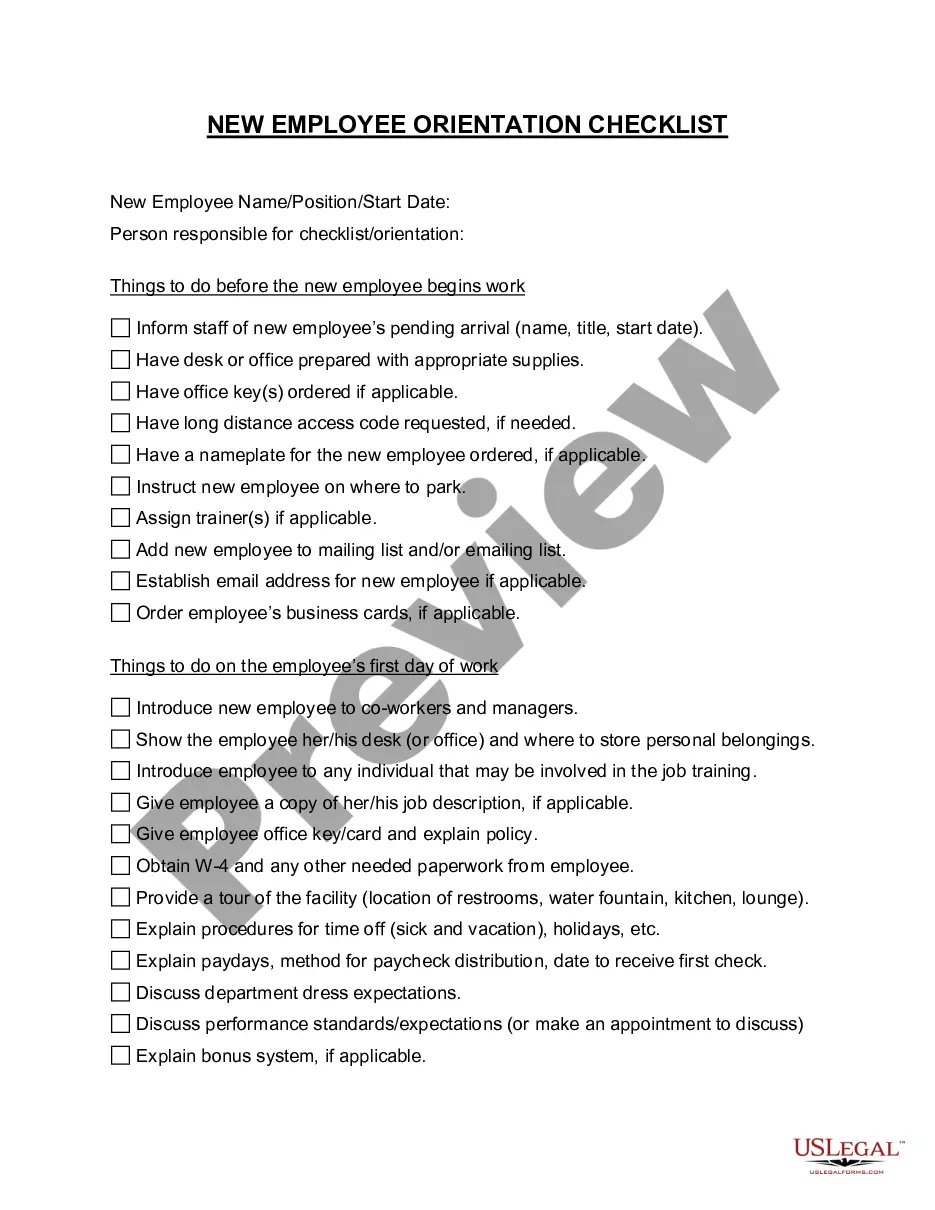

How to fill out Illinois Individual Credit Application?

If you are looking for a suitable form template, it’s incredibly challenging to find a better source than the US Legal Forms site – one of the most comprehensive online collections.

With this collection, you can access a vast array of document samples for both business and personal needs by categories and regions, or keywords.

Utilizing our sophisticated search tool, obtaining the latest Elgin Illinois Individual Credit Application is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the template. Specify the format and download it to your device. Edit. Fill out, modify, print, and sign the downloaded Elgin Illinois Individual Credit Application.

- Additionally, the accuracy of each document is verified by a team of professional attorneys who consistently review the templates on our platform and update them in accordance with the latest state and county laws.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Elgin Illinois Individual Credit Application is to Log In to your account and click the Download button.

- If you’re using US Legal Forms for the first time, simply adhere to the following guidelines.

- Ensure you have selected the template you require. Review its description and utilize the Preview feature (if available) to assess its contents. If it does not fulfill your needs, use the Search field located at the top of the page to locate the suitable document.

- Confirm your selection. Click the Buy now button. After that, choose your desired subscription plan and enter details to register an account.

Form popularity

FAQ

The $3600 Child Tax Credit on TurboTax allows for a higher benefit for qualifying children when you file your return. TurboTax guides you through filling in necessary information correctly for the Elgin Illinois Individual Credit Application. This ensures you receive the full benefit legally available to you.

To claim the $3600 Child Tax Credit, ensure you have filed your tax return accurately, including information on your qualifying children. You can apply this while filling out the Elgin Illinois Individual Credit Application to streamline the process. Tracking changes in eligibility or benefits is essential to maximize your claim.

Yes, the $3600 Child Tax Credit for eligible children aged under six was made available, but this can vary based on legislation over subsequent years. Make sure to check current tax updates as these guidelines can change. The Elgin Illinois Individual Credit Application helps you stay informed about any recent changes.

The Illinois education credit applies to tuition, fees, and related expenses for eligible students attending an accredited institution. You need to have a valid proof of payment and your adjusted gross income must fall under certain limits. Utilize the Elgin Illinois Individual Credit Application to find out what qualifies for this credit.

To qualify for the Illinois earned income tax credit, you need to have earned income within specific limits and meet other criteria based on your filing status. Furthermore, having qualifying children can increase the credit amount. You can streamline this process with the Elgin Illinois Individual Credit Application.

Yes, you can qualify for the Child Tax Credit if your income is $3,000 or more. However, eligibility can depend on other factors, such as the number of qualifying children you have. Use the Elgin Illinois Individual Credit Application to clarify your situation and see if you fit the requirements.

You may not qualify for the Illinois property tax credit due to income limitations or failing to meet residency requirements. The Elgin Illinois Individual Credit Application can guide you on what is needed to meet the criteria. Always check the guidelines to understand what factors impact your eligibility.

To receive the full Child Tax Credit, you must meet certain income guidelines and have qualifying children. The Elgin Illinois Individual Credit Application can help you determine your eligibility. Ensuring your application is accurate increases your chances of receiving the maximum credit.

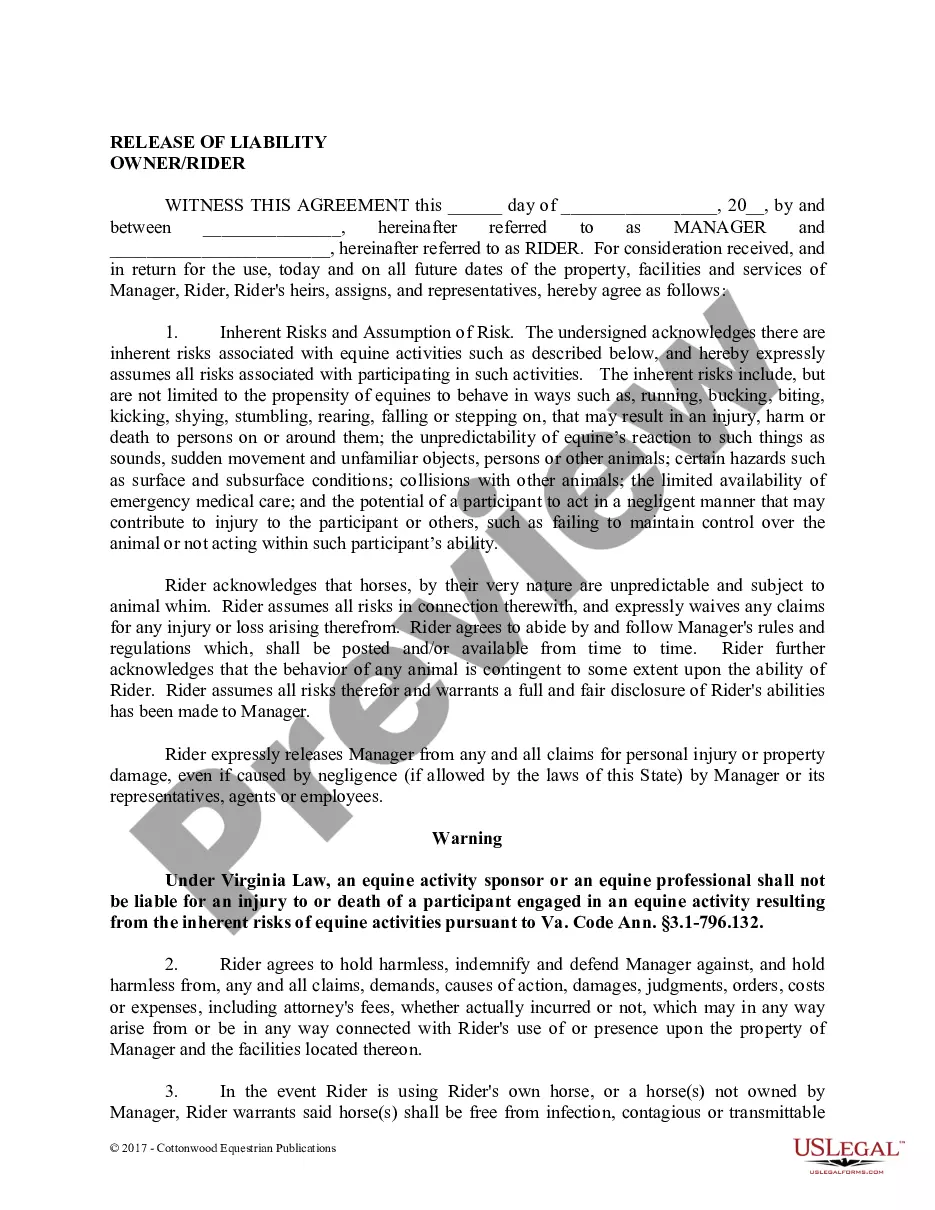

Online credit applications can be safe, but it greatly depends on the service you use to submit your application. The Elgin Illinois Individual Credit Application by US Legal Forms is designed with security in mind, ensuring your data is protected during the application process. Look for websites that have clear privacy policies and secure payment options. Being cautious helps ensure your experience is both safe and efficient.

Filling out a credit application online is generally safe when you choose reliable services. The Elgin Illinois Individual Credit Application from US Legal Forms offers a secure environment for completing your application. Always look for secure connections and read customer reviews to ensure the platform has a solid reputation. Making informed choices helps protect your sensitive information.