Illinois Individual Credit Application

Understanding this form

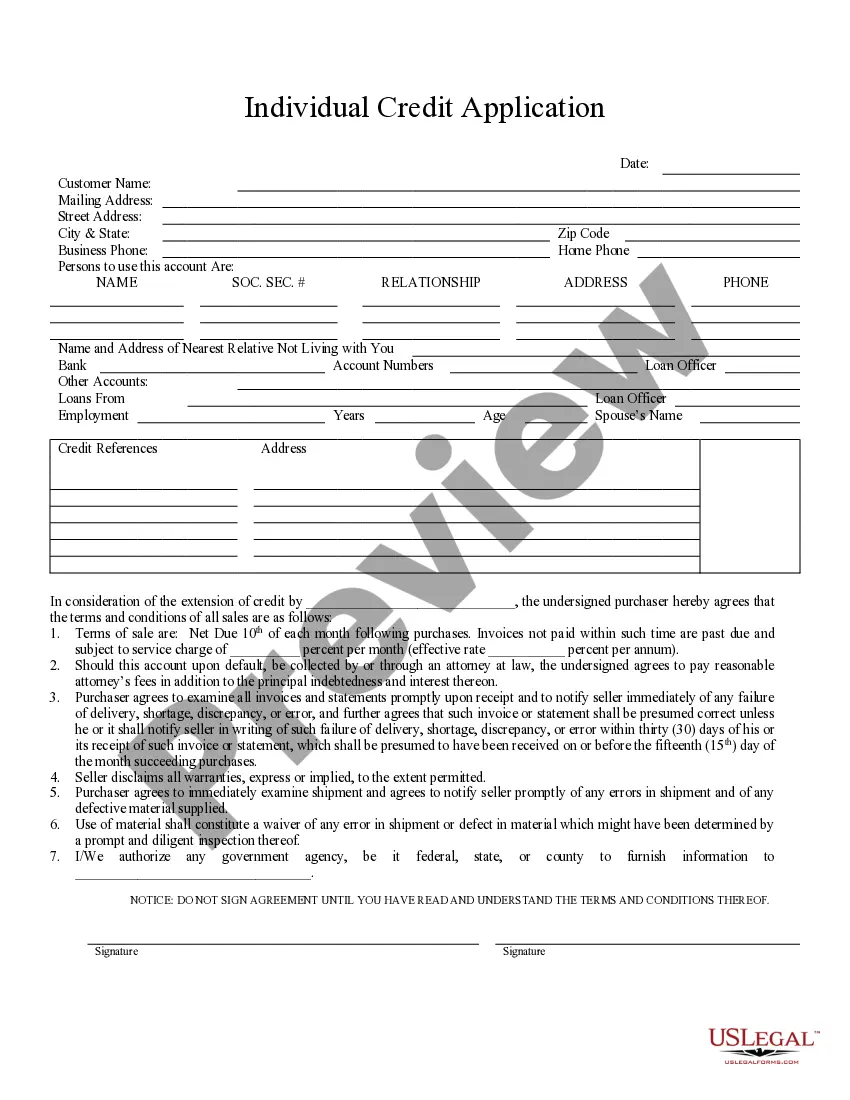

The Individual Credit Application is a legal document designed for individuals seeking to obtain credit for purchases. This form outlines the terms of repayment, interest, and disclaimers related to warranties by the seller. It differs from other credit-related forms by including specific authorizations for the seller to obtain personal information from government agencies, essential for assessing creditworthiness.

What’s included in this form

- Terms of sale: A clear outline of payment terms, including due dates and late fees.

- Default provisions: Consequences of non-payment and related attorney fees.

- Examination of invoices: Requirements for notifying the seller of discrepancies.

- Disclaimer of warranties: A section where the seller disclaims all implied warranties.

- Authorization for information: A clause permitting the seller to acquire personal information from government agencies.

When to use this form

This form is typically used when an individual wants to apply for credit to make a purchase, such as for goods or services. It can be beneficial for those who may not have established credit or when an immediate assessment of creditworthiness is needed by the seller.

Who should use this form

- Individuals seeking credit for personal purchases.

- Small business owners looking to establish credit for their business-related expenses.

- Credit sellers and service providers assessing the credit risk of potential customers.

How to prepare this document

- Identify the parties: Fill in the name of the seller and the purchaser.

- Specify payment terms: Indicate the due date and the service charges for late payments.

- Review and sign: Read the terms thoroughly before signing. Ensure understanding of the implications of default.

- Authorize information access: Clearly state any required authorizations for the seller to obtain personal information.

- Submit the form: Provide the completed form to the seller for processing.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to read the terms thoroughly before signing.

- Not providing accurate personal information, which could delay application processing.

- Ignoring discrepancies in invoices or statements, leading to financial repercussions.

Advantages of online completion

- Convenience: Easily download and complete the form without needing to visit a physical location.

- Editability: Modify the form as needed to suit specific agreements.

- Reliability: Access templates created by licensed attorneys, ensuring legal soundness.

Looking for another form?

Form popularity

FAQ

To qualify for the earned income credit: You must file as single or married filing jointly.You cannot earn over a certain amount of investment income for the year. For 2019 this amount is $3,600, for 2020 the amount is $3,650.

No, Illinois does not have a renter's credit.

For tax years beginning January 1, 2020, it is $2,325 per exemption. If someone else can claim you as a dependent and your Illinois base income is $2,325 or less, your exemption allowance is $2,325. If income is greater than $2,325, your exemption allowance is 0.

No, there are no circumstances where you can deduct rent payments on your tax return.Deducting rent on taxes is not permitted by the IRS. However, if you use the property for your trade or business, you may be able to deduct a portion of the rent from your taxes.

Must have a Social Security number that is valid for employment. Must have earned income from wages or running a business or a farm. May have some investment income. Generally must be a U.S. citizen or resident alien all year.

If you live in private rented accommodation and pay income tax, you may be eligible for tax relief on part of your rent.

Do I qualify for the Illinois EITC/EIC? In general, if you qualified for a federal Earned Income Tax Credit, you also qualify for the Illinois EITC/EIC. Federally, you qualify for EITC/EIC if: you have earned income and adjusted gross income within certain limits; AND.

As far as I know, the states that have anything for rent are Vermont, Michigan, Maine,Maryland, Massachusetts, Minnesota, Missouri, New Jersey, Rhode Island, California, Hawaii, Indiana, Iowa, Arizona, Wisconsin, and Connecticut.

If you have a qualifying child, you must file the Schedule EIC listing the children with either the Form 1040A or the Form 1040. If you do not have a qualifying child, you can use the Form 1040EZ.