An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification is contractual in nature and should be supported by consideration.

Joliet Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate

Description

How to fill out Illinois Modification Of Mortgage Loan In Default To Bring It Current And To Change Variable Rate Of Interest To Fixed Rate?

If you are searching for a pertinent document, it’s exceedingly challenging to select a more suitable location than the US Legal Forms site – likely the most extensive repositories on the web.

Here you can obtain a vast array of templates for both business and personal uses by categories and states, or keywords.

Utilizing our enhanced search feature, locating the latest Joliet Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Acquire the template. Choose the desired file format and store it on your device.

- Moreover, the applicability of each entry is verified by a group of experienced lawyers who regularly assess the templates on our site and refresh them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to obtain the Joliet Illinois Modification of Mortgage Loan in Default to Bring it Current and to Change Variable Rate of Interest to Fixed Rate is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply adhere to the guidelines below.

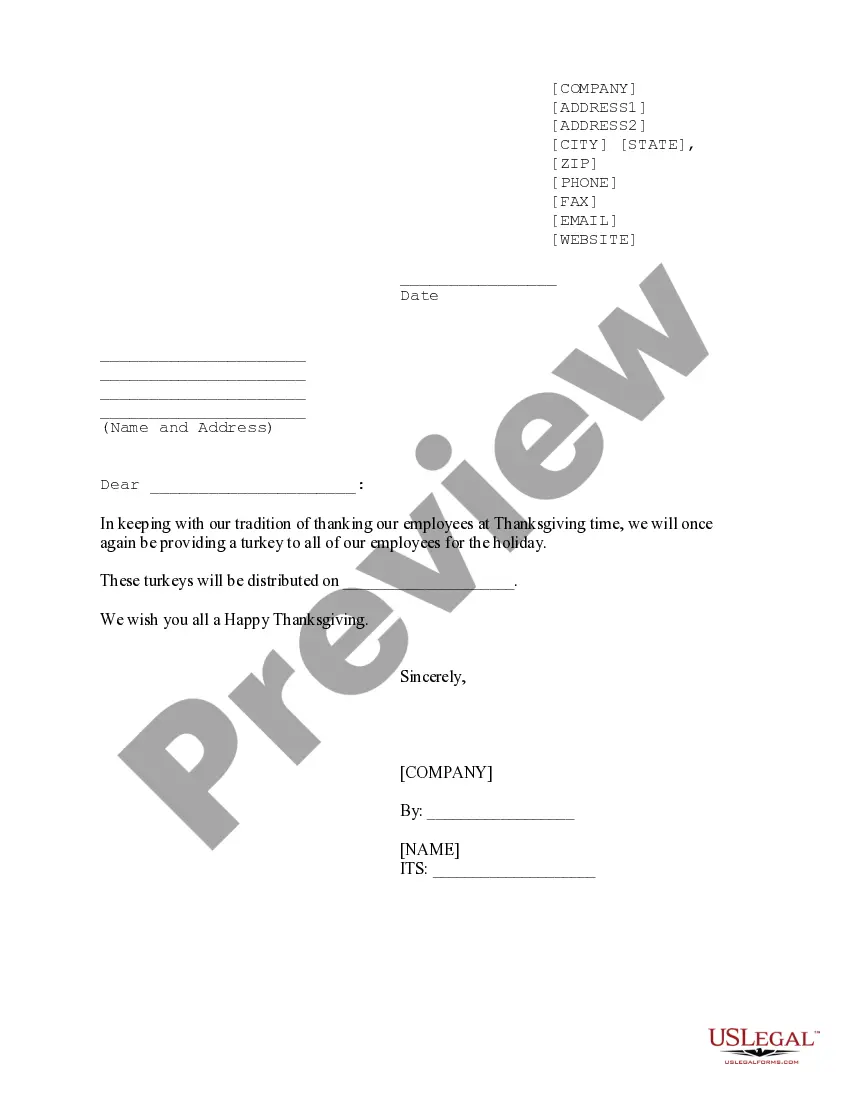

- Ensure you have located the document you need. Review its details and utilize the Preview feature to examine its content. If it doesn’t satisfy your requirements, engage the Search option at the top of the page to find the necessary file.

- Validate your choice. Click the Buy now button. Then, select your desired pricing plan and provide information to create an account.

Form popularity

FAQ

When you take a loan modification, you change the terms of your loan directly through your lender. Most lenders agree to modifications only if you're at immediate risk of foreclosure. A loan modification can also help you change the terms of your loan if your home loan is underwater.

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

Loan modifications are a long-term mortgage relief option for borrowers experiencing financial hardship, such as loss of income due to illness. A modification typically changes the loan's rate or term (or both) to make monthly payments more affordable.

A modification involves one or more of the following: Extending the term of the mortgage (e.g., from a 30-year term to a 40-year term) Reducing the interest rate. Adding any past-due amounts, such as interest and escrow, to the unpaid principal balance, which is then reamortized over the new term.

1. Change your interest pricing regimen Change your interest pricing regimen.Change your interest pricing regimen.Transfer your loan to a new lender.Transfer your loan to a new lender.Move from fixed to floating rate.Move from fixed to floating rate.Make partial prepayment and get the EMI adjusted.

Obtaining a loan modification can also hurt your credit. It will show up on your credit report, and it may lower your credit score, which can affect your ability to get another loan in the future. Loan modifications are also complex, time-consuming, and carry the risk of scams.

If your servicer or lender agrees to a mortgage loan modification, it may result in lowering your monthly payment, extending or shortening your loan's term, or decreasing the interest rate you pay.

Defaulting on a loan modification really isn't any different than defaulting on the original loan. The lender still has the ability to declare a default, to file a mortgage foreclosure lawsuit, to obtain a judgment, and to conduct a judicial auction.

The disadvantages of a loan modification include the possibility that you will end up paying more over time to repay the loan. The total you owe may even be more than your house is worth in some cases. In addition, you may pay extra fees to modify a loan or incur tax liability.