Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement

Description

How to fill out Georgia Financial Statements Only In Connection With Prenuptial Premarital Agreement?

Utilize the US Legal Forms and gain instant access to any form you require.

Our advantageous platform with a multitude of document templates enables you to locate and acquire nearly any document sample you might need.

You can download, complete, and validate the Savannah Georgia Financial Statements solely in Relation to Prenuptial Premarital Agreement in just a few minutes rather than spending several hours searching online for the suitable template.

Using our directory is an excellent method to enhance the security of your document submissions.

If you haven't created a profile yet, follow these instructions.

Locate the form you need. Ensure that it is the template you were searching for: check its title and description, and utilize the Preview option if it is available. Otherwise, use the Search bar to find the suitable one.

- Our expert attorneys consistently review all the documents to confirm that the forms are applicable to a specific area and adhere to new laws and regulations.

- How can you obtain the Savannah Georgia Financial Statements solely in Relation to Prenuptial Premarital Agreement.

- If you possess a profile, simply Log In to your account. The Download button will be activated on all the samples you view.

- Additionally, you can access all previously saved files in the My documents section.

Form popularity

FAQ

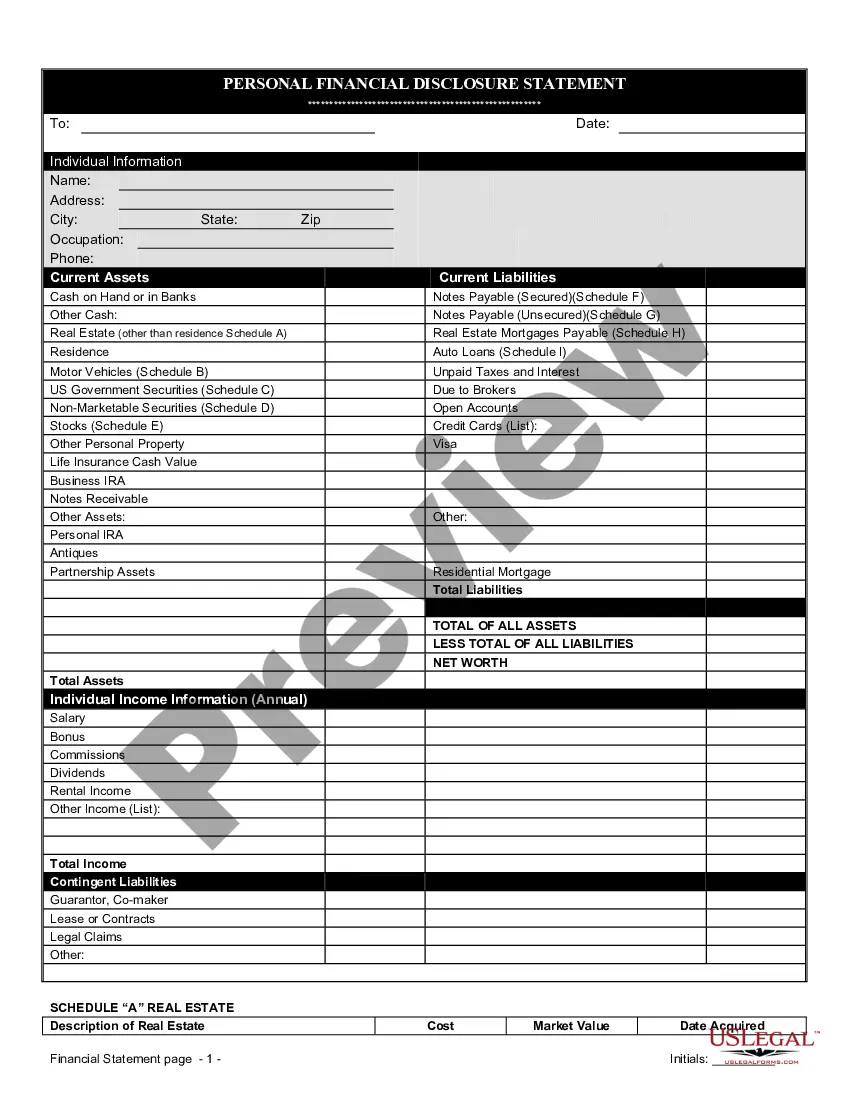

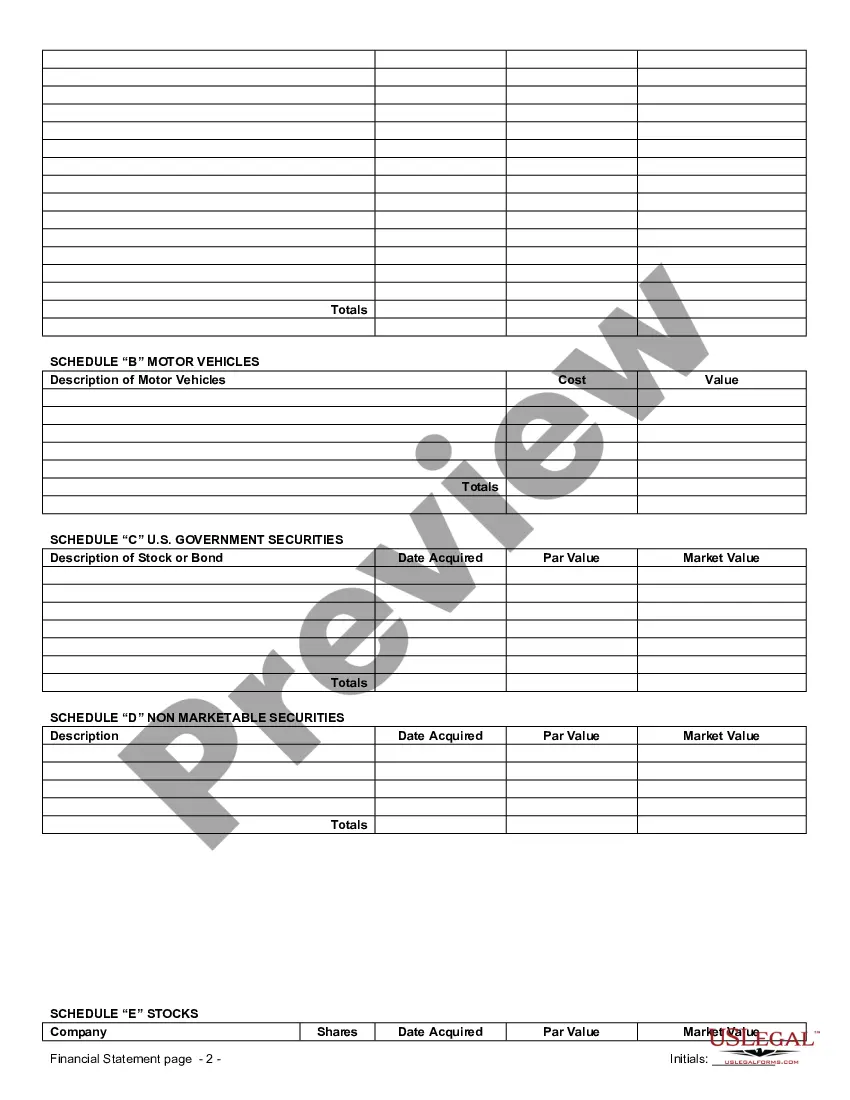

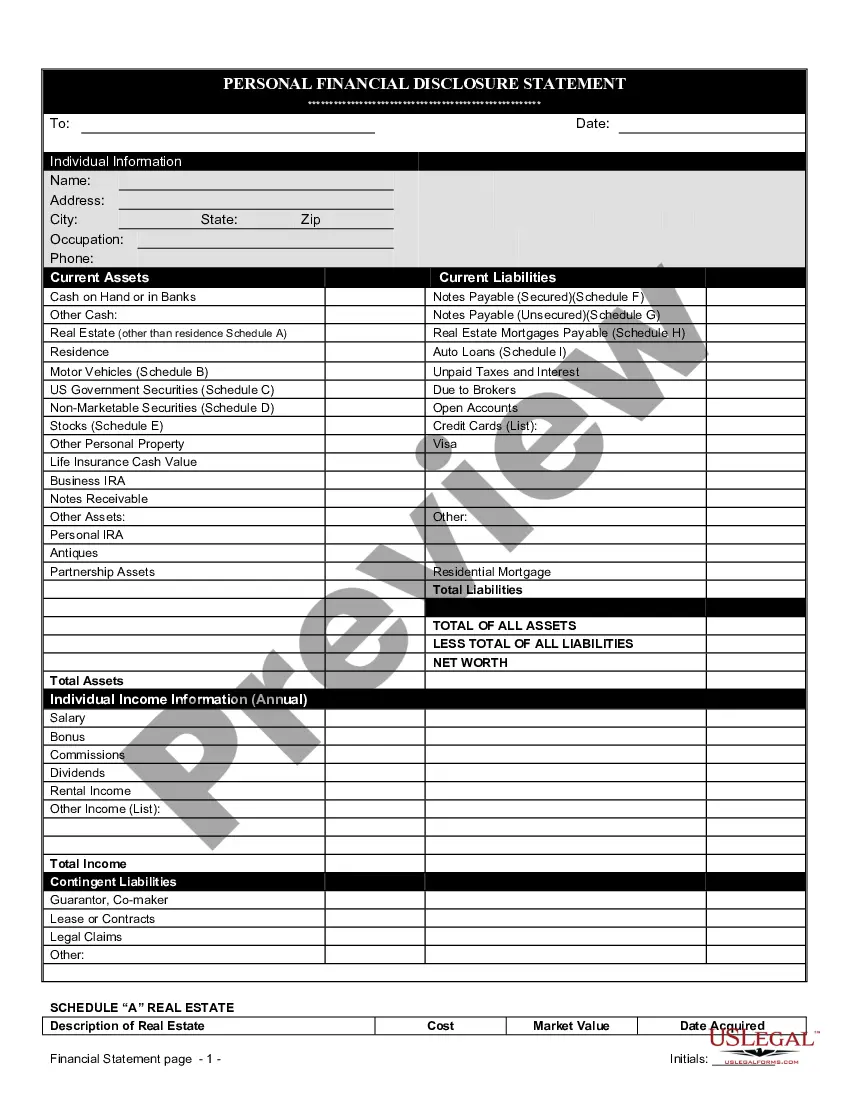

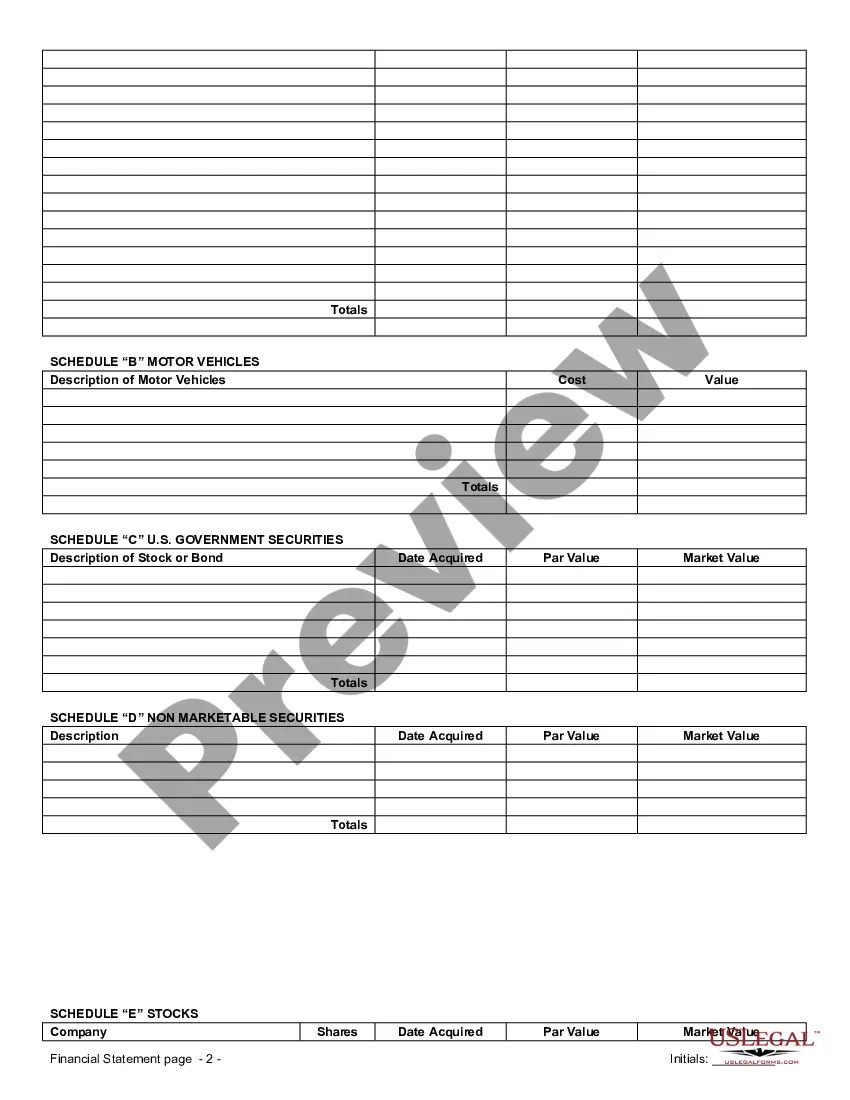

To list assets for a prenup, start by compiling a comprehensive inventory of all your possessions. Include real estate, bank accounts, investments, personal belongings, and any other significant financial items. It is essential to accurately document each asset's value to create clear Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement. If you seek guidance, consider using uslegalforms, which provides tools tailored to help you prepare and organize your financial statements effectively.

A prenuptial agreement can keep many aspects of your finances separate, but it is important to understand the limitations. While you can delineate specific assets and debts in Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement, commingling funds after marriage could complicate separations. Therefore, maintaining separate accounts and adhering to the terms of your prenup is essential for achieving complete financial separation. Careful planning and communication with your partner will aid in this effort.

To keep finances legally separate in marriage, you should consider creating a prenuptial agreement that outlines each spouse's financial responsibilities. Incorporating Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement can help define separate accounts, ownership of property, and debt liabilities. Consulting with a legal professional can provide guidance tailored to your situation. This approach ensures transparency and protection for both spouses.

A prenuptial agreement is an effective tool for keeping assets separate during a marriage. When you utilize Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement, you ensure that individual assets remain distinct. This arrangement can help clarify ownership rights should the marriage end, providing security for both parties. Therefore, it is crucial to include specific asset descriptions in the prenup.

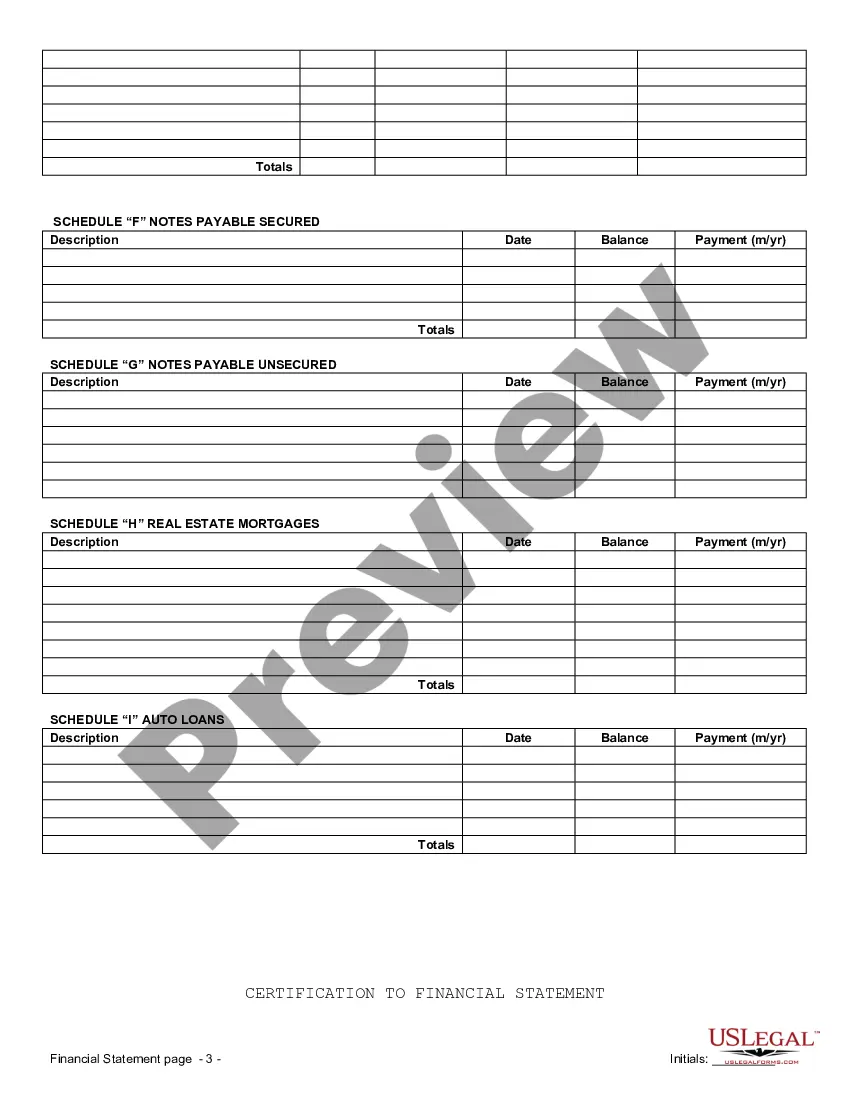

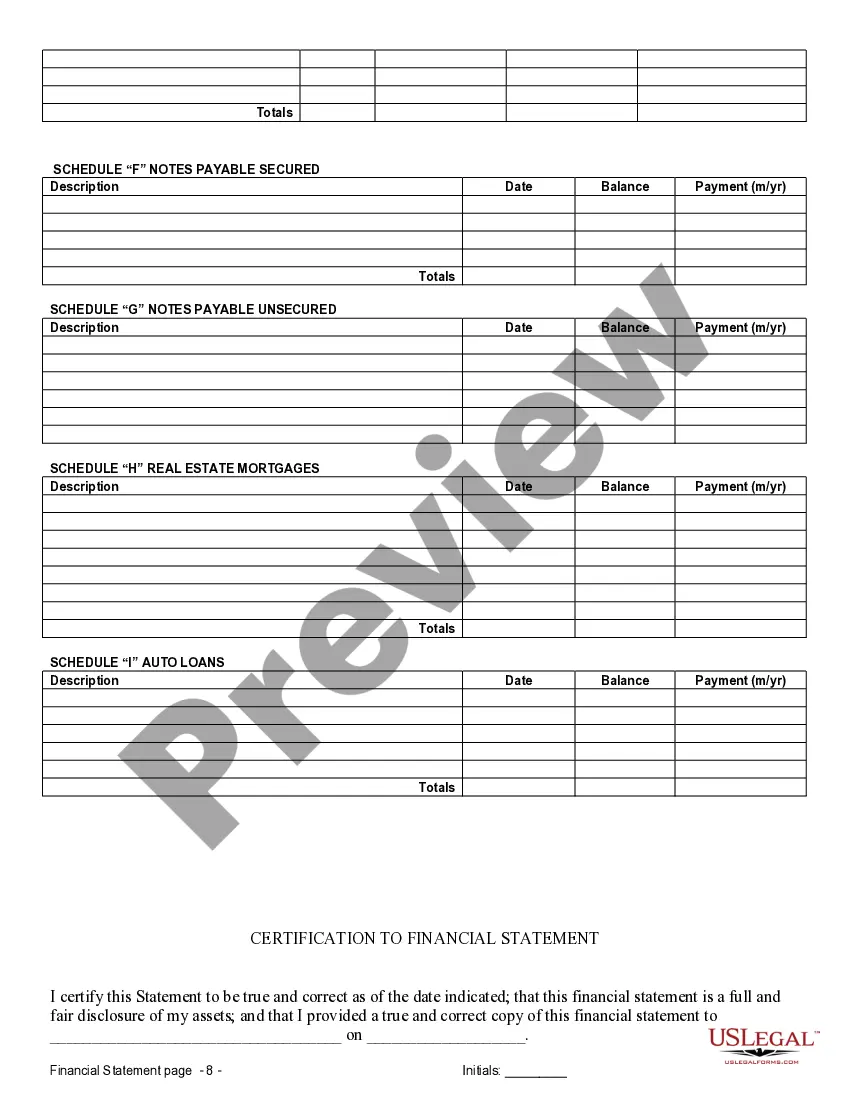

Yes, a prenuptial agreement can keep debt separated between spouses, minimizing financial liability. In Savannah, Georgia, Financial Statements only in Connection with Prenuptial Premarital Agreement play a crucial role in outlining how debts are treated. By clearly specifying which party is responsible for certain debts, you can protect yourself from assuming your partner's financial burdens. Thus, it is wise to include debt provisions in your prenup for clarity.

A prenup primarily addresses premarital assets, but it can also outline how to manage assets acquired during the marriage. This flexibility allows couples to protect both individual and joint financial interests. Understanding Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement can aid couples in creating comprehensive agreements that cover all necessary aspects of their financial lives.

While financial disclosure is a vital part of the prenup process, there are limited situations where parties may agree to waive extensive documentation. However, achieving this may compromise the enforceability of the agreement. Utilizing Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement can provide a structured way to disclose just enough information to satisfy requirement while maintaining some privacy.

Yes, providing bank statements is often essential for a prenup as it demonstrates a clear picture of each party's financial status. These documents, including Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement, help ensure transparency and fairness in the agreement process. Not disclosing complete financial information may lead to a prenup being challenged later.

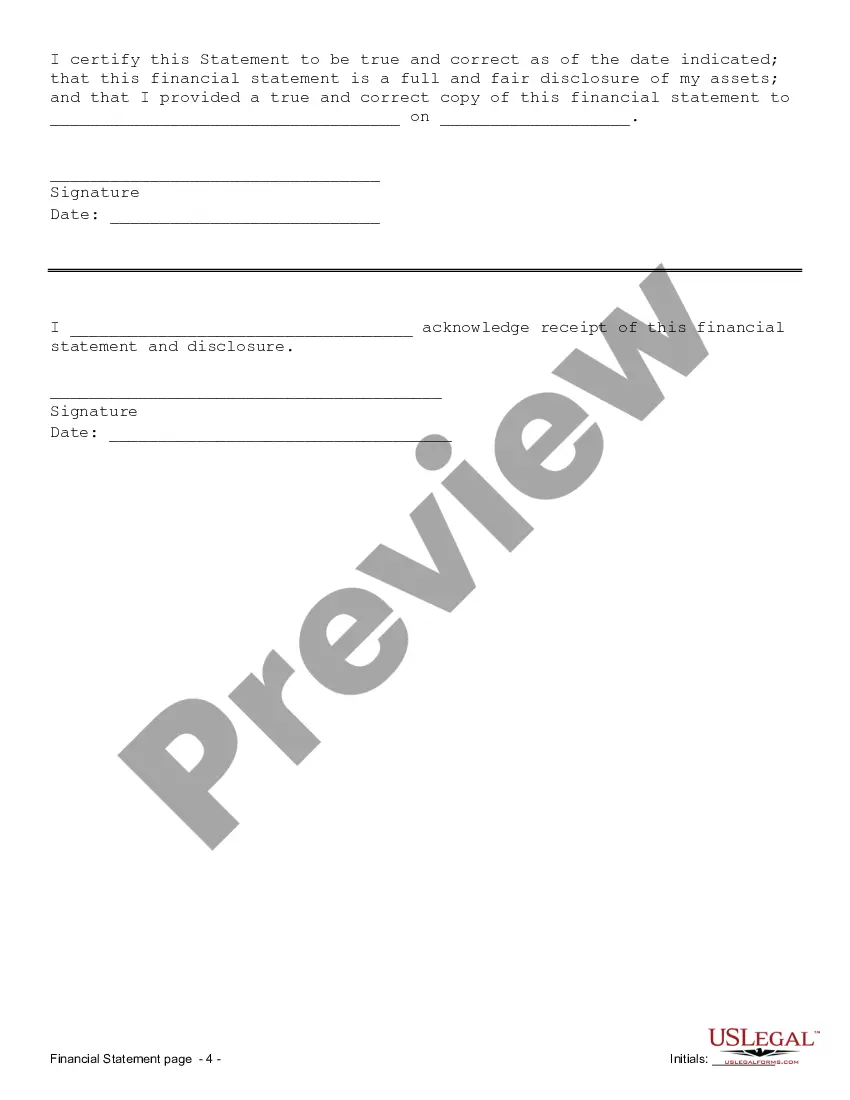

For a prenup to be valid, both parties must voluntarily sign the agreement without any coercion. Additionally, the contract should be in writing, and each party must fully disclose their financial situation, including assets and liabilities. Understanding Savannah Georgia Financial Statements only in Connection with Prenuptial Premarital Agreement is crucial, as proper documentation ensures the enforceability of the prenup in the event of a dispute.

A common loophole in a prenuptial agreement arises from inadequate financial disclosures or unclear language in the document. If one party fails to fully disclose their financial situation, it may undermine the prenup's enforceability. Therefore, emphasizing precise Savannah Georgia financial statements only in connection with a prenuptial premarital agreement can safeguard against such loopholes and secure both parties' interests.