This is a verified complaint as provided for in Florida rules. It is used by a mortgage lender to foreclose on a property.

Miramar Florida Complaint for Mortgage Foreclosure

Description

How to fill out Florida Complaint For Mortgage Foreclosure?

Regardless of social or occupational standing, completing law-related documents is a regrettable requirement in the contemporary world.

Frequently, it’s virtually unfeasible for individuals lacking legal training to draft such documents from scratch, primarily due to the intricate terminology and legal subtleties they entail.

This is where US Legal Forms can be a lifesaver.

Confirm that the template you’ve selected is appropriate for your area, as the regulations of one state or county may not apply in another.

Review the form and read a brief overview (if accessible) of the situations for which the document is applicable.

- Our service offers an extensive library with over 85,000 ready-to-use state-specific templates that cater to nearly any legal scenario.

- US Legal Forms also acts as a valuable tool for associates or legal advisors who wish to conserve time by using our DIY documents.

- Whether you require the Miramar Florida Complaint for Mortgage Foreclosure or any other form that will be recognized in your jurisdiction, US Legal Forms has everything available.

- Here’s how to swiftly obtain the Miramar Florida Complaint for Mortgage Foreclosure by utilizing our reliable service.

- If you are currently a subscriber, feel free to Log In to your account to download the correct form.

- However, if you are not familiar with our platform, ensure to follow these instructions before acquiring the Miramar Florida Complaint for Mortgage Foreclosure.

Form popularity

FAQ

Yes, you can take steps to stop a foreclosure once it begins. In Miramar, Florida, responding quickly to a foreclosure notice is crucial. You may file a complaint for mortgage foreclosure, challenge the lender's claims, or negotiate with them for a possible solution. Utilizing platforms like USLegalForms can provide you with the necessary documents to help you understand your rights and options in these cases.

The homeowner typically suffers the most in a foreclosure, as they face the loss of their home and potential financial hardship. Additionally, the process can affect credit ratings and future borrowing capabilities. Those involved in the property, including tenants and communities, can also experience adverse effects. Seeking solutions like those offered by US Legal Forms can help homeowners navigate the complexities of the Miramar Florida Complaint for Mortgage Foreclosure and find support.

A complaint in foreclosure is similar to a complaint in a mortgage foreclosure, focusing on the legal grounds for foreclosing on a property. This document indicates that the lender is seeking to reclaim the property due to unpaid debts. Familiarizing yourself with the Miramar Florida Complaint for Mortgage Foreclosure is critical. This knowledge can enable you to respond effectively and safeguard your interests throughout the process.

A complaint in a mortgage foreclosure is a legal document filed by the lender to initiate the foreclosure process. The complaint details the reasons for the foreclosure, including the borrower’s default on payments, and typically includes a request for the court to grant the lender possession of the property. Understanding the Miramar Florida Complaint for Mortgage Foreclosure can help you respond appropriately. It is essential to take this document seriously and act without delay.

Responding to a mortgage foreclosure involves understanding the legal documents you receive. You should review the Miramar Florida Complaint for Mortgage Foreclosure thoroughly, as it outlines the lender's claims against you. Consider seeking legal advice to explore your options, which may include negotiating with the lender or filing a response in court. Take action promptly to protect your rights and interests.

In Illinois, the foreclosure timeline often ranges from six months to over a year, depending on various factors, including court schedules and defenses raised by the homeowner. If you receive a Miramar Florida Complaint for Mortgage Foreclosure, it is crucial to respond timely and understand the proceedings. Being proactive can sometimes shorten the foreclosure process.

When reporting a foreclosure on your tax return, you'll typically need to reflect any canceled mortgage debt on Form 1099-C. This applies especially if you faced a Miramar Florida Complaint for Mortgage Foreclosure. Consulting with a tax professional can help you navigate the implications and ensure accurate reporting for your situation.

In Washington State, the foreclosure process usually takes between three to six months from the initial filing of notice to the sale of the property. However, the timeline can be affected by various factors, including whether a homeowner contests the Miramar Florida Complaint for Mortgage Foreclosure. It's important to stay informed throughout the process, as delays can occur.

To respond to a foreclosure complaint, you should file an answer with the appropriate court where the Miramar Florida Complaint for Mortgage Foreclosure has been filed. This answer typically includes your defenses to the foreclosure and any counterclaims you wish to make. Make sure to meet the filing deadlines to protect your rights, as failure to respond may lead to a default judgment against you.

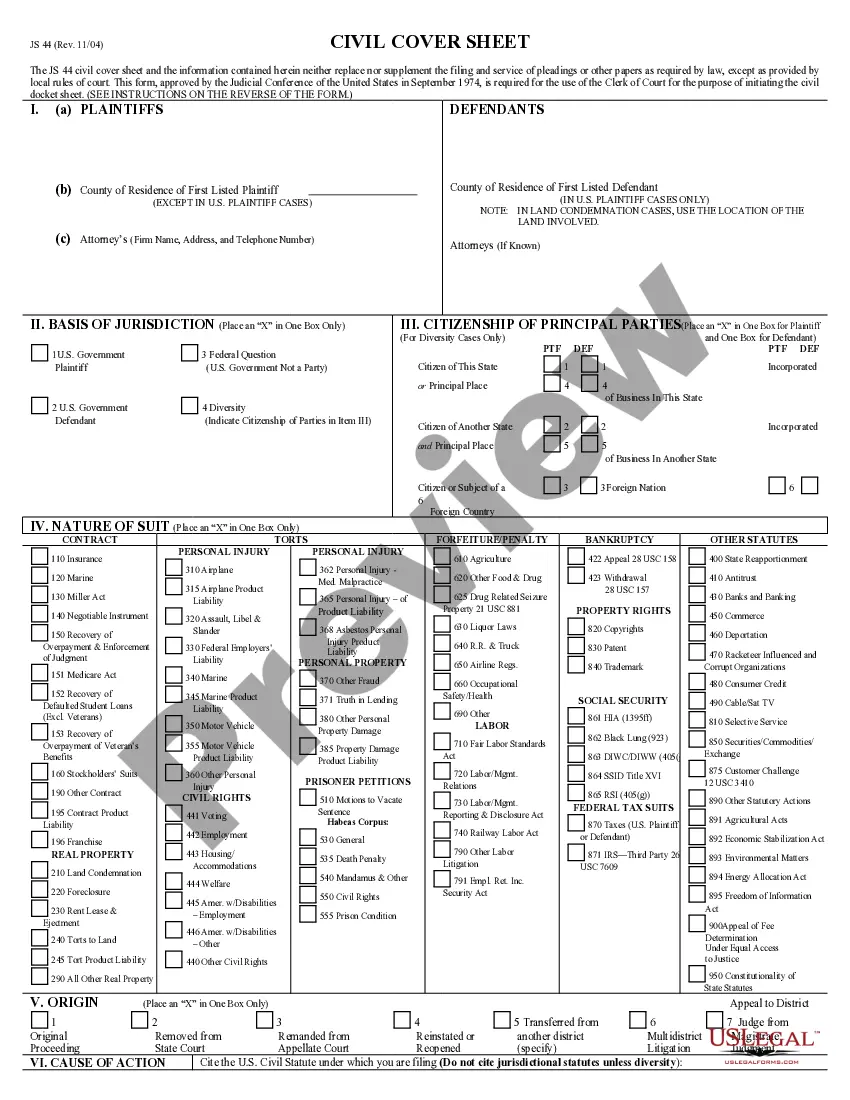

A foreclosure complaint in Florida must include specific components, such as the details of the mortgage, the amount owed, and evidence showing that the borrower defaulted. It should identify all parties involved and may need to accompany documents that prove the lender's standing to file the complaint. Utilizing platforms like US Legal Forms can help guide you in preparing an accurate complaint.