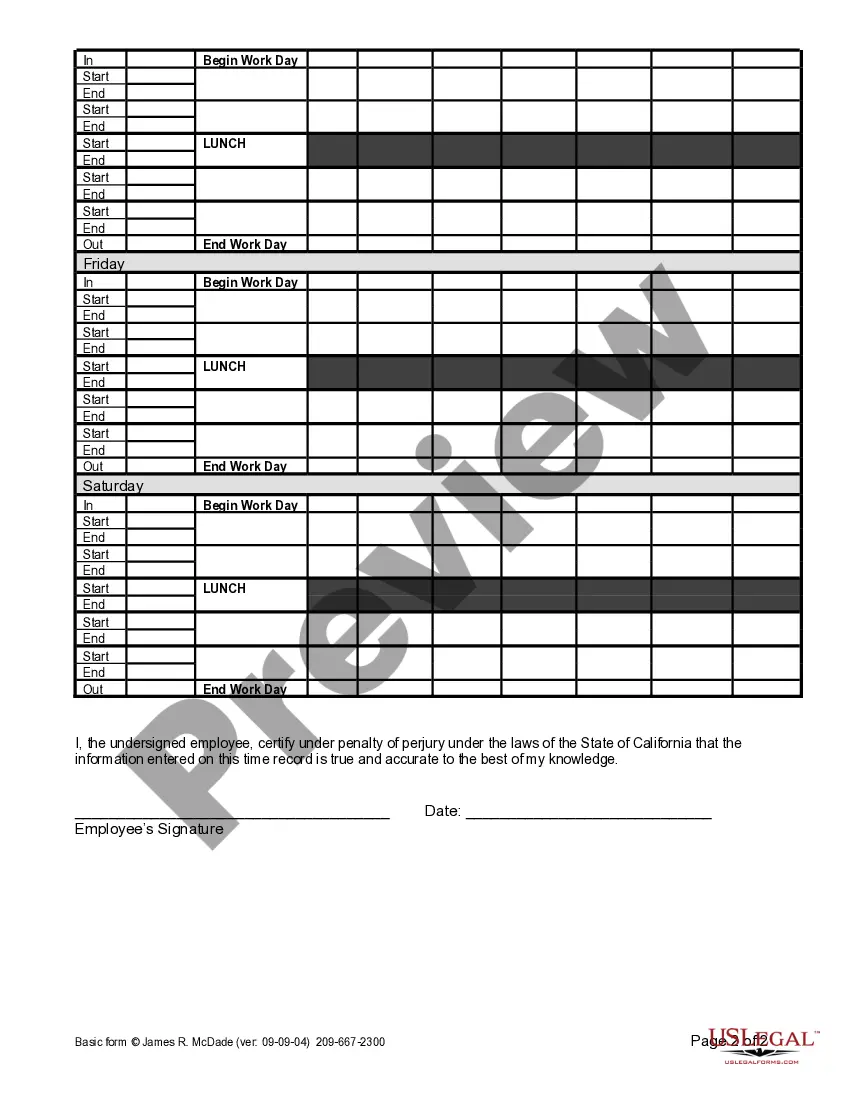

Employers use this form to keep track of an employee’s work time when the employee is paid different wage rates for different work.

El Cajon California Weekly Time Sheet for Multiple Pay Rate

Description

How to fill out California Weekly Time Sheet For Multiple Pay Rate?

Do you require a trustworthy and economical legal forms provider to purchase the El Cajon California Weekly Time Sheet for Multiple Pay Rate? US Legal Forms is your premier option.

Whether you require a straightforward agreement to establish guidelines for living with your partner or a collection of forms to facilitate your divorce process in court, we have you covered. Our platform features over 85,000 current legal document templates for both personal and business applications. All templates we provide are not generic and are structured according to the specifications of particular states and localities.

To download the document, you must Log In to your account, locate the required form, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents tab.

Are you a newcomer to our site? Don't worry. You can create an account in just a few minutes, but beforehand, ensure to do the following: Check if the El Cajon California Weekly Time Sheet for Multiple Pay Rate aligns with the regulations of your state and local jurisdiction. Read the form’s details (if accessible) to understand who and what the document applies to. Restart the search if the form does not suit your legal circumstances.

Try US Legal Forms today, and say goodbye to squandering your precious time searching for legal paperwork online.

- Now you can set up your account.

- Then select the subscription option and move forward to payment.

- Once payment is finalized, download the El Cajon California Weekly Time Sheet for Multiple Pay Rate in any available file format.

- You can revisit the website at any moment and redownload the document free of charge.

- Obtaining current legal forms has never been simpler.

Form popularity

FAQ

1. What is the minimum wage? Effective January 1, 2021, the minimum wage increases to $14 per hour for employers with 26 or more employees and $13 per hour for employees with 25 or fewer employees.

Hourly Rate Salary in San Diego, CA Annual SalaryHourly WageTop Earners$95,398$4675th Percentile$53,340$26Average$59,856$2925th Percentile$30,260$15

As of January 1, 2022, the District of Columbia had the highest minimum wage in the U.S., at 15.2 U.S. dollars per hour. This was followed by California, which had 15 U.S. dollars per hour as the state minimum wage.

More videos on YouTube Effective DateMinimum Wage RateJanuary 1, 2020$13.00January 1, 2021$14.00January 1, 2022$15.00January 1, 2023$16.303 more rows

1.1. How long does an employer have to pay you after payday in California? Most California workers are required to be on a semi-monthly payroll. This means their California employers have to pay them twice a month.

Effective January 1, 2023, the California minimum wage will increase to $15.50 an hour for all employers. The rate reflects an adjustment to the large employer minimum wage (currently $15 an hour) based on inflation, as determined by the state Director of Finance.

Living Wage Calculation for San Diego County, California 1 ADULT2 ADULTS (1 WORKING)0 Children0 ChildrenLiving Wage$22.74$34.15Poverty Wage$6.19$8.38Minimum Wage$15.00$15.00

SAN DIEGO ? Next year many San Diegans will receive more money in their paychecks. Effective Jan. 1, 2023, employees who perform at least two hours of work in one or more calendar weeks of the year within the geographic boundaries of the City of San Diego will receive a minimum wage increase from $15 to $16.30 an hour.

What Is California's Minimum Wage Today? For the remainder of 2022, the current minimum wage in the state will stay at $14 per hour for California employers with 25 employees or less. If your business employs 26 or more people, you've already been subject to a $15 per hour minimum wage rate as of January 1, 2022.

The minimum wage in California is currently $15.00/hour for employers with 26 or more employees, and $14.00/hour for employers with 25 or less employees. Some cities and counties have higher minimum wages than the state's rate. UC Berkeley maintains a list of City and County minimum wages in California.