Employers use this form to reinforce with an employee his or her need to return Company property and to obtain authorization for making deductions from an employee's paycheck.

Thousand Oaks California Advance Authorization for Pay Deduction

Description

How to fill out California Advance Authorization For Pay Deduction?

Regardless of one's social or occupational standing, completing law-related documents is an unfortunate obligation in the current professional landscape.

Frequently, it becomes nearly impossible for individuals lacking legal expertise to draft such documents from scratch, primarily due to the intricate terminology and legal nuances they involve.

This is where US Legal Forms steps in to offer assistance.

Ensure the form you selected is appropriate for your region, as the regulations of one state or county may not apply to another.

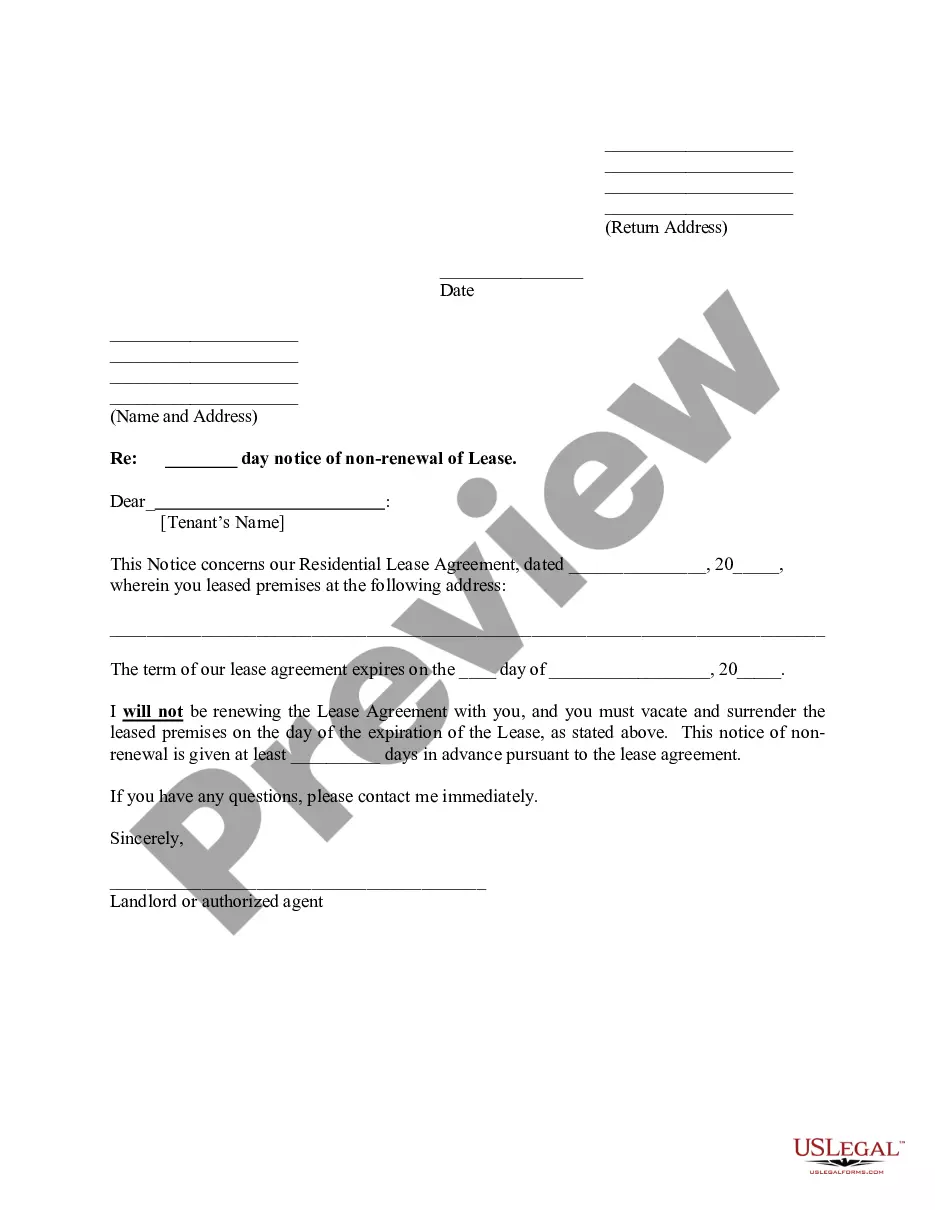

Preview the document and review a brief summary (if available) of the situations for which the document can be utilized.

- Our platform provides an extensive collection of over 85,000 state-specific forms that are applicable for nearly any legal circumstance.

- US Legal Forms also proves to be a valuable resource for associates or legal advisors seeking to conserve time with our DIY forms.

- Whether you need the Thousand Oaks California Advance Authorization for Pay Deduction or any other document that will be recognized in your state or county, US Legal Forms makes everything easily accessible.

- Here's how you can quickly acquire the Thousand Oaks California Advance Authorization for Pay Deduction through our reliable platform.

- If you are already a member, you can simply Log In to your account to download the required form.

- However, if you are new to our collection, follow these instructions before downloading the Thousand Oaks California Advance Authorization for Pay Deduction.

Form popularity

FAQ

Advance deduction is a method where an employer deducts an amount from your paycheck to repay an advance you have received. This practice is common in workplace financial agreements and requires clear authorization to avoid confusion. In Thousand Oaks, California, understanding your rights and responsibilities regarding advance deductions is vital, and platforms like USLegalForms offer tools to help clarify these agreements.

Yes, in Thousand Oaks, California, employers can reimburse employees for health insurance premiums under certain conditions. These arrangements must comply with applicable regulations and be clearly documented to avoid any misunderstandings. When planning for these reimbursements, using established procedures and resources like U.S. Legal Forms can help ensure everything is done correctly.

A payroll authorization form is a document that allows an employee to authorize their employer to deduct specified amounts from their paycheck. This form outlines what the deductions will be for, ensuring both parties agree to the terms. Utilizing U.S. Legal Forms can help you streamline the process by providing proper templates designed for Thousand Oaks, California, and aligning with local regulations.

Yes, in Thousand Oaks, California, payroll deductions generally require written approval from the employee. This ensures transparency and maintains the rights of the employee regarding how their compensation is allocated. Clear written consent also helps employers to manage payroll processes effectively, making U.S. Legal Forms an ideal resource for obtaining the right authorization templates.

Payroll deduction authorization signifies that you have given your employer permission to deduct specified amounts from your earnings for particular purposes. This can include health insurance premiums, retirement savings, or other benefits. In Thousand Oaks, California, having this authorization protects both the employer and employee by providing a clear record of consent for these deductions.

The 90-day rule for insurance in Thousand Oaks, California, typically refers to the period during which an employee must wait before their insurance coverage begins after hiring. This rule is designed to give employers time to process paperwork and ensure that all necessary documentation for payroll deductions is in place. Therefore, understanding this rule is important for employees anticipating their benefits starts.

Under federal law, you may deduct an advance from your employee's paycheck. However, you may not deduct so much that it reduces your employee's pay to less than the hourly minimum wage ($7.25, currently).

What types of things cannot be deducted from employees' wages? Employers cannot charge interest or fees for cashing cheques or providing payroll advances. Employers cannot recover business expenses from the wages of employees.

The short answer is no. An employer cannot deduct from an employee's final paycheck any amount representing the unpaid balance of a debt owed by the employee. In California, wage deductions from final pay are highly regulated.

Under federal law, the general rule is that employers may deduct certain expenses from their employees' paychecks, as long as the deductions don't bring the employee's earnings below the minimum wage. (However, there are some exceptions, as explained below.) Some states have laws that are more protective of employees.