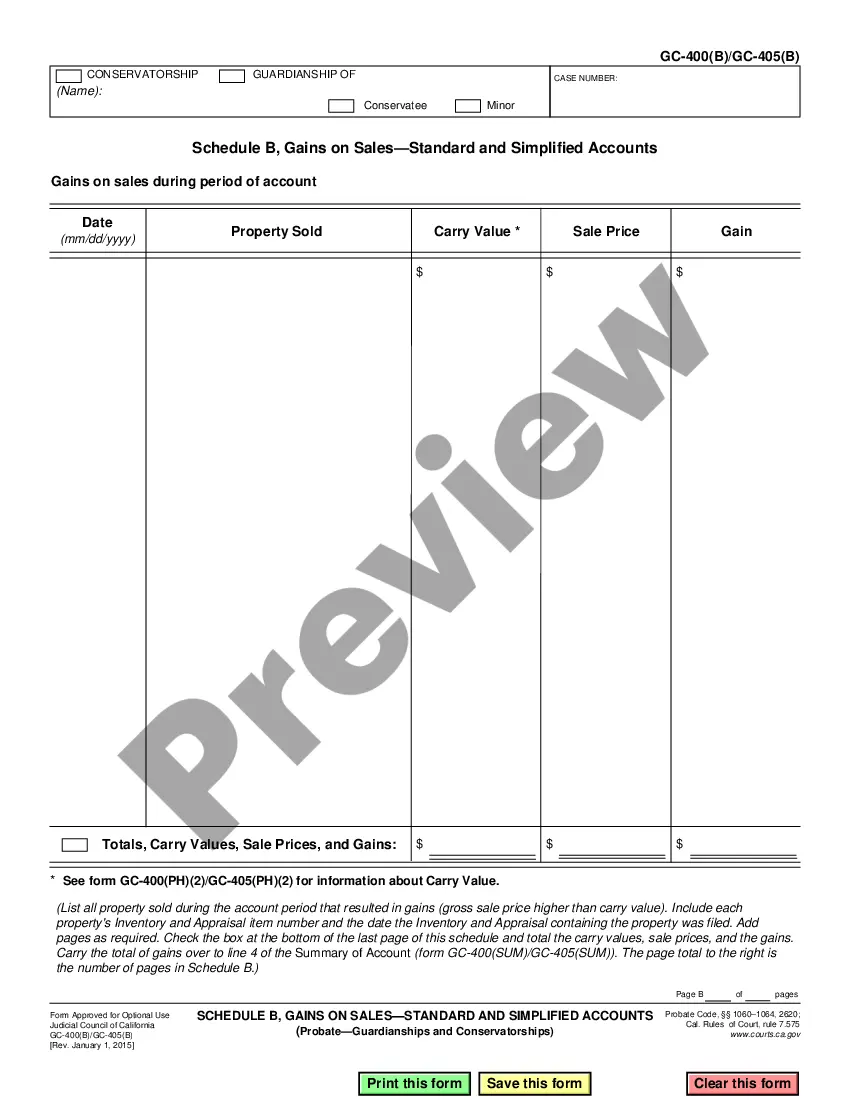

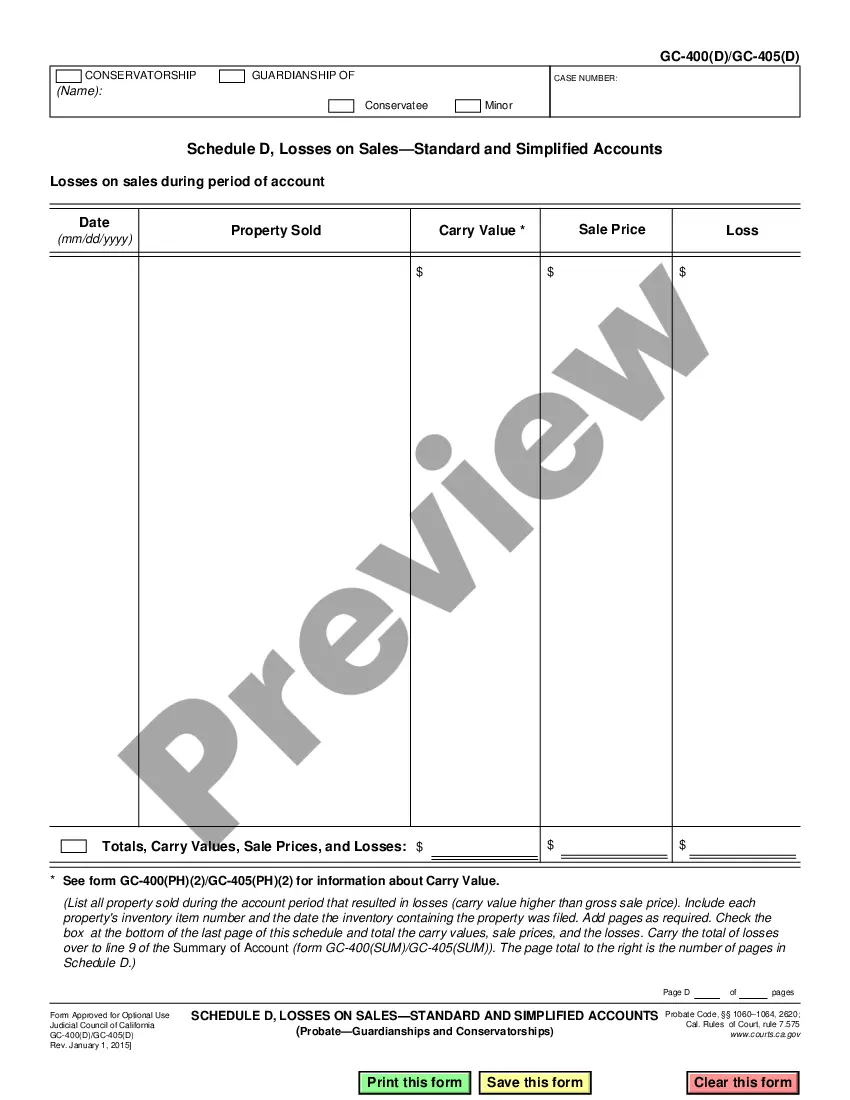

This form is an official California Judicial Council form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

San Diego California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D)

Description

How to fill out California Schedule D, Losses On Sales-Standard And Simplified Accounts 405(D)?

Obtaining validated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms collection.

It’s an online repository of over 85,000 legal forms catering to both personal and professional requirements as well as various real-life circumstances.

All documents are systematically organized by usage area and jurisdictional domains, making it easy and quick to find the San Diego California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D).

Maintaining documentation organized and compliant with legal standards is critically important. Leverage the US Legal Forms library to always have critical document templates readily available for any requirements!

- For those already familiar with our inventory and who have utilized it previously, acquiring the San Diego California Schedule D, Losses on Sales-Standard and Simplified Accounts 405(D) only requires a few clicks.

- Simply Log In to your account, select the document, and click Download to store it on your device.

- This procedure will involve just a few extra steps for new users.

- Follow the instructions below to begin accessing the most extensive online form collection.

- Examine the Preview mode and form description. Ensure you have selected the correct document that fulfills your needs and fully aligns with your local jurisdiction standards.

Form popularity

FAQ

Who Needs to File Schedule D: Capital Gains and Losses? In general, taxpayers who have short-term capital gains, short-term capital losses, long-term capital gains, or long-term capital losses must report this information on Schedule D, an IRS form that accompanies form 1040.

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

Use Schedule CA (540), California Adjustments ? Residents, to make adjustments to your federal adjusted gross income and to your federal itemized deductions using California law.

All California capital gains are taxed as ordinary income. Capital gains or losses occur when an asset is sold for either more or less than you spent to purchase that same item. Capital gains are taxed when you sell the item for more than you bought it for, which creates a realized gain.

Capital loss carryover is the net amount of capital losses eligible to be carried forward into future tax years. Net capital losses (the amount that total capital losses exceed total capital gains) can only be deducted up to a maximum of $3,000 in a tax year.

Key Takeaways. Schedule D is required when a taxpayer reports capital gains or losses from investments or the result of a business venture or partnership. The calculations from Schedule D are combined with individual tax return form 1040, where it will affect the adjusted gross income amount.

Preparing Schedule D and 8949 Any year that you have to report a capital asset transaction, you'll need to prepare Form 8949 before filling out Schedule D unless an exception applies. Form 8949 requires the details of each capital asset transaction.

Purpose. Use California Schedule D (540), California Capital Gain or Loss Adjustment, only if there is a difference between your California and federal capital gains and losses.

You'll have to file a Schedule D form if you realized any capital gains or losses from your investments in taxable accounts. That is, if you sold an asset in a taxable account, you'll need to file. Investments include stocks, ETFs, mutual funds, bonds, options, real estate, futures, cryptocurrency and more.