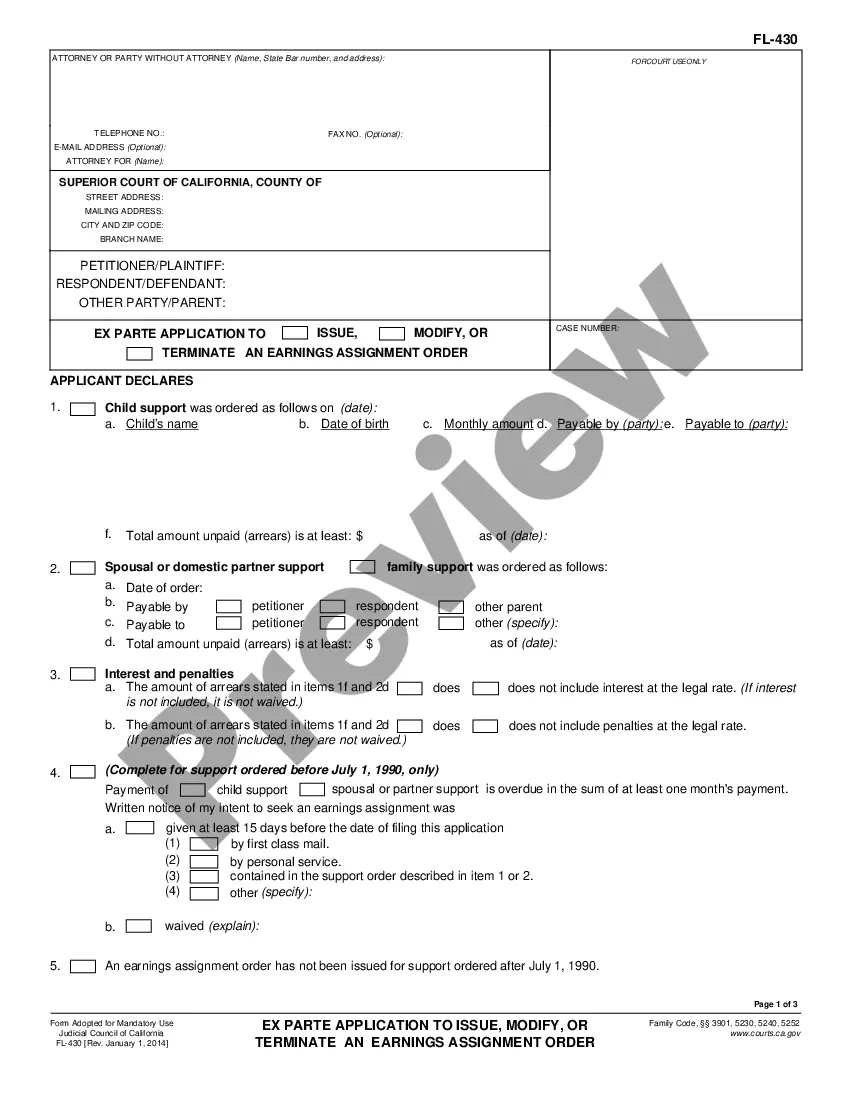

This is an official California Judicial Council family law form, which may be used in domestic litigation in California. Enter the information as indicated on the form and file with the court as appropriate.

Fullerton California Earnings Assignment Order for Spousal Support - Family Law

Description

How to fill out California Earnings Assignment Order For Spousal Support - Family Law?

If you are seeking a pertinent form, it’s challenging to discover a more suitable platform than the US Legal Forms website – one of the most extensive online collections.

Here you can obtain a vast assortment of templates for business and personal needs categorized by type and location, or by keywords.

With the enhanced search feature, locating the latest Fullerton California Earnings Assignment Order for Spousal Support - Family Law is as simple as 1-2-3.

Complete the payment process. Use your credit card or PayPal account to finalize the registration process.

Receive the document. Choose the file format and save it to your device.

- Moreover, the validity of each document is ensured by a team of experienced attorneys who routinely evaluate the templates on our platform and update them in line with the most current state and county regulations.

- If you are already acquainted with our platform and possess an account, all you need to obtain the Fullerton California Earnings Assignment Order for Spousal Support - Family Law is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions outlined below.

- Ensure you have accessed the sample you need. Review its description and utilize the Preview option to inspect its contents. If it doesn’t satisfy your needs, use the Search field at the top of the screen to find the suitable document.

- Verify your choice. Click the Buy now button. Following this, select your desired pricing plan and provide your information to create an account.

Form popularity

FAQ

The FL 157 form, known as the 'Request for Earnings Assignment Order,' is a document used in California to initiate an earnings assignment for spousal support. This form is essential for enforcing the terms of the Fullerton California Earnings Assignment Order for Spousal Support - Family Law, ensuring timely payment of support. By completing this form, you can streamline the process and reduce potential conflict regarding payments. Always consider legal guidance to ensure proper completion and submission for effective results.

In a California divorce settlement, a wife is entitled to a fair share of the marital assets, which includes property, savings, and, potentially, spousal support. The specifics can vary depending on individual circumstances, such as the length of the marriage and financial contributions. The Fullerton California Earnings Assignment Order for Spousal Support - Family Law plays a critical role in securing financial support during this period. It is advisable to seek legal help to ensure your rights are protected and fairly accounted for.

In California, spousal support is awarded based on various factors, including the length of the marriage and each spouse's financial needs. To qualify for spousal support, you must demonstrate that you cannot maintain the same standard of living post-divorce. The Fullerton California Earnings Assignment Order for Spousal Support - Family Law can facilitate the payment process, making it crucial for those who require financial assistance after separation. Consulting with a family law attorney can provide clarity on your situation.

Yes, spousal support is considered taxable income for the recipient and can affect their financial obligations and tax returns. Conversely, the paying spouse may be able to deduct these payments from their taxable income. Understanding this tax implication is crucial within the context of the Fullerton California Earnings Assignment Order for Spousal Support - Family Law.

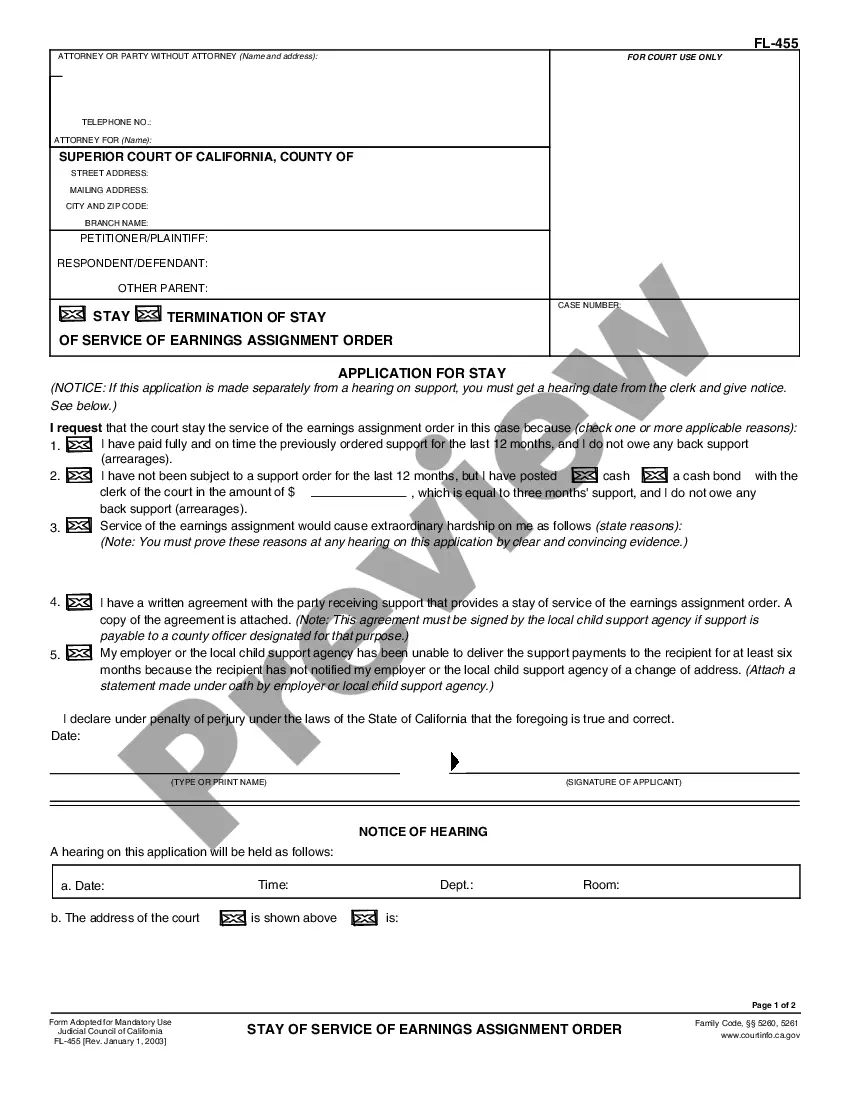

To stop paying spousal support in California, you need to file a request with the court that issued the support order. You must demonstrate a significant change in circumstances, such as a job loss or a change in the recipient's financial situation. It is advisable to consult with legal experts familiar with the Fullerton California Earnings Assignment Order for Spousal Support - Family Law to ensure all steps are correctly taken.

The average spousal support payment in California varies widely based on numerous factors, including the length of the marriage and the income levels of both spouses. Generally, courts may consider a formula or guideline based on a percentage of the higher-earning spouse’s income. Knowing the common figures can help you better navigate the Fullerton California Earnings Assignment Order for Spousal Support - Family Law.

Imputation of income for spousal support occurs when a court assigns an income level to a party based on their potential earning capacity, rather than their actual income. This is often used when a spouse is voluntarily unemployed or underemployed. Understanding how this applies in your case can be crucial, especially in the realm of Fullerton California Earnings Assignment Order for Spousal Support - Family Law.

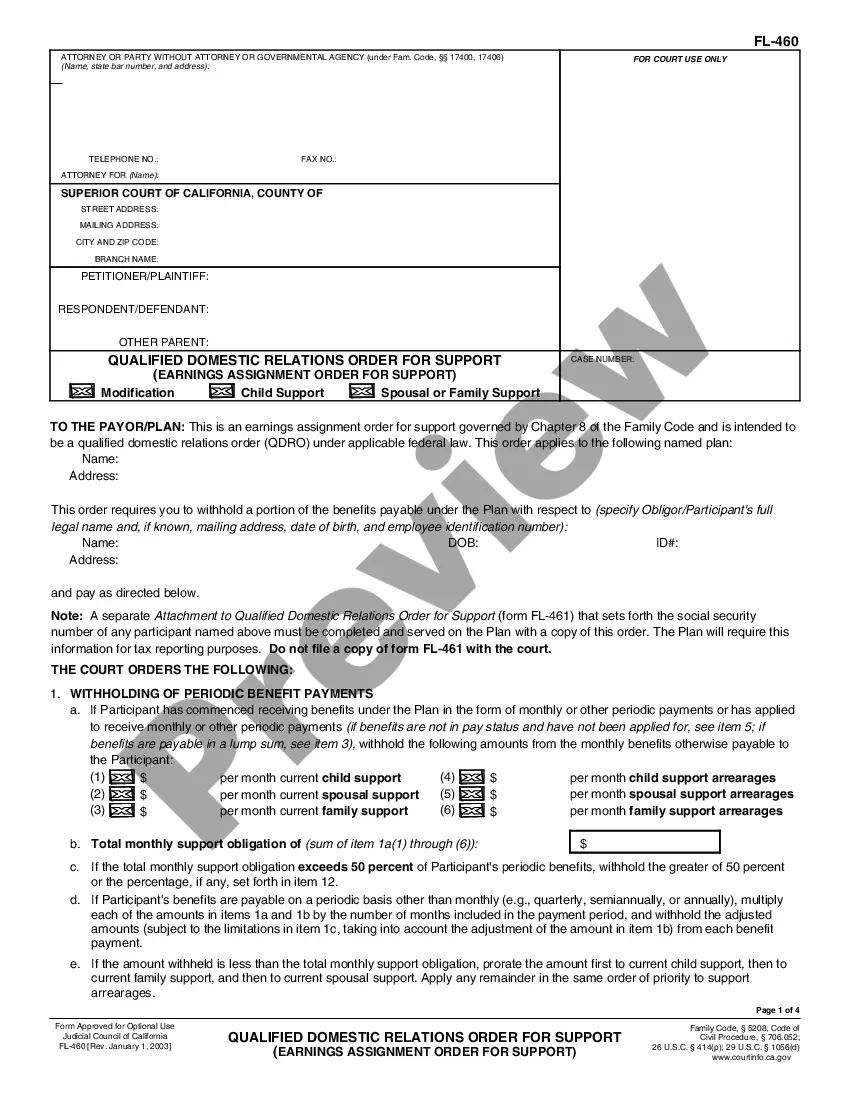

To garnish wages for spousal support in California, you must obtain a court order and then serve this order along with the necessary documents to the employer of the spouse who owes support. The employer will then withhold a portion of their wages and send it directly to you or the appropriate agency. The Fullerton California Earnings Assignment Order for Spousal Support - Family Law is a key tool for initiating and managing such wage garnishments effectively.

To enforce a spousal support order in California, you can file a motion with the court that issued the order. This may involve providing evidence of non-payment and requesting that the court enforce the order through methods such as wage garnishment or further legal action. Utilizing the Fullerton California Earnings Assignment Order for Spousal Support - Family Law can streamline this process and help ensure compliance.

The FL 157 form in California, also known as the Earnings Assignment Order for Spousal Support, is a legal document used to direct an employer to withhold spousal support payments from the paying spouse’s wages. This form is crucial for ensuring that payments are made regularly and on time. If you are in Fullerton, understanding how to properly fill out this form is essential in the context of the Fullerton California Earnings Assignment Order for Spousal Support - Family Law.