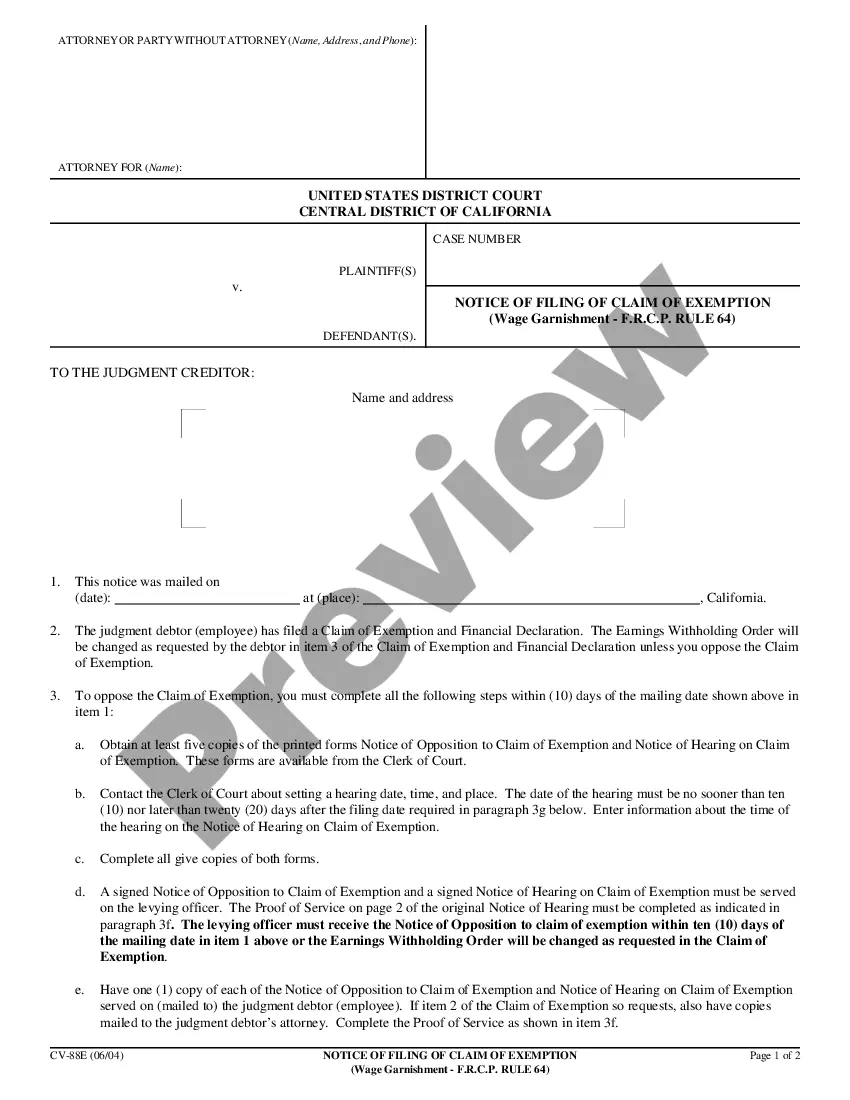

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Anaheim California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64?

Utilize the US Legal Forms and gain prompt access to any form template you desire.

Our advantageous website featuring thousands of templates enables you to discover and acquire virtually any document sample you may require.

You can save, complete, and sign the Anaheim California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64 in merely a few minutes instead of scouring the internet for countless hours seeking a suitable template.

Using our assortment is an excellent method to enhance the security of your form submissions.

If you haven’t created an account yet, follow the steps below.

Access the page with the form you require. Ensure that it is the template you were looking for: verify its title and description, and use the Preview function if available. Otherwise, use the Search box to find the right one.

- Our skilled attorneys regularly review all documents to ensure that the forms are suitable for a specific state and adhere to current acts and regulations.

- How can you acquire the Anaheim California Employer's Return - Wage Garnishment - F.R.C.P. Rule 64.

- If you possess a profile, simply Log In to your account.

- The Download option will appear for all the samples you view.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

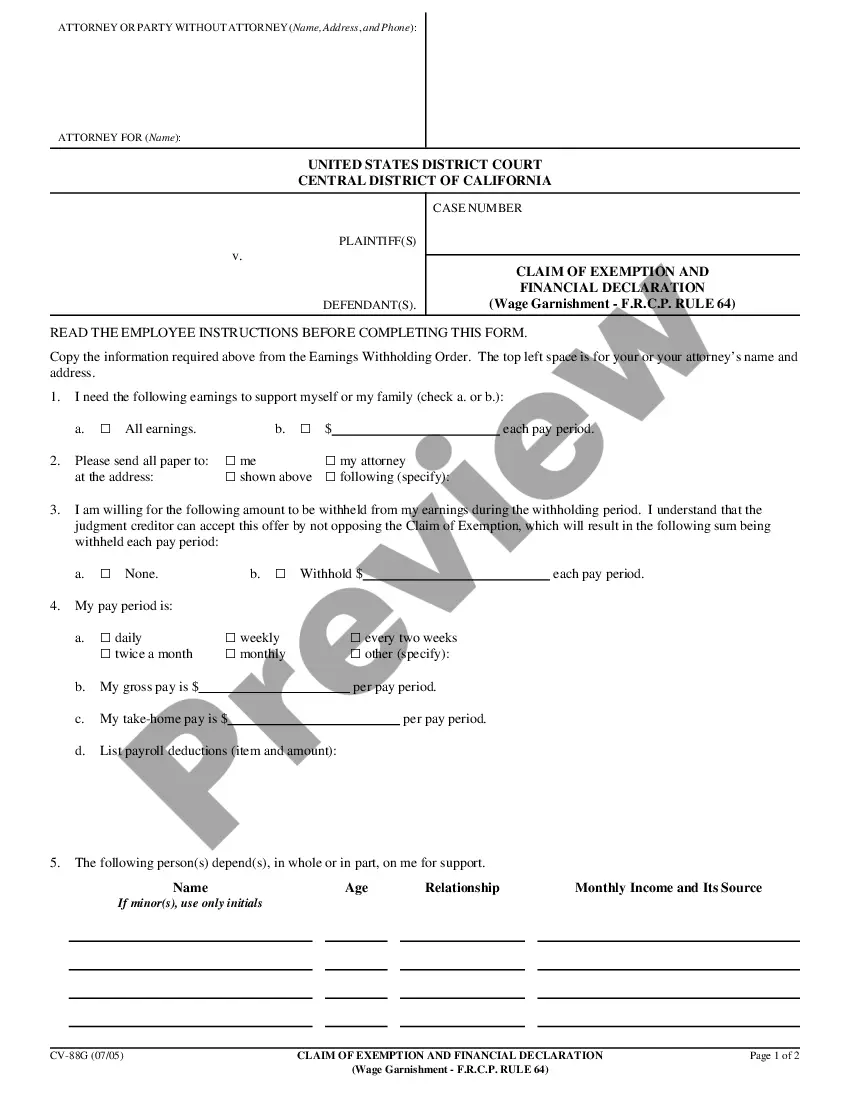

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

Wage garnishment is a legal procedure in which a person's earnings are required by court order to be withheld by an employer for the payment of a debt such as child support.

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

A wage garnishment requires employers to withhold and transmit a portion of an employee's wages until the balance on the order is paid in full or the order is released by us. We issue 3 types of wage garnishments: Earnings withholding orders (EWO): Earnings Withholding Order for Vehicle Registration (FTB 2204)

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

While I wage garnishment should be avoided at all costs, federal and California law affords you some protections. You cannot be fired by your employer the first time your wages are garnished. No more than 25% of your wages, after taxes, can be garnished either.

The earnings withholding order is valid until 180 consecutive days have passed with no money withheld under that order from that employee's earnings.

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

The amount of pay subject to garnishment is based on an employee's ?disposable earnings,? which is the amount of earnings left after legally required deductions are made.