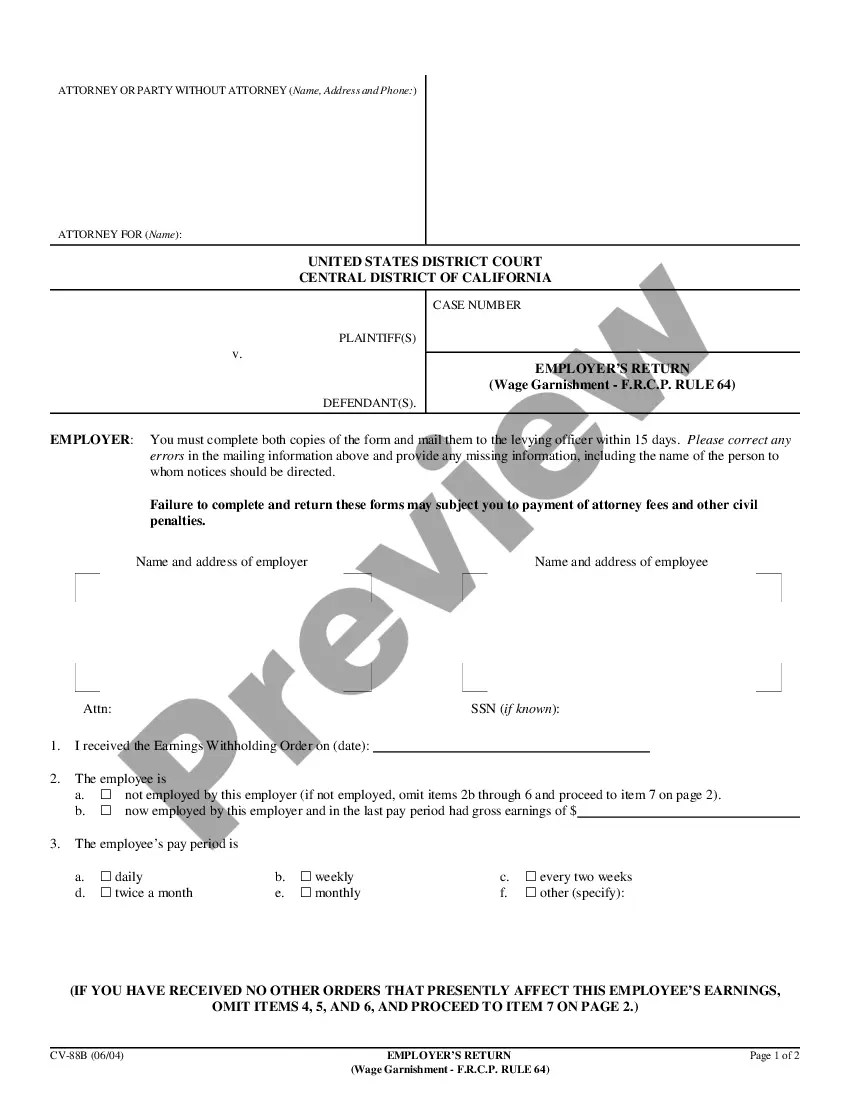

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Bakersfield California Wage Garnishment Package - F.R.C.P. Rule 64

Description

How to fill out California Wage Garnishment Package - F.R.C.P. Rule 64?

If you are seeking a legitimate form template, it’s unfeasible to find a more suitable service than the US Legal Forms website – arguably the most extensive online collections.

With this collection, you can access thousands of document samples for commercial and personal uses categorized by types and states, or keywords.

With our enhanced search feature, locating the latest Bakersfield California Wage Garnishment Package - F.R.C.P. Rule 64 is as simple as 1-2-3.

Obtain the template. Choose the format and download it onto your device.

Make modifications. Fill out, modify, print, and sign the obtained Bakersfield California Wage Garnishment Package - F.R.C.P. Rule 64.

- If you are already familiar with our system and have an account, all you need to do to acquire the Bakersfield California Wage Garnishment Package - F.R.C.P. Rule 64 is to Log In to your account and click the Download button.

- If you are utilizing US Legal Forms for the first time, just adhere to the instructions provided below.

- Ensure you have located the form you need. Review its description and utilize the Preview option to view its contents. If it doesn’t fulfill your requirements, use the Search box at the top of the screen to find the suitable document.

- Verify your choice. Select the Buy now button. Then, choose the preferred subscription plan and enter the details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Form popularity

FAQ

Get form EJ-100 and fill it out. File it with the court and send a copy to the debtor. Keep a copy for your records. Notify the levying officer (i.e., the sheriff's department) that the judgment has been paid and ask them to release the garnishment.

Note that a levy is only effective on the balance in your accounts at the financial institution as of the date it's served. Calif. Code of Civil Procedure § 700.140(b). So as long as the amount you have in your accounts there on that date is no more than $1,826, all of your funds are protected.

Get form EJ-100 and fill it out. File it with the court and send a copy to the debtor. Keep a copy for your records. Notify the levying officer (i.e., the sheriff's department) that the judgment has been paid and ask them to release the garnishment.

Even after a garnishment has started, you can still try and negotiate a resolution with the creditor, especially if your circumstances change.

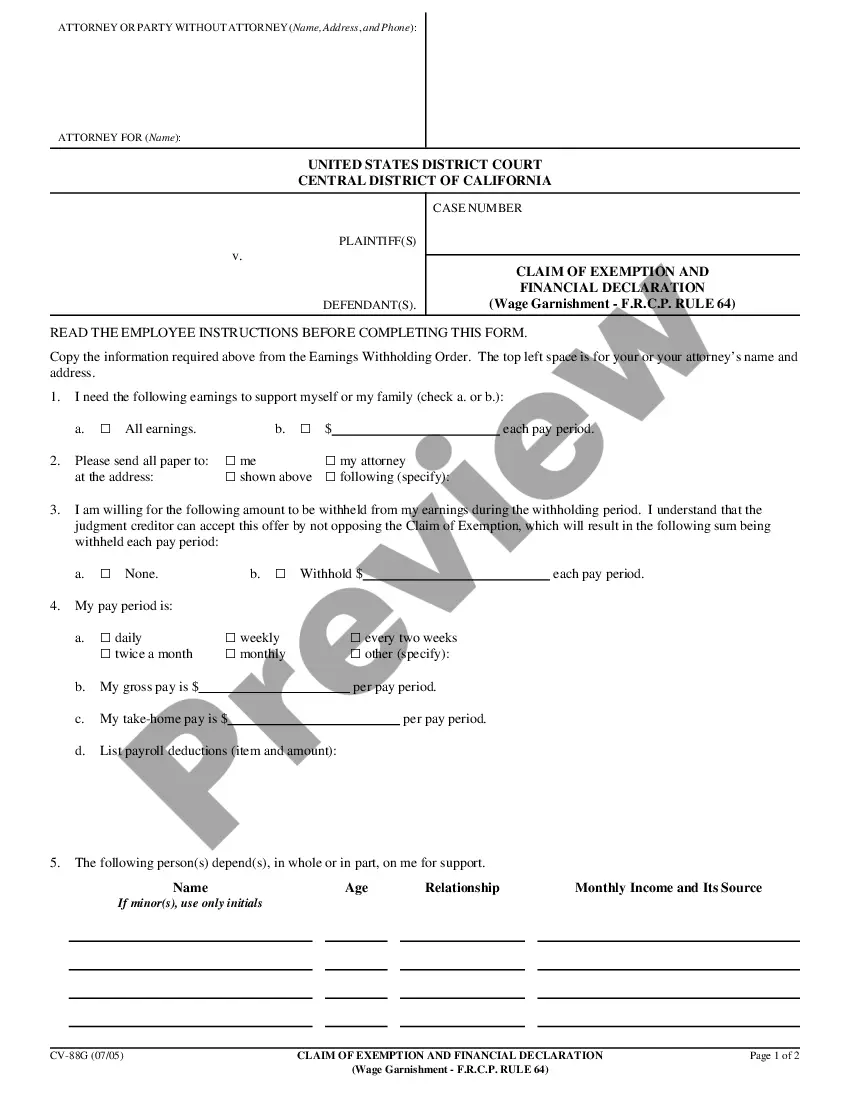

Under California law, the most that can be garnished from your wages is the lesser of: 25% of your disposable earnings for that week or. 50% of the amount by which your weekly disposable earnings exceed 40 times the state hourly minimum wage.

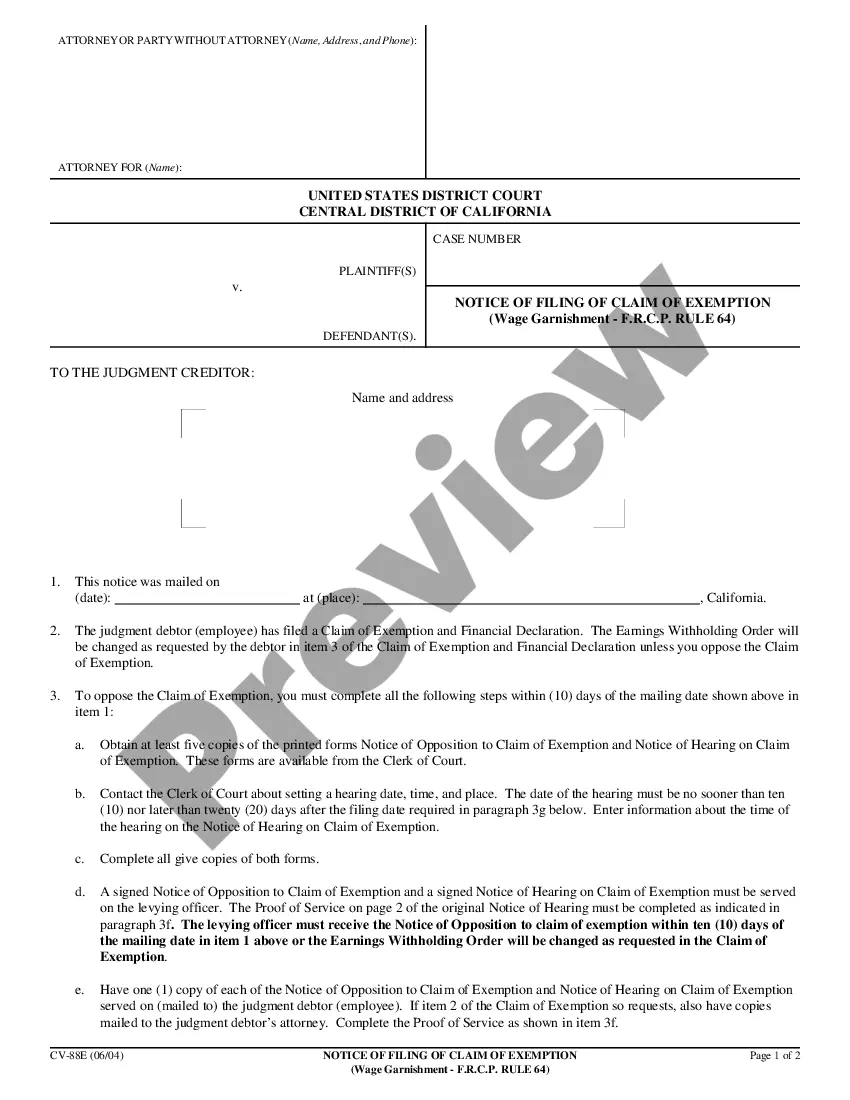

With the notice of garnishment, you should have been served with a form to claim the exemption for money necessary for support. To claim the exemption in wages, you need to also complete the form financial statement. Note that the financial statement asks for your monthly income.

File an Exemption ? In California you may be able to stop the Wage Garnishment through filing an exemption. You may be able to have the wage garnishment stop or reduce the amount being garnished if you can show that the money is needed to support you or your family.

Paying the debt in full stops the wage garnishment. However, if you cannot pay the debt in full, you might be able to negotiate with the creditor for a settlement. For example, the creditor may agree to accept a lower amount to pay off the wage garnishment if you pay the amount in one payment within 30 to 60 days.

A wage garnishment requires employers to withhold and transmit a portion of an employee's wages until the balance on the order is paid in full or the order is released by us. We issue 3 types of wage garnishments: Earnings withholding orders (EWO): Earnings Withholding Order for Vehicle Registration (FTB 2204)

In California, an earnings withholding order carries the same force as a court order. If the employer fails to complete the memorandum of garnishee and withdraw the required wages from the debtor's paycheck, the creditor should immediately send a demand letter to the employer.