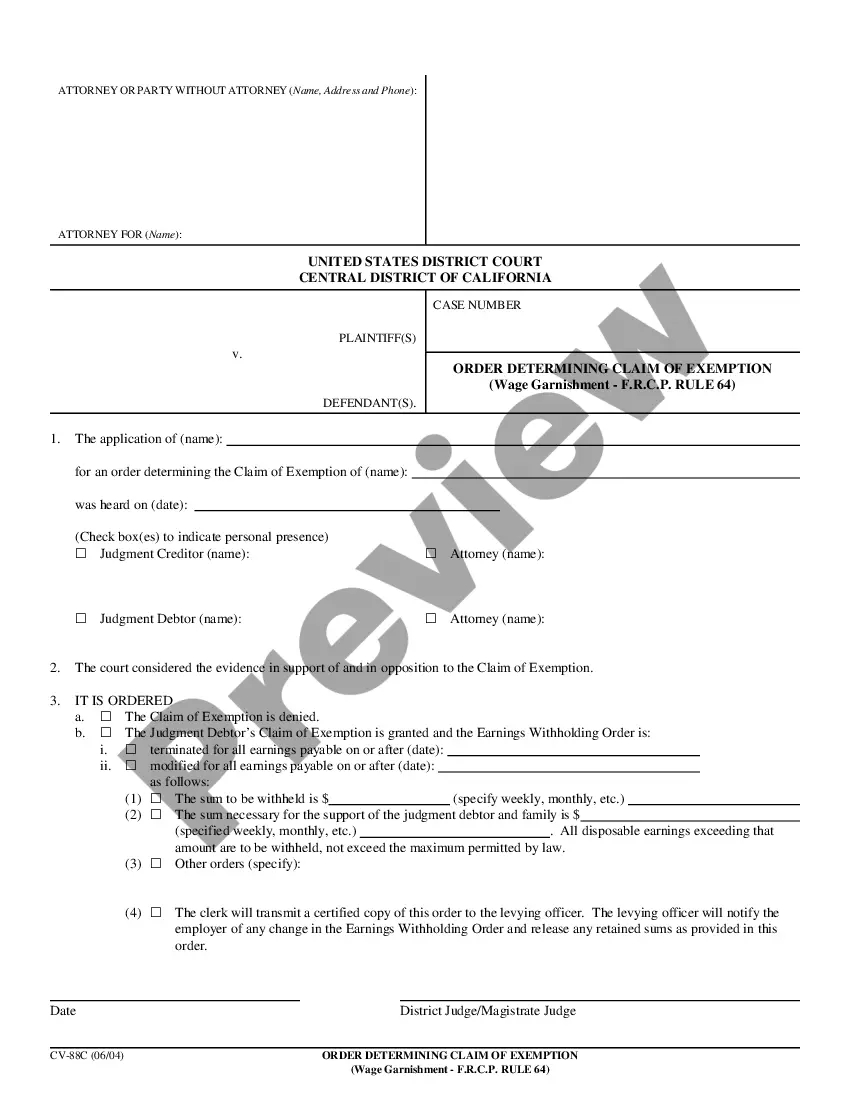

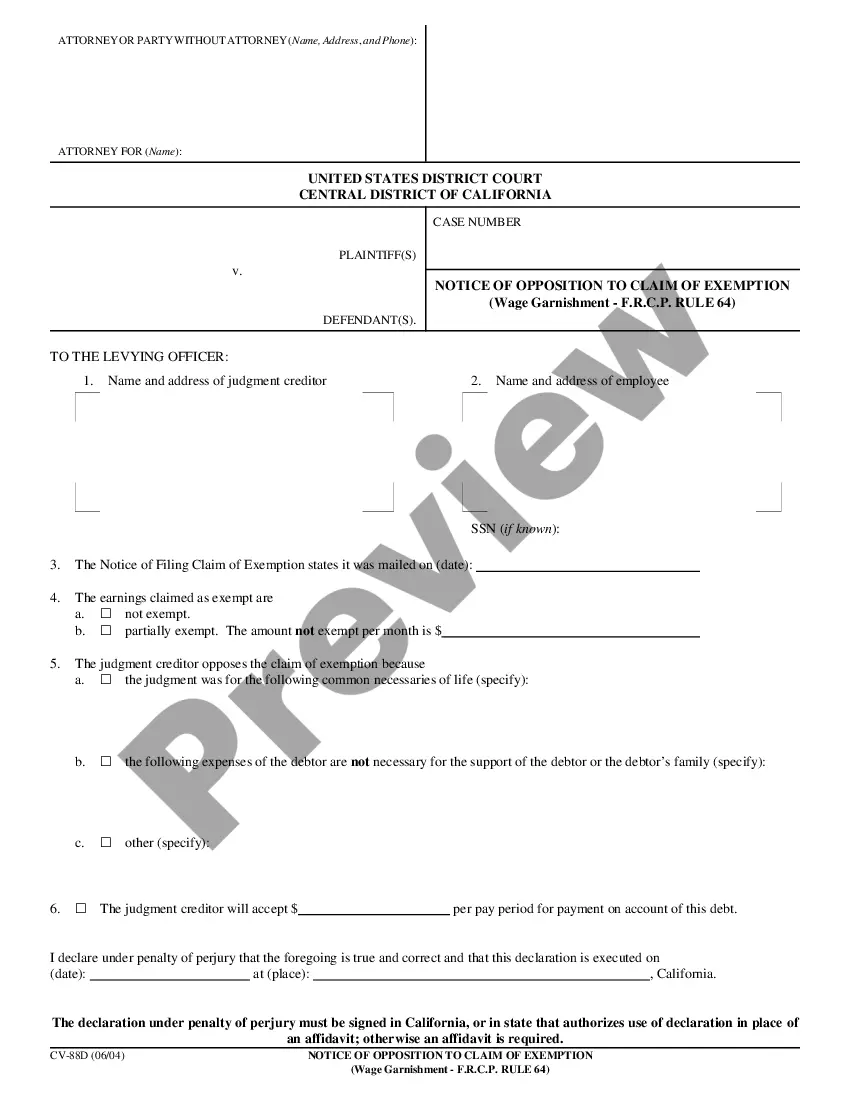

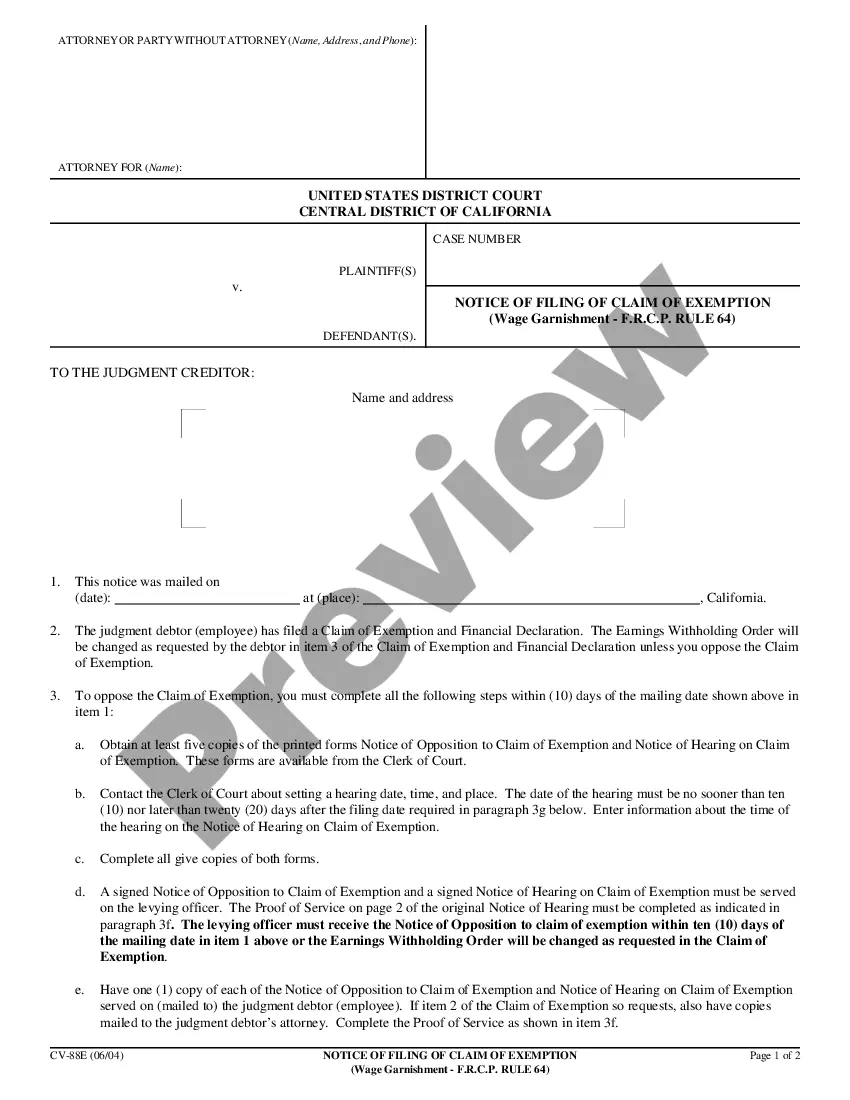

This form is an official United States District Court - California Central District form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64

Description

How to fill out California Claim Of Exemption And Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64?

Regardless of one's social or occupational standing, completing legal documents is an unfortunate requirement in the modern era.

Often, it is nearly impossible for an individual without a legal background to create these kinds of documents from scratch, primarily due to the complex terminology and legal subtleties they encompass.

This is where US Legal Forms can be a lifesaver.

Verify that the form you have located is valid for your area, keeping in mind that the laws of one state or county may not apply to another.

Review the document and check a brief overview (if available) of the scenarios for which the form can be utilized.

- Our service offers an extensive collection of more than 85,000 state-specific forms suitable for nearly any legal situation.

- US Legal Forms is also a fantastic resource for associates or legal advisors looking to save time using our DIY documents.

- Whether you need the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 or any other form that is applicable in your state or county, with US Legal Forms, everything is readily accessible.

- Here’s how to obtain the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 in just minutes using our reliable service.

- If you are already a subscriber, you can simply Log In to your account to access the required form.

- However, if you are new to our platform, be sure to follow these steps before downloading the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64.

Form popularity

FAQ

Filing an exemption for wage garnishment in California requires you to submit a Claim of Exemption to the court where the wage garnishment was issued. You will also need to include a financial declaration detailing your financial situation. It is important to adhere to F.R.C.P. Rule 64 to ensure your exemption is correctly processed. USLegalForms can assist you in preparing these documents, helping you navigate the legal landscape with ease.

To stop wage garnishment in California, it is essential to understand your legal options. You may file a Claim of Exemption, which can significantly reduce or eliminate the amount being garnished from your wages. Engaging with the process can be daunting, but tools like USLegalForms simplify the completion of your financial declaration necessary under F.R.C.P. Rule 64. Taking these steps can help you regain control over your finances.

Filing a Claim of Exemption for wage garnishment in California involves completing the appropriate forms and submitting them to the court. You will need to provide a financial declaration which outlines your income and expenses. In Vallejo, California, following F.R.C.P. Rule 64 ensures your claim is processed correctly. USLegalForms offers user-friendly templates that can guide you through the filing process smoothly.

To stop a wage garnishment immediately in California, you may file a Claim of Exemption. This process allows you to request a court to exempt a portion of your wages from garnishment. In Vallejo, you can use the financial declaration form required under F.R.C.P. Rule 64. Acting quickly is key, so consider using USLegalForms to prepare your documents accurately and efficiently.

In Sacramento County, wage garnishment refers to the legal process through which a creditor can collect a debt by having a portion of your wages withheld from your paycheck. This process requires a court order and adherence to state regulations. Understanding the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 is crucial for residents facing garnishment, as it may help in determining your eligibility for protection or exemptions based on your financial situation.

To file a claim of exemption for wage garnishment in California, you need to complete and submit a Claim of Exemption form to the court where the garnishment was issued. This form allows you to assert that certain amounts of your wages should be protected from garnishment due to financial hardship or other qualifying reasons. Knowing how to navigate the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 process is vital. You may also consider using uslegalforms to assist you in filing the necessary paperwork accurately.

The maximum amount that can be garnished from a paycheck in California is generally 25% of your disposable income, or the amount by which your weekly earnings exceed 40 times the minimum wage, whichever is less. This ensures that you have sufficient funds for living expenses while still allowing creditors to recover debts. By utilizing the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64, you can explore options that may further protect your paycheck from excessive garnishment.

In California, wage garnishment is governed by state laws that outline specific rules for creditors. Generally, creditors must obtain a court order before garnishing wages. Additionally, the law limits the amount that can be garnished, ensuring that individuals retain enough income to cover their basic living expenses. Understanding the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 can provide you with helpful insights if you find yourself facing wage garnishment.

In New Jersey, wage garnishment rules dictate that a creditor must obtain a court order before garnishing your wages. The state limits the amount that can be garnished to help protect your income, allowing you to live your life. If you are facing garnishment, it would be wise to explore options like the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 for guidance and support.

The best way to stop wage garnishment involves understanding your rights and taking proactive measures. Utilize the Vallejo California Claim of Exemption and Financial Declaration - Wage Garnishment - F.R.C.P. Rule 64 to file an exemption claim, ensuring you provide adequate documentation of your financial status. Consulting with a legal expert can also enhance your chances of successfully halting the garnishment.