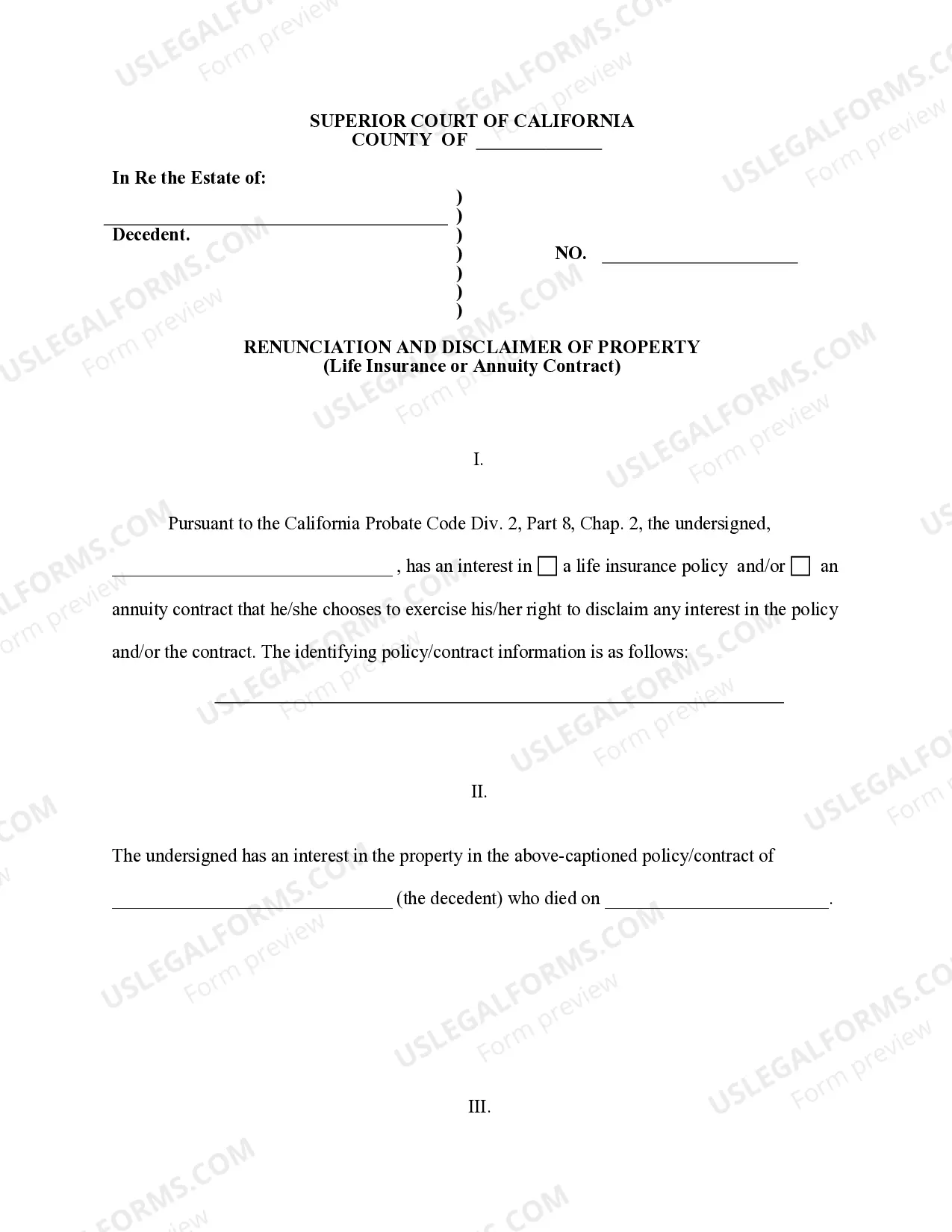

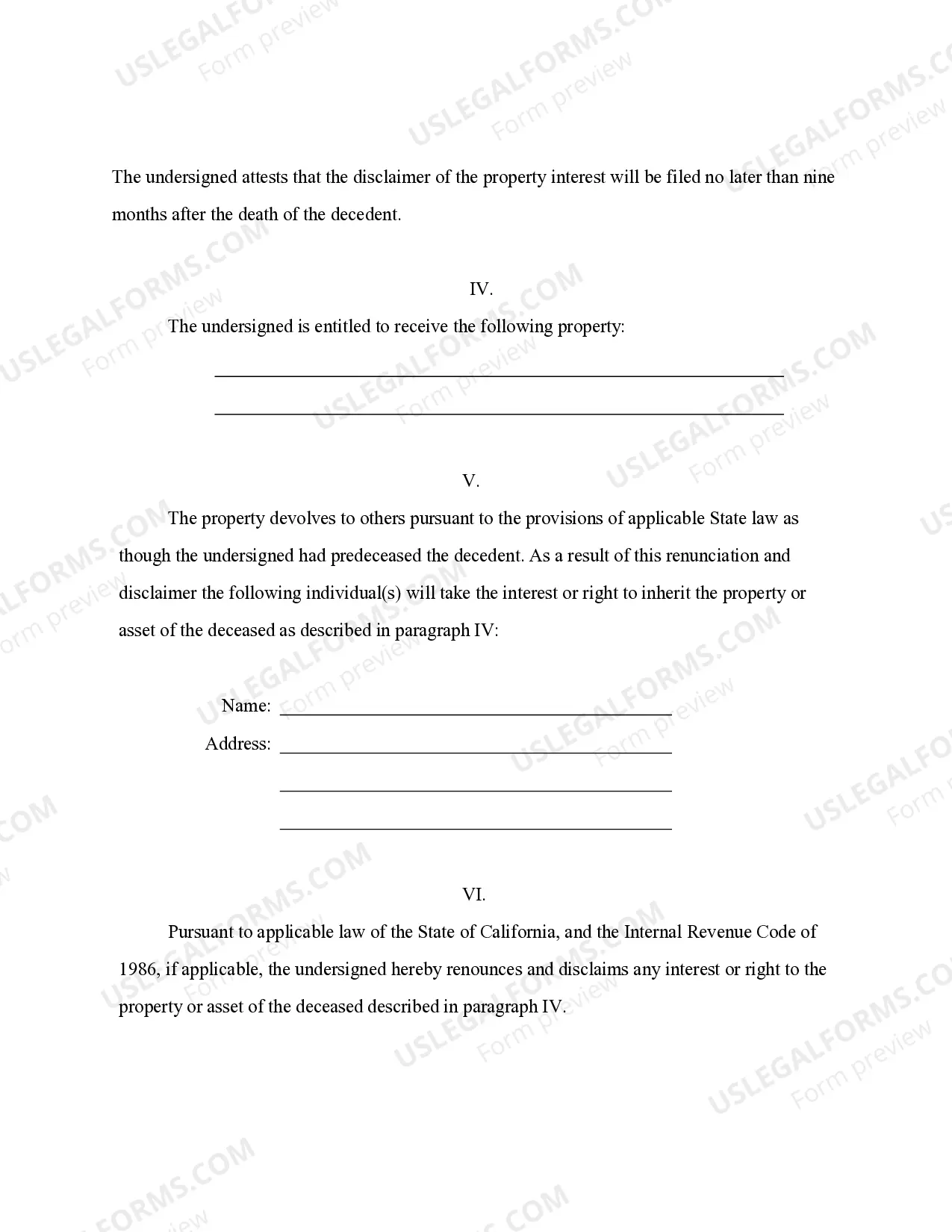

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out California Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Utilize the US Legal Forms and gain immediate access to any template example you require.

Our efficient platform with a vast array of templates streamlines the process of locating and acquiring almost any document example you might need.

You can download, complete, and validate the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract in mere minutes rather than spending several hours searching the internet for a suitable template.

Leveraging our catalog is an excellent method to enhance the security of your document submissions.

If you haven't created an account yet, follow the instructions provided below.

Locate the template you require. Ensure that it is the template you are looking for: verify its name and description, and use the Preview feature if it is offered. Otherwise, use the Search bar to find the necessary one.

- Our skilled legal experts routinely review all the documents to ensure that the templates are applicable to a specific region and adhere to new laws and regulations.

- How can you acquire the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract? If you have a subscription, simply Log In to your account.

- The Download button will appear on all the documents you view. Additionally, you can access all your previously saved documents in the My documents section.

Form popularity

FAQ

While 'renounce' and 'disclaim' may seem similar, they have distinct meanings, especially in legal terminology. In the context of the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, 'disclaim' specifically pertains to refusing an inheritance or benefit. Conversely, 'renounce' is a broader term that can include rejecting rights or claims in various scenarios. Having this clarity can guide you in making the right legal choices.

The terms 'renounce' and 'reject' convey different meanings in legal contexts. To 'renounce' refers to formally giving up a right or claim, such as in the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. In contrast, to 'reject' often implies a refusal of an offer or proposal without formal acknowledgment. It’s crucial to understand these definitions when navigating legal documents to ensure you're making informed decisions regarding your assets.

Renunciation of a will involves a person choosing to refuse their inheritance as stated in the will. In the context of the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, this means that an individual is actively declining the rights to assets allocated to them. This legal gesture can benefit the renouncing party, especially in situations involving debts or tax implications. It's essential to follow the correct legal processes to ensure the renunciation is valid.

In the context of the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, both terms can be used interchangeably. However, 'disclaim' is more commonly accepted in legal language when referring to the rejection of an inheritance or benefit. When you disclaim, you are formally giving up any legal rights to the property or benefits in question. Understanding this distinction can help ensure you proceed correctly in your situation.

A beneficiary may choose to disclaim property for various reasons. They might believe that accepting the property would result in a financial burden, such as taxes or maintenance costs associated with the inherited asset. By executing a disclaimer under the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, they enable other beneficiaries to take over the property without complications. This decision is often strategic, aimed at ensuring that all parties benefit in the long run.

Transferring a property from a trust after death in California requires following specific legal protocols. Initially, identify the successor trustee who will manage the trust under the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. The trustee must review the trust document and decide how to distribute the property according to the wishes outlined by the deceased. It's advisable to consult legal resources or platforms like USLegalForms for guidance on the correct procedure.

An example of a disclaimer is when a beneficiary receives a gift of real estate but decides it would be more advantageous to refuse it. Under the framework of the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, the individual submits a formal statement indicating that they do not wish to accept the property. This ensures that the property can pass to another beneficiary who may benefit more from it.

To write an inheritance disclaimer letter, begin by stating your full name and the date. Then, express your decision to refuse the inherited property, referencing the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. Make sure to describe the property clearly and conclude with your signature and any other required procedural details. A service like USLegalForms can provide templates to assist in drafting this letter effectively.

A real estate disclaimer should clearly specify your intention to refuse the property in question. Include essential details, such as the property address, as part of the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. It’s wise to attach a statement that the disclaimer is irrevocable. Using a legal template or platform like USLegalForms can simplify this process, ensuring compliance with necessary laws.

Writing an inheritance disclaimer involves a straightforward process. Start by stating your intention to disclaim the specific property involved in the San Diego California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract. Clearly identify the details of the property and include your signature for authenticity. It’s essential to be aware of local laws to ensure compliance and potentially consult legal advice if needed.