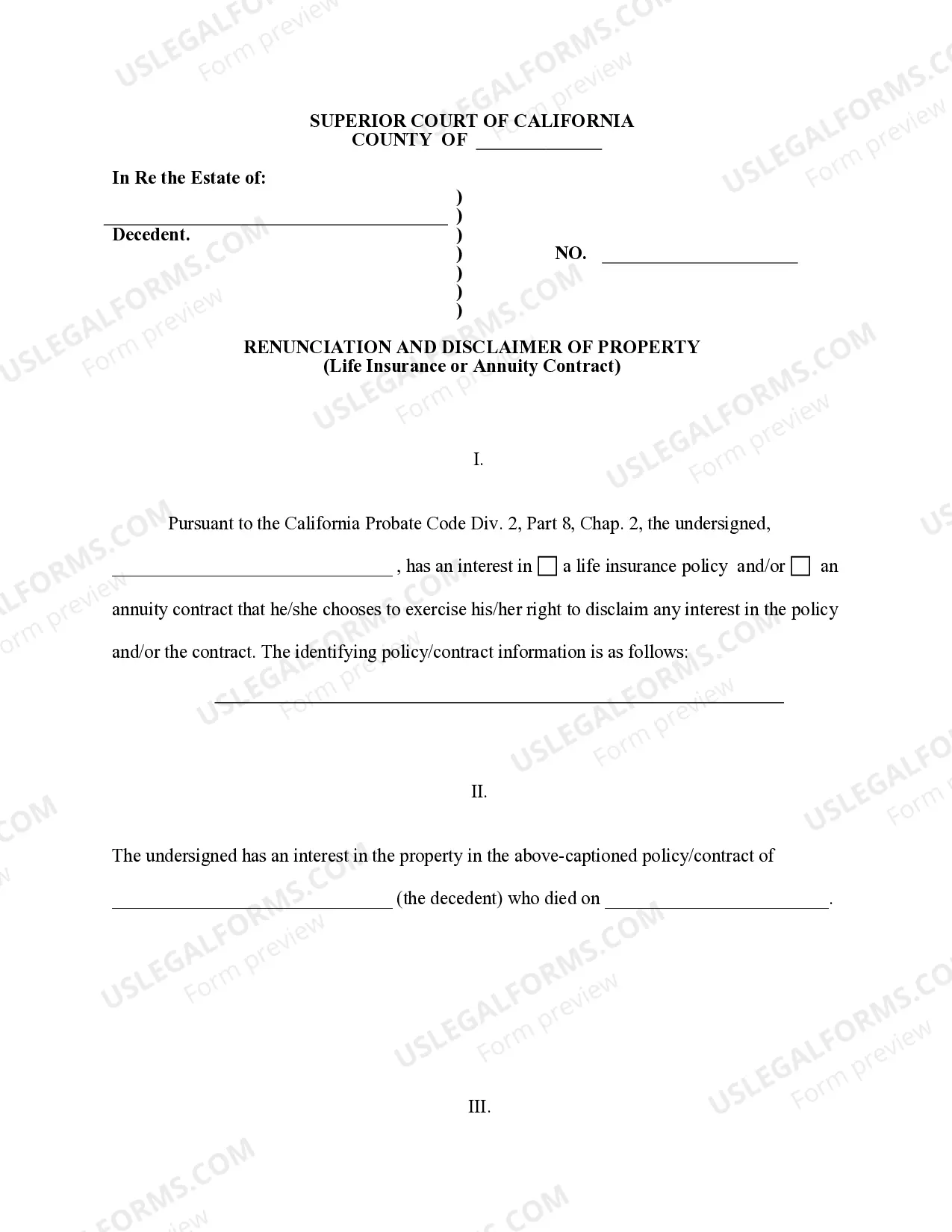

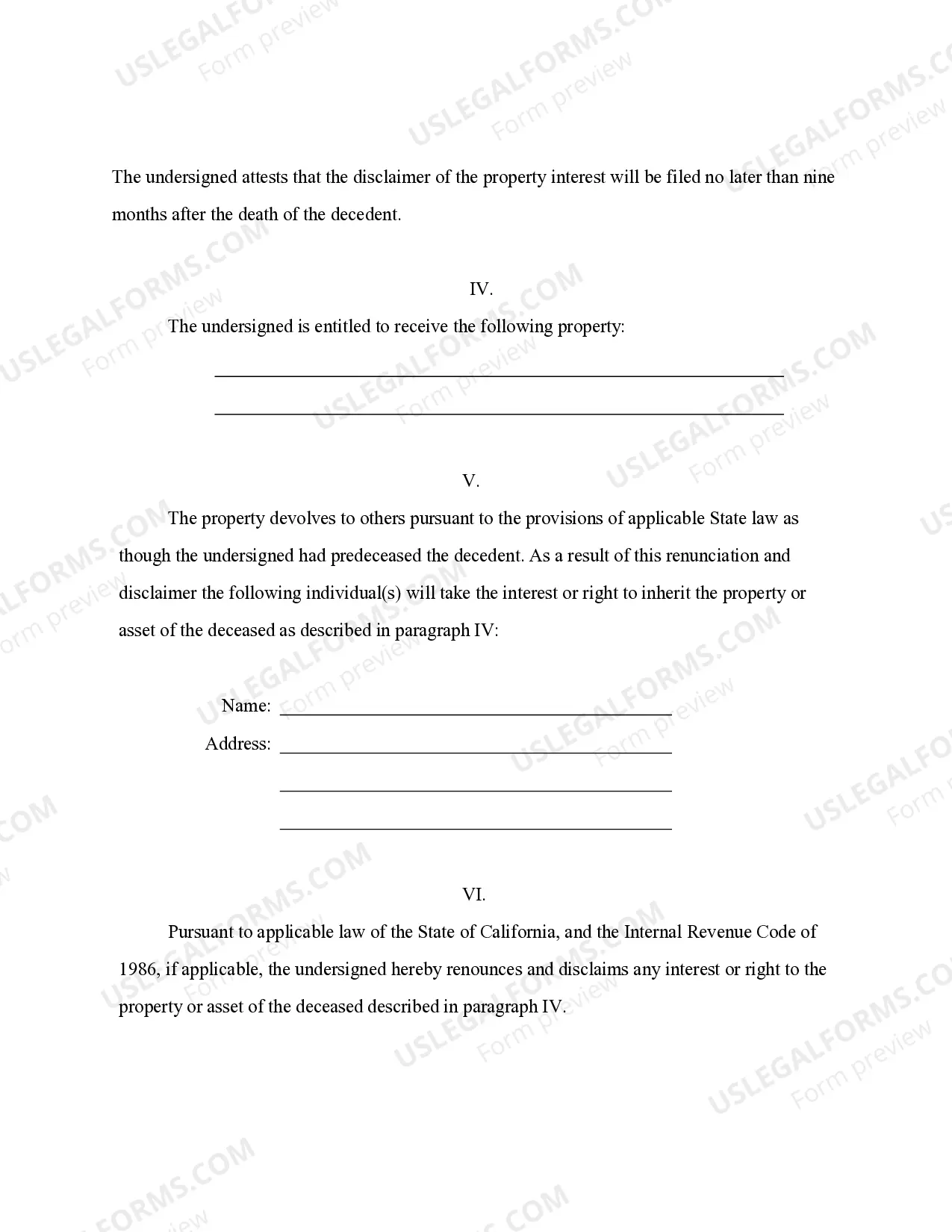

This form is a Renunciation and Disclaimer of Life Insurance and/or Annuity Contract proceeds. The beneficiary has an interest in life insurance and/or annuity contract proceeds due to the death of the decedent. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim his/her interest in the proceeds. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out California Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Regardless of social or professional standing, finishing legal paperwork is an unfortunate requirement in today’s society.

Frequently, it’s nearly impossible for someone without legal education to create such documents from scratch, largely due to the complex terminology and legal nuances they involve.

This is where US Legal Forms steps in to help.

Ensure the form you found is appropriate for your locality, as regulations in one state or region do not apply to another.

Review the form and go through a brief overview (if available) of the situations for which the document can be utilized.

- Our service offers a vast repository with over 85,000 ready-to-use state-specific forms suitable for nearly any legal situation.

- US Legal Forms is also a tremendous resource for associates or legal advisors looking to save time using our DIY documents.

- Whether you require the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract or any other document applicable in your state or region, US Legal Forms has everything readily available.

- Here’s how you can swiftly obtain the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract using our reliable service.

- If you are already a subscriber, proceed to Log In to your account to get the required form.

- However, if this is your first time using our library, please follow these steps before securing the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

Form popularity

FAQ

Yes, annuities are generally protected in California through state regulations that help safeguard policyholders in case of insurance company insolvency. The California Department of Insurance provides oversight to ensure annuity holders receive their benefits. If you need to explore the implications of the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, consider using services from US Legal Forms to get the necessary documents.

Section 10509 of the California Insurance Code addresses the rights of individuals concerning the renunciation and disclaimer of benefits from life insurance or annuity contracts. This section defines the legal framework for individuals wishing to refuse or relinquish rights to benefits. If you're exploring the implications of the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, understanding this section can be pivotal in making informed decisions.

If your annuity provider fails, state guaranty associations often step in to protect policyholders up to certain limits. This means you may still receive your guaranteed benefits, depending on the size of your annuity and the state's coverage limits. If you are navigating the complexities of the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, seeking advice can help ensure you understand your protections.

Annuities are generally separate from bank accounts and often considered safer because they are regulated by state insurance departments, not the federal government. If a bank fails, your annuity will usually remain intact since it is not tied to the bank's assets. However, understanding the nuances of the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract can help you safeguard your investments during economic uncertainty.

Annuities in California are typically backed by the financial strength of the issuing insurance company, which provides a level of guarantee. However, guarantees can vary based on the issuer's stability and financial health. If you're considering the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, it’s important to review the guarantees associated with your specific annuity product.

If the market crashes, the impact on an annuity depends on its type. Fixed annuities generally maintain their value because they are backed by the issuing insurance company. Variable annuities, on the other hand, may lose value as they are tied to investments in the market. Understanding how the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract interacts with these scenarios can be crucial in planning.

Finding a life insurance policy after someone's passing can be a straightforward process. Start by searching through important documents, such as wills or any financial records. If those avenues don’t yield results, organizations like the National Association of Insurance Commissioners can assist in tracking down policies. Using the USLegalForms platform may ease the process of dealing with the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract as well.

Annuities in California can be protected under state laws, especially when they are allocated for retirement savings. In some cases, they may be exempt from judgments and creditor claims. For tailored advice concerning the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract, consulting a legal professional is essential.

In California, annuities are primarily regulated by the California Department of Insurance. This department establishes and enforces rules to protect consumers and ensure fair practices among insurance companies. Familiarizing yourself with these regulations is crucial when dealing with the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.

To check for life insurance policies, start by reviewing any documents or records the deceased may have left behind. You can also contact their banks and financial institutions for any active policies. Additionally, using resources like USLegalForms can help you navigate the process of the Oxnard California Renunciation And Disclaimer of Property from Life Insurance or Annuity Contract.