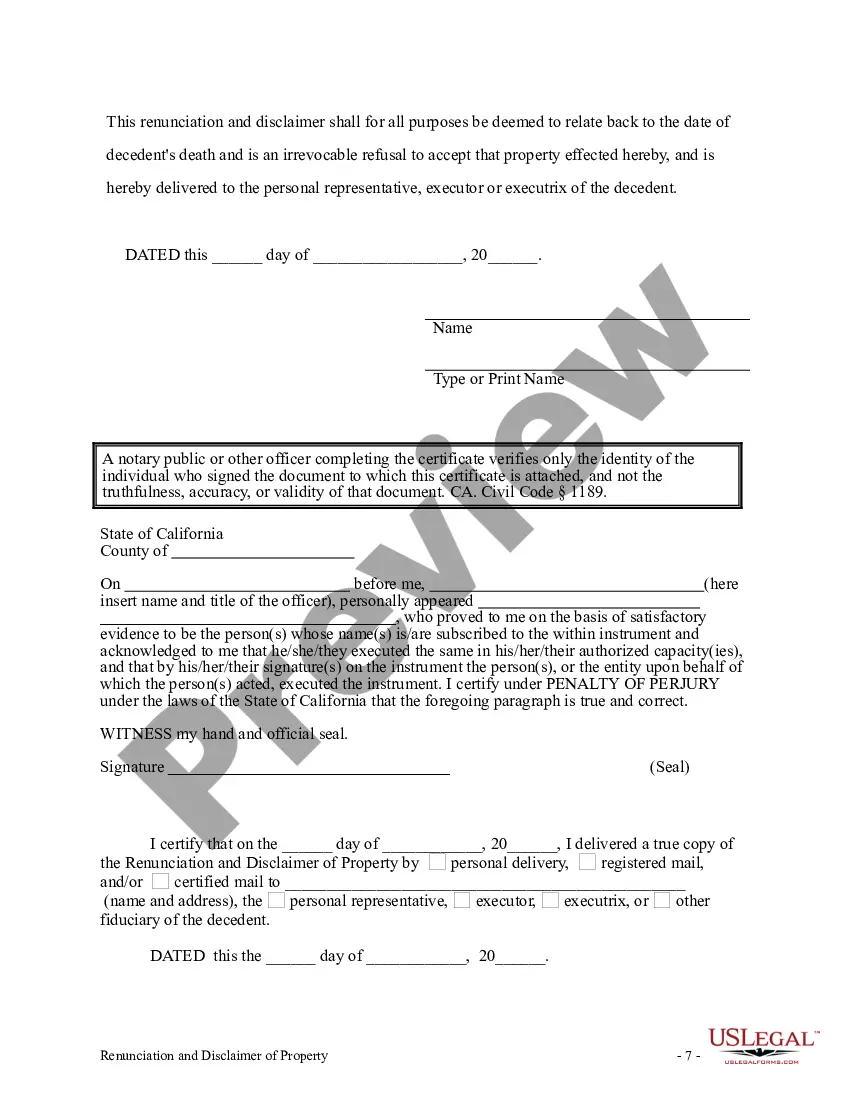

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Oxnard California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond

Description

How to fill out California Renunciation And Disclaimer Of Individual Retirement Account, Annuity, Or Bond?

Locating authentic templates tailored to your regional statutes can be challenging unless you utilize the US Legal Forms repository.

This is an online collection of over 85,000 legal documents catering to both personal and business requirements along with various real-life situations.

All the paperwork is properly sorted by usage area and jurisdiction zones, making the search for the Oxnard California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond as straightforward and simple as 1-2-3.

Maintaining documentation in an orderly manner and in compliance with legal standards is crucial. Take advantage of the US Legal Forms library to consistently have important document templates readily available for all your needs!

- Review the Preview mode and document description.

- Ensure you’ve selected the accurate one that satisfies your specifications and fully complies with your local jurisdiction regulations.

- Look for an alternative template if required.

- If you encounter any discrepancies, utilize the Search tab above to find the correct one. If it meets your needs, proceed to the next step.

- Purchase the document. Click on the Buy Now button and select your preferred subscription plan. You should register an account to gain access to the library’s resources.

Form popularity

FAQ

Many financial experts argue that investing in diversified funds or real estate may outperform conventional annuities. These options can offer potential for higher growth, accessible liquidity, and flexibility that annuities often lack. If you reside in Oxnard, California, and are exploring the renunciation of an annuity as part of your financial strategy, uslegalforms can provide useful templates and guidance tailored to your needs.

Historically, investments like stocks and mutual funds have provided better returns than traditional annuities. While annuities offer guaranteed income, the trade-off is often lower growth potential. Therefore, it's essential to weigh the pros and cons based on your retirement goals. If you're considering a renunciation or disclaimer related to your retirement assets in Oxnard, California, our platform is equipped to support you in making an informed decision.

Many retirees shy away from annuities due to concerns about their inflexibility and associated fees. Often, retirees prefer more liquid options that allow easy access to their funds in case of emergencies. Furthermore, annuities can have complex terms that make it hard to understand potential returns. If you live in Oxnard and are contemplating whether to renounce an annuity, our user-friendly tools can provide valuable insight into your choices.

In California, some annuities may offer protection from creditors, but this can vary based on specific circumstances and the type of annuity. It's crucial to understand the legal nuances when considering an annuity as part of your retirement plan. Additionally, engaging in an Oxnard California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond can clarify your financial position, and our platform can help you navigate these complexities.

Investing in real estate can often be a better option than an annuity for retirement. Real estate can generate rental income and appreciate in value, providing long-term financial security. Additionally, contributing to a retirement account, like a 401(k) or an IRA, can offer tax advantages that annuities may not have. If you're considering the implications of renouncing an annuity in Oxnard, California, our resources can guide you.

One effective alternative to an annuity is investing in a diversified portfolio of stocks and bonds. This strategy can provide greater flexibility and potentially higher returns over time. You may also consider mutual funds or exchange-traded funds, which can help you achieve better growth for your retirement savings. If you're in Oxnard, California, and need help understanding the impacts of renunciation and disclaimers on these investments, our platform can assist you.

California does tax federal retirement income, including Social Security benefits for some individuals depending on total income. It's important to review your tax situation to understand how this can affect your overall retirement planning. The Oxnard California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond might offer you effective strategies to mitigate your tax dues and enhance your financial security.

Yes, both pensions and annuities are subject to taxation in California. When you receive periodic payments from these sources, they must be reported as income for state tax purposes. Understanding the implications of the Oxnard California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond can assist you in managing the tax impact of these kinds of income.

California does allow IRA deductions, but income limits apply. This means that your eligibility to deduct contributions might change based on your adjusted gross income. As you navigate the complexities of accounts, considering the Oxnard California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond may help you optimize your financial situation.

Yes, teacher pension income in California is subject to state taxation. Teachers, just like other retirees, must report their pension income on their state tax returns. If you wish to explore options like the Oxnard California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond, you may find beneficial ways to manage your tax burden.