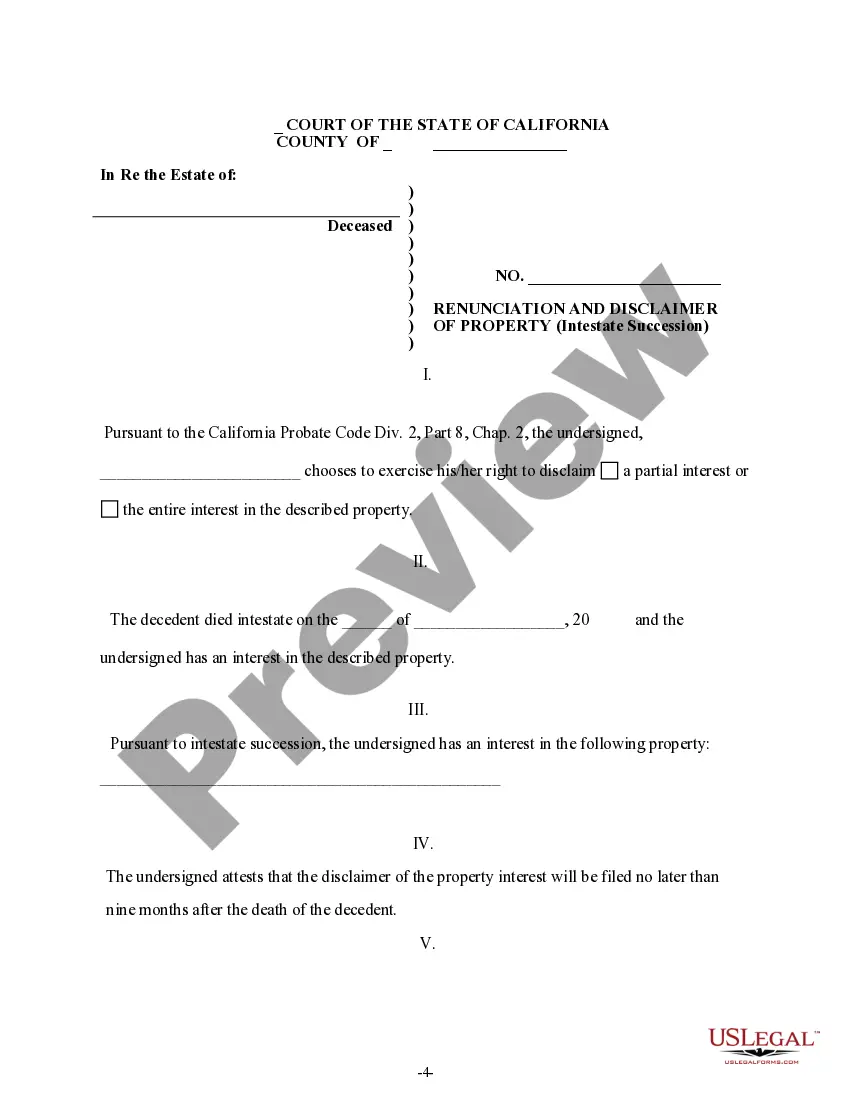

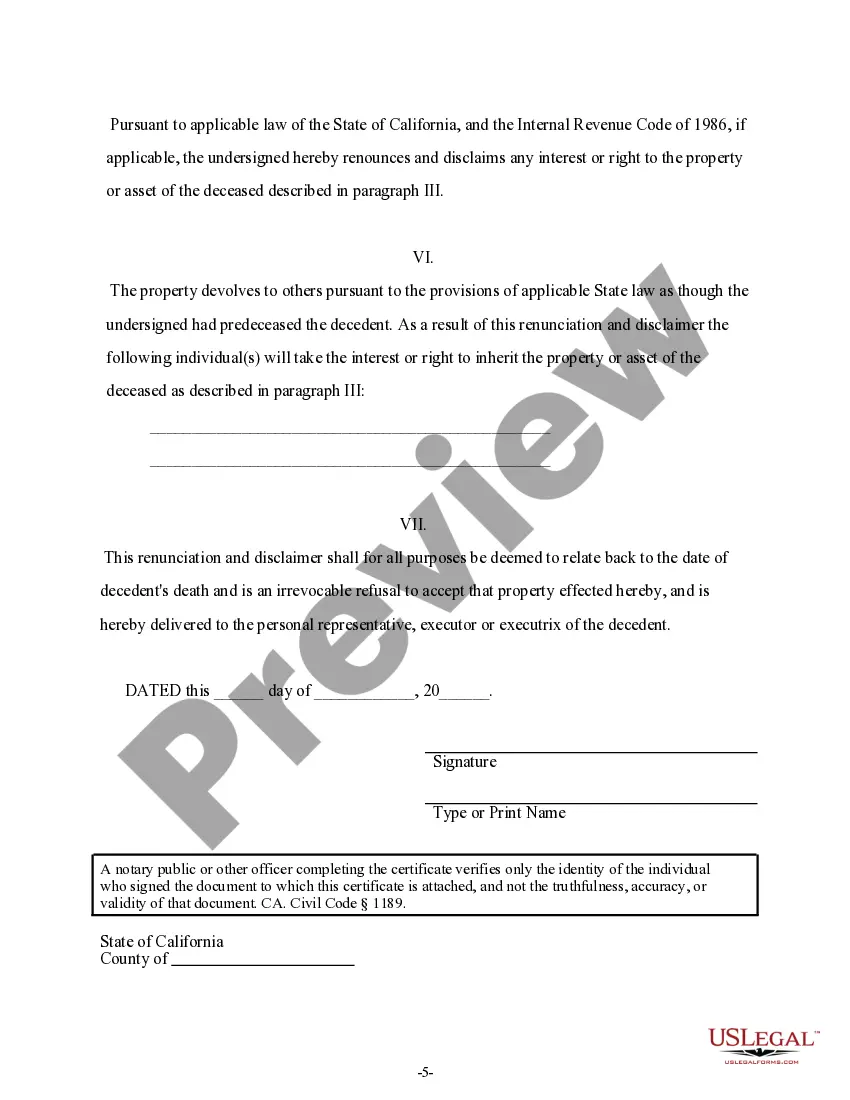

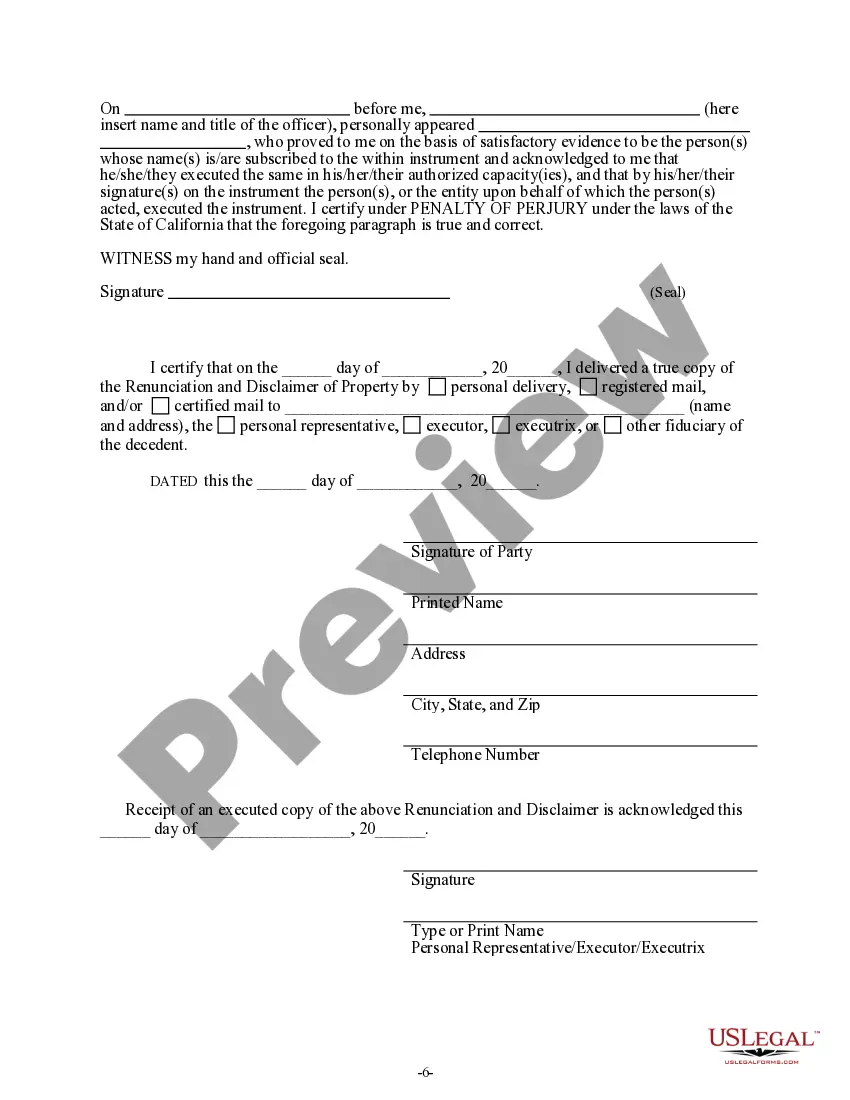

This form is a Renunciation and Disclaimer of Property acquired through intestate succession. The decedent died intestate and the beneficiary gained an interest in the described property. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has decided to disclaim a portion of or the entire interest he/she has in the property. Under California law, the beneficiary is also required to list in the disclaimer the individual(s) who will take the interest or right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Vallejo California Renunciation And Disclaimer of Property received by Intestate Succession

Description

How to fill out California Renunciation And Disclaimer Of Property Received By Intestate Succession?

Utilize the US Legal Forms to gain immediate access to any form template you need.

Our beneficial website, featuring thousands of document templates, simplifies the process of locating and acquiring almost any document sample you require.

You can download, fill out, and validate the Vallejo California Renunciation And Disclaimer of Property obtained through Intestate Succession in mere minutes rather than spending hours online searching for a suitable template.

Using our collection is a smart approach to enhance the security of your form submissions.

Access the page with the form you need. Ensure it is the template you were looking for: check its title and description, and utilize the Preview feature if available. If not, use the Search bar to find the required one.

Initiate the download process. Click Buy Now and choose the pricing plan that suits you. Then, register for an account and complete your order using a credit card or PayPal.

- Our knowledgeable legal professionals routinely assess all documents to ensure that the forms are suitable for a specific jurisdiction and compliant with updated laws and regulations.

- How do you acquire the Vallejo California Renunciation And Disclaimer of Property obtained via Intestate Succession.

- If you have an account, simply Log In to your profile. The Download option will be available on all the documents you access.

- Additionally, you can view all previously saved files in the My documents section.

- If you haven’t created an account yet, follow the steps below.

Form popularity

FAQ

A beneficiary might choose to disclaim property for several reasons, including avoiding tax liabilities or debt responsibilities associated with the inheritance. In Vallejo, California, this can be a savvy decision if accepting the property would cause financial difficulties. By renouncing the inheritance, a beneficiary can ensure that assets pass on to subsequent heirs without complications. To learn more about disclaiming property effectively, uslegalforms offers resources to assist.

Individuals inheriting property through intestate succession in Vallejo, California, receive a share of the decedent's estate as defined by state law. This may include monetary assets, real estate, or personal items. Each heir's portion depends on their relationship to the decedent and the overall size of the estate. If you contemplate renouncing your share, uslegalforms can help clarify your legal choices.

Assets such as real estate, bank accounts, and personal belongings usually transfer through intestate succession statutes in Vallejo, California. Intestate laws identify the heirs who inherit these assets without a will. It is crucial to understand this transfer process, especially when considering renunciation, to be aware of responsibilities and rights involved. Uslegalforms can guide you through your options effectively.

To disclaim an inheritance in Vallejo, California, you must provide a written disclaimer to the estate's personal representative. This document must be filed within nine months after the decedent's death. By doing this, you formally renounce your right to the property without accepting any liabilities attached. If you need help with this process, uslegalforms offers tools and templates to streamline your renunciation.

A person who inherits items from an intestate estate is commonly referred to as an heir. Heirs receive property according to state intestate succession laws, which determine the distribution of assets. In Vallejo, California, these laws ensure a fair process for passing on property without a will. For more assistance on how to address your status as an heir, resources like uslegalforms are available.

Intestate succession in Vallejo, California, dictates how property is distributed when a person dies without a will. The law prioritizes spouses, children, and other relatives based on closeness of relation. Understanding these principles can help heirs make informed decisions, especially when dealing with renunciation and disclaimers. To facilitate your understanding further, uslegalforms can provide valuable insights.

In Vallejo, California, heirs generally have one year from the date of death to claim their inheritance under intestate succession laws. Failing to claim within this timeframe can mean loss of rights to the inheritance. It is essential to be aware of this timeline to ensure that you receive what is rightfully yours. For detailed guidance on navigating the claim process, especially if you wish to discuss renunciation, consider reaching out to resources like uslegalforms.

Writing a disclaimer of inheritance involves drafting a document that states your intention to renounce the inheritance. Ensure it includes your name, the date of the document, and a clear statement regarding the inheritance you are disavowing. Accessing templates from platforms like USLegalForms can aid you in creating a compliant disclaimer for the Vallejo California Renunciation And Disclaimer of Property received by Intestate Succession.

If you wish to transfer heir property into your name without a will in Vallejo, California, you may need to go through a legal process known as intestate succession. This typically requires proving your relationship to the deceased before the court. Resources from USLegalForms can guide you through this complex procedure effectively.

In California, you can inherit an unlimited amount from your parents without incurring federal estate taxes. However, California does not impose a state inheritance tax, which further simplifies the process. Understanding these tax implications can be valuable during the Vallejo California Renunciation And Disclaimer of Property received by Intestate Succession process.