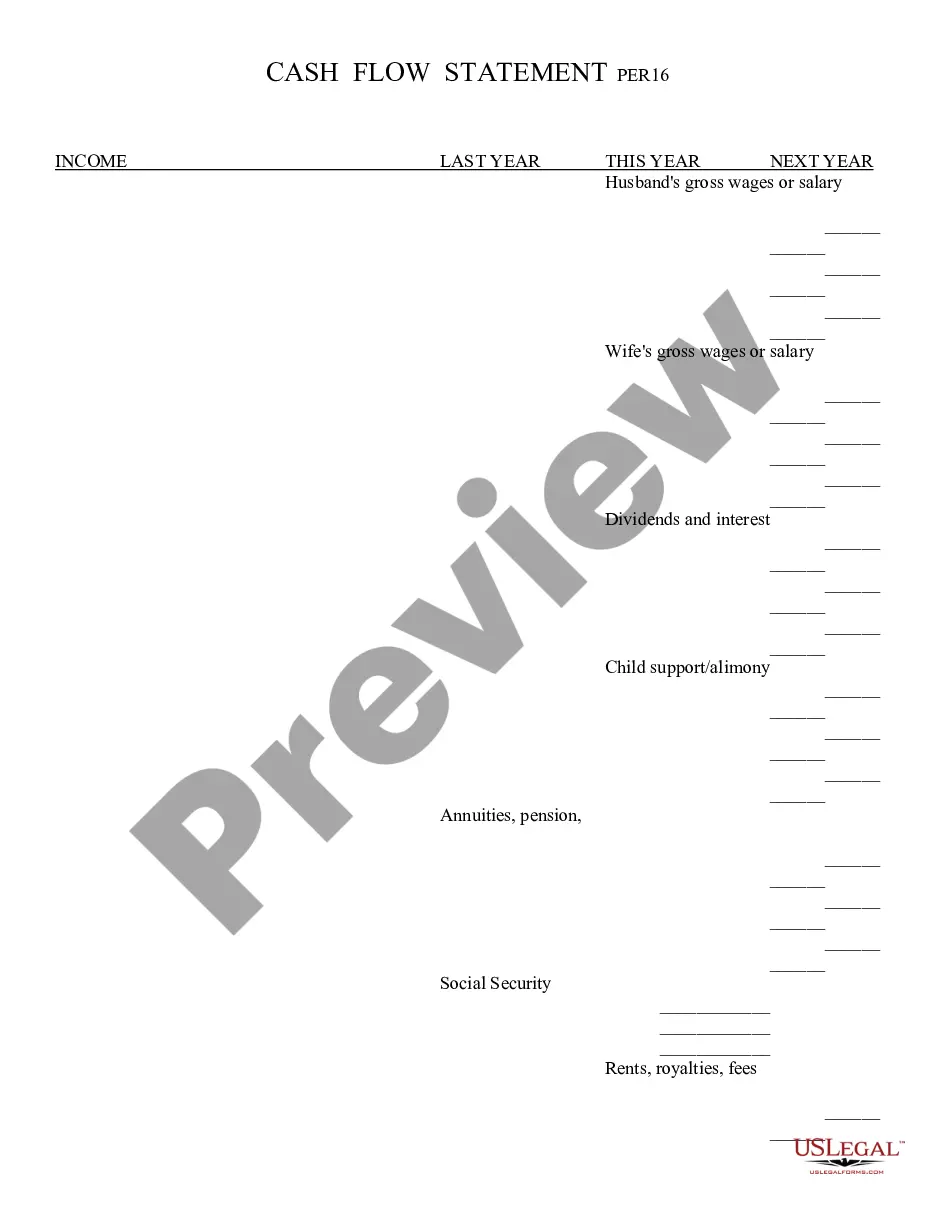

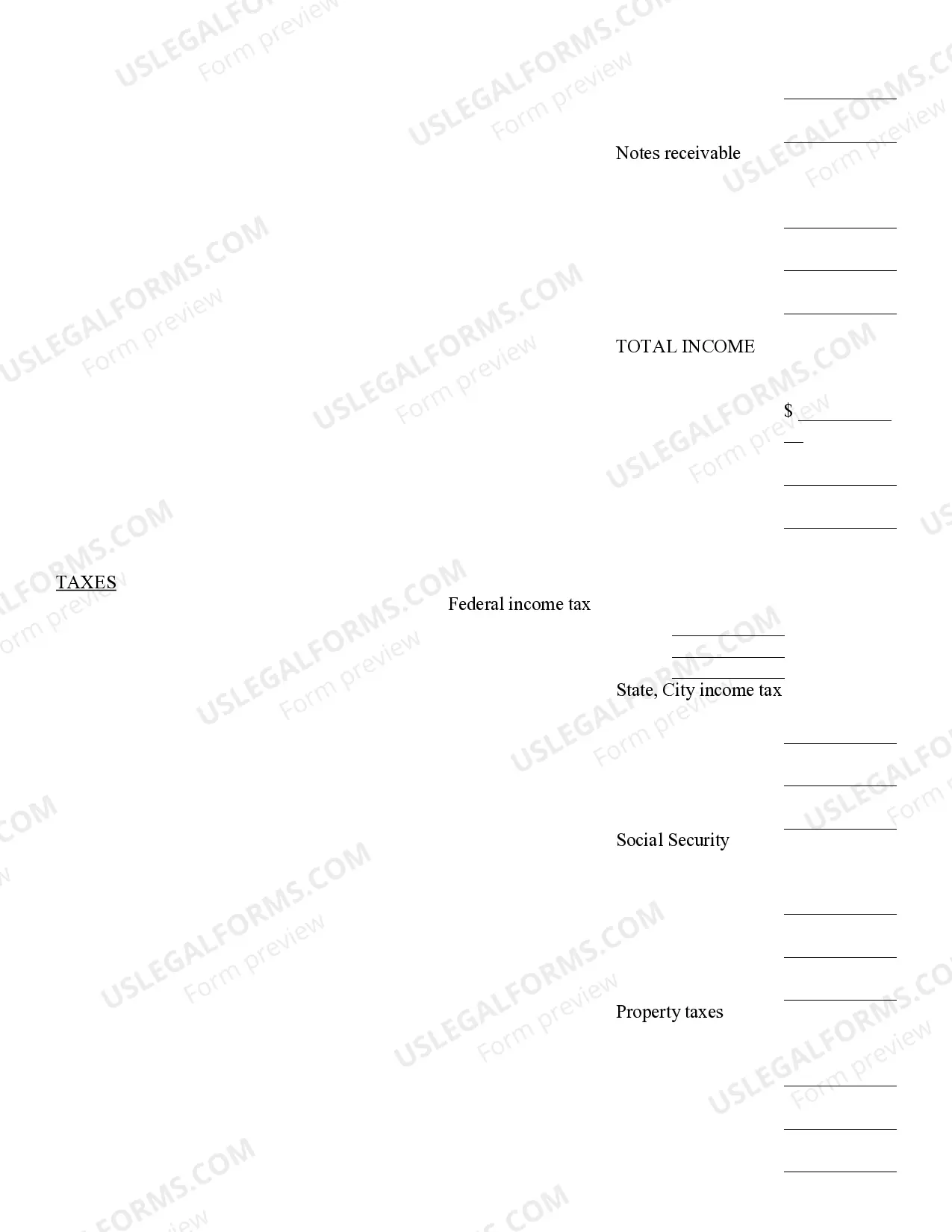

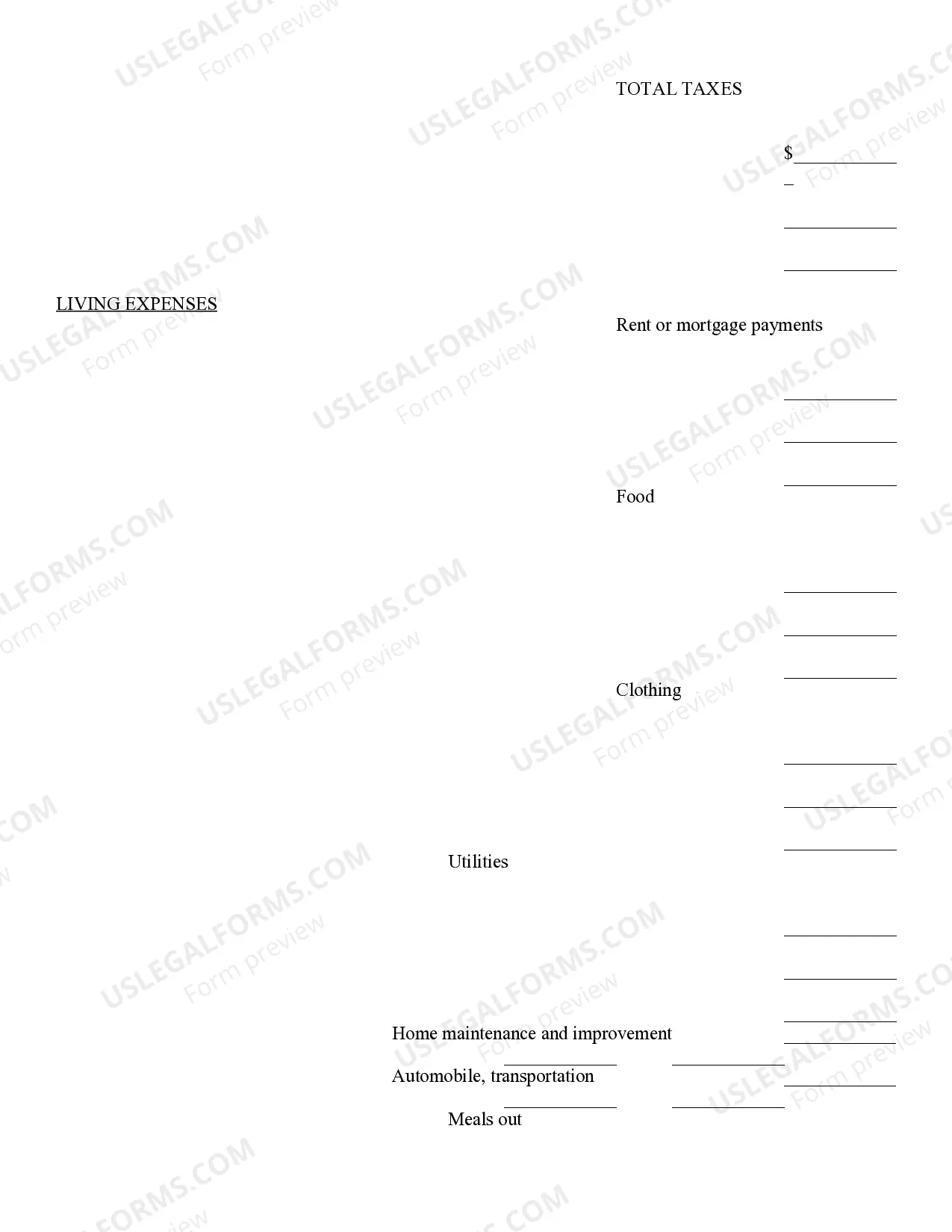

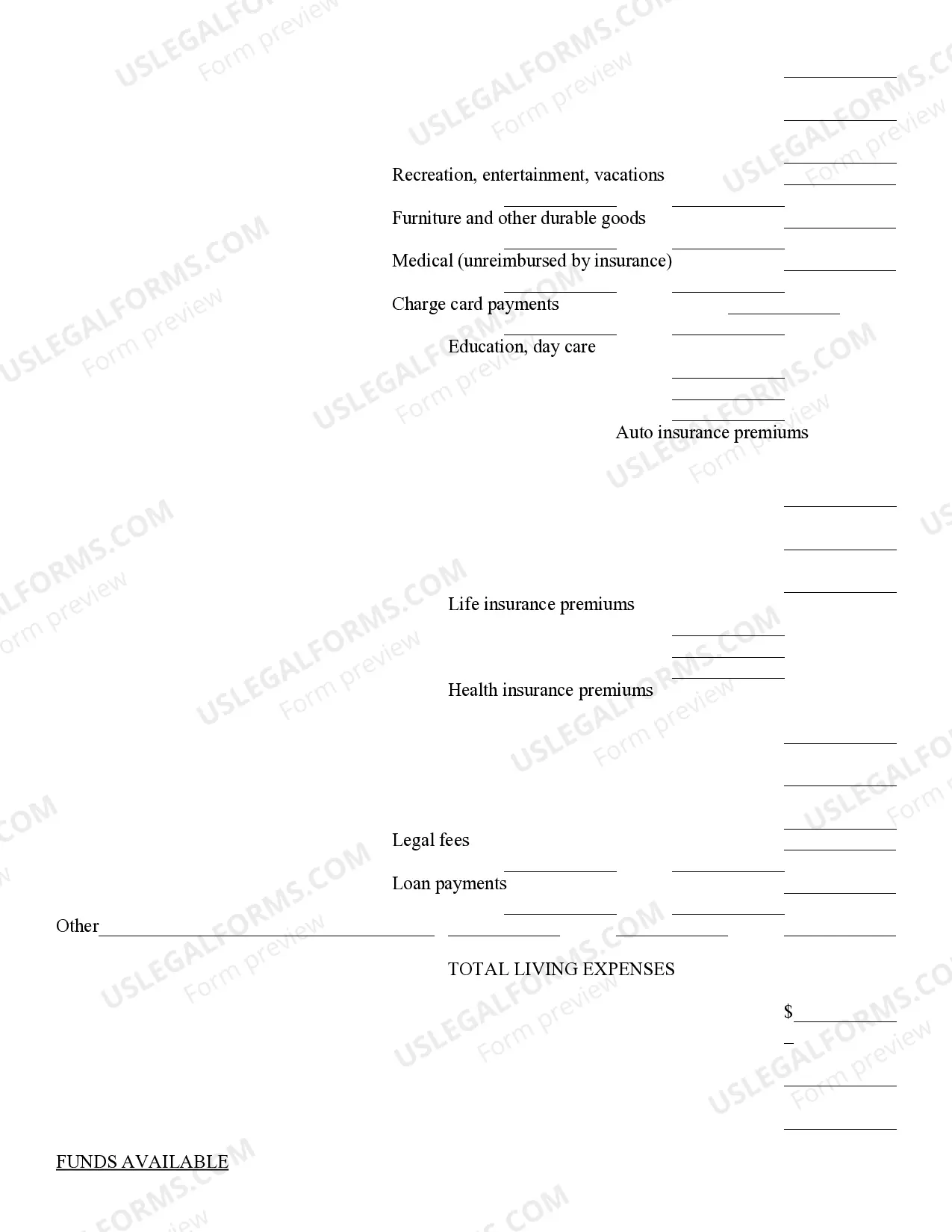

Cash Flow Statement - Arizona: This is a standard statement which includes all the money coming in and the money going out each month. There are places for wage information, as well as debt payment information. It is available for download in both Word and Rich Text formats.

Phoenix Arizona Cash Flow Statement

Description

How to fill out Arizona Cash Flow Statement?

If you’ve previously used our service, sign in to your account and retrieve the Phoenix Arizona Cash Flow Statement on your device by clicking the Download button. Ensure your subscription is current. If not, renew it per your payment plan.

If this is your initial use of our service, follow these easy steps to obtain your file.

You have continuous access to every document you have acquired: you can find it in your profile under the My documents menu whenever you need to reuse it. Utilize the US Legal Forms service to swiftly discover and save any template for your personal or professional requirements!

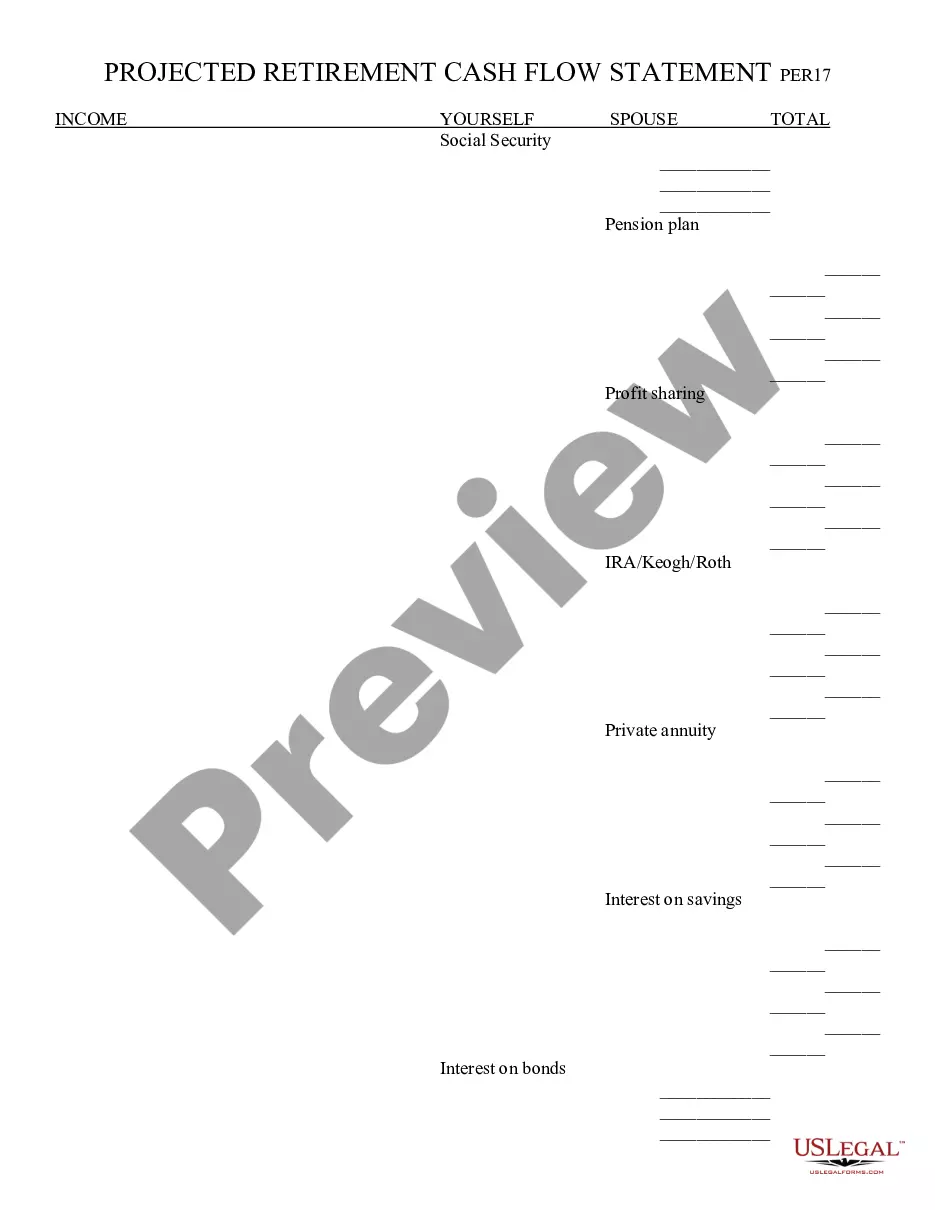

- Ensure you’ve located the correct document. Review the description and utilize the Preview option, if available, to determine if it suits your needs. If it doesn’t match, employ the Search tab above to find the suitable one.

- Purchase the template. Click the Buy Now button and opt for a monthly or yearly subscription plan.

- Set up an account and process a payment. Enter your credit card information or select the PayPal option to finalize the purchase.

- Retrieve your Phoenix Arizona Cash Flow Statement. Choose the file format for your document and store it on your device.

- Finalize your document. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

What is Negative Cash Flow? Negative cash flow describes a situation in which a firm spends more cash than it takes in. This is a relatively common situation in the first few months or years of a business, when it is still ramping up production and searching for customers.

A ratio less than 1 indicates short-term cash flow problems; a ratio greater than 1 indicates good financial health, as it indicates cash flow more than sufficient to meet short-term financial obligations.

Positive cash flow indicates that a company's liquid assets are increasing, enabling it to cover obligations, reinvest in its business, return money to shareholders, pay expenses, and provide a buffer against future financial challenges.

Cash flow from assets can be found by subtracting capital spending and additions to net working capital from your operating cash flow. Having a negative cash flow from assets indicates that you're putting more money into the long-term success of your company than you're actually earning.

Cash flow is the money that flows in and out of your business throughout a given period, while profit is whatever remains from your revenue after costs are deducted.

Cash flow from operations is comprised of expenditures made as part of the ordinary course of operations. Examples of these cash outflows are payroll, the cost of goods sold, rent, and utilities. Cash outflows can vary substantially when business operations are highly seasonal.

The three categories of cash flows are operating activities, investing activities, and financing activities. Operating activities include cash activities related to net income.

Accounting experts recommend using three categories to organize cash flow data: operating activities, investing activities, and financing activities....Here are the reasons why: Depreciation and Amortization.Accounts Receivable.Inventory.Income Tax.

As a result, the negative cash flow from investing means the company is investing in its future growth. On the other hand, if a company has a negative cash flow from investing activities because it's made poor asset-purchasing decisions, then the negative cash flow from investing activities might be a warning sign.

Cash flow refers to the net balance of cash moving into and out of a business at a specific point in time. Cash is constantly moving into and out of a business. For example, when a retailer purchases inventory, money flows out of the business toward its suppliers.