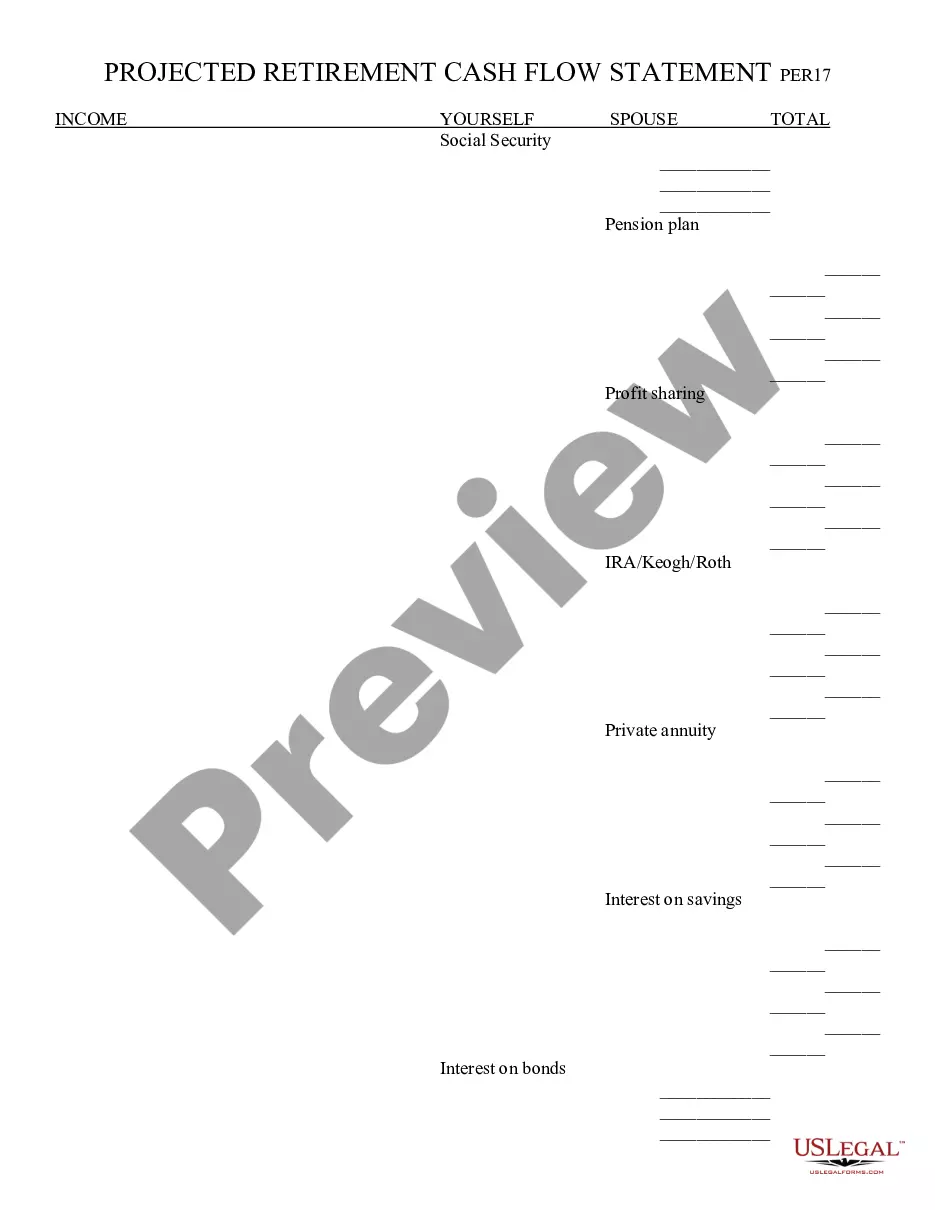

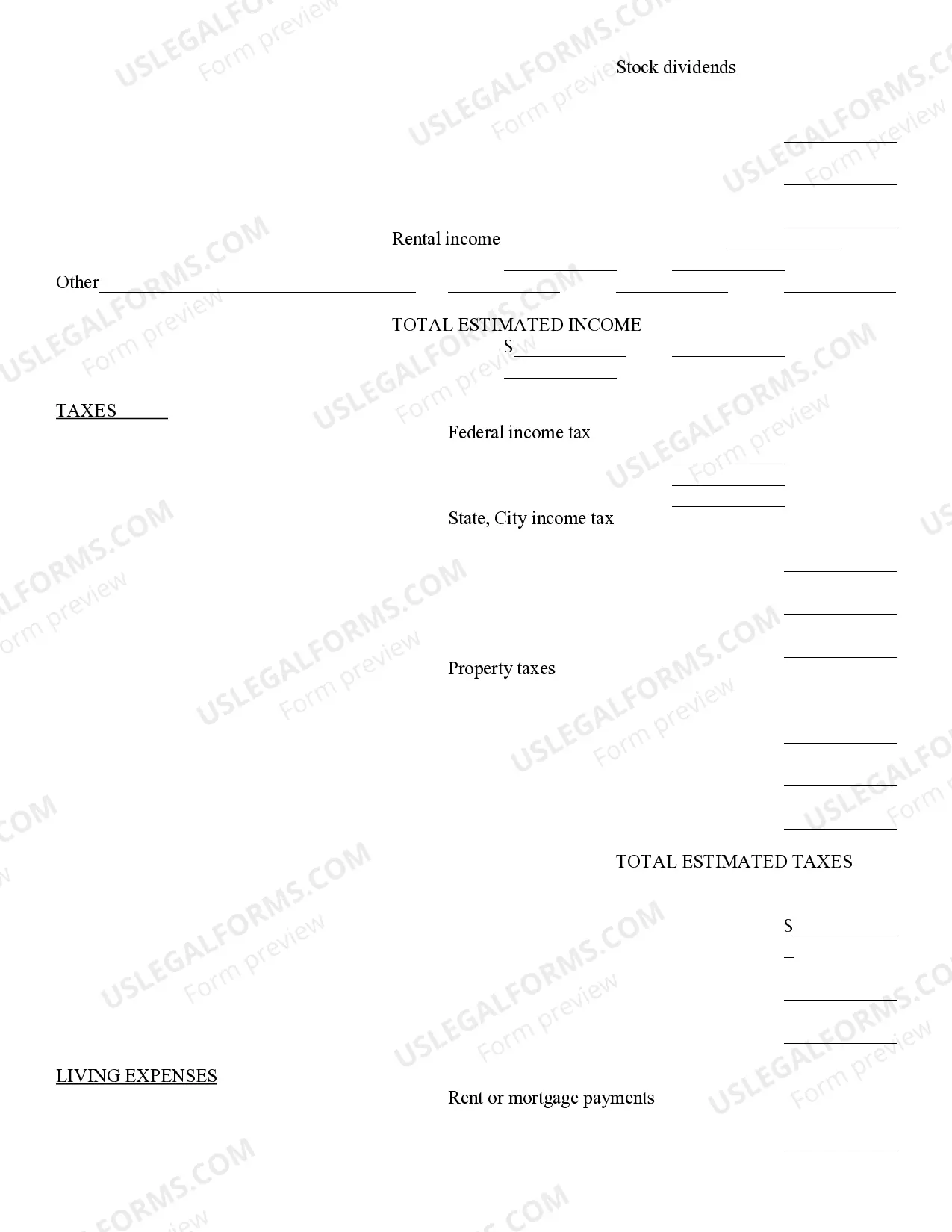

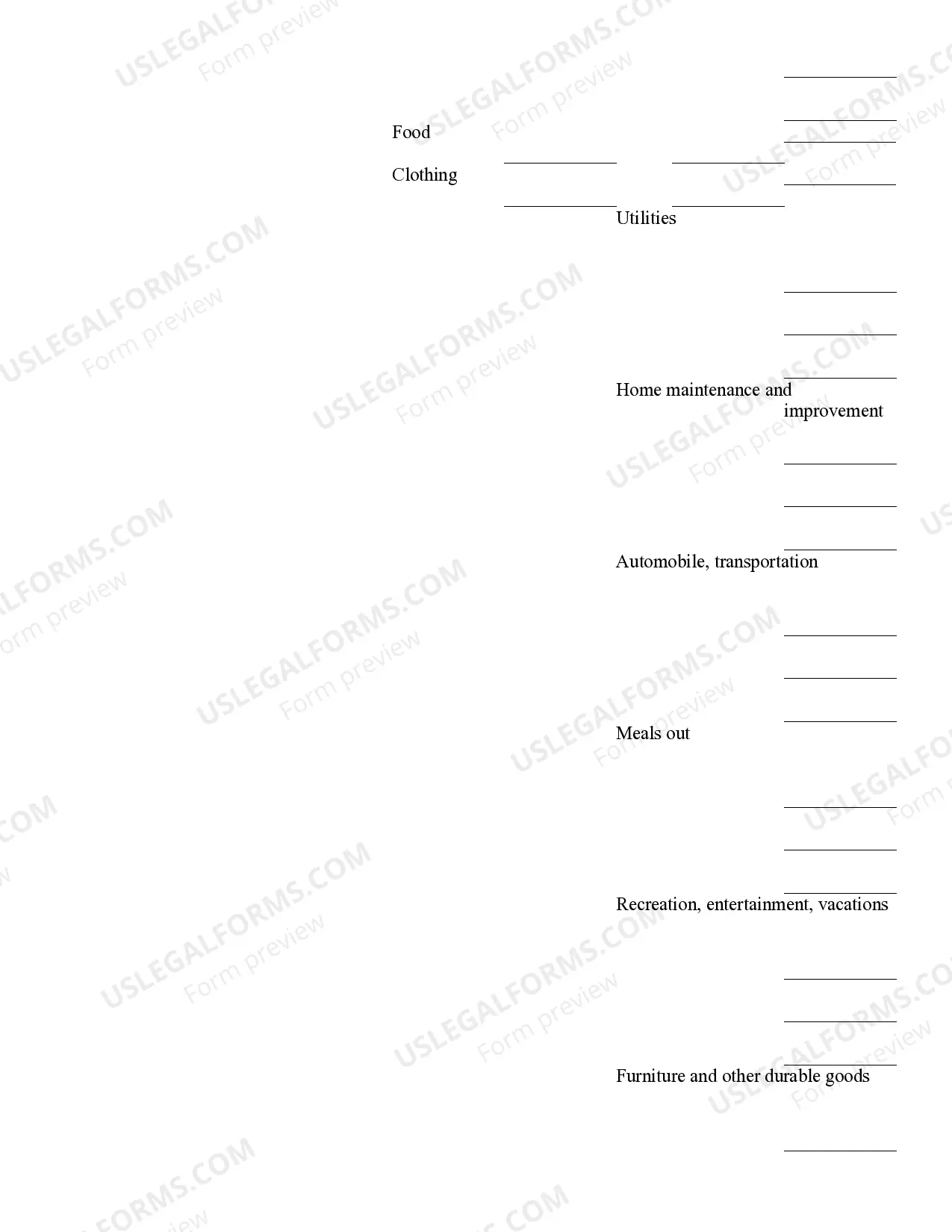

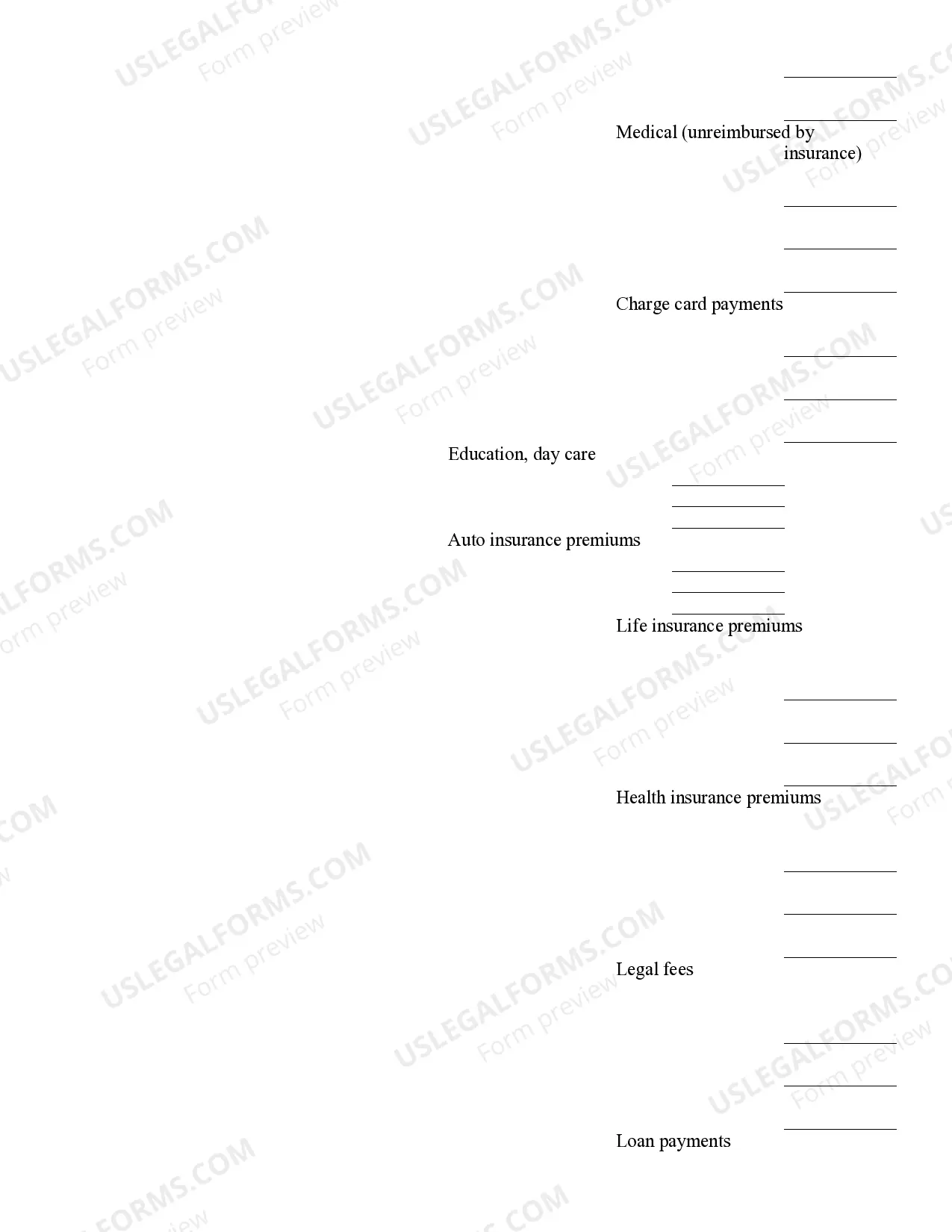

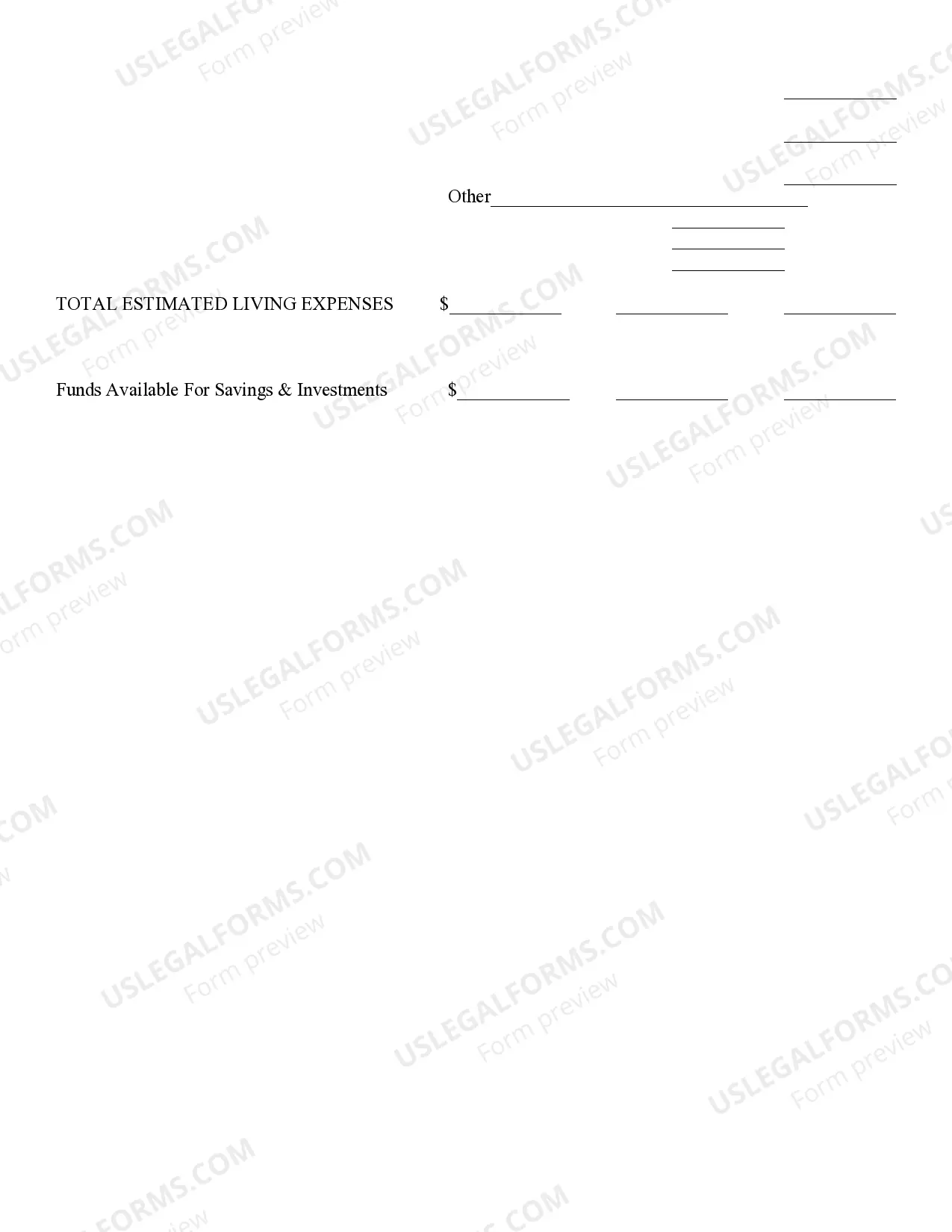

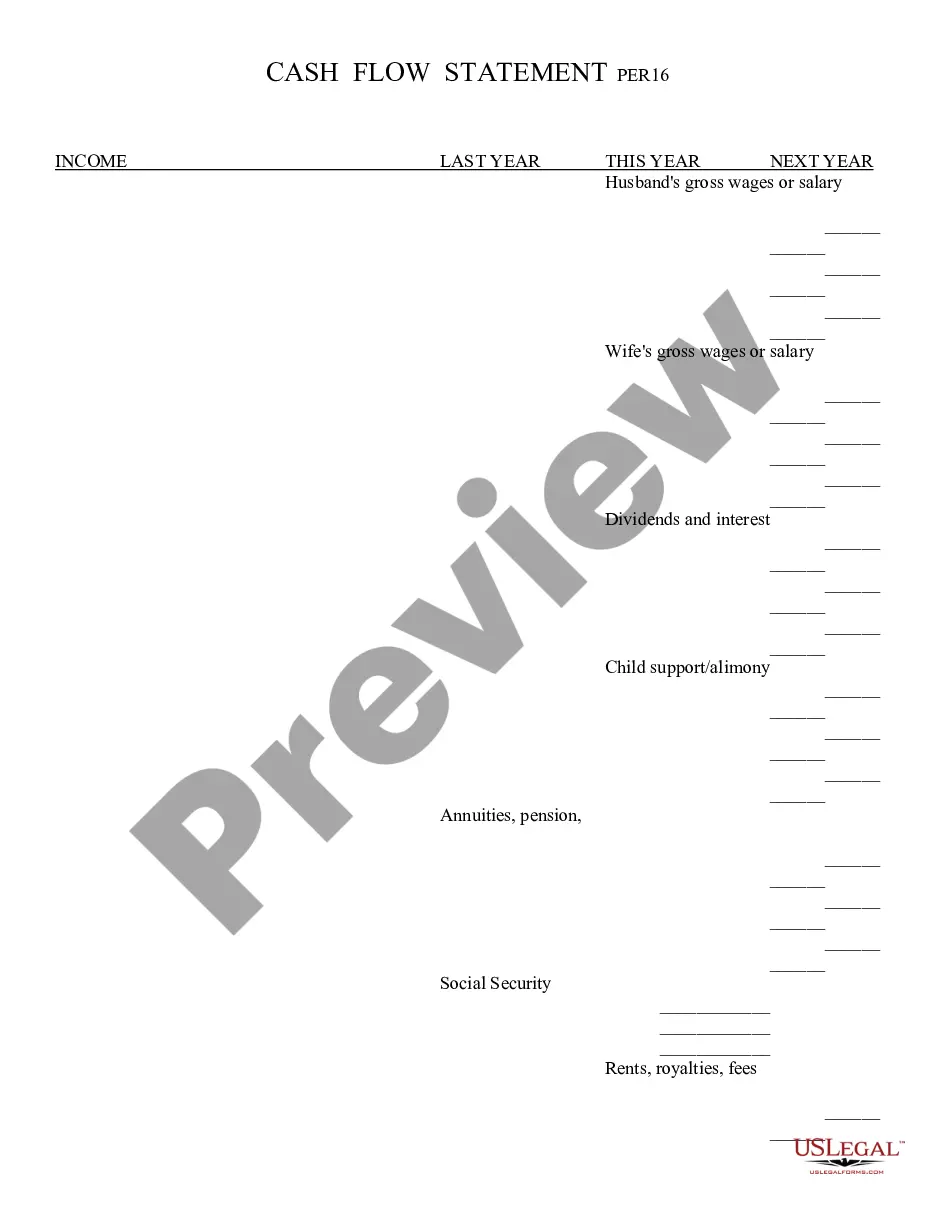

Retirement Cash Flow - Arizona: This is a standard statement which includes all the money coming in after retirement, including annuities, IRA's, pension, etc. It also includes a place for money going out each month, such as rent. It is available for download in both Word and Rich Text formats.

Mesa Arizona Retirement Cash Flow

Description

How to fill out Arizona Retirement Cash Flow?

Acquiring authenticated templates tailored to your local regulations can be challenging unless you access the US Legal Forms repository.

It’s a digital collection of over 85,000 legal documents catering to both individual and business requirements, as well as various real-life scenarios.

All the paperwork is meticulously categorized by application field and jurisdiction regions, making it as quick and simple as one-two-three to find the Mesa Arizona Retirement Cash Flow.

Organizing documentation in accordance with legal standards is of great significance. Utilize the US Legal Forms repository to always have vital document templates readily available for any requirements!

- Examine the Preview mode and document details.

- Ensure you have selected the right one that fulfills your needs and aligns with your local legal stipulations.

- Look for another template, if necessary.

- If you notice any discrepancies, use the Search tab above to locate the appropriate one.

- If it fits your needs, proceed to the following stage.

Form popularity

FAQ

Arizona is a moderately tax-friendly state Arizona is retiree-friendly with respect to your Social Security benefits, inheritance, and estate taxes?that's because they don't get taxed, allowing you to pocket additional money and leave more to your heirs.

The average retirement income in Arizona is $30,168 (20th among all states), and 60.5% (18th) of retiree households have retirement income. The top 10 states for retirement, according to the index, in order: Delaware, Washington, Oregon, Wisconsin, Michigan, Arizona, Virginia, Minnesota, Alaska and Utah.

Arizona is moderately tax-friendly for retirees. Like most U.S. states, it does not tax Social Security retirement benefits. However, other types of retirement income are taxed, either partially or fully.

The state has something for everyone, no matter how you want to spend your retirement. If you think Arizona sounds like a great destination for your dream retirement, you're absolutely right!... Eloy. Percentage of the Population Over 65: 10.8%Douglas.Apache Junction.Coolidge.San Luis.Nogales.Somerton.Bullhead City.

In 1989, the Arizona Legislature passed a bill which mandates the taxation of retirees' pensions for the year of 1989 and thereafter. Retirees living in Arizona are required to pay Arizona state income taxes on any taxable distribution from the ASRS over $2,500 per year.

In Arizona, average retirement spending stands at an estimated $1,062,468 - the 19th highest among states. Goods and services in the state are 0.9% less expensive than they are, on average, nationwide, and life expectancy at age 65 is 19.6 years to 84.6, compared to 19.5 years to 84.5 across the country as a whole.

What is the Rule of 80? This provision creates a so-called Rule of 80, a new definition of Normal Retirement for members of the Hybrid Defined Benefit Component. This allows members to claim a full, unreduced pension benefit if their combined age and years of service equal at least 80, beginning at age 50.

Arizona's Income Tax Picture for Retirees IsArizona, rated by Kiplinger as one of the nation's most tax-friendly states, does not tax your Social Security benefits (unlike these states that do).

One rule of thumb is that you'll need 70% of your pre-retirement yearly salary to live comfortably. That might be enough if you've paid off your mortgage and are in excellent health when you kiss the office good-bye.

We recommend consulting with a financial planner before retiring to another state. Arizona rose from the ninth spot last year to the third-best state for retirement for 2022. The state offers affordable living and a warm, dry climate that draws many retirees.