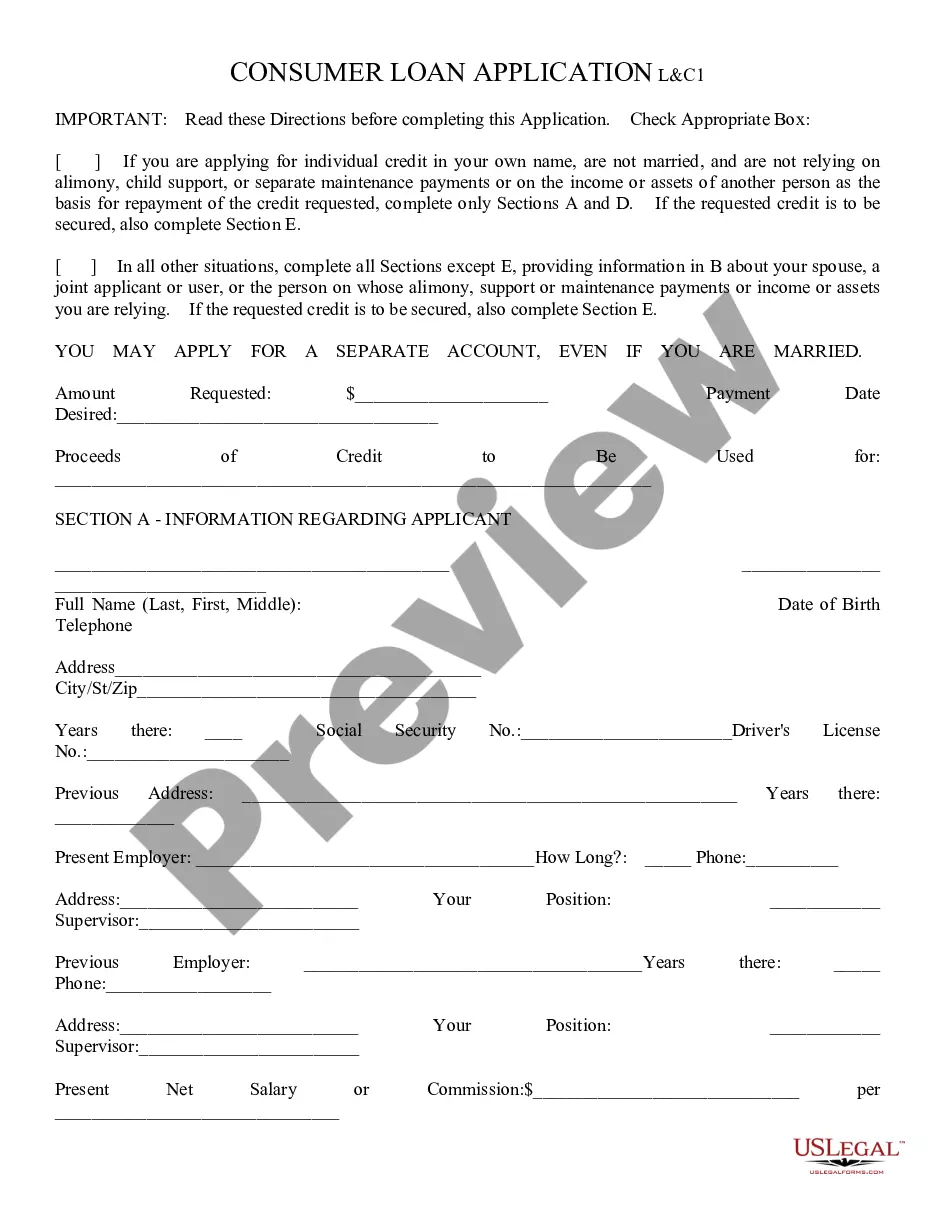

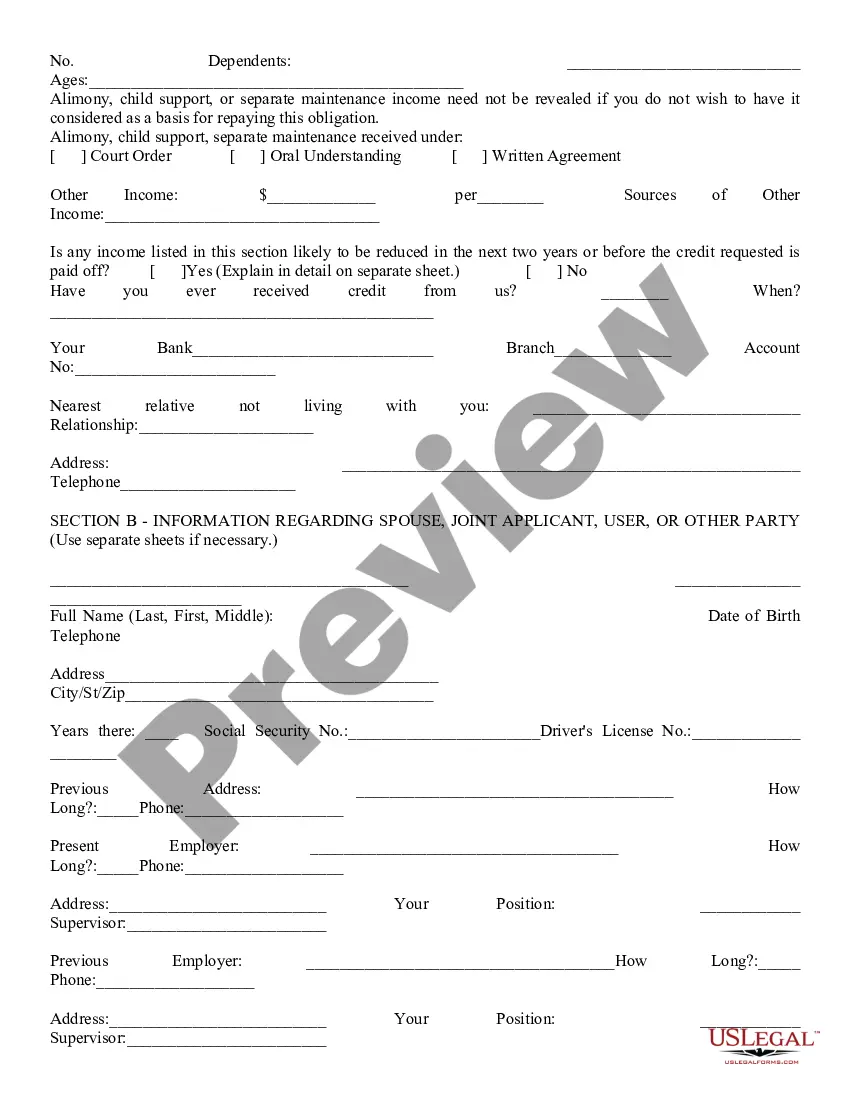

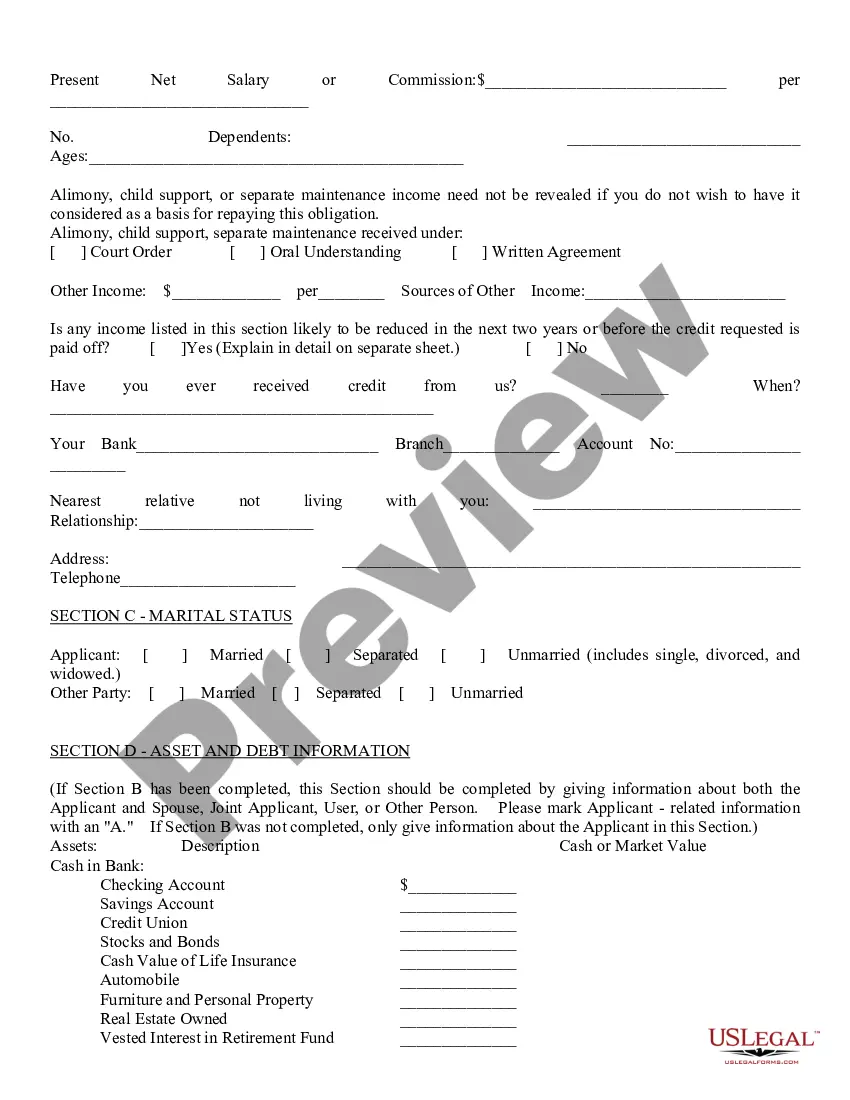

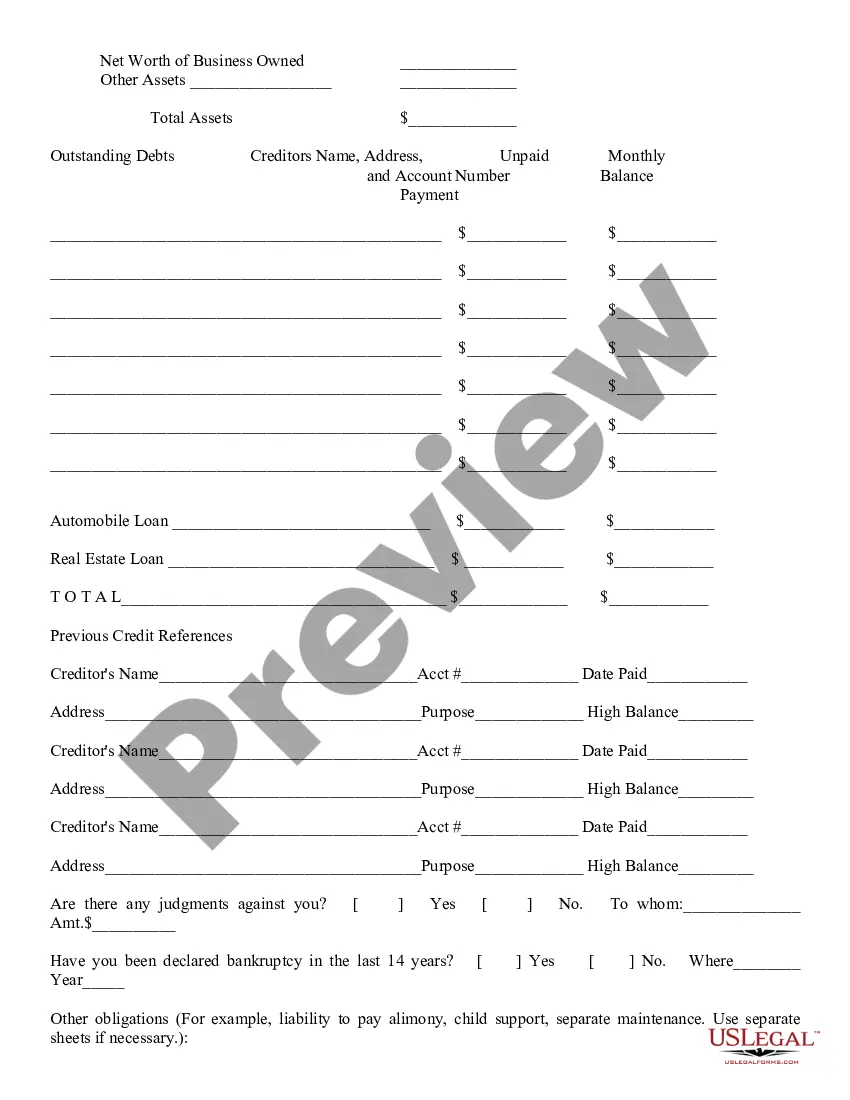

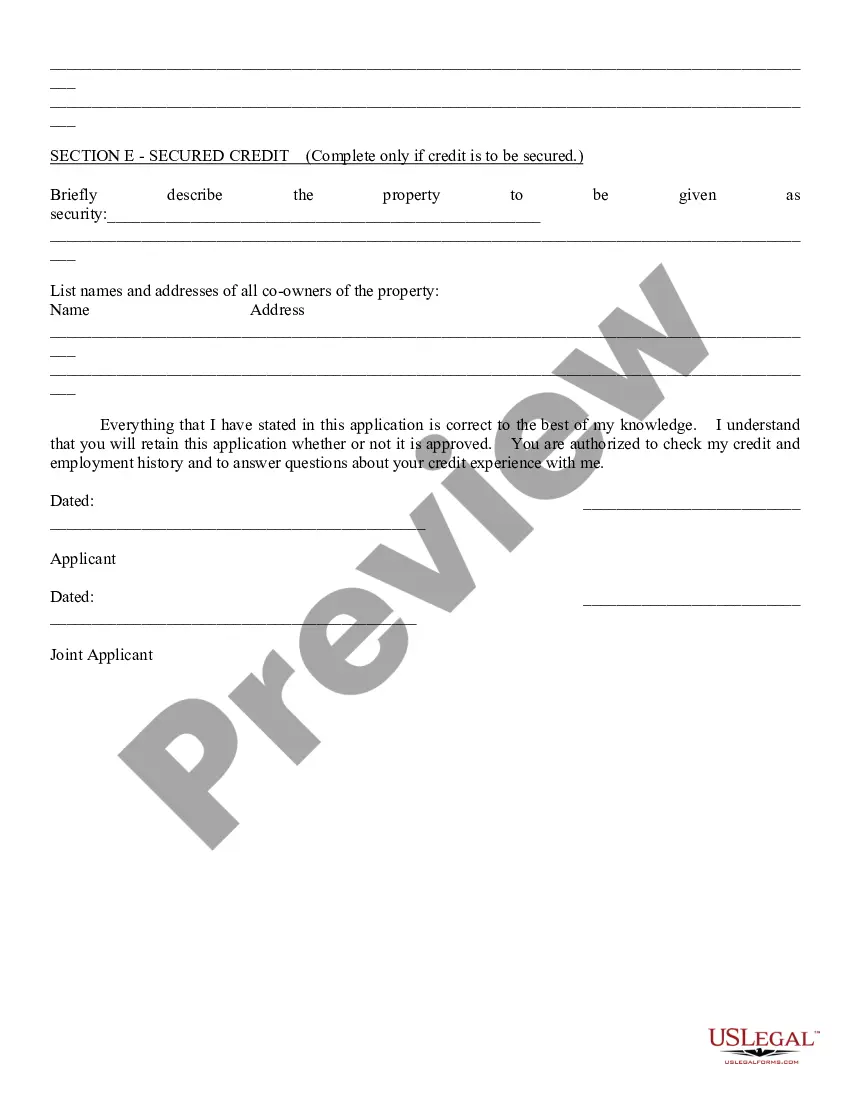

Consumer Loan Application: This is a general Consumer Loan Application which can be used in any instance where a consumer requests a loan. The application asks for all relevant personal and financial information of the applicant. This form is available for download in both Word and Rich Text formats.

Mesa Arizona Consumer Loan Application

Description

How to fill out Arizona Consumer Loan Application?

Utilize the US Legal Forms and gain instant access to any form template you need.

Our useful website with a vast selection of templates makes it easy to locate and acquire almost any document sample you require.

You can download, fill out, and authorize the Mesa Arizona Consumer Loan Application in just a few minutes instead of browsing the Internet for hours searching for a suitable template.

Leveraging our collection is an excellent method to enhance the security of your form submission.

How do you access the Mesa Arizona Consumer Loan Application? If you have an account, simply sign in to your profile. The Download button will be activated for all the samples you view.

If you don’t have an account yet, follow the steps outlined below.

- Our qualified attorneys regularly review all documents to ensure that the templates are suitable for a specific region and in line with current laws and regulations.

Form popularity

FAQ

The average time for formal approval takes about four to six weeks from submitting the application to your lender, to reaching settlement on the property.

The easiest loans to get approved for would probably be payday loans, car title loans, pawnshop loans, and personal installment loans. These are all short-term cash solutions for bad credit borrowers in need. Many of these options are designed to help borrowers who need fast cash in times of need.

It usually takes one and seven business days to get a personal loan ? though this will depend on which type of lender you work with. Here's how long it typically takes to get a personal loan: Online lenders: Less than 5 business days. Banks: 1-7 business days.

It's not hard to get a personal loan in general, but some personal loans are much more difficult to get than others. Unsecured personal loans often require a credit score of 660+, and some are only available to people with scores of 700+.

A consumer loan is a loan given to consumers to finance specific types of expenditures. In other words, a consumer loan is any type of loan made to a consumer by a creditor. The loan can be secured (backed by the assets of the borrower) or unsecured (not backed by the assets of the borrower).

Boost Your Chances of Getting Your Personal Loan Approved Clean up your credit. Credit scores are major considerations on personal loan applications.Rebalance your debts and income.Don't ask for too much cash.Consider a co-signer.Find the right lender.

The basics of Consumer Loans With a loan, you receive all the money the lender has approved for you in one lump sum. Then, to pay the lender back, you make equal monthly payments, called installments, for a fixed period of time, until the loan is paid off. This is called a long-term loan or an installment loan.