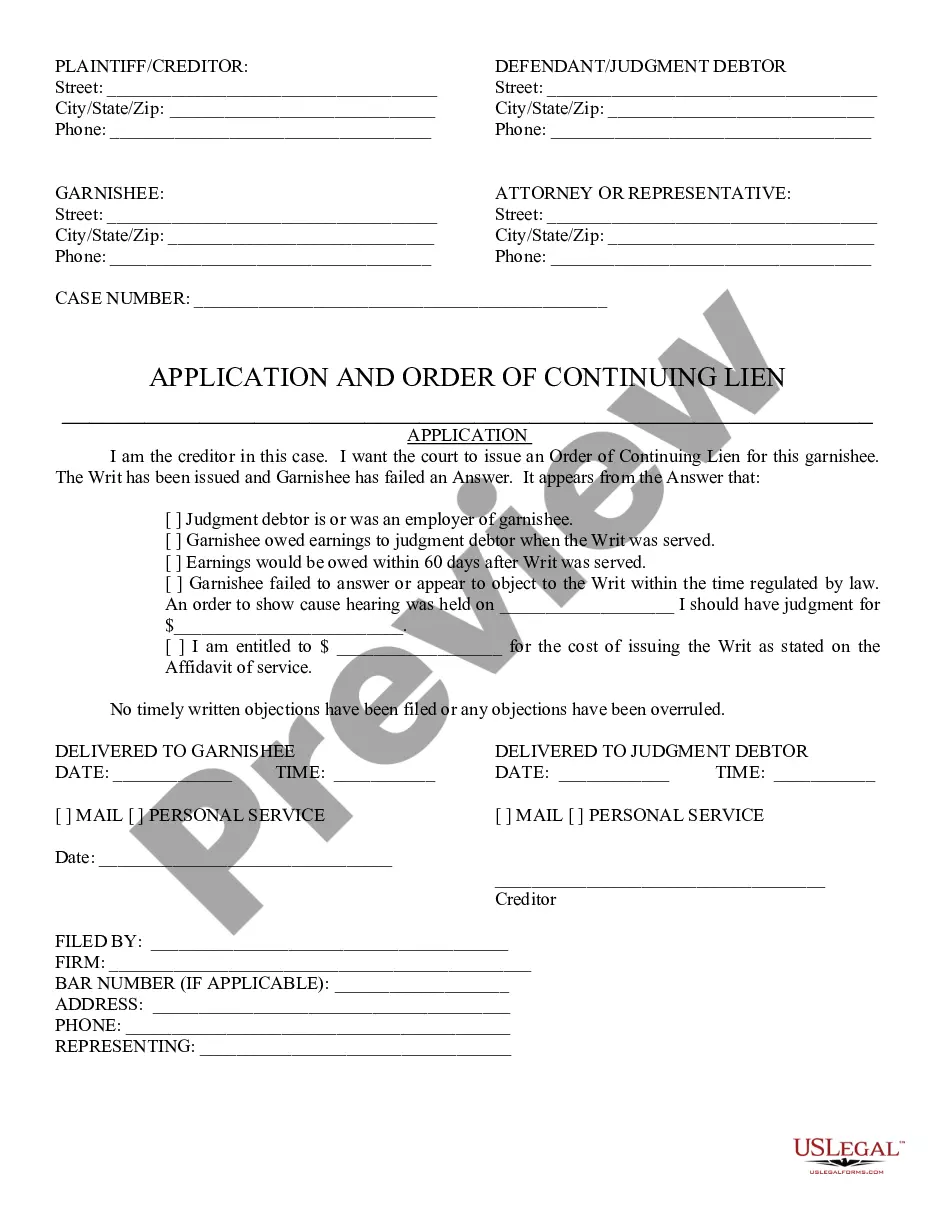

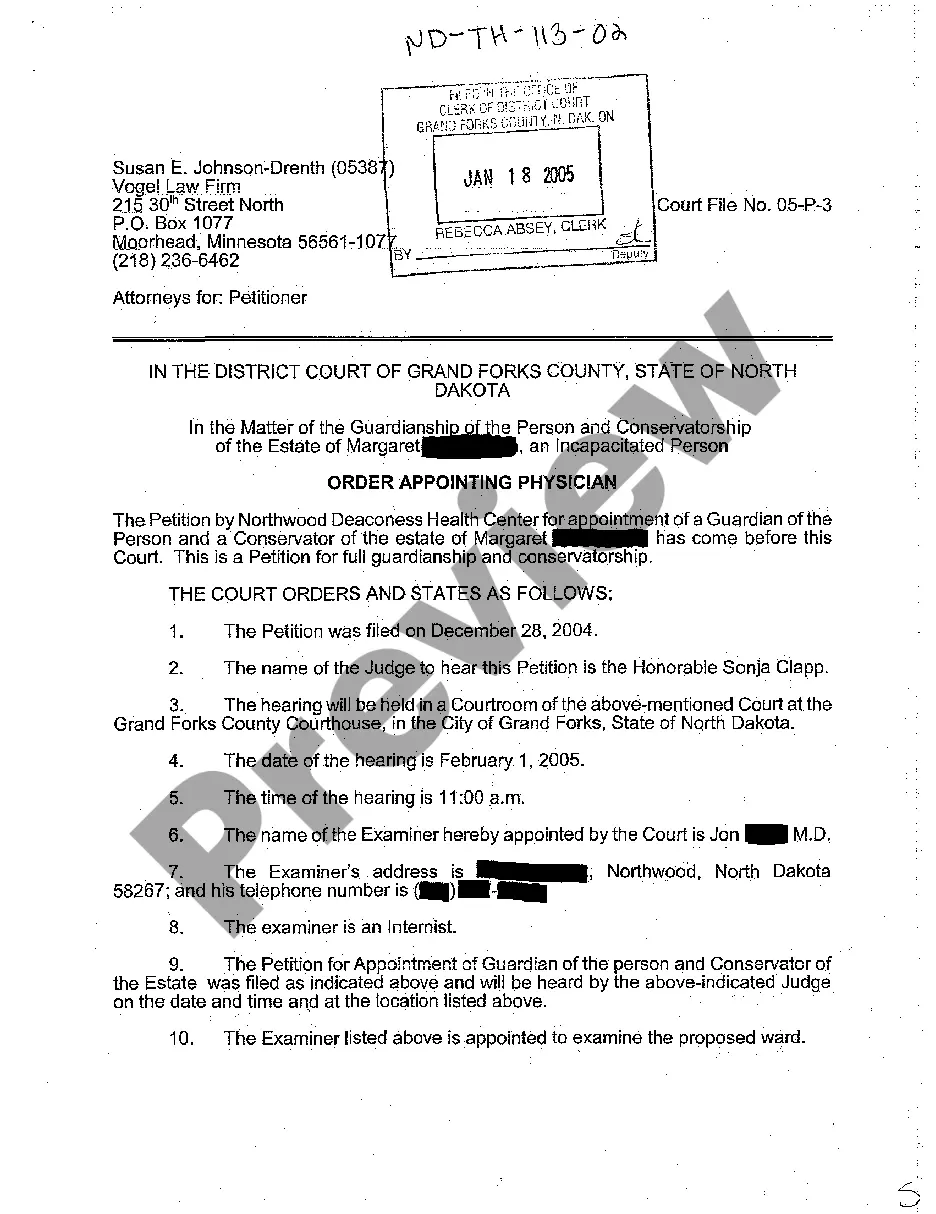

Application for Order of Continuing Lien: An Application for Order of Continuing Lien simply requests that the court continue a lien previously established on the Defendant. Further, it asks the court to continue the lien until such time the judgment is satisfied. This form is available in both Word and Rich Text formats.

Tucson Arizona Application for Order of Continuing Lien

Description

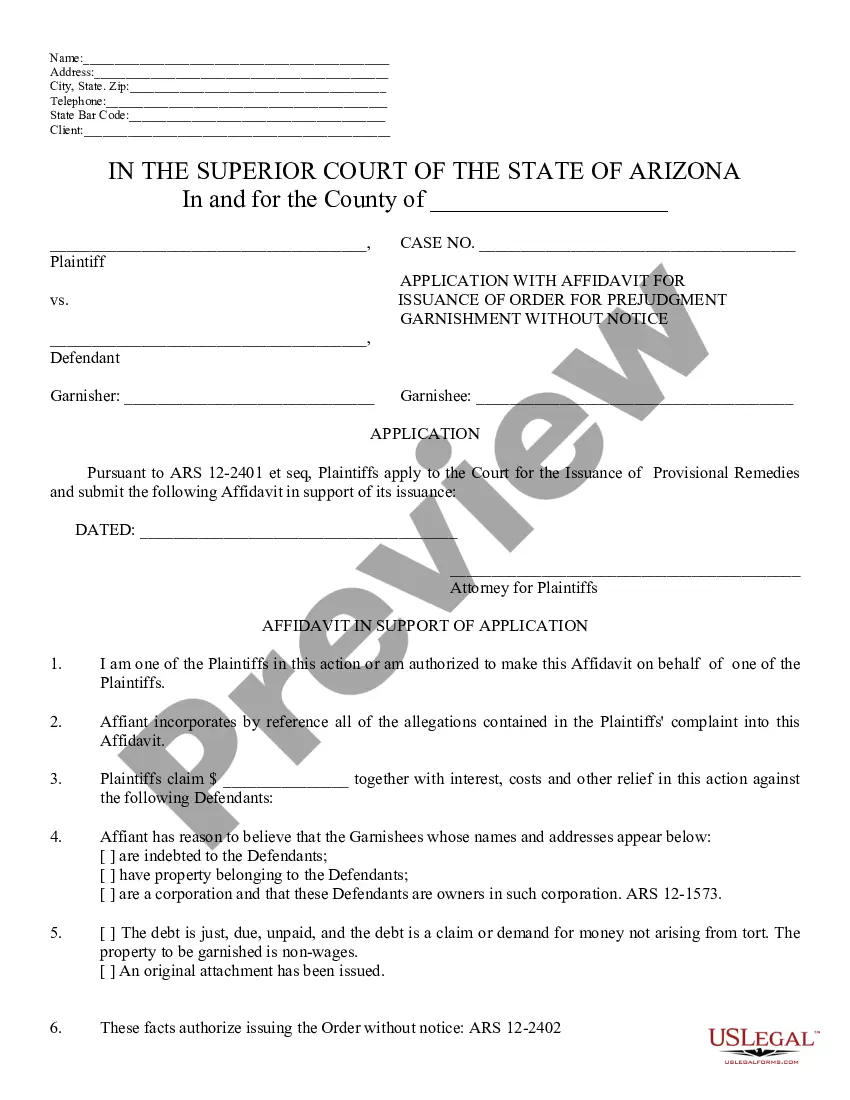

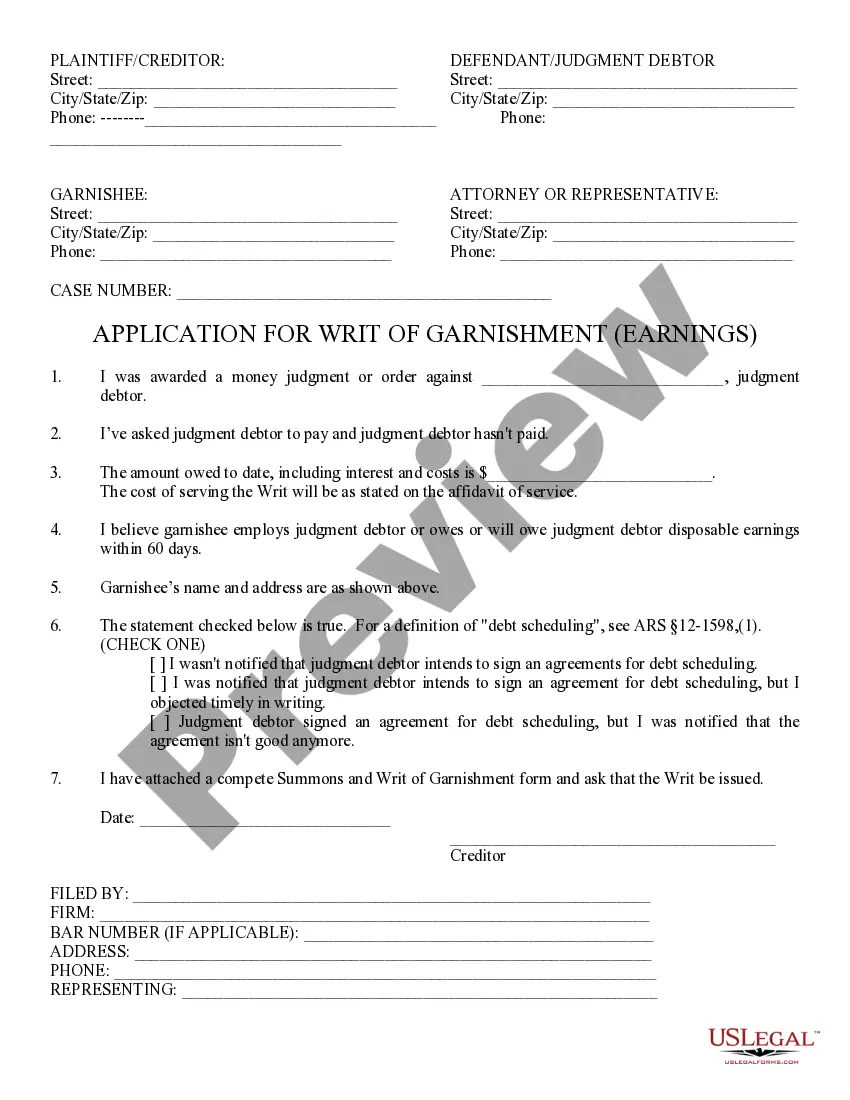

How to fill out Arizona Application For Order Of Continuing Lien?

If you are looking for a legitimate form template, it’s unfeasible to discover a superior location than the US Legal Forms website – one of the most substantial collections on the web.

With this collection, you can acquire thousands of templates for commercial and personal use by categories and regions, or keywords.

With our top-notch search feature, locating the most current Tucson Arizona Application for Order of Continuing Lien is as simple as 1-2-3.

Complete the payment. Use your credit card or PayPal account to finalize the registration process.

Retrieve the form. Specify the file format and download it to your device.

- Moreover, the pertinence of each document is confirmed by a team of experienced attorneys that consistently assess the templates on our site and update them in accordance with the latest state and county requirements.

- If you are already familiar with our system and possess an account, all you need to do to obtain the Tucson Arizona Application for Order of Continuing Lien is to Log In to your account and click the Download button.

- If you are using US Legal Forms for the first time, simply follow the instructions below.

- Ensure you have accessed the form you require. Read its description and utilize the Preview feature to examine its contents. If it doesn't satisfy your needs, employ the Search function near the top of the screen to find the correct document.

- Confirm your choice. Click the Buy now button. Subsequently, select the desired pricing plan and provide details to create an account.

Form popularity

FAQ

Pursuant to A.R.S. §§ 33-963 and 33-964(A), a judgment that is recorded in the manner prescribed by A.R.S. § 33-961 becomes a lien on the real property of the judgment debtor for a period of ten years from the date the judgment was given.

As discussed hereinbelow, a judgment may be renewed either by filing a suit on it or by filing an affidavit renewal with the clerk of the appropriate court. A.R.S. §§ 12-1611, 1612(A). Such a renewal, however, does not automatically extend the judgment lien created by the recording of the original judgment.

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in accordance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.

You can sell your property with a lien attached as long as the buyer is willing to pay off the lien at closing or the proceeds of the sale satisfy the lien before you receive your portion. Many buyers don't like the thought of buying a property with a lien attached, but you can find cash buyers who won't hesitate.

How long does a judgment lien last in Arizona? A judgment lien in Arizona will remain attached to the debtor's property (even if the property changes hands) for five years.

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.

In addition, the new law expressly authorizes a judgment creditor to force an involuntary sheriff's execution sale of homestead property if the equity in the property exceeds $250,000.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.

Garnishment procedures are governed by Arizona law and are extremely complicated. All parties involved must follow these procedures correctly. The Court may issue an order for monetary penalties against any party who does not proceed properly, including the judgment creditor.

A judgment or judgment lien will be valid for ten years from its date of entry. A.R.S. § 12-1551. The deadline for renewing a judgment by filing a lawsuit or an affidavit will be ten years from the judgment's date of entry.