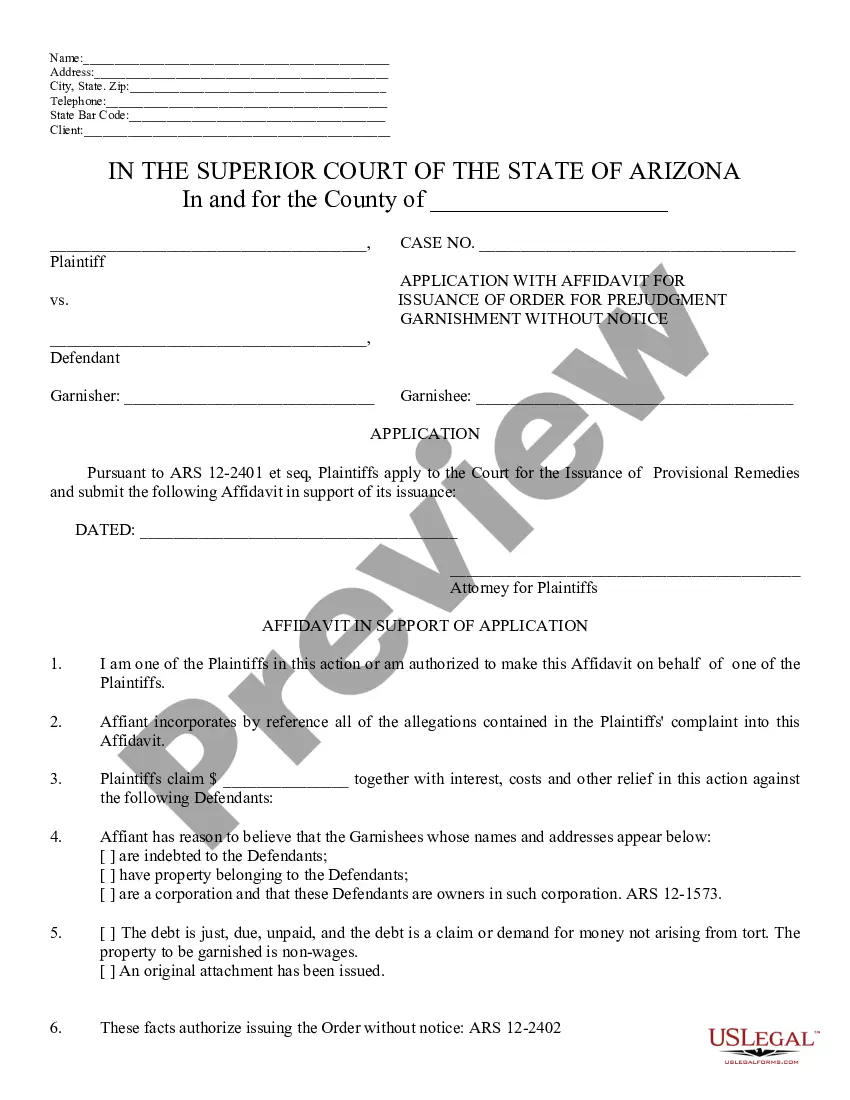

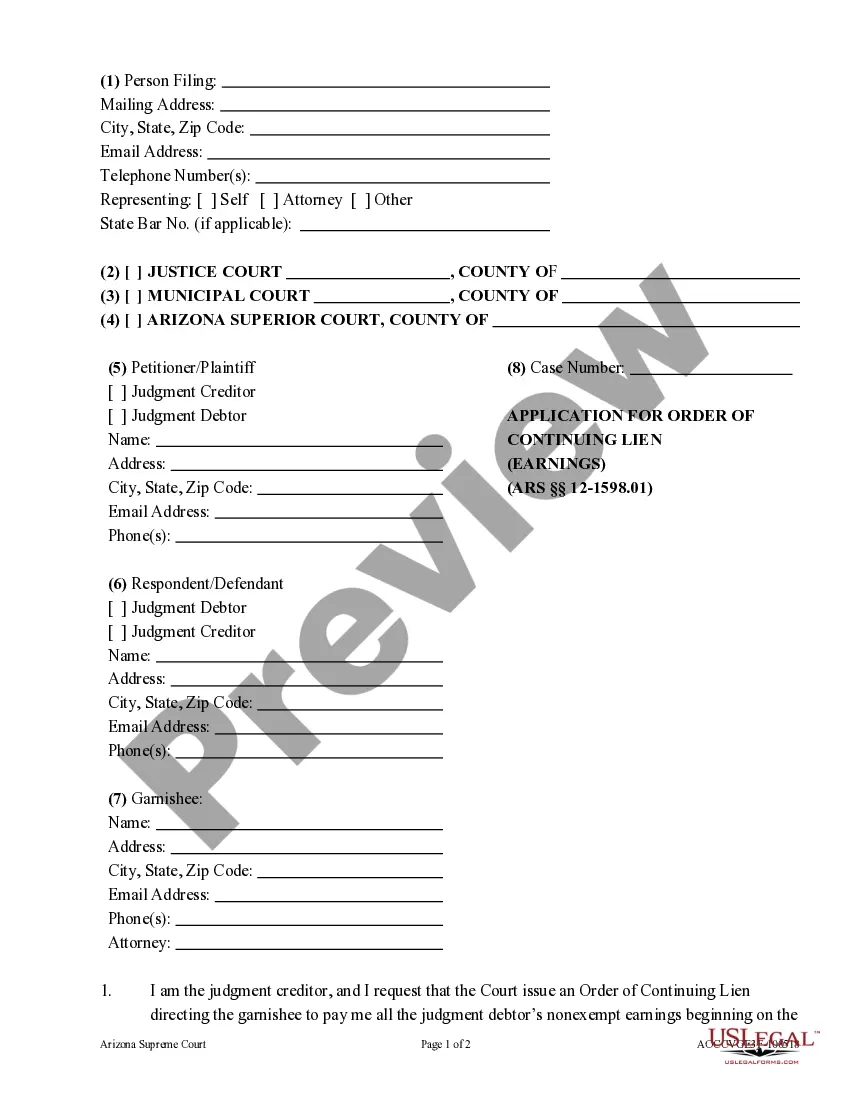

Application and Order of Continuing Lien: An Application for Continuing Lien is filed when the Debtor has not completely satisfied the judgment owed a Creditor. The Creditor uses this form to ask the court to continue the lien on a Debtor's property until such time that the judgment is satisfied. This form is available for download in both Word and Rich Text formats.

Tucson Arizona Application for Order of Continuing Lien

Description

How to fill out Arizona Application For Order Of Continuing Lien?

If you are looking for a suitable form template, you won’t find a more user-friendly platform than the US Legal Forms website – one of the most extensive collections online.

With this collection, you can access a vast number of document examples for both business and personal use categorized by type and location, or specific keywords.

Utilizing our enhanced search feature, finding the most up-to-date Tucson Arizona Application and Order of Continuing Lien is as simple as 1-2-3.

Complete the purchase. Use your credit card or PayPal account to finalize the account registration process.

Access the template. Specify the file format and download it to your device.

- Moreover, the relevance of each document is verified by a group of specialized attorneys who routinely review the templates on our site and update them according to the latest state and county regulations.

- If you are already familiar with our platform and possess an account, all you need to obtain the Tucson Arizona Application and Order of Continuing Lien is to Log In to your account and click the Download option.

- If you are using US Legal Forms for the first time, simply follow the steps outlined below.

- Ensure you have found the form you desire. Examine its description and utilize the Preview feature (if available) to review its contents. If it doesn’t fulfill your needs, use the Search field at the top of the page to find the suitable document.

- Confirm your choice. Select the Buy now button. Then, choose your preferred subscription plan and enter your information to create an account.

Form popularity

FAQ

You can sell your property with a lien attached as long as the buyer is willing to pay off the lien at closing or the proceeds of the sale satisfy the lien before you receive your portion. Many buyers don't like the thought of buying a property with a lien attached, but you can find cash buyers who won't hesitate.

Pursuant to A.R.S. §§ 33-963 and 33-964(A), a judgment that is recorded in the manner prescribed by A.R.S. § 33-961 becomes a lien on the real property of the judgment debtor for a period of ten years from the date the judgment was given.

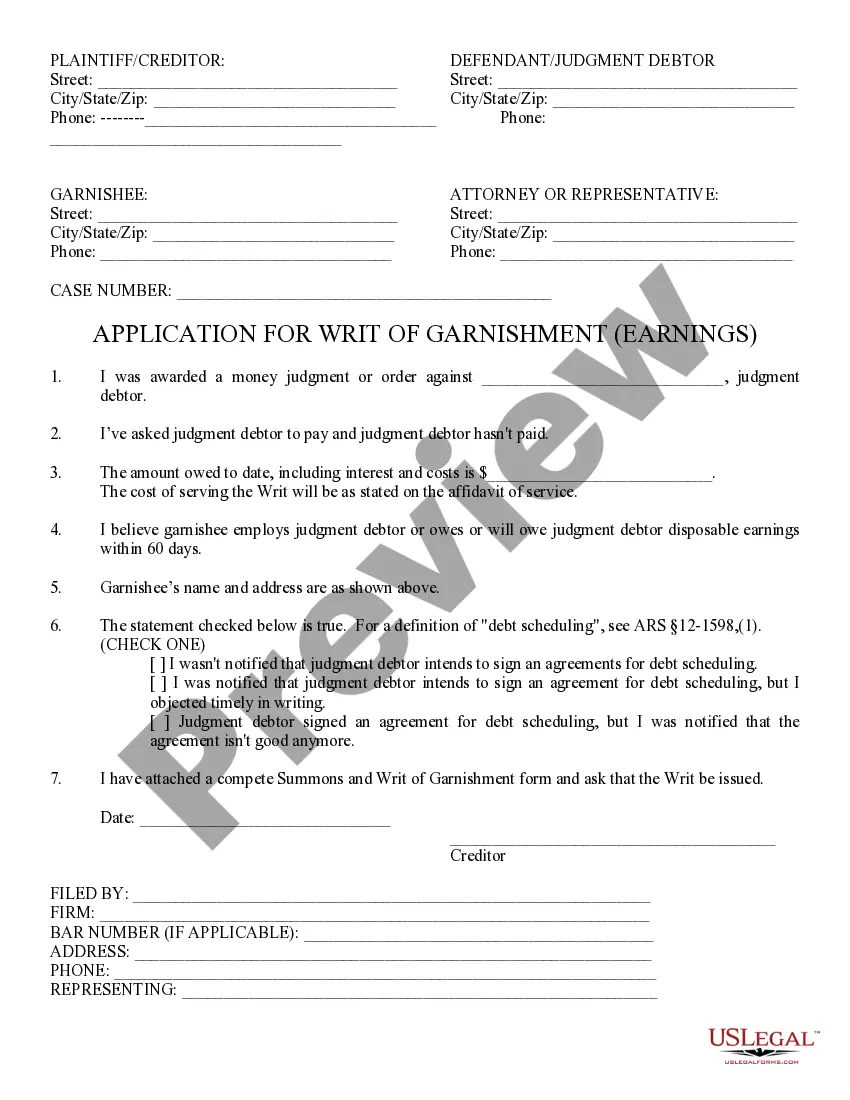

The wage garnishment laws in Arizona are generally the same as federal wage garnishment laws, with a few added protections. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court.

Garnishment procedures are governed by Arizona law and are extremely complicated. All parties involved must follow these procedures correctly. The Court may issue an order for monetary penalties against any party who does not proceed properly, including the judgment creditor.

In addition, the new law expressly authorizes a judgment creditor to force an involuntary sheriff's execution sale of homestead property if the equity in the property exceeds $250,000.

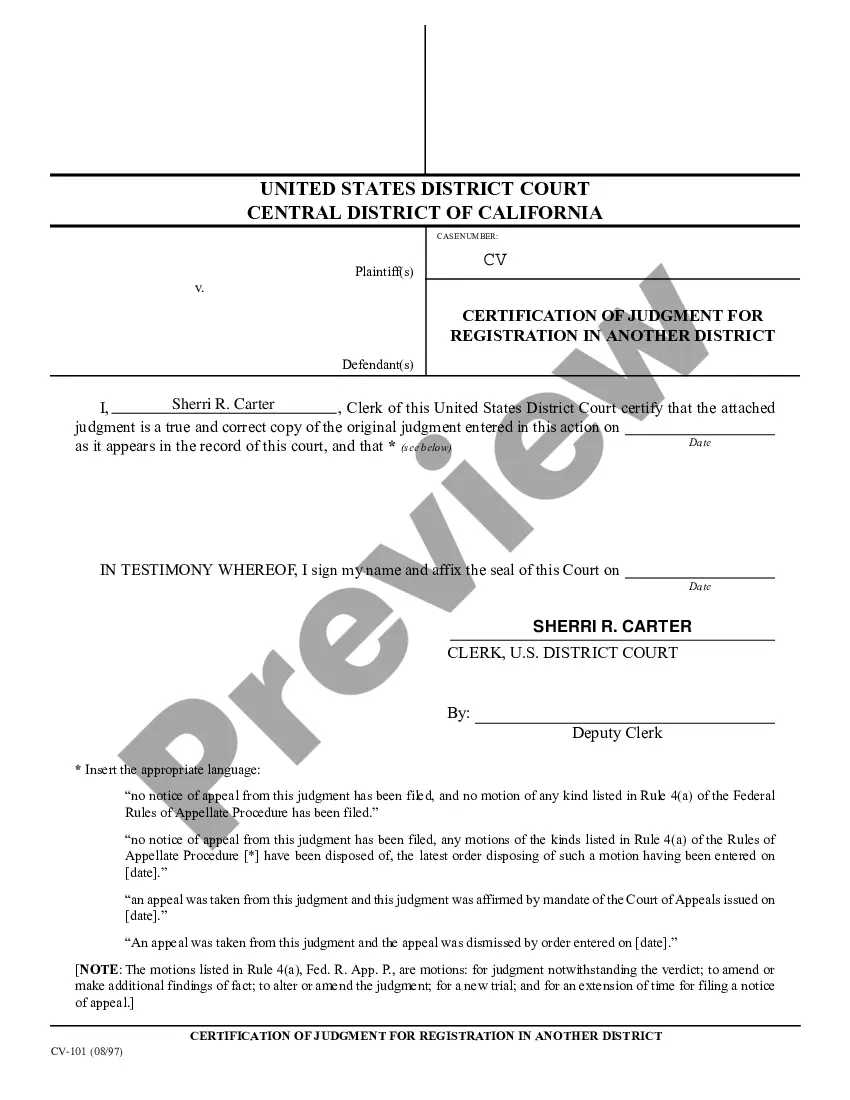

A judgment or judgment lien will be valid for ten years from its date of entry. A.R.S. § 12-1551. The deadline for renewing a judgment by filing a lawsuit or an affidavit will be ten years from the judgment's date of entry.

Typically, judgment creditors collect outstanding debts through wage garnishments, but our laws do allow for levying bank accounts and/or non-exempt property.

How long does a judgment lien last in Arizona? A judgment lien in Arizona will remain attached to the debtor's property (even if the property changes hands) for five years.

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.