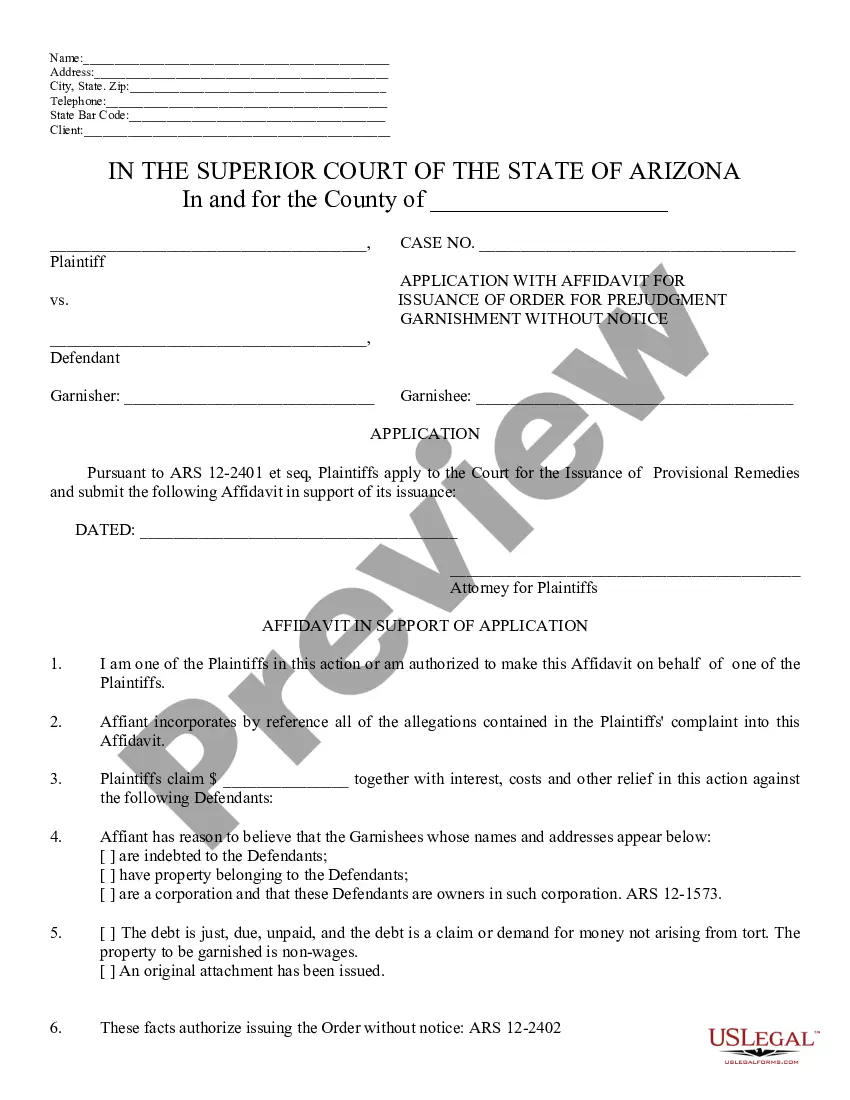

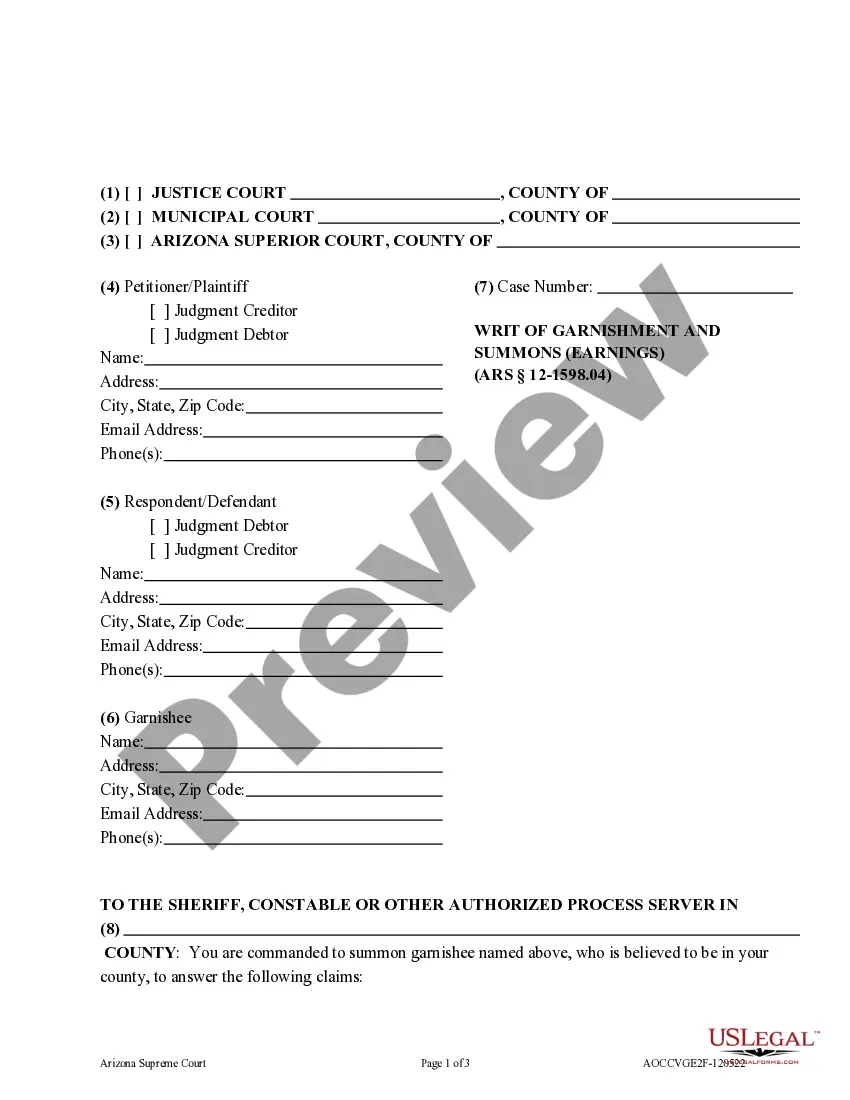

Application for Writ of Garnishment Earnings: This Application requests that the court issue an Order, garnishing the wages of a Judgment Debtor, who is currently not paying the Creditor. The motion states both the Debtor's and Creditor's name, as well as the Debtor's place of business. This form is available for download in both Word and Rich Text formats.

Tucson Arizona Application for Writ of Garnishment

Description

How to fill out Arizona Application For Writ Of Garnishment?

If you're searching for a legitimate form, it’s hard to discover a more accessible service than the US Legal Forms site – one of the broadest collections available online.

Here you can access a vast array of templates for both organizational and personal needs sorted by categories and regions, or keywords.

With our premium search feature, locating the most up-to-date Tucson Arizona Application for Writ of Garnishment Earnings is as simple as 1-2-3.

Finalize the payment. Use your credit card or PayPal account to complete the registration process.

Obtain the template. Choose the format and save it on your device. Make alterations. Complete, modify, print, and sign the acquired Tucson Arizona Application for Writ of Garnishment Earnings.

- Moreover, the relevance of each document is confirmed by a team of skilled attorneys who routinely audit the templates on our site and refresh them in accordance with the latest state and county regulations.

- If you are already familiar with our platform and possess a registered account, all you need to do to obtain the Tucson Arizona Application for Writ of Garnishment Earnings is to Log In to your user account and select the Download option.

- If you are using US Legal Forms for the first time, simply adhere to the steps below.

- Ensure you have located the sample you require. Review its details and utilize the Preview option (if available) to inspect its contents. If it does not match your requirements, utilize the Search field located at the top of the screen to find the correct document.

- Confirm your choice. Click on the Buy now option. Next, select your desired pricing plan and enter your information to establish an account.

Form popularity

FAQ

6 Options If Your Wages Are Being Garnished Try To Work Something Out With The Creditor.File a Claim of Exemption.Challenge the Garnishment.Consolidate or Refinance Your Debt.Work with a Credit Counselor to Get on a Payment Plan.File Bankruptcy.

In simple terms, a ?garnishee order? allows a creditor to force your employer to deduct money from your salary or wages to go toward repayment of an outstanding debt. Such orders can be cancelled, or rescinded by court application.

The garnishment amount is limited to 25% of your disposable earnings for that week (what's left after mandatory deductions) or the amount by which your disposable earnings for that week exceed 30 times the federal minimum hourly wage, whichever is less.

Creditors and debt collectors do not want to put more effort than they have to into your case. Even after a garnishment has started, there is always the opportunity to try to negotiate a resolution. Putting pressure and trying to negotiate provides you a chance to stop the garnishment.

You do this by submitting a request for hearing to the court, on a form that you should have received with the garnishment paperwork. You will have to show that a garnishment of 25% of your disposable income will subject you or your family to extreme economic hardship.

Up to 25% of Wages Are Garnished Until Debt is Repaid Wage garnishment in Arizona is limited in accordance with the federal Consumer Credit Protection Act (CCPA). This means that garnishees may withhold no more than 25% of your non-exempt disposable earnings to be paid to a single judgment creditor.

Here's how you may be able to stop a garnishee order Pay the debt in full.Make alternative repayment arrangements.Apply to pay by instalments through the court.Use the Bankruptcy Act.

You can STOP the garnishment any time by paying the Clerk's Office what you owe. The Clerk will give you a receipt. Take the receipt to your employer right away. They should stop taking money from your pay as soon as they get the receipt.

Garnishment procedures are governed by Arizona law and are extremely complicated. All parties involved must follow these procedures correctly. The Court may issue an order for monetary penalties against any party who does not proceed properly, including the judgment creditor.

How do I stop a garnishment? Option 1: Don't allow a judgment to be entered against you. Option 2: Challenge the judgment. Option 3: Don't expose assets to garnishment. Option 4: Reduce the amount that is being garnished (wage garnishments only) Option 5: Settlement. Option 6: Bankruptcy.